Weekly Checkup

February 23, 2018

The Long-Term Prognosis on Short-Term Health Insurance Plans

This week the Trump Administration released its long-awaited proposed rule on short-term, limited-duration health insurance plans. These plans have traditionally functioned as a bridge to longer-term health insurance options. Say you’re changing employers and are going to have a two-month gap in your health insurance. You might consider picking up one of these plans to protect yourself.

The kicker, though, is that these plans exist outside of the Affordable Care Act’s (ACA) insurance market reforms, which gives insurers a lot of flexibility. Insurers can pick and choose what they cover, don’t have to sell to you if they think you’re too risky, and can charge you more based on your health status.

These plans can also be dramatically cheaper than what’s available in the ACA Marketplace, making them an attractive option for healthy people with incomes too high to qualify for federal subsidies. In fact, the Obama Administration—concerned that these plans were an attractive alternative to the ACA Marketplace—issued a rule in October 2016 limiting the duration of these plans to less than three months, significantly shorter than their traditional duration of less than 12 months.

The Trump Administration (at least for now) is simply proposing to reverse the previous administration’s last-minute change and allow these plans to extend to the previous duration limit of less than 12 months. Some observers worry this could further erode the ACA’s market by providing a viable alternative for healthy individuals. Others might reasonably counter that considering the exploding premiums of Marketplace plans, providing people with viable alternatives might be a worthwhile objective for the administration.

One downside of these plans in the past has been that they don’t fulfill the ACA’s mandate that individuals carry qualified health insurance. The repeal of the mandate penalty (effective next year) could make these plans even more attractive to healthy individuals. Additionally, there are rumblings the administration would like to take things a step further and allow the plans to be sold as renewable. Insurers would likely charge extra for the option, but renewability would in practice provide the same protection as the ACA against medical underwriting.

In the absence of renewability, the impact of these plans isn’t abundantly clear, but if the administration were to make them renewable, this policy could create a genuine alternative to the ACA Marketplace.

Chart Review

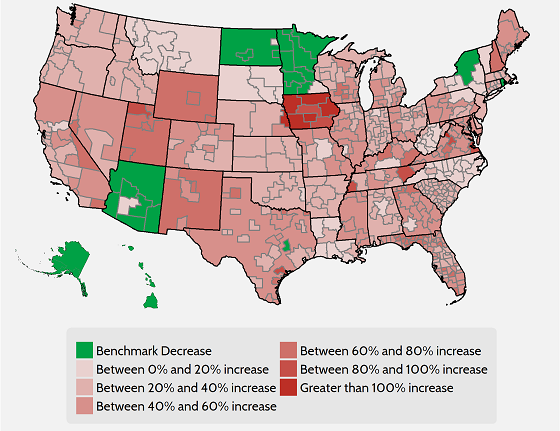

From a December analysis of ACA marketplace premiums by AAF’s Jonathan Keisling, the graphic below illustrates changes in premiums by rating area across the country.

Comparison of 2018 and 2017 Benchmark Premium by Rating Area

Worth a Look

Liberal think tank has a “Medicare for all” plan (Axios)

Health chief exploring more actions on high drug prices (The Hill)

Even for Bezos, Fixing Health Care Will Be Hard (Bloomberg Businessweek)