Weekly Checkup

July 2, 2021

It’s the Risk Pool, Stupid

Last week the Supreme Court rejected a third legal challenge to the constitutionality of the Affordable Care Act (ACA) and the Biden Administration wasted no time in celebrating, rolling out a litany of proposed regulatory changes to the law. Chief among them is a proposal for year-round open enrollment for households at or below 150 percent of the federal poverty level (FPL). This proposal raises questions around the stability of the health insurance market.

Under the ACA, individuals and families can normally enroll in coverage through the exchanges during an open enrollment period occurring at the end of the year. Anyone can also sign up for coverage during special enrollment periods that are triggered when a household experiences certain life events such as the birth of a child or the loss of insurance coverage. Beyond those opportunities, however, if you want to sign up for coverage you’re out of luck. The reason for these limited windows is to prevent freeloading where people wait to buy insurance coverage until they get sick, and potentially drop it again once they’ve received treatment. Because the ACA requires insurers to sell insurance to anyone who wants to buy it, regardless of health status, a limited sign-up period is necessary to ensure enough healthy people are buying into the risk pool.

From the start of his term, however, President Biden has been working to undermine this valuable part of the marketplace. Within days of taking office, Biden announced a special enrollment period (SEP) supposedly to allow people who lost their insurance because of unemployment during the pandemic to sign up for subsidized coverage, but the SEP was open to anyone. Then in March the administration decided to extend the SEP through August 15—a full six months. At the time, I wrote that Biden’s SEP was relatively pointless because individuals who lost coverage were already eligible to sign up for ACA Exchange coverage, and we had just concluded an open enrollment period. But, “if market-wide SEPs were to evolve into a continual open enrollment period, there would be real risks to the health insurance market.” And voilà, here we are, year-round open enrollment, though limited to a subset of consumers for the moment.

The open enrollment would be optional for states that run their own exchanges but would be implemented in the majority of states that use the federal exchange. The administration argues it’s necessary to make open enrollment year-round for these people in part to ensure that anyone who loses Medicaid coverage when states begin checking eligibility again will be able to enroll in Exchange coverage—but of course, loss of insurance coverage already allows people to buy in during the plan year. The Centers for Medicare and Medicaid Services (CMS) argues in the proposed rule that the risk to market stability is minimal because once enrolled these individuals would have little incentive to drop coverage as they won’t in most cases be paying anything for it. There is still, however, the risk that people will wait to sign up until they have medical expenses, and CMS does project that the policy will directly lead to an increase in health insurance premiums of between .5 percent and 2 percent. The proposed rule also notes federal spending on insurance subsidies will increase by between $250 million and $1 billion annually.

Whether the administration’s relatively rosy projections are accurate is somewhat beside the point. More interesting is the question, why cap this permanent open enrollment at 150 percent of FPL? Why not 250 percent, the point at which eligibility for cost-sharing reduction payments phases out? Why not higher? The ACA removed most of the options insurers had for limiting cost, and in the absence of the individual mandate, limits on when people can enroll are crucial to controlling insurance premiums. The Biden Administration appears unconcerned, however. After all, the federal government can just put the bill on the national credit card.

