Solution

March 29, 2017

Affordable and Targeted: How Paid Parental Leave in the US Could Work

Solution published by the American Action Forum and American Enterprise Institute

Executive Summary

Paid parental leave, which refers to compensation for time off from work to care for a new child, can promote family well-being and support continued employment. Yet, too common are stories of parents who must return to work too quickly or lose their job entirely upon the birth of a new child because they lack paid leave. Work-related compensation of this type is typically left to the decision-making of private employers and their workers. But for a variety of reasons, the private market does not provide paid parental leave to all workers. According to US Census data, approximately 50 percent of workers have access to some level of paid leave for the birth or adoption of a new child, but wage earners in the bottom of the income distribution are the least likely to receive any paid time off.[1]

In this paper, we propose an affordable federal paid parental leave program, targeted to low-income families. By ensuring paid leave for the most vulnerable and the least likely to receive it through the private market, a government-supported paid leave program would increase access to paid time off from work to care for a newborn or newly adopted child. Income testing the program would ensure that government assistance is well targeted to those who need it the most, while not displacing what is already available in the private market.

This proposal follows up on the American Action Forum’s proposed Earned Income Leave Benefit (EILB), a highly targeted program that would provide paid parental, family care, and medical leave to workers in low-income households. In this paper, we narrow our focus to paid parental leave for the birth or adoption of a new child and outline a proposal to provide paid leave to low-income and lower-middle-income working households. This proposal is intended to supplement what the private market already provides, as well as to offer job protection and paid leave to those who do not currently receive it.

Like the EILB, the total benefit would be based on household earnings. Only households with sufficient work histories and incomes below a certain threshold would be eligible. We expand the parameters so that a larger number of workers would be eligible for benefits, while remaining targeted on low-income and lower-middle-income households. This not only makes it better targeted than universal programs, but also ensures that it is cost-effective. Based on our estimates, the income-tested paid parental leave program we outline would have the following impacts:

- 57.1 million low- and middle-income workers, almost 40 percent of civilian employment, would gain access to 12 weeks of job-protected, paid parental leave;

- Each participating household would receive $343.34 per week on average;

- The federal government would spend approximately $4.3 billion annually on the program’s benefits, assuming that each year 2 million covered workers would have a new child; and

- All benefits would go to workers in households under 325 percent of the federal poverty threshold (approximately $62,000 per year for a family of three).

No parents are immune from difficult decisions surrounding time off from work after the birth or adoption of a child. These difficulties are compounded for low- and lower-middle-income households who are not only the least prepared to handle income loss, but also the least likely to receive pay while they take time off to care for their child. First-time parents, particularly low-income mothers, often find no other option than to quit their jobs to care for newborn children, even though work is their most effective path to self-sufficiency. An income-tested paid parental leave program would effectively target these workers so they can raise healthy children and remain attached to the labor force.

Note: The authors of this report participated in a joint American Enterprise Institute–Brookings Institution working group on paid parental leave. Although our participation in the working group helped us further develop what we believe is the most effective way for the federal government to expand access to paid parental leave, this paper does not reflect the work or the views of that group.

Introduction

Recently, considerable interest in paid parental leave has emerged in the United States. On Capitol Hill there are several competing proposals on both sides of the aisle to increase access to paid leave, and for the first time ever in a presidential election, both major party nominees proposed solutions to paid parental leave. While some proposals would provide paid parental leave universally, others would help either employers provide paid leave or employees afford time away from work.

In a previous report, American Action Forum (AAF) introduced the Earned Income Leave Benefit (EILB), an income-tested way to provide 12 weeks of paid parental, family care, and medical leave in the United States.[2] This paper offers a more narrow approach that covers only paid parental leave for the birth or adoption of a new child (versus time off for a sick family member or a personal medical reason). In particular, we propose an income-tested program specifically for paid parental leave and outline how it would work. Like the EILB, this program departs from traditional paid parental leave programs (including those offered in other countries and in a few states in the US) in two critical ways: First, eligibility is based on household income rather than universally applying to all new parents. Second, the amount of the benefit is calculated based on household income, not individual worker earnings, and phases in and out depending on income.

Structuring the program in this way targets families who are the least able to tolerate an income shock that results from time off of work after childbirth as well as the least likely to receive paid leave benefits in the private market. By completely phasing it out at incomes above a certain threshold, the benefit would go to only the most vulnerable workers in the labor market. According to US Census Bureau data, 66 percent of new mothers with a college degree or more have access to paid maternity leave compared with under 20 percent of those with less than a high school diploma.[3] Under the prototype we outline, all benefits would go to households with incomes under 325 percent of the poverty threshold (approximately $62,000 for a family of three). The result is a cost-effective program that makes available 12 weeks of job-protected, paid parental leave to 57.1 million low- and middle-income workers per year. Our estimates suggest that approximately 2 million of the 57.1 million eligible workers would participate each year, receiving an average total benefit of $2,220 per household. Since the program is targeted to low-income households, it would be highly efficient, costing the federal government $4.3 billion annually, which would be less than 0.1 percent of all federal outlays and tax expenditures.

Parental Leave in the United States

Under the Family and Medical Leave Act of 1993 (FMLA), certain workers are allowed up to 12 weeks of unpaid, job-protected leave to care for a newborn or adopted child (“parental leave”), recover from a serious medical condition (“medical leave”), or care for a family member with a serious medical condition (“family care leave”). No federal laws, however, guarantee workers are paid during their time away from work. In fact, the United States is the only developed country in the world that does not guarantee workers some form of paid parental leave.[4]

Universal Approaches to Paid Leave. One of the most common approaches to providing paid parental leave is taxpayer-funded social insurance programs that compensate working parents while they are on leave. Taxpayers in Denmark, for instance, fund a program that provides payments to new mothers for up to 50 weeks of maternity leave.[5]

In the United States, state-level policymakers hoping to guarantee universal paid parental leave have adopted the same social insurance model. California, New Jersey, and Rhode Island provide paid parental leave universally as part of a taxpayer-funded social insurance program that also provides paid medical and family care leave. These states each provide several weeks of paid leave by distributing payments through state trust funds that are financed with payroll taxes. The benefits are generally set at a fixed percentage of a worker’s usual weekly earnings up to a cap. In California, for instance, workers receive 55 percent of their weekly earnings with a maximum benefit of $1,173 per week.[6]

California, New Jersey, and Rhode Island built their paid parental leave programs on top of existing temporary disability insurance (TDI) programs that provide long-term paid medical leave. California, for instance, provides workers with up to 52 weeks of benefits for a disability and for pregnancy through TDI, and an additional six weeks of benefits for parental leave after the birth of a child.[7] New York and the District of Columbia recently passed bills that use the same social insurance model to provide paid leave.

