Testimony

June 19, 2019

Promoting Economic Growth: Exploring the Impact of Recent Trade Policies on the U.S. Economy

Testimony to the U.S. House Committee on Financial Services, Subcommittee on National Security, International Development and Monetary Policy

*The opinions expressed herein are mine alone and do not represent the position of the American Action Forum. I thank Madison Erbabian for excellent research assistance.

Introduction

Chairman Cleaver, Ranking Member Stivers and members of the Committee, I am honored to be before you today to discuss the outlook for the U.S. economy and discuss that outlook in the context of developments in trade policy.

In my testimony, I wish to make several basic observations:

- Recent economic growth outperformed the trend that prevailed throughout the recovery, underscoring the significance of pro-growth policy, and should neither be taken for granted nor ascribed to any single policy change.

- The Tax Cuts and Jobs Act (TCJA) and other policies have improved the investment climate in the United States and the competitive posture of U.S. firms abroad.

- Reducing global trade barriers and expanding markets are pro-growth trade policies and should be pursued where possible.

Let me discuss these in turn.

The U.S. Economic Outlook

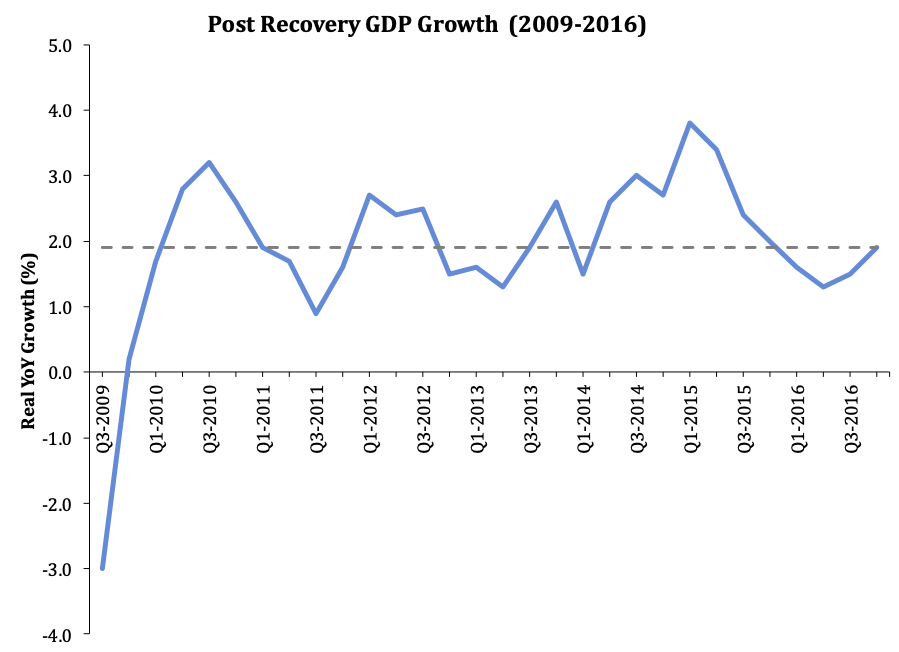

According to the National Bureau of Economic Research (NBER), the U.S. economy began to recover from the Great Recession in June of 2009.[1] Ten years on, the recovery continues. But the pace and character of the recovery matters deeply for American workers and households. For 7 years after the start of the recovery, the pace of national income, employment, and wage growth was positive but disappointing. Real gross domestic product (GDP) growth averaged 1.9 percent per year.

That sluggish pace of growth equates to an average 1 percent per capita income growth. At that rate, it would take 70 years for an individual to double their standard of living – an achievement that used to take just 35 years or about one working career.[2]

