Insight

March 13, 2025

Update: Coal in the Generation Mix – State-level Policies

Executive Summary

- Since 2021, several states have enacted legislation establishing a preference for the continued operation of coal-fired power plants rather than the development of other energy resources.

- While regulators have a necessary role in guiding utility operations, policies that resist transition from coal to other sources can undermine utilities’ ability to operate assets economically, and as a result, these policies could also create otherwise avoidable costs for consumers.

- Utilities, whose development plans are overseen by public service commissions to ensure reliable service, are best positioned to choose which resources to retire or construct.

Introduction

As one of the largest contributors of greenhouse gas emissions, the power sector has long been the subject of policymaking. Utilities, however, typically develop generation resources in response to market conditions rather than to policies that set a preference for a specific type of energy resource (solar, e.g.). As such, the decline of coal-fired power plants has occurred and continues to occur not in response to policy pressure but to commodity prices and growing operational costs.

Proposed policies for reforming the generation industry have often established targets for renewable generation at the state level or provided subsidies for technologies in order to drive decarbonization. Over the past few years, however, some state legislatures have adopted policies seeking to preserve coal-fired generators. These guidelines increase costs for utilities and consumers alike and create additional regulatory oversight while failing to make coal more economically viable.

Utilities, as market participants, are best positioned to manage their generation resource mix in a cost-effective manner. Rather than mandating particular generation mixes, policies that take into account a preference for adopting cost-effective resources are ideal.

Preferential Policies

Policies that seek to reduce greenhouse gas emissions by increasing non-fossil-fuel generation have long been the subject of scrutiny. Most states have enacted renewable portfolio standards (RPS) or targets for zero-emissions energy production despite concerns about increased costs. Policies to maintain existing coal-fired resources beyond their economically practicable lifetime, on the other hand, are relatively novel. Such policies include subsidies for coal-fired facilities as well as new public-interest standards maintained by public service commissions (PSC) that call for increased investment in existing resources rather than retirement.

As of February 2025, six states, including Arkansas, Wyoming, West Virginia, Kentucky, Nebraska, and Utah, passed laws to protect existing power generation that complicate public service commissions’ efforts to provide consumers with fair rates and utilities with appropriate returns.

Arkansas passed the 2021 Affordable Energy Act that requires the state’s PSC to evaluate the remaining useful life of an existing electric generation unit and complete a cost-benefit analysis, a rate impact analysis, and a reliability and resilience analysis every three years. The PSC must explicitly state whether a life extension of each unit is in the public interest. According to the legislation, it is in the “public interest to promote and encourage the use of existing electric generation units to the maximum extent practicable” to ensure that units remain operational for their full useful life, and thus it is in the public interest for the state to foster investments to extend their useful life. In essence, this new public interest finding creates a presumption that existing coal-fired plants should remain open, but it is unclear how the investment to keep them operational will be provided. In April 2023, Arkansas amended its Affordable Energy Act to mandate that the Arkansas Public Service Commission produce a report reviewing the remaining useful lives of existing electric generation units that have a planned retirement date.

Wyoming’s 2021 legislation similarly establishes a presumption against facility retirements. In order to retire facilities, utilities must rebut the presumption by demonstrating that the retirement will result in cost savings and will not result in “insufficient amount of reliable and dispatchable capacity.” The PSC must determine that the retirement would not result in a shortage of electricity nor would it “adversely impact” the dispatchability of electricity in the state. The legislation goes even further, preventing utilities from “recovery of or earnings on the capital costs associated with electric generation facilities built, in whole or in part, to replace the electricity generated from a retired coal or natural gas electric generation facility that was retired on or after July 1, 2021, and for which the presumption against retirement was not rebutted.” In 2023, Wyoming’s governor Mark Gordon signed the coal-fired facility closures litigation-funding amendments that allow the governor to use dedicated funding to litigate against entities that “impermissibly impede Wyoming’s ability to export coal, that cause the early retirement of coal-fired electric generation facilities located in Wyoming, that result in the decreased use of Wyoming coal or the closure of coal-fired electric generation facilities that use Wyoming coal.”

West Virginia’s 2021 legislation, which is aimed at maintaining employment in the coal mining industry, states that “It is imperative the State of West Virginia take immediate steps to reverse these undesirable trends to ensure that no more coal-fired plants close, no additional jobs are lost, and long-term state prosperity is maintained…. Public electric utilities in West Virginia should be encouraged to operate their coal-fired plants at maximum reasonable output and for the duration of the life of the plants.” In February 2023, West Virginia passed legislation that mandates an existing power plant obtain approval from West Virginia Public Energy Authority before undertaking any decommissioning or deconstructing activities.

In March 2023, Kentucky passed legislation requiring utilities to obtain approval from the Public Service Commission (PSC) to retire fossil fuel-fired power generating units. The legislation established a rebuttable presumption against the retirement of a fossil fuel-fired electric generating unit, requiring a utility to submit sufficient evidence to demonstrate that the retired capacity will be replaced by reliable new electric generating capacity and that the retirement will not cause the utility’s ratepayers to incur higher costs. Additionally, the decision to retire a plant cannot be “the result of any financial incentives or benefits offered by any federal agency.” In April 2024, state lawmakers overrode the governor’s veto of a bill that created additional barriers for utilities to retire fossil fuel-fired power plants. This legislation will create a new commission to review any requests to retire a fossil fuel-fired plant before the PSC makes a decision. Moreover, a utility cannot retire a plant until after “the replacement generating capacity is fully constructed, permitted, and in operation,” unless the utility can demonstrate the necessity to retire the plant earlier.