On the federal level, Sen. Kirsten Gillibrand (D-NY) introduced the Family and Medical Insurance Leave (FAMILY) Act, which would provide universal paid parental leave, along with paid family care and medical leave, by using the same social insurance model. If approved, the FAMILY Act would provide up to 12 weeks of paid leave by creating a trust fund that would be financed with a 0.4 percent payroll tax, split between employers and employees.[8] For those 12 weeks, the federal government would provide benefits equal to two-thirds of regular earnings, with a minimum monthly benefit of $580 and a maximum monthly benefit of $4,000.

The major drawback to this approach is that it is extraordinarily expensive and would displace benefits already provided in the private market. AAF previously estimated that the FAMILY Act would cost the federal government at least $85.9 billion annually. Moreover, the 0.4 percent payroll tax proposed by the FAMILY Act would raise only $30.6 billion in annual revenue. This means that the payroll tax would cover at most only 35.6 percent of the program’s promised benefits. In addition, since the monthly benefit increases with earnings and there is no maximum income level to be eligible for the benefit, most of the federal government’s expenditures would go to workers with high earnings, who are the most likely to already receive paid leave benefits from their employer and the most likely to be able to afford time away from work.[9]

The Congressional Budget Office projects that the annual federal budget deficit will double over the next few years, surpassing $1 trillion per year starting in 2023. At that point, federal debt held by the public will equal 82.6 percent of the nation’s gross domestic product.[10] Given the nation’s current fiscal outlook, creating new federal programs at this scale is irresponsible, particularly when they are unable to pay for themselves over time as in the case of the FAMILY Act.

Parental Leave in the Private Sector. The data suggest that an expensive federally funded universal paid parental leave program may also be unnecessary and redundant. In the private sector, only 13 percent of workers in 2016 received a paid parental leave benefit from their employers.[11] However, just because few workers are offered a defined benefit specifically for parental leave does not mean that workers are not paid when they are away from work. Workers often use other forms of paid time off, such as vacation and sick days.

In addition, instead of offering distinct vacation and sick days, many employers pool those days into one generous paid time off benefit that employees can use, whether they go on vacation, become ill, or care for a newborn child. A survey conducted by the Society for Human Resource Management found that 51 percent of employers offer a paid time off plan that encompasses all types of leave.[12] Some employers are even starting to offer their workers unlimited paid time off, allowing the flexibility for employees to take as much time away from work as they want.[13]

Moreover, evidence also indicates a great deal of paid leave informally available in the private sector. President Barack Obama’s Council of Economic Advisers noted in 2014 that, while roughly 40 percent of workers reported having access to paid parental leave, employers reported that only 11 percent of workers are offered a paid parental leave benefit. This suggests that, although many employers may not have a defined paid parental leave benefit, they still frequently offer to pay their workers when welcoming a newborn child.[14]

Among all these resources, when employees are on parental leave, they are paid much more frequently than suggested by the 13 percent rate of family leave benefits. For instance, in 2008, 50 percent of female workers received some paid time off for the birth of their children.[15] Additionally, a survey of workers on job-protected leave under the FMLA in 2012 found that 48 percent were paid fully and another 17 percent were paid partially.[16] In total, this suggests that 65 percent of workers on FMLA job-protected leave were paid by their employers.

Advantages of an Income-Tested Program

For a universal, federal paid leave program such as the FAMILY Act, $85.9 billion is a large expenditure on something that many workers are already acquiring on their own. It also fails to recognize that higher-income workers are in the best position through savings or income from a spouse to afford time away from work. A more cost-effective way for the federal government to provide paid parental leave is to target workers in low-income households, who are the least likely to have access to paid leave in the private sector and the least able to afford time away from work on their own. To that end, an income-tested paid parental leave program has significant advantages.

Targets Workers Who Lack the Benefit. An income-tested paid parental leave program would target the workers who are the least likely to have access to the benefit on their own. Defined paid family leave benefits are much more widely available in the private sector for high-wage workers than for low-wage workers. According to the National Compensation Survey, in 2016 only 6 percent of workers in the bottom quartile of wages had access to a defined paid family leave benefit. Meanwhile, 24 percent of workers in the top quartile had access to defined paid family leave benefit.[17] This suggests that workers in the top quartile are four times more likely to be compensated through a parental leave program than workers in the bottom quartile.

Targets Paid Leave to Those Who Need It the Most. Even for those who do not receive paid parental leave, higher-income workers are better positioned than lower-income workers to afford time away from work. In the private sector, low-wage workers often lack other forms of paid leave that higher-income workers can use after the arrival of a new child. Table 1 contains the frequency that workers in the bottom quartile of wages and top quartile of wages receive various paid leave benefits (other than parental leave).

Table 1. Percent of Private-Sector Workers Offered Paid Leave Benefits in 2016

| Paid Leave Benefit |

All Workers |

Bottom 25% of Wage Earners |

Top 25% of Wage Earners |

| Vacation |

76 |

50 |

91 |

| Holiday |

77 |

52 |

92 |

| Sick |

64 |

39 |

84 |

| Short-Term Disability |

40 |

17 |

61 |

| Long-Term Disability |

33 |

7 |

62 |

| Personal |

40 |

19 |

58 |

Source: US Bureau of Labor Statistics, National Compensation Survey.

In 2016, only 50 percent of workers in the bottom quartile of wage earners received paid vacation days, and only 39 percent had paid sick days. Conversely, 91 percent of workers in the top quartile received paid vacation, and 84 percent received sick days. Moreover, only 17 percent of workers in the bottom quartile could participate in a short-term disability policy to help pay for time needed away from work due to pregnancy. Meanwhile, 61 percent of workers in the top quartile could use a short-term disability benefit.

