Weekly Checkup

November 8, 2019

Medicare for All: Ascendant, yes, but popular?

Late last week, Senator Elizabeth Warren released her Medicare for All (M4A) proposal. With both Warren and Senator Bernie Sanders — who is still the favorite of the progressive wing of the Democratic party — all in on M4A, the policy has been dominating conversations around both the campaigns and health care policy. There are a number of avenues of inquiry into M4A—including Warren’s proposed ways to pay for it, which AAF President Douglas Holtz-Eakin discussed in Wednesday’s Daily Dish—but at this point an analysis of the political angle is valuable. In short, how real is M4A?

Recent polling from the Kaiser Family Foundation suggests that M4A’s support might not be as deep as some have supposed, potentially signaling danger for candidates like Warren and Sanders who have wrapped themselves in the idea. Kaiser’s October polling on health care shows a clear downward trend in support for M4A since the spring. From June of 2017 until April of 2019, support for M4A nationally has remained relatively stable in the 56 percent range with a highwater mark of 59 percent in March of 2018. But since April, support has dropped to 51 percent while opposition has grown to its highest point at 47 percent.

It’s interesting, but perhaps not surprising, that M4A’s popularity has decreased at the same time it has dominated the Democratic primary debate. With the idea receiving more exposure, voters have seen a lot they don’t like. According to Kaiser, voters are particularly concerned about the possibility that M4A could delay access to medical care in some cases, jeopardize (or eliminate) the current Medicare program, increase taxes, and eliminate private insurance. Of note, among those voters who do support M4A, 67 percent believe they’ll be able to keep their current private insurance, which is not true under either the Warren or Sanders proposal. Most concerning for Senators Warren and Sanders, 55 percent of Democratic voters would prefer a candidate who would work within the framework of the Affordable Care Act (ACA), while only 40 percent want to see the ACA replaced with M4A.

What does all of this mean? For one thing, while it’s an open question whether or not Senators Warren and Sanders will find their embrace of M4A to be a blessing in the nominating contest, it will almost certainly create problems in a general election where the particulars will be even more aggressively contested. It also brings into question whether M4A is politically viable at all. Imagine for a moment President Warren with Democratic control of Congress. Democrats themselves aren’t unified behind the idea of M4A, and the broader public is less supportive the more they know about it. M4A could easily become Repeal and Replace for Democrats—a catchy campaign talking point that policymakers can never unify around implementing.

Also of note from Kaiser, support for other health reforms such as a Medicare buy-in or a public option is much higher than for M4A. Seventy-three percent of Americans support a public option, and 77 percent support Medicare buy-in for those ages 50 to 65. It is possible, however, that just as with M4A, these ideas will lose their appeal as Americans become more aware of the details. Check back next week for a look at the likely real-world impact of a Medicare buy-in plan for those age 50 to 65.

Chart Review

Andrew Strohman, Health Care Data Analyst

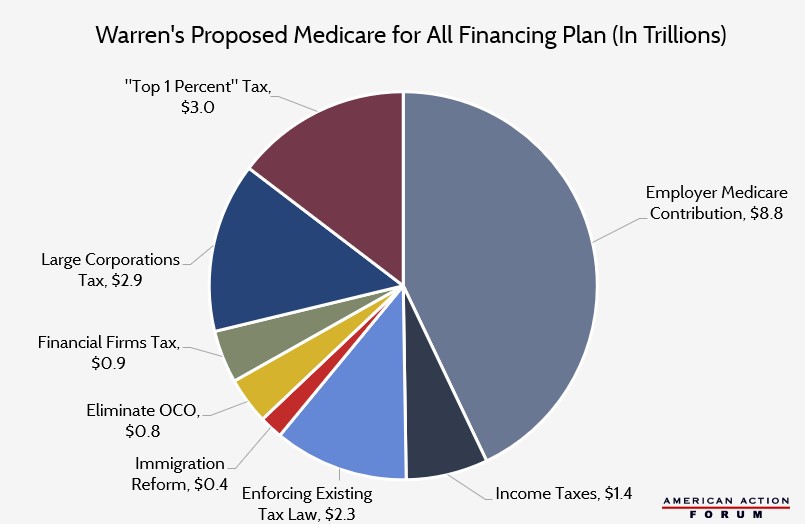

Senator Elizabeth Warren recently released her new Medicare for All (M4A) plan, which she claims would require $20.5 trillion in new federal spending over a 10-year period to finance, substantially less than the $32-34.67 trillion estimated by organizations such as the Urban Institute, the Mercatus Center, and the Center for Health and Economy. While Warren’s underlying cost assumptions are debatable, it is important to look at her funding streams, as well. First, since M4A would abolish private insurance, employers’ existing health insurance payments would be replaced by a mandated Employer Medicare Contribution of $8.8 trillion (while maintaining current tax deductions on employer health spending). Warren also estimates increased take-home pay for employees under M4A, which would be subject to existing income taxes and yield $1.4 trillion in revenue. Next, better enforcement of existing tax law, Warren claims, would bring in an additional $2.3 trillion. Undefined reforms to immigration and an elimination of the Overseas Contingency Operations Fund (OCO) would bring in $1.2 trillion, combined. Finally, new taxes on financial firms, large corporations, and the top 1 percent of income earners would bring in the remaining $6.8 trillion needed to fund the program, she asserts.

Data obtained from the Elizabeth Warren campaign

From Team Health

It is very unlikely that the revenues and savings that Senator Warren has proposed to pay for Medicare for All will materialize.

Worth a Look

Axios: Increasing millennial health problems set up future economic challenges

Modern Healthcare: Patients feel the pain of hospital-physician consolidation