Insight

April 12, 2024

The Cost of Tax Paperwork for Tax Day 2024

INTRODUCTION

The American Action Forum (AAF) tracks the cost of complying with Internal Revenue Service (IRS) paperwork. The tracker uses data on Information Collection Requirements (ICRs) from the Office of Information and Regulatory Affairs’ (OIRA) RegInfo.gov website. For more information on how costs are calculated, see the Methodology section, below.

For this edition of the tracker, data as of April 12, 2024, is compared to the snapshot of costs compiled annually by AAF on Tax Days going back to 2017.![]()

TAX DAYS: YEAR OVER YEAR

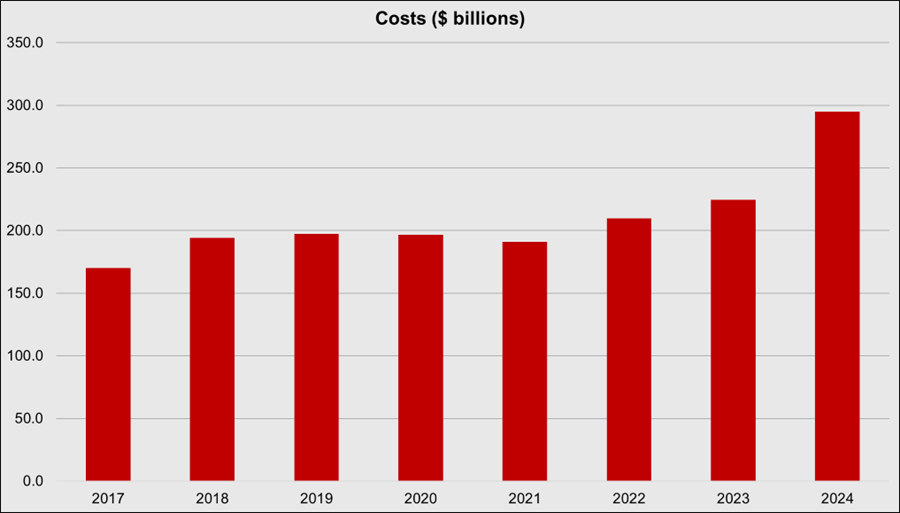

Costs Note: Due to COVID-19, Tax Day 2021 was in May, and Tax Day 2020 was in July.

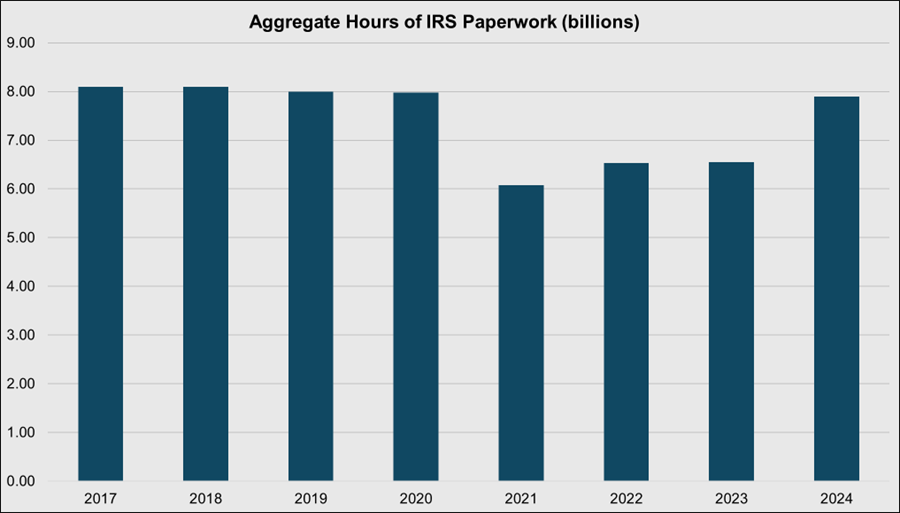

Note: Due to COVID-19, Tax Day 2021 was in May, and Tax Day 2020 was in July.

Hours For those that have been procrastinating on filing their tax returns, you can find solace in knowing that the IRS has also apparently waited until right before the usual April 15 deadline to duly file updated records on their paperwork requirements. Thanks primarily to a single ICR clearing OIRA’s paperwork review process on April 11, Tax Day 2024 will see a tax compliance cost total pushing nearly $300 billion – far and away the highest level AAF has recorded since 2017. The increase from this one ICR also puts the overall annual IRS paperwork burden total back up around eight billion hours, the level it largely hovered at between 2017 and 2020.

For those that have been procrastinating on filing their tax returns, you can find solace in knowing that the IRS has also apparently waited until right before the usual April 15 deadline to duly file updated records on their paperwork requirements. Thanks primarily to a single ICR clearing OIRA’s paperwork review process on April 11, Tax Day 2024 will see a tax compliance cost total pushing nearly $300 billion – far and away the highest level AAF has recorded since 2017. The increase from this one ICR also puts the overall annual IRS paperwork burden total back up around eight billion hours, the level it largely hovered at between 2017 and 2020.

The ICR in question is the paperwork for “Proceeds From Broker and Barter Exchange Transactions,” which saw its burden increase by more than 1.5 billion hours, from 674 million hours previously to now nearly 2.2 billion. The primary reason for this adjustment according to the IRS is that “Section 80603 of the Infrastructure Investment and Jobs Act requires brokers to report digital assets.” This involves 700 million hours attributable directly to the statute and another 808 million hours the IRS now calculates “due to better filing estimates.” Applying the hourly rate of a typical compliance officer (see methodology section below) to the updated hour total yields $84 billion in costs – a nearly $60 billion increase from the previously estimated total. For perspective, the next closest cost increases in terms of magnitude came from the always-ubiquitous Business Income Tax Return and Individual Income Tax Return ICR totals rising by $7.2 billion and $2.3 billion, respectively.

METHODOLOGY

The tax paperwork costs tracker reviews every active IRS Office of Management and Budget Control Number (collections of information or recordkeeping requirements) on RegInfo.gov, the government website that houses all federal paperwork information. That search found 456 unique ICRs, which is how OIRA segments different paperwork requests from federal agencies, all of which contained IRS estimates of expected responses and burden hours. The IRS only estimates the costs for about a dozen of these ICRs, however. To project costs for the rest, AAF applies the Bureau of Labor Statistics’ estimated average hourly wage for compliance officers ($38.55). The methodology is consistent with AAF’s previous Tax Day research. Per tax return calculations are based on the latest IRS official projection for expected returns filed in fiscal year 2024.