Targeting a paid parental leave program to low-income workers would also ensure that the least-skilled workers in the labor force receive support when they welcome a new child. According to Census data, the lowest-educated mothers are the least likely to receive any paid time off, including paid vacation or sick days. In 2008, only 18.5 percent of first-time mothers without a high school degree used any paid leave, compared with 66.3 percent of first-time mothers with a bachelor’s degree or more.[18] This suggests that an income-tested program would be particularly effective because education level closely correlates with household income.[19]

Finally, low-income households are also the least able to save enough money to afford paid parental leave on their own. According to the US Financial Diaries project, low- and moderate-income families display short-term saving behaviors, but tend to spend down savings throughout the course of the year to account for short-term income volatility.[20] Few families save for the long term and plan for significant reductions in earnings, such as taking time off for the birth of a child. This makes it difficult for any new parents to forgo job earnings, forcing them to make difficult decisions between caring for a new child and maintaining a source of earnings. An income-tested paid parental leave program would provide these households with the benefits they otherwise would not have, allowing them to pay the bills while temporarily away from work.

Mitigates Risk of Displacing Private-Sector Benefits. An income-tested paid parental leave program also mitigates some risk of displacing privately provided paid leave benefits already available. The portion of high-wage workers with defined paid family leave plans in the private sector has grown rapidly in recent years and will likely continue to expand. In 2010, only 16 percent of private-sector workers in the top wage quartile received a paid family leave benefit. By 2016, that figure jumped to 24 percent.[21] If that growth rate continues over the next 10 years, nearly half (47 percent) of workers in the top wage quartile will have a paid family leave benefit by 2026.

Alternatively, if the government provides paid parental leave to every worker in the labor force, chances are that employers already providing paid leave will discontinue paying for the benefit or scale back their programs, opting instead to have their workers enroll in the government program. Since a government benefit would likely be less generous than most private-sector paid leave packages, many workers would be better off with their employers’ plans. With an income-tested program, however, the federal government would provide the benefit to only low- and moderate-income workers, who are the least likely to have paid parental leave in the first place, reducing the chances that many employers will drop more generous packages. Phasing out the benefits at higher levels also ensures that more moderate-income families are less likely to receive better benefits from the government than what is available through their employer.

Provides Economic and Health Benefits to Low-Income Workers. Paid parental leave has many economic and health benefits that would particularly help low-income households. Research shows that parental leave in reasonable amounts can lead to higher employment rates, which supports economic growth.[22] Research also shows that the medium-term impacts of paid parental leave on mothers’ employment are positive and large and that it supports job continuity.[23]

For low-income households in particular, employment is the best path out of poverty. AAF previously found that those who are unemployed are over four times more likely to be in poverty than those who have jobs.[24] And an American Enterprise Institute (AEI) study found that two-thirds of children in poverty live in a home without a full-time worker. The main reason given by those who do not work at all is home and family responsibilities.[25] It is possible that many new parents, especially those who are poor, would prefer to work but are forced to leave jobs without job protection and paid leave. According to census data, 50 percent of the least-educated mothers (which correlates with income) quit their job before the birth of their first child compared with just 12.9 percent of those with a bachelor’s degree or more.[26]

Health benefits can also result from paid leave. A study of the California Paid Leave program found that mothers who received paid leave breastfed for twice as long as those who did not,[27] and a study of the Canadian program implemented in 2000 found similar results.[28] Breastfeeding is linked to better child health and mother-child bonding. Paid leave is also linked to decreased infant mortality and morbidity, possibly because of a higher incidence of wellness doctor visits and vaccinations of babies whose mothers receive paid leave, as well as better emotional and psychological health for the mother.[29] Moreover, infant mortality is more common in lower-income households than higher-income households,[30] suggesting that an income-tested paid parental leave program would be particularly effective in directly improving infant health.

Cost-Effective. An income-tested paid parental leave program would be much less costly than a universal paid leave program. Universal programs such as the FAMILY Act are expensive because the benefits are proportional to an individual’s earnings and there is no maximum earnings threshold to limit eligibility. This means that all workers qualify for the program, even those in high-paying jobs and those who already receive paid leave benefits from their employer. An income-tested program would be much more efficient because it bases benefits on total household earnings and caps the household income level at which a worker would be eligible for the program. Since the benefits replace earnings for low-income households, the average benefit per worker is smaller than it would be for a universal program that includes high-income workers. Consequently, an income-tested program would be highly cost-effective because all government expenditures would go directly to the households who need them the most. Below, we outline our proposal for an income-tested paid leave program and estimate the cost.

Review of EILB

In a previous report, AAF introduced the concept of an income-tested paid leave program with the EILB, a highly targeted program that would provide the benefit to low-income workers. The prototype program outlined in that report would provide up to 12 weeks of benefits for parental, family care, and medical leave. With a benefits structure modeled after the earned income tax credit (EITC), the benefits available would be based on household income, and only workers in households with incomes below a certain threshold would be eligible. Like the EITC for a single adult with one child, the EILB phases in at a modest 34 percent rate, has a maximum 12-week benefit of $3,359, and phases out at a 34 percent rate. Under these parameters, only workers in households with annual incomes below $28,000 would qualify (approximately 130 percent of the federal poverty level for a family of three). AAF estimated that if there are no work restrictions, 14.4 million workers would be eligible for the EILB. Of those workers roughly 2.3 million would participate each year, costing the federal government at least $2.7 billion annually.[31]

Design of Paid Parental Leave Program

As a variation of the EILB, this proposal is to provide paid parental leave only, but policymakers could enact a more expansive program that also covers family and medical leave. The costs would increase, but maintaining an income test could still control costs. This proposal also differs from the EILB in that the income level at which households are eligible and the benefits that they would receive are higher. Our goal was to design a program that could cover the most vulnerable, including those who are unlikely to receive benefits in the private market and may find it difficult to afford time away from work without paid leave. Our program would provide access to paid parental leave to approximately the bottom 40 percent of workers.

Benefits Parameters. This program would provide working mothers and/or fathers up to 12 weeks of job-protected, paid parental leave. The program would (1) base the benefits on total household earnings for the year prior to the birth of the child and (2) cap the household earnings level at which a worker can be eligible for the program.

The weekly benefit available would be equivalent to a fixed percentage of their average weekly household earnings leading up to the birth of the child; as weekly household earnings rise, so would the benefit at a constant rate. The benefit would hit a maximum value and then be flat at the maximum value for a certain earnings range. When household earnings rise above that range, the benefit would decline at a constant rate until the household phases out and is no longer eligible for the paid leave program.

Specifically, as outlined in Table 2, earnings eligibility and weekly benefits would be based on household earnings as a percentage of the federal poverty level (FPL).

