Week in Regulation

August 30, 2021

The Proposed Rule Streak Continues

Summer may be winding down, but new regulatory initiatives from the Biden Administration appear to be picking up. For the third consecutive week, proposed rules had their moment in the sun. This week, a Department of Energy (DOE) proposal to update efficiency standards for manufactured housing led the charge. Across all rulemakings, agencies published $4.7 billion in total net costs but cut 13,994 paperwork burden hours.

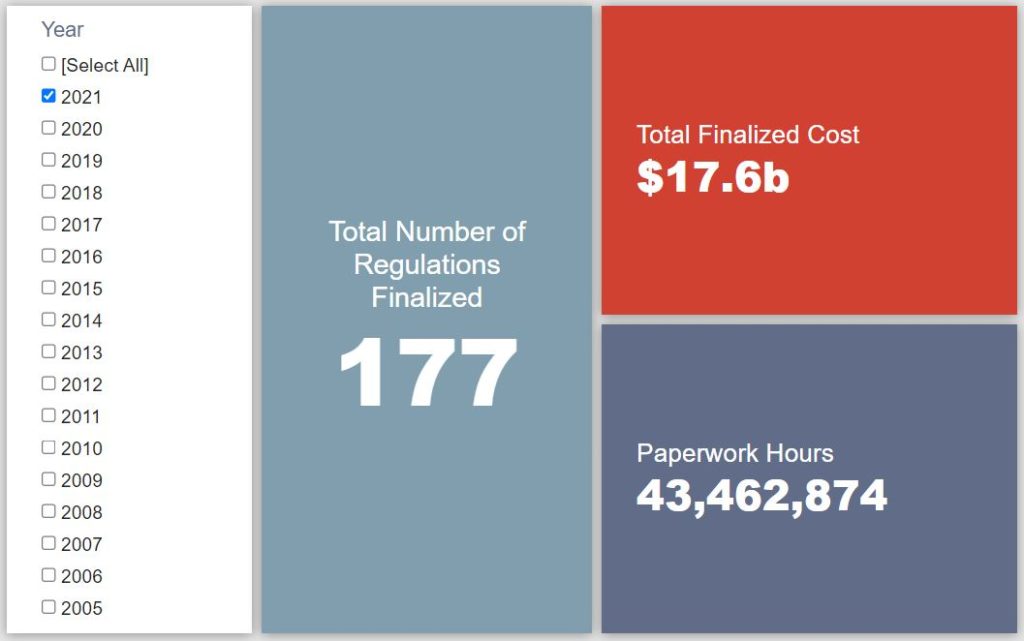

REGULATORY TOPLINES

- Proposed Rules: 52

- Final Rules: 62

- 2021 Total Pages: 48,215

- 2021 Final Rule Costs: $17.6 billion

- 2021 Proposed Rule Costs: $143.1 billion

NOTABLE REGULATORY ACTIONS

As noted above, the most significant rulemaking of the week was DOE’s proposed rule regarding “Energy Conservation Standards for Manufactured Housing.” The Energy Independence and Security Act of 2007 “directs DOE to base the standards on the most recent version of the International Energy Conservation Code (‘IECC’).” This rulemaking seeks to align DOE standards with the 2021 IECC.

Of note, the agency is proposing two potential sets of standards. The “untiered” approach “would apply standards based on the 2021 IECC to all manufactured homes” and impose $4.7 billion in net present value (NPV) “Incremental Product Costs” (on a seven percent discount rate). The “tiered” alternative would include a less stringent level of standards for units “with a manufacturer’s retail list price of $55,000 and below.” DOE estimates that this tiering would shave off roughly $800 million from the “untiered” approach’s total cost figure. Interested parties have until October 25 to submit comment.

TRACKING THE ADMINISTRATIONS

As we have already seen from executive orders and memos, the Biden Administration will surely provide plenty of contrasts with the Trump Administration on the regulatory front. And while there is a general expectation that the new administration will seek to broadly restore Obama-esque regulatory actions, there will also be areas where it charts its own course. Since the AAF RegRodeo data extend back to 2005, it is possible to provide weekly updates on how the top-level trends of President Biden’s regulatory record track with those of his two most recent predecessors. The following table provides the cumulative totals of final rules containing some quantified economic impact from each administration through this point in their respective terms.

![]()

For the second straight week, due to much of the action coming on the proposed rule side of the ledger, there was limited movement in the final rule tallies for the Biden Administration. This was largely the case across the other two administrations as well. In fact, the most notable shift across any of the administrations came from the Obama Administration’s paperwork total. Thanks primarily to a pair of rules from late August 2009, that administration’s topline paperwork figure jumped by 357,000 hours.

THIS WEEK’S REGULATORY PICTURE

This week, the Department of Education (ED) makes permanent a student loan rule discharging the loans of veterans with a total and permanent disability (TPD).

In the August 23 edition of the Federal Register, ED published a final rule titled “Total and Permanent Disability Discharge of Loans Under Title IV of the Higher Education Act.” The rule makes permanent, with some changes, an interim final rule (IFR) of the same title published in November 2019.

According to ED, the rule will remove “administrative burdens that may have prevented at least 20,000 totally and permanently disabled veterans from obtaining discharges for their student loans.”

Before the 2019 IFR, veterans had to obtain documentation of their TPD status from the Department of Veterans Affairs and submit that information along with an application to ED in order to have their student loans discharged, i.e. provided relief from the obligation to repay a federal student loan. The primary change of the IFR, which is now made permanent, is that ED will automatically discharge the loans of veterans when ED gets routine updates of TPD status from Veterans Affairs. The final rule goes further, automatically discharging loans of those identified through a similar update from the Social Security Administration.

The final rule also removes a provision that monitored the income of certain veterans for three years to see if their income rose above a certain threshold, at which point they would lose their discharge and need to repay the loan.

According to an ED press release accompanying the final rule, there are over 320,000 borrowers with a TPD, and the sum of the relief is expected to be about $5.8 billion. ED expects about 33,000 veterans per year will no longer have to file an application for a TPD discharge, saving recipients a total of about $470,000 in time spent filing.

TOTAL BURDENS

Since January 1, the federal government has published $160.7 billion in total net costs (with $17.6 billion in new costs from finalized rules) and 44.9 million hours of net annual paperwork burden increases (with 43.5 million hours in increases from final rules).