Chart Review: Health Care Workers Shortages

Jake Griffin, Health Care Policy Intern

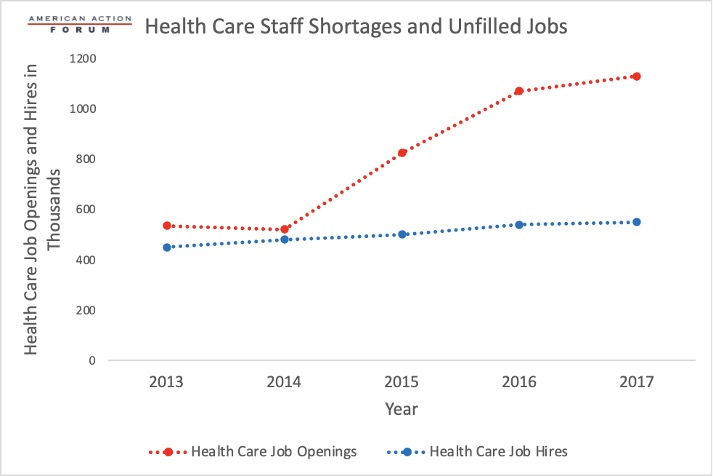

The United States is projected to face significant health care worker shortages in the coming years. Several factors have been identified as contributing to this shortage. As the population continues to get older, chronic conditions will become more prevalent and require more health care for longer periods of time. Additionally, nearly a third of the nurse workforce will retire in the next 10 to 15 years and need to be replaced. The graph below shows that the gap between health care job openings and hires has grown wider over the years, suggesting that health care organizations are struggling to find workers to fill job openings. By 2025, the largest shortages of health care personnel are projected to be not in physicians or nursing assistants but in home health aides (446,000) and registered nurses (500,000), with both as a result of an older population needing care and a limited supply of new nurses. Nursing assistants are not predicted to experience the same levels of shortages as home health aides, who fulfill similar duties, due to the slightly higher pay that results in decreased job turnover. Unfortunately, there is no easy solution. Health care workers need comprehensive training and specific qualifications, so it is difficult to quickly boost the pool of available workers. Strategies to grow the health care workforce will need to be crafted creatively if they are to be successful in meeting demand.

Tracking COVID-19 Cases and Vaccinations

Jake Griffin, Health Care Policy Intern

To track the progress in vaccinations, the Weekly Checkup will compile the most relevant statistics for the week, with the seven-day period ending on the Wednesday of each week.

| Week Ending: | New COVID-19 Cases: 7-day average |

Newly Fully Vaccinated: 7-Day Average |

Daily Deaths: 7-Day Average |

| 30-Jun-21 | 12,514 | 246443 | 206 |

| 23-Jun-21 | 11,472 | 394,539 | 233 |

| 16-Jun-21 | 11,610 | 613,357 | 285 |

| 9-Jun-21 | 15,975 | 717,985 | 350 |

| 2-Jun-21 | 14,969 | 513,079 | 383 |

| 26-May-21 | 22,273 | 809,533 | 455 |

| 19-May-21 | 27,917 | 1,051,361 | 523 |

| 12-May-21 | 34,780 | 1,261,937 | 562 |

| 5-May-21 | 45,321 | 1,455,650 | 592 |

| 28-Apr-21 | 52,139 | 1,490,998 | 620 |

| 21-Apr-21 | 60,939 | 1,511,760 | 637 |

| 14-Apr-21 | 68,420 | 1,763,713 | 637 |

| 7-Apr-21 | 64,032 | 1,590,184 | 624 |

| 31-Mar-21 | 63,844 | 1,374,986 | 730 |

| 24-Mar-21 | 56,774 | 966,514 | 731 |

| 17-Mar-21 | 53,191 | 1,028,148 | 876 |

| 10-Mar-21 | 53,998 | 957,466 | 1,148 |

| 3-Mar-21 | 60,982 | 916,637 | 1,405 |

| 24-Feb-21 | 64,228 | 847,638 | 1,780 |

| 17-Feb-21 | 73,730 | 746,423 | 1,940 |

| 10-Feb-21 | 99,865 | 703,230 | 2,379 |

| 3-Feb-21 | 128,984 | 486,150 | 2,724 |

| 27-Jan-21 | 159,012 | 337,569 | 3,167 |

Sources: Centers for Disease Control and Prevention Trends in COVID-19 Cases and Deaths in the US, and Trends in COVID-19 Vaccinations in the US.

Note: The U.S. population is 332,472,594.

From Team Health

Medicaid and the Goldilocks Test – AAF President Douglas Holtz-Eakin

The Biden Administration will likely use every administrative route at its disposal to keep individuals on Medicaid.

Worth a Look

Axios: The growing threat of drug-resistant, invasive fungi

New York Times: Masks Again? Delta Variant’s Spread Prompts Reconsideration of Precautions.