Research

September 18, 2014

The Family Glitch

The “Family Glitch,” as it has become known, is an odd and particularly problematic side-effect of the Affordable Care Act (ACA). Since several provisions of the law are rather ambiguous, they unfortunately combine to create a perfect storm where obtaining affordable health insurance is practically impossible. This “glitch” will leave as many as 1.93 million Americans without affordable health coverage according to American Action Forum estimates.[1]

Understanding the Family Glitch

The ACA promises Medicaid coverage to anyone whose household income places them below 138 percent of the Federal Poverty Level (FPL) —contingent on states agreeing to expand their programs.[2] Those above 138 percent, and up to 400 percent FPL, are eligible for tax subsidies to purchase insurance in a state-established Health Insurance Exchange under the ACA—assuming no one in their family is offered affordable employer-sponsored insurance (ESI).[3]

This provision of the law lacks clarity on the point of whether or not the coverage offered must be family coverage, or whether individual coverage is sufficient. The Internal Revenue Service (IRS), through rule making, has interpreted the statute as only requiring an employer to offer individual coverage, and pegged affordability at 9.5 percent of the employee’s household income.[4] The glitch occurs when one (or both) spouses are offered affordable individual ESI under the IRS definition, but family coverage is either not offered or is unaffordable. Spouses and children of an employee offered ESI could be unable to afford the employer plan, but because it is offered to one family member, the rest are made ineligible for subsidies in the Exchanges.

The IRS has determined that its interpretation of the law was the least disruptive available interpretation of the ambiguous language of the statute. This is in spite of the fact that the IRS’ interpretation contributed to the creation of the Family Glitch. The IRS has therefore decided not to enforce the individual mandate against families with members impacted by the glitch.[5]

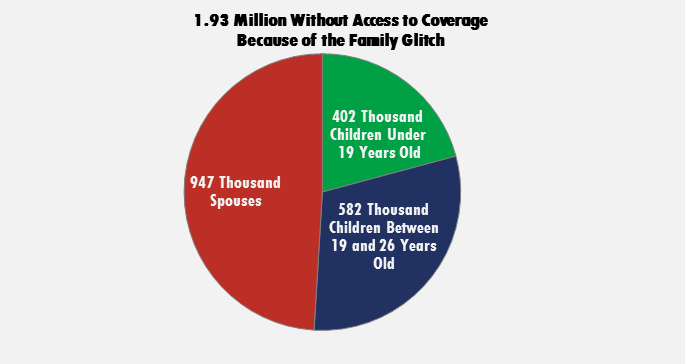

We estimate this glitch will impact 1.93 million Americans.[6] Up to 947,000 spouses and 984,000 children could be left uninsured by this conundrum.[7] Up to 428,000 women will fall into the glitch, and 519,000 adult men. An additional 2.28 million children could fall into this glitch when the Children’s Health Insurance Program (CHIP) funding expires or if it is altered.

Methodology

We assess the scope of the family glitch through analysis of Survey of Income and Program Participation data from April 2013. In order to determine whether an individual falls into the family glitch, we use household composition and income to determine a given individuals eligibility for tax subsidies or other public insurance, such as Medicaid and CHIP. Households are composed of a taxpayer and spouse, if applicable, and tax-dependent children or relatives in the household. Tax dependents are defined as children under the age of 19, full-time students between 19 and 23 years old, or family members in the household that earn below the income tax filing threshold. Any individual, along with a spouse if applicable, is considered to be a taxpayer if that individual or couple earns more than half of household income. If there are multiple taxpaying and tax-dependent relatives in a household, all tax-dependent relatives are dependents of the highest earning family member. Household income is the sum of all income of individuals within a household, less any means-tested cash transfers.

In order to address under-reporting of Medicaid enrollment, we define any parent that receives public assistance, any child of a parent that receives public assistance or is enrolled in Medicaid, any spouse of an adult that receives public assistance or is enrolled in Medicaid, any childless or unemployed adult that receives Supplemental Security Income payments, or any foster child as being enrolled in Medicaid. A child is considered to be enrolled in CHIP if he or she is identified as enrolled in Medicaid but falls within state-specific CHIP eligibility levels. Besides Medicaid and CHIP enrollment, an individual is considered eligible for either program if his or her household income falls within state-specific eligibility levels.

A household is considered to have access to affordable employer-sponsored insurance if a taxpayer or spouse obtains health insurance through an employer and if the average single coverage employee contribution is less than 9.5 percent of household income. According to the Medical Expenditure Panel Survey-Insurance Component, the average employee contribution for single coverage was $1,170 in 2013. An individual is considered to be subject to the family glitch if he or she is uninsured, a tax dependent or spouse of an individual with access to affordable employer-sponsored insurance, and would otherwise be eligible for tax subsidies. We limit our analysis to citizens or legal residents.

