Testimony

February 5, 2020

More Cures for More Patients: Overcoming Pharmaceutical Barriers

United States House of Representatives Committee on Ways and Means Subcommittee on Health

* The views expressed here are my own and not those of the American Action Forum.

Chairman Doggett, Ranking Member Nunes, and members of the committee, thank you for the opportunity to testify today on the matter of drug prices and access to medications. I hope to make four basic points:

- Medicare Part D represents nearly one-third of all drug spending in the United States, meaning reform to the program could impact the rest of the pharmaceutical market, and all of the major policy proposals as well as the president’s budget include a redesign of the Medicare Part D benefit structure.

- The current structure of Medicare Part D’s benefit design, along with pricing incentives in the broader pharmaceutical market, create perverse incentives for insurers and drug manufacturers to benefit from high-cost drugs. These incentives have resulted in a rapid increase in spending in the catastrophic phase of the Part D program over the past decade, exposing taxpayers and high-cost beneficiaries to ever-increasing costs.

- Under current law, the mandatory discount decreases (as a proportion of the drug’s price) as the price increases. To counter this undesirable effect, each of the proposals currently under consideration instead require manufacturer rebates in the catastrophic phase, ensuring the mandatory discount increases along with a drug’s price. Insurer liability is also increased significantly in the catastrophic phase under each proposal. Both of these changes should put downward pressure on drug prices.

- Each proposal would also establish an out-of-pocket maximum for beneficiaries and reduce the government’s open-ended insurance liability, providing greater protection to beneficiaries and taxpayers. I calculate that, in 2022, H.R. 19 could save the federal government $28.3 billion in reinsurance payments and beneficiaries more than $10.6 billion in out-of-pocket costs, while insurer liability would increase by $33.7 billion and drug manufacturer liability would increase by $5.2 billion.

Let me discuss these further.

Introduction

Over the past few years, members of Congress have put forward many policy proposals to lower prescription drug costs.[1] While many policies have gained broad support, few are as transformative as proposals to reform the Medicare Part D benefit structure. Part D reforms are also of particular importance as they are the only major policy reforms that each of the major legislative packages and the president’s fiscal year 2020 budget include.

Since Medicare Part D’s inception, Republicans, Democrats, and beneficiaries alike have hailed the program as a rare success among government programs. The program has provided millions of seniors access to prescription drugs at a budgetary impact equaling only half of what was projected.[2] But nearly 15 years after its implementation, the program’s costs and the prescription drug market have changed. The emerging trends highlight the need to reform the program in order to account for these changes.

Congress should amend the benefit design to provide beneficiaries an out-of-pocket (OOP) cap; reduce taxpayer exposure by reducing the government’s reinsurance liability; increase insurers’ incentive to control drug costs by increasing their liability throughout the benefit; and decrease drug manufacturers’ incentive for higher prices by requiring them to pay a share of the catastrophic phase’s costs, lifting the existing cap on their liability for drug costs. Each of the major drug-focused legislative packages that Congress is considering—H.R. 3 from Speaker Pelosi and the House Democratic Caucus, S. 2543 from the Senate Finance Committee, H.R. 19 from the House Republican leaders of the Ways and Means, Energy and Commerce, and Education and Labor Committees, as well as S. 3129 from Senators Burr, Crapo, Enzi, and Tillis—includes such reforms.[3]

If the reforms described here are successful in reducing costs in Medicare Part D, such reforms could impact the broader drug market. In 2018, total expenditures in Medicare Part D neared $100 billion.[4] Total prescription drug spending in the United States was $335 billion.[5] Medicare Part D therefore represents 30 percent of the country’s total prescription drug market and more than 8 percent of the global pharmaceutical market.[6]

The Need for Reform

Rising Reinsurance Costs

At the program’s outset in 2006, reinsurance costs accounted for 26 percent of the government’s overall Medicare Part D subsidy. By 2018, reinsurance costs had climbed to 73 percent of the program’s subsidy, surpassing $40 billion.[7] This shift has dramatically increased taxpayers’ financial exposure, putting the program on an unsustainable path. Between 2007 and 2017, premium subsidies decreased by 1.8 percent per year while reinsurance payments increased by 16.7 percent per year, on average.[8]