In April 2024, Nebraska passed legislation that requires a utility to provide a written notice to the Nebraska Power Review Board before making a final decision to close or decommission a power plant. The written notice must include information on transition activities including worker training and education services and promoting economic development in the affected communities.

In March 2024, Utah passed legislation that provides the state the option to “purchase an electrical generation facility intended for decommissioning” for “fair market value,” which is determined by the new authority created under the bill, a “Decommissioned Asset Disposition Authority” within the Office of Energy Development.

Arkansas, West Virginia, Wyoming, Kentucky, and Nebraska have not established RPS or targets for renewable resource development. In that regard, the legislation that they have enacted doesn’t run counter to each state’s other policy goals, which would be the case in most other states with renewable energy standards or targets, such as Utah, which requires utilities to pursue renewable energy when cost-effective.

Market-Driven Transition

Historically, baseload power generation was dominated by coal and nuclear technology during the 20th century. In the 1990s, the amount of electricity generated by natural gas-fired plants began to grow and eventually surpassed coal-fired plants as natural gas became abundant and relatively lower in price. Since then, renewable resources, such as solar modules, have been introduced to the grid in greater quantities and have created greater variability in meeting demand. Most recently, technologies that are more responsive to greater variability, such as small modular reactors and large-scale battery storage, are being developed.

The decline of coal-fired generation can largely be attributed to market forces, particularly the price of natural gas, and much less so to state policies. Coal generators incur large, fixed costs up front in constructing facilities and subsequently significant operations and maintenance costs, including fuel, throughout the lifetime of the facility. Due to natural gas’s more efficient heat conversion, coal must cost at least 30 percent less than natural gas to be competitive, resulting in less use of coal-fired plants. This trend of newer plants being more economical than older ones is not reserved to coal. Newer and more efficient natural gas plants built in the past decade are used with more frequency than older plants built in the 1990s.

In addition, the Energy Information Administration (EIA) has projected that the price of coal will continue to increase in coming years. As a result, generators that continue to rely on coal will face higher costs that will, in turn, reduce the amount of energy generated at existing facilities and increase the number of facilities that are no longer economical to operate.

Not Aging Like Fine Wine

Not only have shifting commodities markets created disparities in the cost of coal and natural gas generation, but they have also contributed to the operational decline of coal-fired facilities by accelerating the growth in costs of these plants.

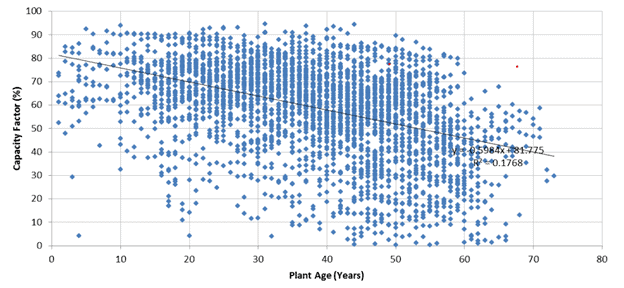

The EIA commissioned an analysis of Generating Unit Annual Capital and Life Extension Costs to address its assumptions about age-related generation costs. Upon reviewing the data filed by utilities with the Federal Energy Regulatory Commission (FERC) regarding their plant operations, the analysis found a statistically significant relationship between age and capital expenditures for coal-fired power plants. Capital expenditures and operations and maintenance costs for “coal steam plants increased significantly with age when expressed on a $/MWh basis. This was primarily a result of significant declines in plant capacity factors over time.” Capacity factor is determined by dividing the actual energy a plant produced by the maximum possible energy that would result from continuous full power operation. The lower the capacity factor the less potential capacity is used. The chart below demonstrates that as plants age, they tend to produce less energy.

Source: EIA

The analysis found that both market conditions and diminishing plant performance can result in a decreased capacity factor. Coal plants may be contributing less to meet demand due to competition with cheaper and more efficient resources, such as gas turbines . In addition, demand growth has slowed with increased energy efficiency and the use of distributed resources, such as rooftop solar.

Decreased capacity factors are also caused by increasingly inefficient heat rates, more frequent component failures, and outage rates. The increased frequency of “cycling,” when in response to fluctuating demand a coal plant is operated at various load levels including by shutting down and restarting, places stress on its components. Market conditions and coal plant technology create a feedback loop that eventually results in the retirement of facilities as age and increased cycling lower efficiency, leading to less frequent reliance on the facility and, in turn, lower sales, resulting in too little revenue to cover growing costs.