Table 2. Income-Tested Paid Parental Leave Parameters

| Benefit Range |

Lower-Bound FPL |

Upper-Bound FPL |

Rate |

| Phase-in |

0% |

125% |

80% |

| Cap |

125% |

200% |

Maximum Benefit |

| Phaseout |

200% |

325% |

80% |

Source: Authors’ proposed parameters.

For all workers in households with incomes under 125 percent of FPL, 80 cents of every dollar in weekly household earnings would be replaced while on paid leave. Households with weekly earnings between 125 percent and 200 percent of FPL would receive the maximum weekly benefit. For households with earnings above 200 percent of FPL, the benefit would decline by 80 cents from the maximum benefit for every additional dollar in weekly household earnings until the benefit reaches $0, when weekly household earnings reach 325 percent of FPL.

For example, Table 3 illustrates the benefits schedule for a household of three (two parents and a new child).

Table 3. Weekly Benefits for Two Parents and a New Child

| Benefit Range |

Lower-Bound Weekly Earnings |

Upper-Bound Weekly Earnings |

Weekly Benefit Amount |

| Phase-in |

$0 |

$485 |

80% of average weekly household earnings |

| Plateau |

$485 |

$775 |

$388 |

| Phaseout |

$775 |

$1,260 |

$388 – 80% of every earned dollar over $775 |

Source: Authors’ calculations.

If this household earns $485 per week (125 percent of FPL), it would receive a weekly benefit of $388 (80 percent of $485). At $485 per week (125 percent of FPL), the benefit plateaus at the maximum benefit, meaning that if the household’s weekly earnings are between $485 (125 percent of FPL) and $775 per week (200 percent of FPL), the household would receive the same $388. Then for this hypothetical family of three, the benefit would decline by 80 cents for each dollar earned over $775. At household weekly earnings of $960 (250 percent of FPL), the weekly benefit would be down to $240, and it would reach $0 at $1,260 in weekly earnings (325 percent of FPL).

For purposes of determining the household FPL, we include newborn children as household members. So the FPL for a single parent caring for his or her first child would be the FPL for a two-person household ($16,020 in 2016); for two parents with a new second child the FPL for a four-person household ($28,440) would be used.

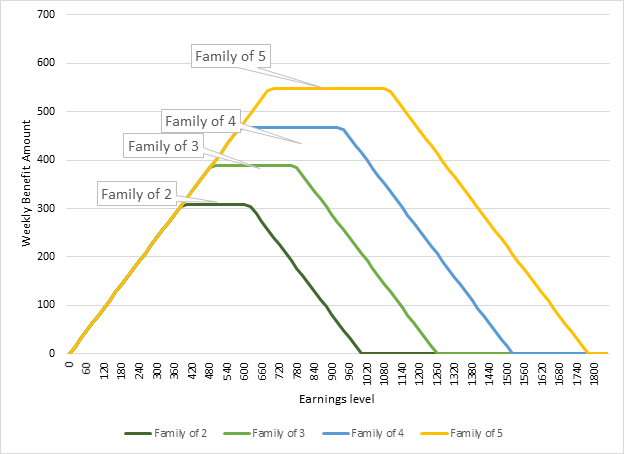

As Figure 1 illustrates, since the benefits and eligibility are based on FPL and not a fixed household income range, the specific income eligibility criteria and weekly benefit size would scale up and down with household size. This means that the benefit a new single parent receives would be smaller than the benefit of a single parent who is welcoming a second child or a married couple with three children. This is intended to recognize that larger families have higher income needs. It also partially accounts for the inherent marriage penalty that is built into this structure. For example, a married couple with a new child would be eligible for a larger benefit and would become ineligible at a higher earnings level than if the parents were unmarried. In cases of unmarried couples or a single parent, the benefits would go to the household where the child resides. If the parents are unmarried and cohabitating, the income of both parents and their work histories will be considered in determining eligibility for the benefit.

Figure 1. Paid Leave Benefit Schedule, Weekly Benefit Amount by Family Size and Household

Source: Authors’ calculations.

Work Requirement. Since the program is intended to replace lost earnings and would provide job protection, it must ensure that the workers are attached to the labor force. To qualify, new parents must meet certain employment requirements leading up to the birth of the child. Specifically, for a household to receive the benefit, at least one parent must have worked a minimum of 1,000 hours in the previous year. If there are two working parents, for both to receive job protection, each must have worked at least 1,000 hours in the previous year. The benefits, however, would be the same portion of household earnings, regardless of how many parents meet the employment criteria and go on parental leave, although at least one must meet the requirement. For instance, if a married couple has their first child and both go on parental leave, the weekly benefit (a fixed portion of weekly total household earnings) would not be any different than if just one parent goes on parental leave.

Program Administration. Even though the program is structured similar to the EITC, we do not envision that it would be administered through the tax system. One of the major drawbacks of the EITC is that the Internal Revenue Service distributes benefits only once per year in one large payment. For a parental leave program, however, since low-income workers frequently do not have enough savings to afford time away from work, it would be important that they receive payments at the time of their parental leave. Another major drawback of the EITC is the high improper payment rate. One reason is that eligibility is not determined before benefits go out. To address these concerns, a paid parental leave program should be administered by the Social Security Administration or another federal agency capable of both determining eligibility before issuing payments and distributing those payments on a weekly or biweekly basis to parents while they are on leave. While some administrative costs will be involved, we believe the advantages of regular payments and program integrity outweigh the added costs.

To determine income eligibility, the federal agency would use the modified adjusted gross income (MAGI) standards used for Medicaid and the Children’s Health Insurance Program, which are based on pay stubs and tax returns. Using pay stubs and tax returns from the previous year, the federal agency would determine if the worker meets household income requirements and the size of the worker’s weekly benefit. In addition, workers would need to demonstrate that they worked at least 1,000 hours in the previous year and that they indeed welcomed a new child, either through pregnancy or adoption. Workers would need to provide proof from their employers for the work requirement and a birth or adoption certificate as proof of the new child (similar to what is currently required as part of the FMLA).

Coverage and Cost

This income-tested paid parental leave program would affect a much larger portion of the workforce than the EILB and still remain less costly than a universal program. Using data from the Current Population Survey (CPS) March 2016 Annual Social and Economic Supplement, which refers to data from 2015, we estimate the number of workers who would have access to this income-tested paid parental leave program and its budgetary costs.[32] We assumed that 4.6 percent of eligible male and female workers (meaning they meet the household income and work history criteria) between the ages of 15 and 50 each year would take an average of 32.3 business days (about 6.5 weeks) of paid parental leave: a rate that matches the percent of employed women who gave birth[33] and a duration that matches that of workers who took unpaid leave under the FMLA in 2012.[34] We expect this to be the lower-bound estimate because take-up of paid leave is likely to be higher, especially when job protection is considered.