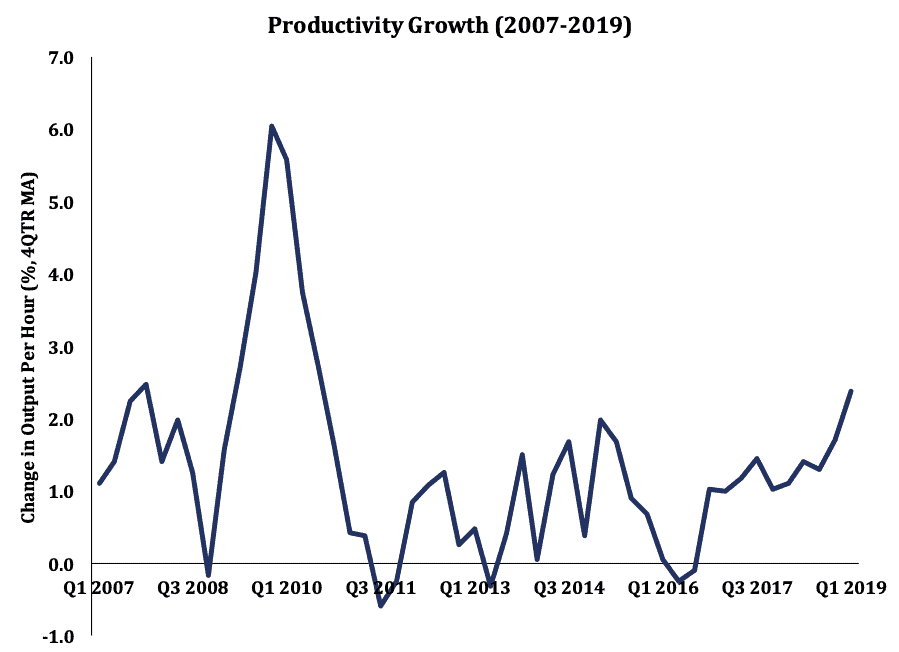

Productivity, an essential ingredient for long-term growth and the key determinant for wage growth, lagged behind historic performance.

But more recently, the pace of growth has accelerated, and has averaged somewhat above the sub-2 percent pace that prevailed during most of the recent recovery. Indeed, over the past 9 quarters, GDP growth has averaged 2.7 percent, 0.8 percentage points higher than the average of the preceding post-recovery period.

Reflecting this acceleration in growth, productivity has also strengthened. The most recent productivity data reflect the strongest annual growth since 2010.[3]

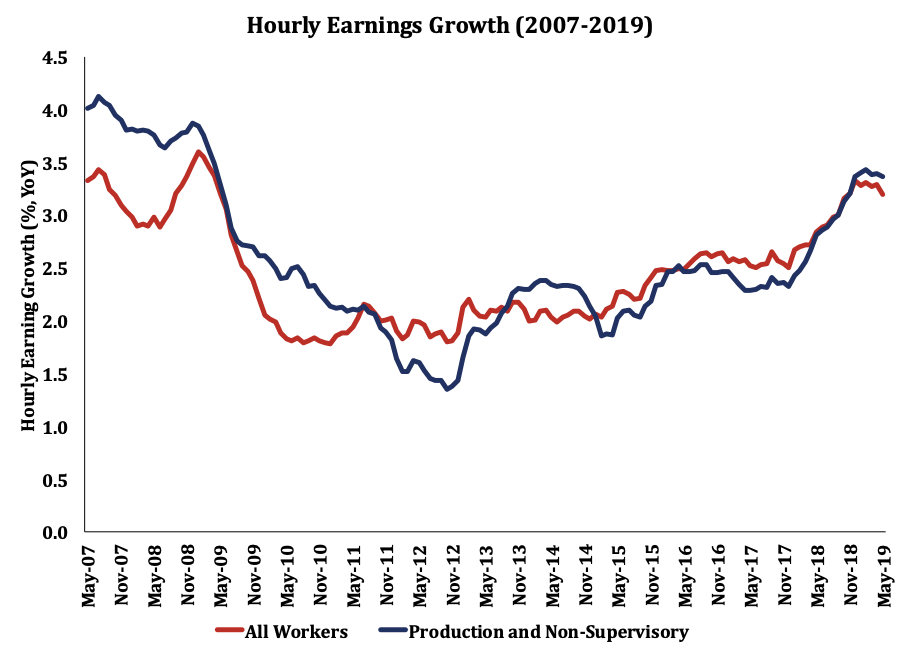

With higher growth and productivity, unemployment has continued to fall as payroll and wage growth have accelerated. Wage growth has improved overall, including for non-supervisory workers.

The upshot of recent economic performance is that past need not be prologue – moribund economic growth is not preordained. Ascribing the recent improvement in economic policy to any single policy would be dubious, but certainly public policy has had an effect on economic output. To the extent that the economy has improved, one could reasonably conclude that recent policy developments have contributed to more robust economic growth.

Recent Developments in Public Policy

Perhaps the most immediate policy change under the current administration has been with respect to the regulatory environment. The previous administration imposed net new regulatory costs of over $890 billion.[4] By contrast, in 2017 and 2018, net regulatory burdens were reported to have decreased by over $31 billion. While assessing the effect this deregulatory effort has had on the economy is difficult, there is a sound basis for concluding that these efforts have had a positive effect on economic growth.[5]

The most significant legislative policy changes achieved by the current administration largely occurred at the end of 2017 and beginning of 2018 – these are the TCJA and the Bipartisan Budget Act of 2018 and related appropriations acts. According to the Congressional Budget Office (CBO) these measures would have, “measurable economic effects.”[6]

Indeed, according to CBO, the TCJA would, through improved incentives to work and invest and increased disposable income, improve GDP by 0.7 percent over the budget window.[7] There is considerable uncertainty attached to such estimates. For example, the Tax Foundation estimated that the TCJA would “increase long-run GDP by 1.7 percent, create 339,000 jobs, and raise wages by 1.5 percent.”[8] With about 18 months since the enactment of the TCJA, evaluating the impact the Act has had on the economy remains difficult. The primary channel for the long-run contribution to GDP growth is through the business tax reforms – essentially the incentive effect of a lower corporate tax rate and the allowance of expensing for investment, which expires in 2025. These incentives will take time to prove out and assessing the impact of these policies on the economy remains challenging, though there are some reasons for cautious optimism.[9]

