Insight

June 16, 2016

Administration Hiding at Least $60 Billion in Regulatory Costs

It should be easy enough for the federal government to display the recordkeeping and reporting requirements of federal regulation. If regulators have already performed initial calculations and taken public comment on that arithmetic, all that’s left is to publish those findings. However, the American Action Forum (AAF) found regulators failed to report more than $60 billion in regulatory costs online.

A survey of the 50 largest paperwork collections reveals a reported cost of $44 billion, from just seven regulations. In other words, despite requiring billions of hours of paperwork, 43 requirements declined to list a monetary cost for the regulatory imposition. This may sound impossible, and in many cases, it is. A review of appendices and supporting information reveals an additional $61.2 billion in unreported costs. These are costs imposed by the regulation, but not listed or tabulated by the White House.

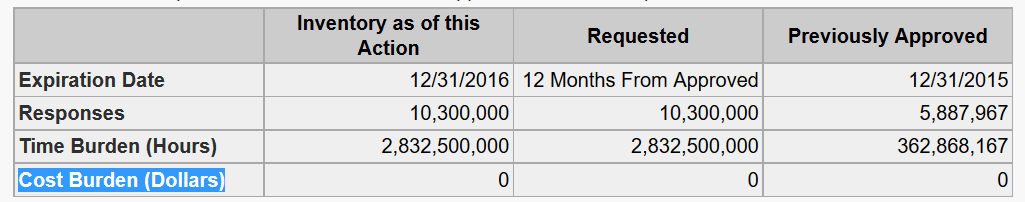

For example, one of the most expensive regulations annually requires compliance with the business income tax. According to government estimates, this requires more than 2.8 billion hours of time, with an associated 235 forms. No other government regulation requires more reporting and recordkeeping time. However, there is no figure listed for the costs of the business income tax, and even the IRS would acknowledge these costs exist. See below:

Yet, AAF commented on this paperwork collection in 2013 and noted that IRS’s original estimated cost was $48.5 billion. Going from this figure to $0 is either an incredible drop or a serious omission. After a review of the supporting statements buried in the docket, the administration does acknowledge the regulation imposes more than $48 billion in annual costs. In addition, each taxpayer will spend roughly 275 hours to complete this tax preparation. That’s equivalent to a full-time employee (40 hours a week), laboring for nearly seven weeks. The “out-of-pocket” costs per taxpayer are $4,700, according to the IRS documents.

For the IRS, this big number omitted from other big numbers might mean little to the overall calculation of how much the agency regulates. For other agencies, these omissions grossly distort the overall regulatory burden.

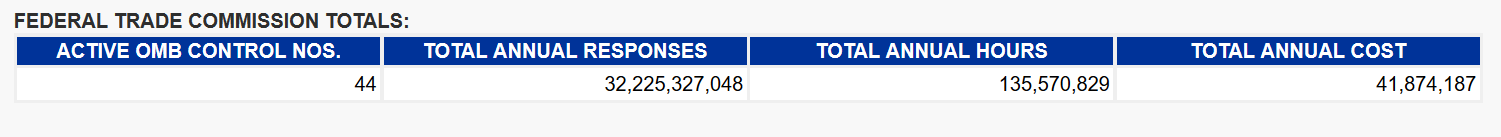

For example, the Federal Trade Commission (FTC) reports that its paperwork compliance costs are only $41 million. They are a little-known agency, so $41 million might seem appropriate, if it were accurate.

In two paperwork collections, for textiles and the “Care Labeling Rule,” the agency publicly reports that the rulemaking will impose $0 in costs. However, a review of the supporting documentation reveals the combined costs for both regulations will approach $540 million. This is more than 12 times what the FTC currently reports for its regulatory burden. If the FTC omits half-a-billion in costs, how mistaken or misleading are other agencies?

The Department of Homeland Security reports a regulatory burden of $2 billion, but it failed to include $2.2 billion in additional costs from “Employment Eligibility Verification” and cargo manifests. Adding those to the agency’s totals and its regulatory imposition more than doubles.