Table 4 shows the number of workers who would be eligible for the program and the program’s estimated annual outlays by income as a percentage of FPL.

Table 4. Worker Eligibility and Cost Estimates

| Income as Percent of FPL |

Eligible Workers |

Cost |

||

| Number | Percent | Dollars | Percent | |

| Total | 57,062,964 | 100.0% | $4,337,950,607 | 100.0% |

| Under 125% | 10,032,821 | 17.6% | $894,258,276 | 20.6% |

| 125% to 200% | 16,142,607 | 28.3% | $1,809,864,998 | 41.7% |

| 200% to 325% | 30,887,536 | 54.1% | $1,633,827,333 | 37.7% |

Note: Costs are based on assumptions about the number of eligible workers who will have a new child in the average year.

Source: Authors’ calculations using the US Census Bureau, Current Population Survey, Annual Social and Economic Supplement, March 2016.

We estimate that, under the income parameters in Table 2 and a 1,000-hour work requirement, the program would provide access to paid parental leave for 57.1 million low-income workers. Based on our assumptions, approximately 1.96 million would apply for and receive a paid leave benefit due to the arrival of a new child. Total costs under our assumptions would be $4.3 billion annually, or an average of $2,217 per household ($343 per week). If the full 12 weeks are taken instead of the 6.5 weeks we assumed, the costs would roughly double to $8.1 billion annually.

Under these parameters, 38.3 percent of the civilian employment population would have access to paid parental leave.[35] That is a much larger portion of the workforce than the 14.4 million workers that the original EILB program would cover. In addition, this income-tested program would be at a fraction of the cost of a universal program: Considering that the FAMILY Act would cost at least $85.9 billion annually, even if all eligible leave (a full 12 weeks) was taken, this program would cost one-tenth of the FAMILY Act.

The figures in Table 4 also illustrate that the program would effectively target workers in low-income households. Benefits would go only to workers in households with incomes below 325 percent of the poverty threshold, and 45.9 percent of eligible workers would be in households with incomes under 200 percent of the poverty threshold. Moreover, the distribution of the benefits would be even more concentrated on low-income households: 62.3 percent of the program’s benefits would go to households under 200 percent of the poverty threshold.

Demographic and Household Characteristics of Covered Workers

With 62.3 percent of benefits going to workers in households under 200 percent of the poverty threshold, this income-tested program would effectively assist low-income workers. But who are these workers, and what is their household situation? In this section we use CPS data to examine the demographic characteristics of workers who would be eligible for this program and the characteristics of their households. We also compare the characteristics of eligible workers with those of ineligible workers, as well as the characteristics of eligible households to those of ineligible working households. We find that our proposed income-tested program would be particularly helpful to those who are single, have other children, have low educational attainment, and are the only earners in their households. However, it should be noted that approximately 4 in 10 eligible recipients would be low-income and married. All of this evidence further underlines how this program would specifically help the most vulnerable workers and households in the United States.

Demographic Characteristics. First, we examine the characteristics of the workers who would be eligible for the income-tested paid parental leave benefit. Starting with marital status, eligible workers would more frequently be single, especially never married, than the rest of the workforce (those who are ineligible). Table 5 compares the marital characteristics of eligible workers with those of ineligible workers.

Table 5. Marital Status

| Marital Status | Eligible | Not Eligible |

| Married | 44.9% | 58.2% |

| Widowed, Separated, Divorced | 19.4% | 12.4% |

| Never Married | 35.7% | 29.4% |

Source: Authors’ calculations using the US Census Bureau, Current Population Survey, Annual Social and Economic Supplement, March 2016.

Workers who would be eligible for the benefit are less likely to be married and more likely to have never married than those who would not be eligible. Nonetheless, 44.9 percent of eligible workers are married, and 35.7 percent have never married. These figures suggest that the income-tested program would be beneficial to both married and single new parents, who often have no choice but to leave work and forgo their private-sector earnings.

Moving on to educational attainment, it is clear that the income-tested program would also be helpful to unskilled workers. Table 6 shows the educational attainment of eligible workers.

Table 6. Educational Attainment

| Attainment | Eligible | Not Eligible |

| Less Than High School | 15.9% | 5.3% |

| High School Degree | 35.8% | 21.7% |

| Some College | 31.7% | 28.0% |

| Bachelor’s Degree | 12.4% | 27.6% |

| Advanced Degree | 4.3% | 17.4% |

Source: Authors’ calculations using the US Census Bureau, Current Population Survey, Annual Social and Economic Supplement, March 2016.

While only 5.3 percent of ineligible workers never completed high school, 15.9 percent of those who would be eligible never finished. This means that workers who would qualify for the benefit are three times more likely to have never finished high school than those who would not qualify. In addition, only 12.4 percent of eligible workers and 27.6 percent of ineligible workers hold bachelor’s degrees. As a result, ineligible workers are over two times more likely to finish college than eligible workers. Beyond college, only 4.3 percent of eligible workers hold an advanced degree. Meanwhile, 17.4 percent of ineligible workers have completed graduate school, suggesting that ineligible workers are over four times more likely to hold advanced degrees than eligible workers.

Workers who would be eligible for this benefit also tend to be younger than ineligible workers, but have similar gender characteristics. Table 7 compares the age and gender characteristics of eligible workers to ineligible workers.

Table 7. Age and Gender

| Age/Gender | Eligible | Not Eligible |

| Age | 39.7 | 43.0 |

| Gender | ||

| Female | 47.4% | 47.7% |

| Male | 52.6% | 52.3% |

Source: Authors’ calculations using the US Census Bureau, Current Population Survey, Annual Social and Economic Supplement, March 2016.

The average age of workers who would be eligible for the program is 39.7, while the average age for those who would not be eligible is 43. This means that eligible workers on average are 3.3 years younger than those who would not be eligible. Meanwhile, the gender characteristics of eligible workers mirror those of ineligible workers. According to the CPS data, 47.4 percent of workers who would be eligible for the benefit are female, and 52.6 percent are male. Similarly, 47.7 percent of ineligible workers are female, and 52.3 percent are male. Even though a higher percentage of eligible recipients are men, women are more likely to be the family head than men,[36] suggesting that they might receive the benefit at higher rates. Fathers who reside with the new child, however, would also receive the benefit, regardless of their marital status.