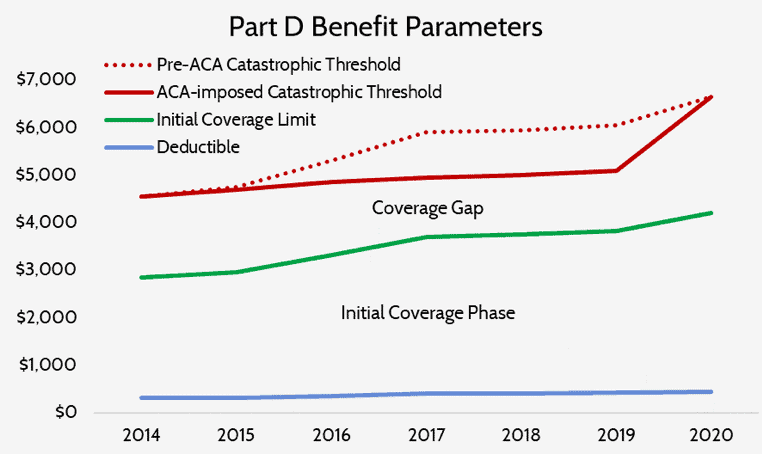

While rising drug spending itself is, of course, partially to blame for the increasing reinsurance costs, structural changes made to the program are also significant contributors. The Patient Protection and Affordable Care Act included two provisions that made significant changes to the Part D program: the Coverage Gap Discount Program—otherwise known as “closing the coverage gap” (or the “donut hole”)—and a temporary slowing of the catastrophic threshold’s growth rate.

The Coverage Gap Discount Program required drug manufacturers to pay 50 percent of the costs of any drug a beneficiary takes while he or she is in the coverage-gap portion of the benefit phases. These manufacturer payments count toward the beneficiary’s true out-of-pocket (TrOOP) cost calculation, which in turn determines when the beneficiary moves from one phase of the benefit to the next. Including manufacturer’s payments in this calculation results in beneficiaries moving through the benefit phases and into the catastrophic phase much more quickly than they otherwise would.

The temporary slowdown in the growth rate of the catastrophic threshold also led to more beneficiaries reaching the catastrophic phase and doing so after less spending than they would have absent this change, as can be seen below.

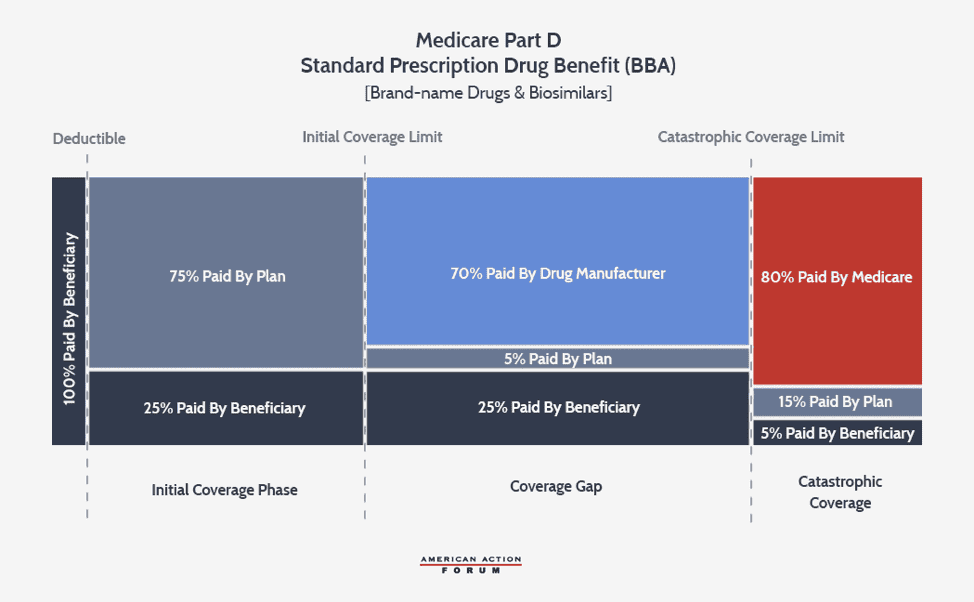

The growth rate of the catastrophic coverage threshold has now returned to normal, but a provision included in the Balanced Budget Act of 2018 (BBA) exacerbates the problem of rising reinsurance expenditures: The BBA increased manufacturer liability in the coverage gap to 70 percent while decreasing insurer liability to 5 percent.