The budget acts, which provided substantially higher levels of federal funding for defense and non-defense agencies, also contributed to stronger economic growth. According to CBO, “the effects of recent spending legislation are projected to boost the annual level of real GDP by 0.3 percent in 2018 and by 0.6 percent in 2019.”[10]

The combined effects of the regulatory policy changes, the TCJA, and recent spending measures contributed to the recent improvement in economic growth and the related uptick in hiring and wage growth. These measures do not present unalloyed growth opportunities, however. Tradeoffs and future risks attend to each of these and other policy changes, particularly with respect to trade, that have been pursued by the current administration.

Evaluating Policy Risks

The major legislative achievements of the current administration also involve tradeoffs, for example higher debt with respect to the TCJA and spending measures, that must also be considered in evaluating the effects of these policies on the economy. Indeed, significant elements of the TCJA are temporary – muting somewhat its economic impact, while the current spending levels are set to decline under current law. The economic outlook is also clouded by uncertainty with respect to other major elements of the federal policy. Trade is a conspicuous example.

The current trade policy outlook is challenging. The United States is the most robust trading partner in the world, with combined trade volume in 2017 of goods and services valued at over $5.2 trillion.[11] Among nations, the United States was the second-largest exporter of goods and the largest exporter of commercial services as of 2017. Trade is vital to the United States, the largest economy in the world, and the trade policy landscape is unsettled.

Congress has an opportunity to contribute to improving the trade outlook by considering the United States-Mexico-Canada Agreement (USMCA). The USMCA modernizes the existing North American Free Trade Agreement (NAFTA) by adding protections for intellectual property and updating rules on digital trade. The agreement also updates prevailing trade rules related to the agriculture, manufacturing, and automotive industries. While the economic implications for the USMCA should not be overstated, demonstrating the capacity to ratify trade agreements would send a meaningful signal to global trading partners and remove some policy uncertainty from the economic horizon.

The executive branch’s approach to trade is also uncertain. The tariffs threatened and imposed by the president and related retaliatory actions by U.S. trading partners is irreducibly costly. According to estimates by my colleague Jacqueline Varas, the administration has imposed tariffs costing $69.3 billion on a combined $283.1 billion of imports. In response, the EU, China, Russia, Turkey, and India have imposed tariffs on $110 billion of U.S. goods.[12] The administration has threatened additional tariff actions that could substantially raise costs to U.S. consumers. Ultimately, the cost of these tariffs must be weighed against the degree to which they are successful in achieving other beneficial trade policy aims. To the extent that the administration can use tariffs as a negotiating tool that secures more beneficial trade terms, particularly with respect to China’s practices, the tariffs could be justified. If the tariffs do not produce an improvement in trading terms, however, they will simply remain a new tax on U.S. households.

Conclusion

The recovery from the Great Recession is poised to ring in its 10-year anniversary, marking the longest economic expansion in U.S. history. That growth in GDP, employment, and wages accelerated in the last 2 years is remarkable, and underscores the significance of public policy to improving the economic outlook. But these improvements in growth are not guaranteed – major forecasters predict the U.S. economy will slow over the next several years. But this is not inevitable –sound, pro-growth policy can meaningfully improve the economic outlook and ensure future Americans will be able to see enjoy the high and growing standard of living that has characterized the modern American economy.

[1] https://www.nber.org/cycles/cyclesmain.html

[2] https://www.uschamberfoundation.org/sites/default/files/The%20Growth%20Imperative.pdf

[3] https://www.washingtonpost.com/business/us-productivity-grew-at-solid-34percent-rate-in-first-quarter/2019/06/06/9be9a372-885a-11e9-9d73-e2ba6bbf1b9b_story.html?utm_term=.857658474db8

[4] https://www.americanactionforum.org/insight/midnight-regulations-push-obama-administrations-regulatory-tally-past-890-billion/

[5] https://www.whitehouse.gov/wp-content/uploads/2019/03/ERP-2019.pdf

[6] https://www.cbo.gov/publication/53651

[7] https://www.cbo.gov/system/files/2019-04/53651-outlook-2.pdf

[8] https://taxfoundation.org/tcja-one-year-later/

[9] https://waysandmeans.house.gov/sites/democrats.waysandmeans.house.gov/files/documents/Holtz-Eakin%20Testimony.pdf

[10] https://www.cbo.gov/system/files/2019-04/53651-outlook-2.pdf

[11] https://www.wto.org/english/res_e/statis_e/wts2018_e/wts2018_e.pdf

[12] https://www.americanactionforum.org/research/the-total-cost-of-trumps-new-tariffs/