Table 8. Race

| Race | Eligible | Not Eligible |

| White | 48.6% | 70.7% |

| Black | 16.3% | 9.1% |

| Asian | 4.9% | 6.3% |

| Other | 2.7% | 2.0% |

| Hispanic | 27.4% | 12.0% |

Source: Authors’ calculations using the US Census Bureau, Current Population Survey, Annual Social and Economic Supplement, March 2016.

In Table 8, we examine the distribution of eligible workers by race. Eligible workers are more frequently a nonwhite race than ineligible workers. Broken down by race, 48.6 percent of eligible workers are white, 16.3 percent are black, and 27.4 percent are Hispanic. On the other hand, while 70.7 percent of ineligible workers are white, only 9.1 percent are black, and 12 percent are Hispanic.

Household Characteristics. Next we examine the characteristics of the households of eligible workers. To receive the paid parental leave benefit, a household must meet the income criteria and have at least one worker who meets the work history requirement. In the following, we compare working households that would be eligible for the benefit with working households that would not be eligible (households with at least one worker, but ineligible for the benefit due to income and work history requirements). We find that households that would be eligible for the benefit tend to be larger, have more children, and be more likely to rely solely on the income earned by only one worker.

Table 9. Household Size

| Persons | Eligible | Not Eligible |

| Total | 3.1 | 2.6 |

| Adults | 2.0 | 2.1 |

| Kids | 1.1 | 0.5 |

Source: Authors’ calculations using the US Census Bureau, Current Population Survey, Annual Social and Economic Supplement, March 2016.

In Table 9, we compare household sizes. Eligible working households contain on average 3.1 persons, while those that are ineligible have 2.6. The size difference is mainly driven by differences in the number of children. The household categories have about the same number of adults (2.0 versus 2.1), but those that would be eligible for the benefit have 1.1 children on average, and those that would be ineligible average 0.5 children. This means that under our proposed parameters, the benefit would not just support newborn children, but also existing children in these low-income households.

Eligible households, meanwhile, tend to only have one employed person. Table 10 contains the distribution of households by number of workers.

Table 10. Workers per Household

| Number of Workers | Eligible | Not Eligible |

| 1 | 62.7% | 45.5% |

| 2 | 30.5% | 44.4% |

| 3 | 5.3% | 7.7% |

| 4 or more | 1.5% | 2.5% |

Source: Authors’ calculations using the US Census Bureau, Current Population Survey, Annual Social and Economic Supplement, March 2016.

As Table 10 shows, 62.7 percent of eligible working households have only one worker, 30.5 percent have two workers, and 5.3 percent have three workers. Meanwhile, 45.5 percent of ineligible working households have one worker, 44.4 percent have two, and 7.7 percent have three. Frequently, low-income households do not earn enough income because they only have one earner trying to support an entire family. The figures in Table 10 suggest that the income-tested program would target households that are currently susceptible to a major loss of income if their only worker requires parental leave. Meanwhile, higher-income working households that are not eligible for the benefit tend to have additional workers, meaning that they have additional sources of income and thus more flexibility when one worker must take parental leave.

In addition, the vast majority of eligible households have only one worker who would be eligible to take paid parental leave under this income-tested program. This is illustrated in Table 11.

Table 11. Eligible Workers per Household

| Number of Workers | Distribution |

| 1 | 76.0% |

| 2 | 21.3% |

| 3 | 2.3% |

| 4 or more | 0.4% |

Source: Authors’ calculations using the US Census Bureau, Current Population Survey, Annual Social and Economic Supplement, March 2016.

In 76 percent of households that would qualify for the parental leave benefit, only one worker would be eligible for job-protected leave. Meanwhile, 21.3 percent would have two eligible workers, and 2.3 percent would have three.

The demographic and household data paint a clear picture of who would benefit from the income-tested paid parental leave program we outlined. The households eligible for the program would include married families, but would disproportionately be unmarried homes that depend on a single worker for their only source of income. Consequently, the program would help some of the most vulnerable households in America because it would help them avoid a significant disruption in earnings if their only worker must take parental leave. At the same time, married workers and workers in multiple earner households would also greatly benefit from this program as they still make up a large portion of eligible workers. Moreover, since married parents are more likely to have a new child than unmarried families, married eligible workers would likely have higher receipt rates than single eligible workers.[37] In addition, eligible workers tend to have low educational attainment, which suggests they are particularly vulnerable to hardship as they are unlikely to currently have access to paid parental leave.

Disadvantages to the Income-Tested Parental Leave Program

Even though an income-tested paid leave program has several advantages over the status quo as well as over a more expansive universal program, we understand that it is not a conventional paid leave program. No other countries offer this type of program for paid parental leave, and no state has developed such a program. The following outlines some of the disadvantages of income-testing the program, which should be considered carefully.

Middle- and High-Income Households and Equity. This income-tested program would not ensure that every worker receives paid parental leave, nor would everyone who contributes into the system receive a benefit. While access to paid parental leave and other forms of paid leave are more widely available for higher-wage workers in the private sector, there is no guarantee that employers will provide a benefit to those not covered by a government program. For instance, even in the top wage quartile, 76 percent of workers do not receive a defined paid parental leave benefit. As a result, even with this program, some workers may still not have access to paid leave. This could be especially problematic for middle-income workers, who may have difficulty affording time away from work for parental leave, particularly if they live in an urban area with a high cost of living. Our program covers households with earnings up to 325 percent of the FPL ($62,000 for a family of three), and our estimates suggest that this covers 40 percent of workers.

Displacing Private-Sector Benefits. Although benefits would be concentrated on low-income households, those who are least likely to have the benefit in the private sector, the program could still displace private-sector benefits, shifting costs to the government. Some employers may choose to drop benefits that they already provide. Or more likely, some employers may choose to never provide a paid parental leave benefit because they would know that any worker in a low-income household could fall back on a program like this one.

Determining Eligibility and Improper Payments. Using income and work eligibility criteria makes a program like this more challenging to administer than a universal program. These extra administrative burdens would likely increase the overall cost of the program. Moreover, the additional requirements also increase the potential for improper payments because program administrators could have difficulty verifying eligibility. It also may reduce participation in the program because potential beneficiaries may not understand the eligibility rules or find it difficult to apply.