The increase in manufacturer liability exacerbates the existing TrOOP problem, while the decrease in insurer liability significantly diminishes insurers’ incentive to control costs for high-cost enrollees. Insurers in 2017 were at risk for only 46 percent of the benefit costs, down from the expected 75 percent rate in 2007.[9] In fact, the BBA reduced insurer liability so substantially that for a beneficiary who reaches the catastrophic threshold in 2020 taking exclusively brand-name or biosimilar drugs, the insurer’s cost at this point ($2,974) is about $700 less than the drug manufacturer’s ($3,698).

Perverse Incentives Favor High-Priced Drugs

The structure of the current benefit design, as well as the pricing incentives in the broader drug market, encourage insurers to prefer coverage of high-price, high-rebate drugs, a preference that also leads to more beneficiaries reaching the catastrophic phase. Because of the BBA’s changes and the insurers’ varying liability for brand-name products (5 percent) versus generics (75 percent), it is now in insurers’ financial interest to prefer a brand-name drug over a generic unless the generic is more than 15 times less expensive than the brand-name product.[10] This incentive may depress demand for generics, which could discourage generic development, harming the broader market. Further, pharmacy benefit managers (PBMs)—working on insurers’ behalf—have created a business model in which their revenue is largely tied to the amount of rebates they are able to obtain from drug manufacturers.[11] Drug manufacturers provide greater rebates in order to secure preferred status on a drug plan’s formulary, which increases sales of the preferred drug. The easiest way to provide a larger rebate is to raise the price of the drug before the rebate (list price). Insurers benefit from greater rebates because these rebates, most often paid after the point-of-sale, can be used to reduce next year’s premiums—the most important factor beneficiaries consider when deciding in which plan to enroll.

The mandatory discounts that Part D requires of drug manufacturers in the coverage gap also encourage higher drug prices. Because the coverage gap is in the middle of the benefit structure, only a finite amount of spending is subject to the discount, resulting in a maximum discount that manufacturers will owe.[12] Under current law, the maximum discount a drug manufacturer will have to pay in 2022 is $4,136. Any manufacturer with a drug costing $10,399 or more will have to pay this discount. For a drug costing $10,399, this discount represents a discount of 40 percent. For a drug costing $50,000, this maximum discount will only equal 8.3 percent of the drug’s price. Thus, the current structure is more punitive to manufacturers of lower-cost drugs and encourages higher prices.

Further, patients who pay coinsurance based on the list price are substantially worse off when list prices rise. Also, because the rebates are used to reduce premiums for everyone, rather than simply reducing the high OOP costs paid by the patients taking the drug for which the rebate was paid, the beneficiaries with higher costs end up subsidizing those with lower costs—the opposite of how insurance is supposed to work. Taxpayers, who subsidize 75 percent of the program, are also worse off when program costs increase. Thus, higher-price, high-rebate drugs are beneficial to each of the industry stakeholders but increase costs for both patients and taxpayers.

High-Cost Enrollees’ Financial Burden

The financial burden for enrollees reaching the catastrophic phase can be quite significant. In 2010, 2.4 million beneficiaries reached the catastrophic phase, and 33,000 beneficiaries did so after filling a single prescription.[13] In 2016, more than 3.6 million beneficiaries reached the catastrophic phase and more than 370,000 did so after a single prescription fill.[14] These beneficiaries had average spending between $20,899 (those with the low-income subsidy, or LIS) and $29,797 (non-LIS).[15] Beneficiaries who do not receive the LIS are responsible for 5 percent of all costs in the catastrophic phase, meaning the average non-LIS high-cost enrollee incurred more than $4,000 in OOP costs in 2016, and that figure will increase each year, particularly as more expensive specialty medicines are developed. Specialty drugs now account for 25 percent of Part D spending, approximately four times more than in 2010.[16]

Redesigning the Benefit to Realign Incentives

One possible reform to address these various problems would involve reconfiguring the liabilities within the Part D structure. These changes include placing a true cap on beneficiary OOP expenditures, eliminating the coverage gap phase entirely and instead requiring drug manufacturers to pay rebates during the catastrophic phase, reducing the federal government’s reinsurance rate, and increasing plans’ liability in the catastrophic phase.[17]

Requiring drug manufacturers to pay discounts in the catastrophic phase ensures that the amount they owe increases along with the drug’s price, discouraging both high launch prices and price increases. The current structure—which caps manufacturer liability as described above—results in the mandatory discount being more punitive for lower-cost drugs, thus encouraging higher prices.

