Weekly Checkup

February 14, 2020

The Drawbacks of the Drug-Scheduling Regime

Last Thursday, the president signed S. 3201, extending the Drug Enforcement Agency’s (DEA) temporary ban on fentanyl analogues such as carfentanil for another 15 months. Even though everyone agrees that fentanyl analogues are dangerous—up to 100 times more potent than fentanyl, which is itself 50 times more potent than heroin—there is a surprising amount of controversy over the implications of continuing this ban. At the core of the controversy is how this ban illustrates the challenges with the United States’ current system for categorizing drugs.

The Controlled Substance Act of 1970 established a system that categorizes controlled substances into one of five schedules based on known medical uses, potential for abuse, and safety. According to the DEA, Schedule I is reserved for compounds that have no accepted medical use and have a high potential for abuse. Fentanyl, for example, is currently classified as Schedule II due to its high potential for abuse but also its medical utility for postoperative pain control and severe chronic pain. Its analogues, however, are classified as Schedule I, which initially makes sense given their potency.

But the consequences for this scheduling are a mixed bag. On the positive side, regulating powerful drugs permits the government to limit access to them and thus their potential to do harm. Making a drug Schedule I empowers federal entities to crack down on the illicit manufacture and distribution of drugs of abuse, potentially saving lives. Categorizing a drug as Schedule II steps down the restrictions so as to allow for use by hospitals and other credentialed providers in a managed and appropriate way.

On the negative side, however, classifying a drug as Schedule I significantly limits the capacity of researchers to investigate such compounds in either a clinical or preclinical manner. As noted by David Nutt from the Imperial College of London, categorizing analogues of illicit substances as Schedule I makes it much more difficult to find alternatives or medicinal uses of those drugs that could help people. For example, this classification has largely stalled marijuana research, as Trevor Burrus from the Cato Institute points out. This classification makes it more difficult to understand the consequences of marijuana use and its potential for chronic pain control—potentially even providing a substitute for opioids.

Some current research demonstrates the value of opening up Schedule I drugs to inquiry. There is already an FDA-approved medication called Epidiolex which contains Cannabidiol—a non-psychoactive compound in the marijuana plant—and treats epilepsy in people ages 2 and up. Current research is still ongoing for additional uses, but this research is progressing slowly due to scheduling barriers. And there is a plethora of ongoing clinical research on Psilocybin—a Schedule I hallucinogenic compound found in “magic mushrooms”—from places like Johns Hopkins and NYU, some of which is sponsored by the National Institute on Drug Abuse. Classifying the substances underlying these research projects as Schedule I makes breakthroughs more difficult.

In a recent letter to Congress, U.S. Attorney Bill Powell called for the permanent ban of fentanyl analogues, citing the heavy toll these analogues take on citizens across the United States and particularly in his home state of West Virginia. While this desire is understandable, a permanent ban may in fact perpetuate the addiction crisis by detracting from our ability to transition to new means of severe pain control free from the fear of destroying lives. The current scheduling system certainly does not need to be gutted, but it does have drawbacks for research, and policymakers should keep these consequences in mind when banning drugs.

Chart Review: CBO’s Projections of Total Drug Spending Under H.R. 3

Margaret Barnhorst, Health Care Policy Intern

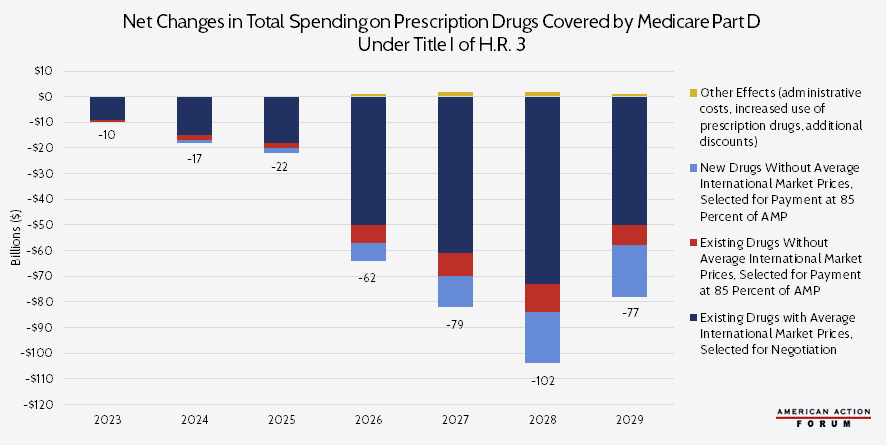

The Congressional Budget Office (CBO) projects that H.R. 3 will decrease spending on prescription drugs covered by Medicare Part D by $369 billion from 2023 to 2029, with over two-thirds of the savings—$276 billion—coming from lower prices on existing drugs. Those projected savings, however, would almost certainly come at a cost to innovation. H.R. 3 requires drug manufacturers “negotiate” with the Secretary of Health and Human Services (HHS) and accept the resulting prices. This price cannot exceed 120 percent of the Average International Market price from six other countries: Australia, Canada, France, Germany, Japan, and the United Kingdom. The secretary would likely focus negotiation on drugs for which the potential savings would be the greatest, i.e. those with the largest U.S.-international drug price differentials. According to a study from the House Ways and Means Committee, those are drugs for diabetes, arthritis, multiple sclerosis, and cancer.

For drugs without information on international prices, CBO assumes that the HHS Secretary would engage in minimal negotiation and instead set prices at 85 percent of the Average Manufacturer Price in the United States. With the provisions included in H.R. 3, CBO estimates that manufacturers will raise foreign drug prices over time to increase the upper bound on negotiated prices, as well as raise the launch price of new drugs within the United States to compensate for the effects of negotiation. Furthermore, with these provisions, earnings will decrease for pharmaceutical manufacturers, and they will likely reduce spending on research and development, too. CBO estimates that this shift will result in 8 to 15 fewer drugs introduced to the market over the next 10 years. As AAF’s Christopher Holt has previously noted, however, this figure is likely a substantial underestimation. The White House’s Council of Economic Advisers estimates that H.R. 3 could result in 100 fewer drugs over the next decade. Another study estimates 56 fewer new drugs would be developed.

Note: For this analysis, CBO assumed that H.R. 3 would be enacted near the end of 2019 and that the negotiating process would begin in 2021, so the resulting prices take effect in 2023.

Worth a Look

FierceHealthcare: Prices for those in employer plans went up in 2018—but growth is slowing: study

New York Times: U.S. Supports Aid to North Korea for Fighting the Coronavirus