Improper payments are, regrettably, a major drawback to some of the federal government’s low-income support programs. The EITC, for instance, has a very high rate of improper payments. Overall, the federal government spends $60 billion to $70 billion each year on the EITC, with about a quarter of those expenditures going to individuals who do not qualify for the credit. This means that the federal government loses about $15 billion to $18 billion annually on these improper payments, which occur because of fraud and simple mistakes.[38] Eligibility for a paid leave program would be slightly more straightforward than the EITC—problems defining a qualifying child would be less of an issue, for example—but chances for error remain more likely in an income-tested program than a universal program.

Inequity and Separating the Poor from the Affluent. An income-tested program might be viewed simply as another welfare program that supports the poor at the expense of the more affluent. Middle- and higher-income households may resent paying for a paid leave program for low-income households, especially if they do not receive the same benefits themselves.

Dynamics of Two-Parent Households and the Marriage Penalty. A potential drawback to basing the benefit on total household income is that households with two working parents could benefit more if only one parent takes time off from work after the birth of a new child than if they both do. This is because the benefit based on total household earnings would not change if only one parent takes time off.

For instance, if a working married couple with $400 in average weekly total household earnings ($200 each) has their first child, the weekly parental leave benefit from this program would be $320 (80 percent of $400). But, if only one parent goes on parental leave and the other keeps working, the new parents would receive the $320 weekly benefit, while the parent who continues work earns $200 per week. As a result, the married couple ends up making $520 per week with the paid leave benefit, $120 more than before the child was born. One way to remedy this is to ensure that the weekly benefit in combination with earnings from parents who continue to work does not exceed total weekly household earnings. Another way is to base the benefit on individual rather than household earnings, but this creates additional concerns, mainly that it might go to low earners in high-income households and that benefits in low-income households would be less generous.

Income-testing the program at the household level also introduces a marriage penalty. Incomes for both parents in a two-parent married household would be considered in determining eligibility, whereas it is possible that only one income would be considered if the household was unmarried, especially considering that eligibility would be partially based on tax returns. Parents expecting a new child would face a disincentive to marrying if it meant they would no longer be eligible for the paid leave program. This is a major concern, and one way to remedy it would be to consider individual income, but as outlined above this also has problems. The program we outlined already partly addresses this issue because benefits and eligibility scale up and down with household size. A way to further alleviate the marriage penalty is to make income eligibility limits higher for married families than unmarried families.

Marginal Tax Rates. Low-income households already face very high marginal tax rates, meaning that a high percent of each additional dollar earned is taxed away or lost due to benefits phasing out. As earnings rise, low-income workers simultaneously receive fewer government benefits and pay more in taxes, which could be a disincentive to working. This income-tested paid parental leave program would add to the mix of benefits that result in high marginal tax rates for low-income households. As a result, if certain parents are anticipating a newborn child in the near future, they may choose to limit their hours at work or to not pursue higher paying jobs so that they remain eligible for the benefit. While this is certainly a possibility, it might be less of a concern than other benefit programs because the paid leave benefit is time-limited (12 weeks) thereby eliminating any long-term work disincentive. It also applies only to those who expect to have a new child, which is a relatively infrequent occurrence. Once a new parent returns to work, the disincentive to work disappears unless and until they decide to have another child.

This potential work disincentive could be exacerbated by the 80 percent phaseout rate we propose. One option to mitigate this issue would be to use a slower phaseout rate. For instance, instead of phasing the benefit out at an 80 percent rate, it could phase out at a 40 percent rate. While this would not eliminate any disincentive to work, it would make it less prevalent.

Table 12 contains the distribution of workers eligible for the benefit and the program’s costs if the phaseout rate were 40 percent instead of 80 percent.

Table 12. Worker Eligibility and Cost Estimates with a 40 Percent Phaseout Rate

| Income as Percent of FPL | Eligible Workers | Cost | ||

| Number | Percent | Dollars | Percent | |

| Total | 83,668,453 | 100.0% | $5,844,669,136 | 100.0% |

| Under 125% | 10,032,821 | 12.0% | $894,258,276 | 15.3% |

| 125% to 200% | 16,142,607 | 19.3% | $1,809,864,998 | 31.0% |

| 200% to 325% | 30,887,536 | 36.9% | $2,443,788,151 | 41.8% |

| 325% to 450% | 26,605,488 | 31.8% | $696,757,711 | 11.9% |

Source: Authors’ calculations based on income-targeted paid parental leave proposal.

While a 40 percent phaseout rate may mitigate any potential disincentives to increasing private-sector earnings, it would also have its own disadvantages. In particular, it would raise the income eligibility threshold to 450 percent of FPL and increase the overall cost of the program because more workers would be eligible for the benefit. Overall, the number of workers eligible would increase to 83.7 million (56.2 percent of civilian employment) and the program’s cost would increase from $4.3 billion to $5.8 billion. It would also become less targeted because all of the additional payments would go to workers in households over 200 percent of FPL.

Conclusion

Although the arrival of a new child is a joyous event, many American families still face difficult decisions around work and family upon a birth. Low-income households may face particular challenges if taking time off to care for the child means losing a job or reduced income that cannot be overcome. Regrettably, the lack of paid leave and job protection for many workers means that too many are forced to return to work too quickly or not return at all, exacerbating their problems.

Some private employers offer benefits to their employees, recognizing that paid leave can be beneficial to them and to their employees and that paid leave is a form of compensation that helps businesses better compete for workers. There is no reason to displace these benefits through a government program, especially when the country’s fiscal outlook is so challenging. But for many employers, paid parental leave is difficult to offer, and low-income households are not only the least likely to receive an employer benefit, but also the least equipped to overcome a job or income loss. This is concerning, from both the perspective of family health and well-being and the perspective of the overall economy. Public policy can play a constructive role in addressing these concerns.

We propose an income-tested paid parental leave program to provide the most vulnerable households with sufficient resources while on leave and to keep them attached to the labor force so they can continue to build skills to increase their future earnings. Overall, the program we outlined in this report is a cost-effective way the government can target those who lack paid leave in the private sector and the ability to afford time away from work on their own.

About the Authors

Ben Gitis is director of labor market policy at the American Action Forum. Angela Rachidi is a research fellow in poverty studies at AEI.

[1] US Bureau of Labor Statistics, National Compensation Survey.

[2] Ben Gitis, “The Earned Income Leave Benefit: Rethinking Paid Family Leave for Low-Income Workers,” American Action Forum, August 15, 2016, https://www.americanactionforum.org/solution/earned-income-leave-benefit-rethinking-paid-family-leave-low-income-workers/.

