Weekly Checkup

September 14, 2016

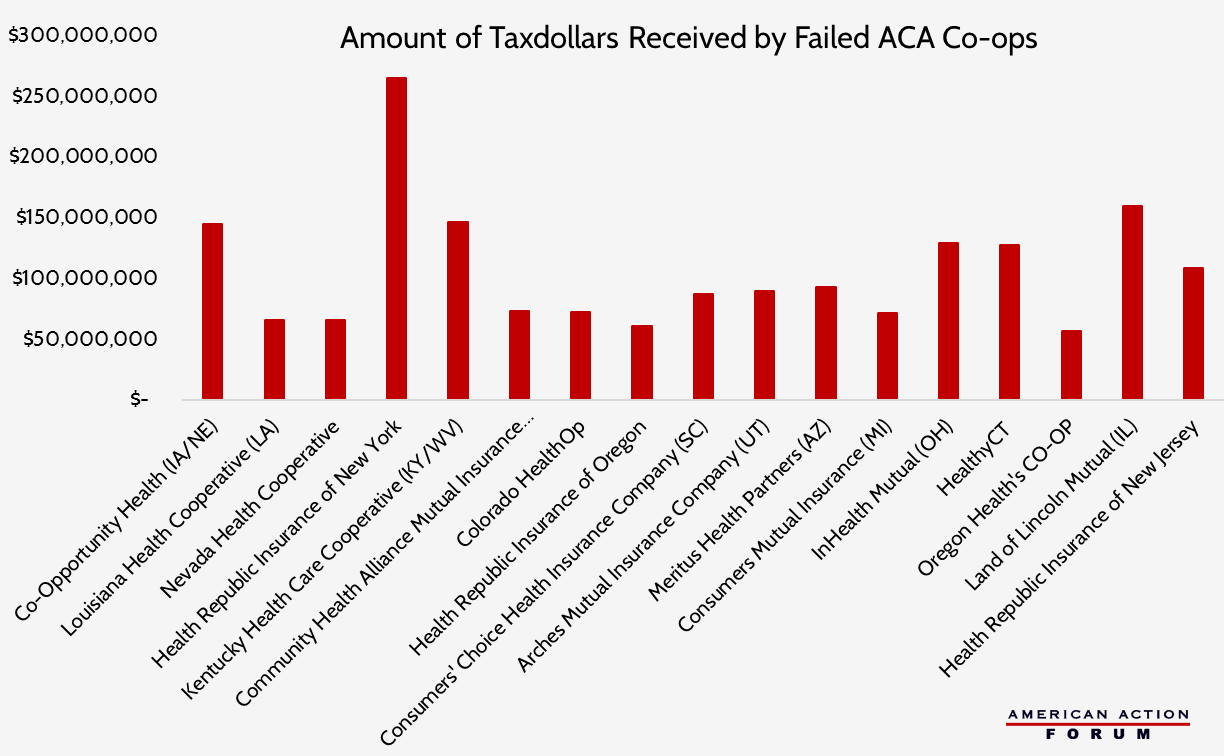

17 Co-ops Have Failed After Receiving Nearly $2 Billion in Taxpayer Financing

Included in the Affordable Care Act was $2.4 billion in grants and loans for the establishment of consumer operated and oriented plans (co-ops). These co-ops were intended to provide consumers in each state with alternative sources of health insurance in the individual market, increasing competition beyond the few long-standing nation-wide insurance companies. With this money, 23 co-ops were formed across the country and began selling insurance in 2014. However, as AAF has detailed the co-ops have been nothing short of a disaster. In less than three years, 17 have collapsed. At this point, it would be surprising if most of the six remaining co-ops do not follow suit. All of the co-ops lost money in 2015, and those six still in operation had an average profit margin of -51 percent last year after accounting for risk adjustment payments. Compounding the problem, the Centers for Medicare and Medicaid recently announced that all money received through the risk corridors program in 2015 will be used to back-fill the 87.4 percent of risk corridor payments owed that were unable to be paid to plans for the 2014 plan year because of a lack of sufficient funds. Thus, while current taxpayer losses for these co-ops stands at $1.82 billion, that number is likely to climb throughout the next year.