Weekly Checkup

February 23, 2024

New State of Play: Florida and the Limits of ERISA Preemption

Following in the footsteps of other states, the Florida legislature made a small change that could have a big impact on the future of employer-sponsored health insurance. In 2023, the state enacted a statute that revised the definition of “pharmacy benefits plan or program” to require self-insured plans governed by the Employee Retirement Income Security Act (ERISA) of 1974 to follow state law. While this revision may be slight, it could have sizable implications for the future of state regulation of federally governed health insurance. What’s more, numerous states are considering similar bills in 2024 to address their regulatory concerns over self-insured ERISA plans. Let’s dive into what Florida lawmakers were attempting to do, why other states want to exercise this authority over self-insured plans, and why such laws may be a harbinger of future insurance regulation in the United States.

First, some context: As a general rule, states have a reduced capacity to regulate self-insured plans owing to ERISA, which established a single federal regulatory framework for large and multistate employers to follow alongside the construction of a single health insurance benefit to be offered to all employers. This law was created to reduce costs and regulatory burdens on employers to incentivize them to offer employees high-quality health insurance. More than 70 percent of employers with 500 or more employees are typically self-insured and regulated by ERISA. Self-insured plans alongside other commercial plans pay significantly more for health care as compared to other government payers such as Medicare or Medicaid. For example, the Kaiser Family Foundation found that commercial plans paid nearly double Medicare rates for all hospital sites with commercial payment amounts ranging from 141 percent to 259 percent of Medicare payments in 2020. There are tremendous benefits to ERISA, namely that self-insured plan sponsors don’t have to contend with 50 versions of state law, keeping costs down for insurers and plan holders.

In that sense, the Florida statute represents a further weakening of ERISA’s preemption provisions. Florida lawmakers revised a legal definition that now requires self-insured plans preempted by ERISA to be subject to state law. The statute also mandates that 100 percent of rebates passed through to the pharmacy benefits plan or program must be used to offset costs for beneficiaries through lower cost-sharing and reduced premiums. If an employer has only a few employees in the state, this requirement could create inequity in the health benefits offered to all of its employees, regardless of in which state in which they reside or work. Moreover, one could assume that increased costs to the employer or plan sponsor operating in an affected state would have to be offset by employees in other states. The law has other requirements on self-insured plans including specific requirements on the pharmacy network offered by a pharmacy benefit manager (PBM) and other PBM-specific services. Of note, Florida has the seventh largest ERISA-governed self-insured population (2.77 million) which means this small definitional change could have long-term negative economic consequences for employers and employees.

If ERISA preempts states from creating a patchwork of onerous regulations that govern self-insured plans, why are Florida and several other states gaining ground in regulating these markets? A big problem is that the statutory language of ERISA is notoriously vague. The statute allows states to set standards provided the requirements do not have “a connection or reference to” an ERISA plan. What “connection or reference to” means in practice is very unclear.

It is so unclear, in fact, that it has spurred numerous federal court cases to adjudicate the matter – although none has been as successful as the 2020 Supreme Court case Rutledge v. Pharmaceutical Care Management Association, which required PBMs, acting on behalf of ERISA self-insured plans, to reimburse pharmacies as required by state law. In this author’s opinion, the Supreme Court issued a narrow ruling in favor of Arkansas (Act 900), but this decision has emboldened state lawmakers to test the limits of preemption through various PBM-specific reforms. Subsequently, Oklahoma, and Tennessee passed similar PBM laws and faced serious litigation. (For a deeper dive, please see Jackson Hammond’s examination of Pharmaceutical Care Management Association v. Mulready the 10th Circuit Court’s 2023 decision on the Oklahoma law.)

In short, the courts have been largely unable to adequately clarify the proper bounds of ERISA and aren’t likely to arrive at a definitive conclusion any time soon. Absent robust ERISA preemption, the imposition of state mandates on self-insured plans is likely to increase costs for health plans, employers, and employees. Preserving a robust private insurance marketplace requires congressional action to support a single regulatory framework for large and multistate employers to provide affordable and good quality health care to their employees. Without lawmakers’ input, private insurance will increasingly become less attractive to both employers and their employees.

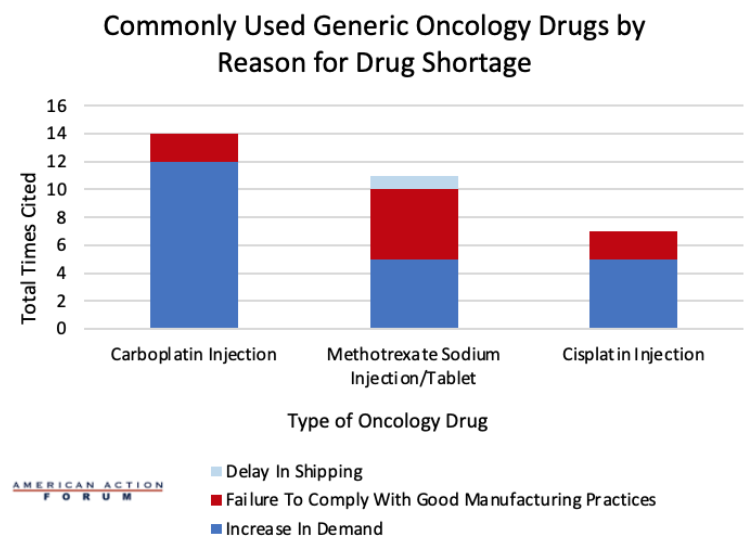

Chart Review: Reasons for Inadequate Supply of Top Three Oncology Drugs

Anna Grace Shepherd, Health Policy Intern

A July 2023 survey conducted by the University of Utah Drug Information Service found that 309 drugs were in active and ongoing shortages by the end of the second quarter of 2023. The Food and Drug Administration (FDA) defines a drug shortage as a period where demand, or projected demand, exceeds the United States supply of the drug. Currently, the United States is facing shortages for around a dozen oncology drugs and around 90 percent of hospital systems across the country are facing a shortage of 15 irreplaceable chemotherapy drugs. Cisplatin, carboplatin, and methotrexate are three of the most used generic cancer drugs, and the supply of these drugs has been cut in half within the past year. A dashboard created by the FDA shows which drugs are currently in shortage and the estimated shortage duration. As seen in the chart below, an increase in demand was the most cited reason for drug shortages among the top three chemotherapy drugs, followed by failure to comply with good manufacturing practices, which may constitute a problem with the quality of a product. For carboplatin injections, an increase in demand was cited as the reason for the shortage 12 times. The same is true for cisplatin injections, where an increase in demand was cited five times, as well as for both methotrexate sodium injections and tablets. Solving these shortages will be important both now and in the future, as global chemotherapy use is expected to rise to 53 percent by 2040. Policymakers should look for ways to reduce regulatory burdens that make domestic production of generics more expensive while also working to understand if there are issues in the FDA inspection process that cause issues with manufacturing practices that aren’t caught early enough.