The relative costs and benefits of various generation technologies can be compared by way of the levelized cost of energy (LCOE) as well as the levelized avoided cost of energy (LACE). LCOE is an estimate of the revenue required to build and operate a generator over a specified cost-recovery period, while LACE is a measure of potential revenues from sale of electricity generated from a generation source displacing another marginal asset. When the ratio of these values is considered (value to cost), it is possible to identify those resources with higher values, suggesting a resource is more economically attractive to construct. The EIA projects that in 2026 the ratio for supercritical coal-fired power plants would be 0.49 while combined cycle natural gas facilities would be 0.98 and solar facilities would be 1.05. These figures suggest that rejuvenating existing coal capacity with investment to extend their lifetime would prove to be relatively more costly than investing in other forms of generation.

Ratemaking

All six states’ PSCs continue to regulate electric utilities. PSCs oversee utilities within their state and ensure that retail rates are “just and reasonable.” This legal standard serves as the basis of the process for setting rates, or ratemaking, which is typically structured to provide utilities returns based on their cost of service. These costs include the capital necessary to build a facility subject to depreciation and operational costs such as fuel and administration of the business, among others.

Power plants depreciate in value throughout their lifetime, which is defined upon their construction. Coal-fired power plants may be expected to operate for 60 years or more. Capital expenditures to maintain plant operations typically occur throughout the life of a plant as a series of projects rather than a single life-extension project. The costs incurred by power plants serve as the basis for retail rates, in combination with the cost of electric transmission and distribution.

Retail rates vary among states and their utilities. For example, according to the EIA, average retail rates across the total electric industry (expressed in cents/kilowatt hour (kWh)) in Arkansas, West Virginia, Wyoming, Kentucky, Nebraska, and Utah in 2023 were 9.73, 10.26, 8.39, 9.96, 9.14, 9.03, respectively. The lowest rates were around 8.03 cents/kWh while the highest rates were nearly 38.6 cents/kWh.

By continuing to operate coal-fired power plants beyond their economical and maybe even depreciable lifetime, as the new state legislation suggests, the utility and consumer would incur the cost that would otherwise be avoided by retirement or incur additional cost should the coal-fired plant require a significant upgrade to its facilities to continue operating. Modernization programs to upgrade facilities do not fit well within the existing cost of service ratemaking structure because they require the addition of fixed capital costs rather than discretionary operations and maintenance costs. As a result, they can significantly increase the rate base and as a result, retail rates.

In order to address this issue, with respect to grid modernization programs, rather than generation modernization, PSCs have instituted various approaches to determine the necessity of the modernization, its benefits and costs, and who as a result should pay to recoup the cost. Similarly, they have instituted various mechanisms to ensure returns to the utility, including adding the investment to the rate base, modifying the formula for returns, or allowing utilities to institute trackers that are reflected as additional fees on consumers’ bills. FERC issued a policy statement that provides mechanisms for returns under cost-of-service ratemaking for modernization efforts that increase efficiency and environmental performance of natural gas pipelines. As both the natural gas and electric industries rely on cost-of-service ratemaking, legal precedent and interpretations are considered analogous. FERC found that operators could institute a surcharge or tracker to recover the costs of modernization. These state and federal interpretations suggest that generation extension programs would require similar decisions to be made at PSCs, which inevitably create additional costs for consumers.

Even if a PSC’s public interest finding extends the lifetime of these coal-fired power plants beyond that which is considered economical by the utility, the plants would still face competition. In order to overcome market effects, additional legislation or regulation would be necessary. Coal-fired plants will remain more expensive, and as a result unless states mandate reliance on these plants’ capacity, these facilities will be no more likely to operate and contribute to capacity.

Resource Planning

Regional differences in resources drive diverse needs. North Carolina, for example, has seen a significant increase in the installation of solar modules during the past decade. With 7.04 gigawatts installed, it ranks third in the United States in 2021 and has met 7.46 percent of its demand through solar power. Arkansas, on the other hand, only generates 0.68 percent of its demand through solar resources.

Utilities are required to prepare Integrated Resource Plans (IRP) in a large majority of states. IRPs provide an opportunity to demonstrate various development scenarios to PSCs that consider which future resources are necessary to ensure reliable delivery of power to customers while acknowledging states’ policy priorities. In practice, IRPs rely on demand forecasting as well as pricing of resources to identify which facilities should be constructed, modified, or retired to meet the needs of the service area.

Utilities are best suited to determine the date when existing resources are no longer economical and which resources are necessary to replace them. They respond to the daily demand and seasonal changes of customers by operating and maintaining their facilities, and by interfacing with neighboring utilities, regional market organizations, and independent power producers. As a result, utilities have both the data and relationships necessary to make the most informed decisions regarding resource allocation.

Conclusion

Over the decades, coal generation has declined drastically in its significance compared to other modern generation sources. With competing resources, utilities are no longer bound to operate last century’s technology. Instead, new modern facilities that are more cost effective can be developed while more costly technologies are retired.

While state legislatures and regulators undoubtedly have a role to play in balancing utility cost-effectiveness with the needs of a local economy, regulating the generation resource mix too inflexibly leads to increased costs ultimately borne by consumers. A more balanced approach involves policies that reduce barriers to developing the resource mix necessary for cost, carbon, and energy-efficient generation.

This piece was updated by Shuting Pomerleau