Weekly Checkup

April 20, 2018

Medicare Part E and the Magical Federal Money Tree

This week Democratic Senators Chris Murphy (CT) and Jeff Merkley (OR) announced new legislation they describe as a Medicare buy-in option. Senator Merkley argues, since Medicare is a “popular, affordable, high-quality health-care option, shouldn’t every American deserve the opportunity to participate in such a plan?” Whether you accept everything in that statement as true—and there’s a lot to quibble with—making Medicare available to everyone isn’t exactly what the proposal does.

Instead, Medicare Part E (as the senators have branded it) is best understood as a leap toward single payer. Rather than Medicare as traditionally understood, what they are proposing is a federal public health insurance option. The plan would be sold through the Affordable Care Act (ACA) Marketplace and would compete with private insurers. Both individuals and employers could purchase the plan, which would piggyback on Medicare’s existing provider network by requiring providers who participate in Medicare to accept Medicare Part E beneficiaries as well.

The plan would be actuarily equivalent to a Gold plan in the Marketplace. It would comply with the ACA’s essential health benefits and all of the ACA’s premium rating restrictions relating to age bands, tobacco use, and family size—while also applying these rules to large-group (i.e. employer-sponsored) insurance for the first time. Premiums for the plan will be set ambiguously at a rate “sufficient to fully finance the costs,” but your ACA subsidy can be applied to this plan as well.

Don’t worry if your income is too high for a subsidy today: The proposal also sneaks in some significant expansions of the ACA. Those subsidies would now cover people up to 600 percent of the federal poverty level (FPL), and cost-sharing reduction mandates on insurers—now unfunded—would be extended to those with incomes up to 400 percent of the FPL. Most significantly, the premium subsidy would be pegged to the second-lowest cost Gold plan, rather than Silver.

In short, what the senators are proposing is the massive expansion of the ACA and the creation of a public option, something that was a bridge too far for President Obama and congressional Democrats in 2010. But don’t worry! Apparently it will all be paid for with dollar bills plucked from the magical federal money trees that grow in the basement of the Treasury Department.

Chart Review

Jonathan Keisling, Health Care Policy Analyst

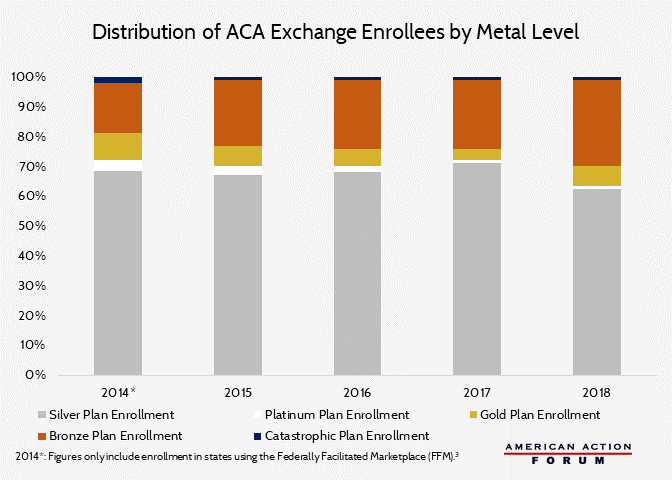

During the 2018 open enrollment period for the Affordable Care Act marketplaces, many consumers chose to buy Gold- or Bronze-level plans instead of Silver plans because of the disproportionate premium increases for Silver plans. Gold plan enrollment increased by 68 percent, and Bronze plan enrollment increased by 20 percent. Silver plan enrollment, in contrast, decreased by roughly 15 percent.

– from A Closer Look at the Final 2018 Open Enrollment Report

Worth a Look

Health Affairs: Antibiotic-Resistant Infection Treatment Costs Have Doubled Since 2002, Now Exceeding $2 Billion Annually

Axios: White House reviewing drug-pricing plan

New York Times: As Opioid Prescriptions Fall, Prescriptions for Drugs to Treat Addiction Rise