Increasing insurer’s liability throughout the benefit, and particularly in the catastrophic phase, increases insurers’ incentive to control costs and reduce the use of high-cost, high-rebate drugs.

Reducing the government’s reinsurance liability reduces taxpayers’ exposure to rising costs.

Establishing an OOP cap provides beneficiaries with financial protection, assuring them they will not face open-ended OOP costs. More than a million beneficiaries could save hundreds or thousands of dollars each year.

The following bills each include provisions to reform the Medicare Part D benefit structure in a similar conceptual manner: H.R. 3, H.R. 19, S. 2543, and S. 3129.[18] The president’s FY2020 budget also included a proposal to redesign the benefit structure, and while that proposal was conceptually different from the ideas discussed here, the administration has since expressed support for this conceptual framework.[19]

H.R. 19, the Lower Costs, More Cures Act

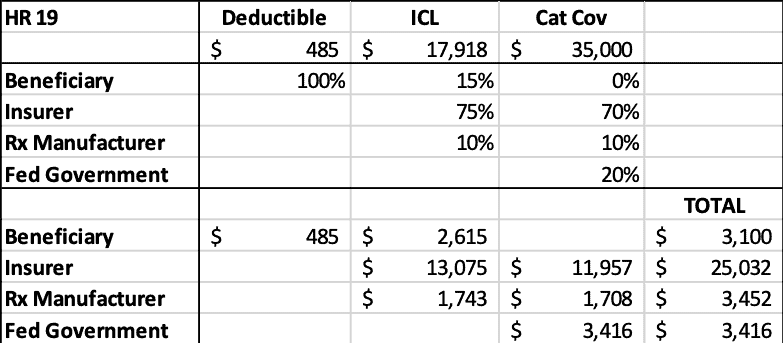

H.R. 19 provides Part D enrollees with a $3,100 OOP cap on prescription drug costs; reduces the government’s reinsurance liability to 20 percent for all brand-name and biosimilar products and 30 percent for all generic products; increases insurer liability in the catastrophic phase to 70 percent; and requires drug manufacturers to pay 10 percent of all costs above the deductible for brand-name and biosimilar products. H.R. 19 also reduces beneficiaries’ coinsurance to 15 percent for brand-name and biosimilar products in the initial coverage limit (ICL), reducing costs for most enrollees with spending above the deductible.

Equalizing insurer liability for all products throughout the benefit phases should eliminate insurers’ existing financial incentive to prefer brand-name products over generics.

H.R. 19 would require drug manufacturers to provide discounts for products that LIS beneficiaries take; under current law, rebates are only required for non-LIS beneficiaries. In 2015, high-cost LIS enrollees took 18 more prescriptions, on average, than high-cost non-LIS enrollees.[20] The most common types of drugs taken by high-cost LIS enrollees are for mental health, diabetes, HIV/AIDS, and pain, whereas high-cost non-LIS beneficiaries most commonly take drugs for cancer, multiple sclerosis, rheumatoid arthritis, and pulmonary hypertension. Current law therefore penalizes manufacturers of drugs that predominantly non-LIS beneficiaries take. Requiring discounts for all beneficiaries and throughout the benefit will help prevent manufacturers from being hit disproportionately based on their product line.

Overall, H.R. 19 will make several important changes to the structure of the Part D benefit which should put pressure on both insurers and drug manufacturers to reduce drug costs and provide greater financial protection to both patients and taxpayers. For the included reforms to have maximum benefit, Congress should provide insurers with additional tools and flexibility to better manage enrollees’ drug utilization. Further, because these reforms would significantly increase insurer liability, regulatory changes need to be made to recalibrate the program’s risk adjustment system in order to protect against risk selection.