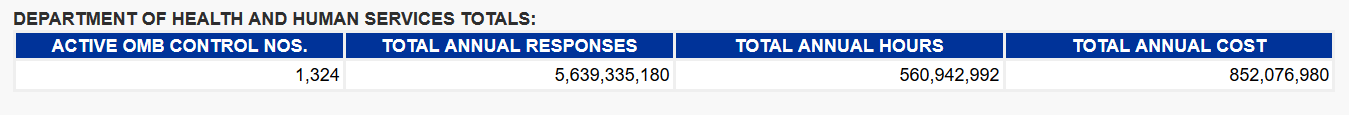

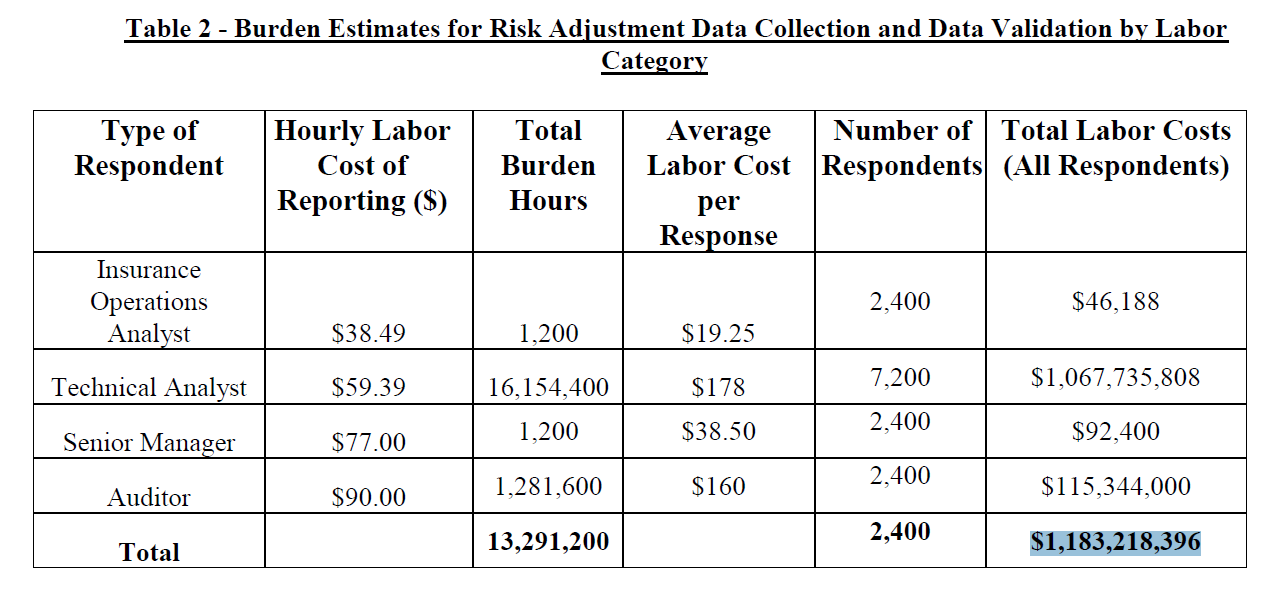

Finally, the Federal Communications Commission reports a total recordkeeping and reporting cost of $843 million, but omits the cost of its “Lifeline Reform” regulations, which impose more than $562 million in costs. This would raise the agency’s cost total by 66 percent. Rounding out the omissions, the Department of Health and Human Services (HHS) declined to include more than $5 billion in regulatory costs. This is notable because HHS only reports a public cost burden of $852 million, so the agency is off by around 600 percent. See below.

A single paperwork collection for risk corridors indicates HHS’s “total annual cost” figure is far off the mark.

Conclusion

In many cases, agencies are reporting totals that are orders of magnitude off from what is likely, or even tabulated in the docket. Currently, the federal government represents the recordkeeping and reporting burden at $1.8 trillion, but $1.7 trillion of that is from one collection, which is likely an error. There is little doubt the White House would vehemently deny federal paperwork alone costs $1.8 trillion.

So what government regulatory figures can the public trust? Regulators once claimed an obscure collection would result in 43 billion hours of paperwork, only to issue a correction. When and if regulators realize a single Affordable Care Act regulation somehow imposes $1.7 trillion in costs, they’ll likely correct that error as well. These findings are sobering because AAF surveyed just the largest paperwork requirements and found more than $60 billion in omissions, but can the public trust that these rules actually cost $60 billion? Judging from the data, it seems regulators have no clue about the costs and benefits of federal regulation. That should give the public and regulators pause.