The Daily Dish

March 14, 2019

2019 Tax Refunds

Eakinomics: 2019 Tax Refunds

Washington politics and arithmetic are distant acquaintances. But the discussion surrounding refunds during the 2019 tax-filing season has been so convoluted that you would think we were asking people to multiply in hexadecimal. Fortunately, AAF’s Gordon Gray has devoted 1 minute, 10 seconds to clearing up the confusion. It is a good investment of your time. Or, you could simply employ “a smaller refund is not a tax increase; a larger refund is not a tax cut” as your yoga mantra (WAY better than this). Either way, the issue should disappear, especially because the most recent data show that the average refund is up $40 over 2018. (As Gray says, “Wait for the data.”)

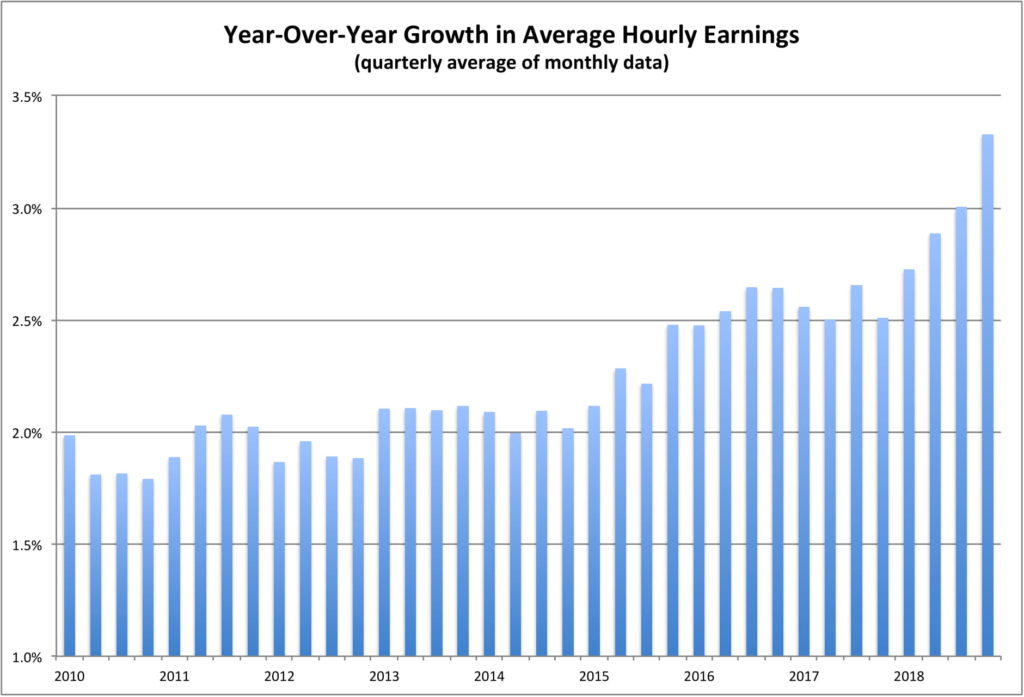

The back-and-forth is part of the larger debate over the efficacy of the Tax Cuts and Jobs Act (TCJA). That debate will continue, but it is interesting to zero in for a second on the recent growth in wages. One of the major debates was whether workers would benefit from the combination of reforms and cuts in the corporation income tax. The answer seems to be a pretty clear yes. The chart below displays clearly the 2010-2015 Era of Wage Funk, the uptick as the recovery continued in 2016-17, and the acceleration in 2018 after the TCJA. Even better, Goldman Sachs research indicates that “the bottom half of earners are benefiting more than the top half — in fact, about twice as much.”

Wages are going up, not taxes. That is good news.

Fact of the Day

National security tariffs on steel and aluminum will increase the amount consumers are expected to spend by $7.5 billion per year.