Options for Families Impacted by the Glitch

There are a number of options available to families who are caught in the glitch, none of which are ideal.

If possible, both spouses could accept the ESI offered by their different employers. This would be the best option available for childless adults who are both employed. Children in a family where both parents are employed are less likely to be CHIP eligible, but some still may be. In families where the children are not covered by CHIP parents will have to decide whether to pay the full price of private insurance or to leave their children uninsured.

In the case where only one spouse is offered ESI, that individual could decide to take that insurance and the other spouse could purchase full-priced private insurance. If children are ineligible for CHIP they could also purchase a private plan to avoid being uninsured. Similarly, one parent could accept ESI while the other remains uninsured, and children would rely on either CHIP or private-market insurance.

A final scenario could play out where despite ESI being offered, the household income is still below 138 percent FPL, and the family lives in an expansion state where they are eligible for Medicaid. In this situation the spouses may elect to forego ESI altogether, or take it for the employed spouse and use Medicaid wrap-around funds to pay any extra expenses. In this case the parents’ Medicaid eligibility means that the children will also be covered either by Medicaid or CHIP.

Incentives and Results

The choices that families will have to face as a result of the family glitch, described above, will change the way many people in the middle class view employment. One result of the glitch that we should expect to see even among upper income families is that family members will be forced into two, three, or even four different health insurance plans, all with different benefits, rates, and provider networks. This could be burdensome and confusing, and create continuity of care issues.

Another effect of the glitch will be the creation of a disincentive for unemployed or underemployed people to accept better jobs with benefits packages. For example, someone who works only 29 hours a week could completely lose insurance for their entire family by accepting a full time job that offers benefits only to the employee because they would lose subsidy eligibility—if the job offers insurance they could be ineligible for subsidies and may even be worse off financially than they were without the job. Another scenario exists where someone who is unemployed would have to reconsider the benefits of employment if it jeopardizes his or her entire family’s Medicaid eligibility. These scenarios would be made even more dramatic if one of the employee’s family members had any kind of serious or chronic illness that makes being uninsured untenable, and therefore makes Medicaid preferable to employment.

Unfortunately, another solution for some families is separation[8] or even getting legally divorced[9]. Living separately could establish Medicaid eligibility for married individuals, while continuing to live together as divorced individuals would give all family members subsidy eligibility, except the spouse offered ESI.

Other people, particularly those with Exchange insurance, might consider foregoing marriage altogether. By not getting married, couples where one partner has ESI preserve the other partner’s Exchange subsidy eligibility and couples where both partners are in the Exchange avoid the marriage penalty (where the upper income limit for subsidy eligibility is lower for married couples than for two individuals).

Conclusion

The family glitch is just one of many problems that will inevitably arise from the ACA’s complete restructuring of the health care system. It is an unintended consequence that creates hardship and perverse incentives for American families struggling to obtain affordable health insurance. This year alone 1.93 million Americans will be impacted by this glitch and that number will likely increase as the employer mandate goes into effect.

[1] Conor Ryan, Who Still Needs CHIP?, American Action Forum Weekly Check-Up (Sept. 15, 2014), http://americanactionforum.org/weekly-checkup/who-still-needs-chip.

[2] Samantha Artiga & Robin Rudowitz, Medicaid Enrollment Under the Affordable Care Act: Understanding the numbers, Kaiser Family Foundation (Jan. 29, 2014), http://kff.org/health-reform/issue-brief/medicaid-enrollment-under-the-affordable-care-act-understanding-the-numbers/.

[3] Options if You Have Job-Based Insurance, Healthcare.gov, https://www.healthcare.gov/what-if-i-have-job-based-health-insurance/.

[4] 26 CFR Parts 1, 54, and 301 II.C. (Feb. 12, 2014), http://www.gpo.gov/fdsys/pkg/FR-2014-02-12/pdf/2014-03082.pdf.

[5] Id.

[6] Ryan, supra note 1.

[7] Because the Federal Tax Code does not currently recognize same-sex marriage, legally married same-sex couples will not be affected by this glitch. Both partners will retain their individual eligibility for either ESI or Exchange subsidies.

[8] Tom Wilemon, Couple Married 33 Years Separates So Wife Can Keep Insurance, The Tennessean (Jul. 5, 2014), http://www.tennessean.com/story/news/health/2014/07/05/couple-married-years-separate-wife-can-keep-insurance/12203959/.

[9] Garance Franke-Ruta, The Hidden Marriage Penalty in Obamacare (Nov. 5, 2013), http://www.theatlantic.com/politics/archive/2013/11/the-hidden-marriage-penalty-in-obamacare/280890/.