Analysis of H.R. 19 Compared to Current Law

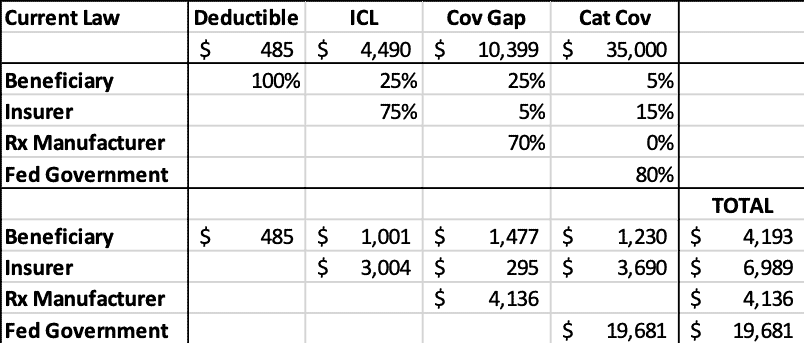

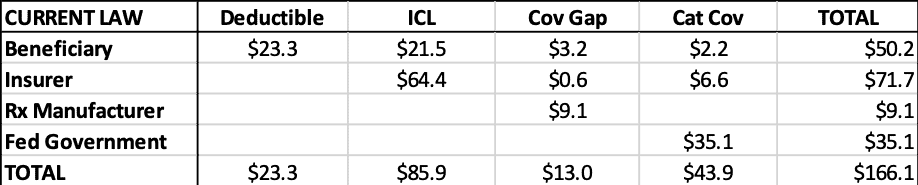

The following tables illustrate the projected stakeholder liability in 2022 for a drug costing $35,000 during each phase of the benefit under current law and under H.R. 19. As the tables show, under current law, taxpayers’ share of the costs are nearly three times greater than insurers’.

Table 1: Current Law 2022 Liability by Stakeholder for $35,000 Drug

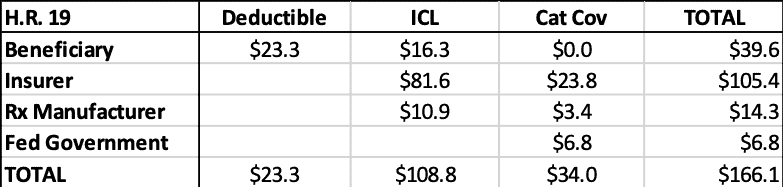

H.R. 19 would significantly increase insurer liability while greatly reducing taxpayer liability. Beneficiaries would save nearly $1,300 in OOP costs. Manufacturer liability would be reduced by $1,400 in this instance, but, as noted before, if the drug’s price increased, so would the manufacturer’s liability, whereas under current law, no such deterrent exists.

Table 2: H.R. 19 2022 Liability by Stakeholder for $35,000 Drug

Aggregate Stakeholder Liability

The following analysis examines the expected aggregate effect of H.R. 19. This analysis is based on the latest data available through the Centers for Medicare and Medicaid Services’ Drug Spending Dashboard.[21] The most recent drug spending and utilization data for Medicare Part D is from 2018. In order to calculate estimates of the effect of H.R. 19 relative to current law in 2022—the year H.R. 19 would be implemented—this estimate assumes utilization will increase by 16 percent (equal to the amount enrollment in Part D is projected to increase during this period) and the average spending per drug will increase 6 percent.

Limitations

This analysis is based on spending on individual drugs for which per-beneficiary spending is high enough to trigger a rebate. These estimates do not include rebates for drugs that have an average annual cost per beneficiary that is lower than the rebate threshold, even though these drugs could be provided after the beneficiary surpasses the threshold and a rebate would be required. Conversely, these estimates do not exclude the many drugs that may be generic products. Further, it is important to note that these estimates do not account for any new drugs that have come to market or are expected to come to market after 2018.

Findings

Given these assumptions and limitations, an estimated 48 million beneficiaries will fill a prescription for which the average spending per beneficiary is greater than the deductible, projected to be $485 in 2022.[22] Total spending for these 1,898 drugs will equal an estimated $166.1 billion.

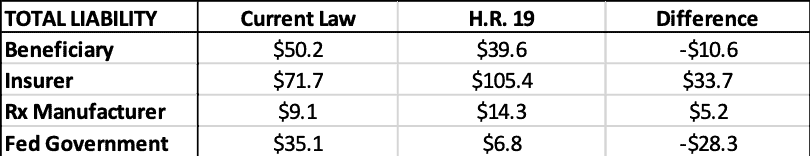

The estimated liability for each stakeholder during each coverage phase can be seen in the tables below. Table 3 shows the liabilities under current law while Table 4 shows the estimates for H.R. 19. Table 5 shows the totals side-by-side.

Table 3: Current Law Estimated 2022 Liability by Stakeholder ($billions)

Table 4: H.R. 19 2022 Estimated Liability by Stakeholder ($billions)

Relative to current law, the federal government would be expected to save more than $28.3 billion in reinsurance payments, under this analysis, as shown below. Beneficiaries are expected to save $10.6 billion in OOP costs. Insurers’ liability will increase more than $33.7 billion and drug manufacturers’ liability will increase more than $5.2 billion. Of course, the increase in insurer liability is likely to result in higher premiums, which beneficiaries and the federal government will pay, offsetting much—but not all—of their expected savings in the catastrophic phase.

Table 5: Current Law vs H.R. 19 Estimated 2022 Liability by Stakeholder ($billions)

Conclusion

The Medicare Part D Prescription Drug Program has been highly successful, providing millions of seniors with access to prescription drugs they would otherwise not be able to afford. Recent trends, however, reveal the need for some structural reforms to ensure the program continues to be successful in terms of access and affordability for both patients and taxpayers. Restructuring the program’s benefit design in a way that realigns incentives away from high-cost, high-rebate drugs may be the best way to reduce overall program costs as well as drug prices in other parts of the market.

[1] https://www.americanactionforum.org/insight/comparing-drug-pricing-reform-proposals/

[2] https://www.americanactionforum.org/research/competition-and-the-medicare-part-d-program/

[3] S. 1895 also includes many provisions aimed at reducing drug prices but does not include language to reform the Medicare Part D benefit structure because the Senate HELP Committee, which drafted the legislation, does not have the jurisdiction to do so.

[4] https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/ReportsTrustFunds/Downloads/TR2019.pdf

[5] https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NHE-Fact-Sheet

[6] https://www.iqvia.com/insights/the-iqvia-institute/reports/the-global-use-of-medicine-in-2019-and-outlook-to-2023

[7] http://www.medpac.gov/docs/default-source/default-document-library/ma_vip_public_jan_2020.pdf?sfvrsn=0

[8] http://www.medpac.gov/docs/default-source/reports/mar19_medpac_ch14_sec.pdf?sfvrsn=0

[9] http://www.medpac.gov/docs/default-source/reports/mar19_medpac_ch14_sec.pdf?sfvrsn=0

[10] For low-income subsidy (LIS) enrollees, the distortion is even worse because plans have no liability for such beneficiaries in the coverage gap.

[11] https://www.americanactionforum.org/research/primer-prescription-drug-prices-discounts-fees-effects-part-d/

[12] https://www.americanactionforum.org/insight/the-impact-of-shifting-rebates-to-catastrophic-coverage-in-medicare-part-d/

[13] http://www.medpac.gov/docs/default-source/reports/mar19_medpac_ch14_sec.pdf?sfvrsn=0

[14] http://www.medpac.gov/docs/default-source/reports/jun19_ch2_medpac_reporttocongress_sec.pdf?sfvrsn=0

[15] http://www.medpac.gov/docs/default-source/reports/mar19_medpac_ch14_sec.pdf?sfvrsn=0

[16] http://www.medpac.gov/docs/default-source/reports/mar19_medpac_ch14_sec.pdf?sfvrsn=0

[17] https://www.americanactionforum.org/research/redesigning-medicare-part-d-realign-incentives-1/

[18] https://www.americanactionforum.org/insight/competing-proposals-to-reform-medicare-part-d/

[19] https://www.modernhealthcare.com/government/top-white-house-adviser-says-hospital-price-transparency-rule-coming-soon

[20] http://www.medpac.gov/docs/default-source/reports/mar18_medpac_ch14_sec.pdf (pg. 425)

[21] https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/Information-on-Prescription-Drugs/MedicarePartD

[22] https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/ReportsTrustFunds/Downloads/TR2019.pdf