[3] Lynda Laughlin, “Maternity Leave and Employment Patterns of First-Time Mothers: 1961–2008,” US Census Bureau, October 2011, https://www.census.gov/library/publications/2011/demo/p70-128.html.

[4] Gretchen Livingston, “Among 41 Nations, U.S. Is the Outlier When It Comes to Paid Parental Leave,” Pew Research Center, September 26, 2016, http://www.pewresearch.org/fact-tank/2016/09/26/u-s-lacks-mandated-paid-parental-leave/.

[5] Organisation for Economic Co-operation and Development, “Key Characteristics of Parental Leave Systems,” February 28, 2016, https://www.oecd.org/els/soc/PF2_1_Parental_leave_systems.pdf.

[6] California Employment Development Department, “Calculating Disability Insurance Benefit Payment Amounts,” http://www.edd.ca.gov/disability/Calculating_DI_Benefit_Payment_Amounts.htm.

[7] Sarah Jane Glynn, Gayle Goldin, and Jeffrey Hayes, “Implementing Paid Family and Medical Leave Insurance, Connecticut,” Institute for Women’s Policy Research, [2016], https://www.ctdol.state.ct.us/FMLI%20report%20for%20CT.pdf.

[8] Family and Medical Insurance Leave Act, S. 786, 114th Cong. (2015).

[9] Gitis, “The Earned Income Leave Benefit.”

[10] Congressional Budget Office, “The Budget and Economic Outlook: 2017 to 2027,” January 2017, https://www.cbo.gov/publication/52370.

[11] US Bureau of Labor Statistics, National Compensation Survey, https://www.bls.gov/data/.

[12] Society for Human Resource Management, “2016 Employee Benefits: Looking Back at 20 Years of Employee Benefits Offerings in the U.S.,” June 2016, https://www.shrm.org/hr-today/trends-and-forecasting/research-and-surveys/pages/2016-employee-benefits.aspx.

[13] Ibid.

[14] Council of Economic Advisers, “The Economics of Paid and Unpaid Leave,” June 2014, https://obamawhitehouse.archives.gov/sites/default/files/docs/leave_report_final.pdf.

[15] Laughlin, “Maternity Leave and Employment Patterns of First-Time Mothers.”

[16] Jacob Alex Klerman, Kelly Daley, and Alyssa Pozniak, “Family and Medical Leave in 2012: Technical Report,” US Department of Labor, revised April 2014, https://www.dol.gov/asp/evaluation/fmla/FMLA-2012-Technical-Report.pdf.

[17] US Bureau of Labor Statistics, National Compensation Survey.

[18] US Census Bureau, “Maternity Leave and Employment Patterns of First-Time Mothers.”

[19] See US Bureau of Labor Statistics, “Earnings and Employment Rates by Educational Attainment, 2015,” https://www.bls.gov/emp/ep_chart_001.htm.

[20] See the US Financial Diaries, http://www.usfinancialdiaries.org/.

[21] US Bureau of Labor Statistics, National Compensation Survey.

[22] Maya Rossin-Slater, “Maternity and Family Leave Policies,” National Bureau of Economic Research, January 2017, http://www.nber.org/papers/w23069.

[23] Jochen Kluve and Sebastian Schmitz, “Social Norms and Mothers’ Labor Market Attachment: The Medium-Run Effects of Parental Benefits,” Institute for the Study of Labor, April 2014, http://ftp.iza.org/dp8115.pdf; and Heather Boushey, “To Grow Our Economy, Start with Paid Leave,” Cato Institute, https://www.cato.org/publications/cato-online-forum/grow-our-economy-start-paid-leave.

[24] Ben Gitis, “Primer: Earned Income Tax Credit and the Minimum Wage,” American Action Forum, February 2014, https://www.americanactionforum.org/research/primer-earned-income-tax-credit-and-the-minimum-wage/.

[25] Angela Rachidi, “America’s Work Problem: How Addressing the Reasons People Don’t Work Can Reduce Poverty,” American Enterprise Institute, July 2016, https://www.aei.org/publication/americas-work-problem-how-addressing-the-reasons-people-dont-work-can-reduce-poverty/.

[26] US Census Bureau, “Maternity Leave and Employment Patterns of First-Time Mothers.”

[27] Eileen Applebaum and Ruth Milkman, “Leave That Pays: Employer and Worker Experiences with Paid Leave in California,” Center for Economic and Policy Research, 2011, http://cepr.net/documents/publications/paid-family-leave-1-2011.pdf.

[28] Michael Baker and Kevin Milligan, “Maternal Employment, Breastfeeding, and Health: Evidence from Maternity Leave Mandates,” Journal of Health Economics 27, no. 4 (July 2008): 871–87.

[29] Barbara Gault et al., “Paid Parental Leave in the United States: What the Data Tell Us About Access, Usage, and Economic and Health Benefits,” Institute for Women’s Policy Research, January 2014, http://www.iwpr.org/publications/pubs/paid-parental-leave-in-the-united-states-what-the-data-tell-us-about-access-usage-and-economic-and-health-benefits/.

[30] Alice Chen, Emily Oster, and Heidi Williams, “Why Is Infant Mortality Higher in the US Than in Europe?,” National Bureau of Economic Research, September 2014, http://www.nber.org/papers/w20525.

[31] Ben Gitis, “Work Criteria and the Earned Income Leave Benefit,” American Action Forum, October 2016, https://www.americanactionforum.org/insight/work-criteria-earned-income-leave-benefit/.

[32] It is important to understand that this is a rough cost estimate that uses available information to best gauge the magnitude of the program. Several factors end up having mixed effects on the cost estimate. For factors that may lead to overstating the cost estimate, we assume that both male and female workers will use the program at the same rate and the same duration (4.6 percent and 6.5 weeks). However, the take-up rate and duration of leave among male workers will likely be much lower than among female workers. In addition, the estimate assumes that each of the 4.6 percent of workers annually taking parental leave is from a separate household and the benefit will be a portion of their own household earnings. However, there will be instances where households have two working parents and both take parental leave. In those cases, the benefit would not double and instead would be the same as for just one parent taking parental leave. But we are unable to adjust the estimate for two working parent households because there is no way to tell how often both would take parental leave. As a result, the estimate in effect double counts the size of the benefit in cases in which households have two working parents taking parental leave, which could put additional upward pressure on the cost estimate.

For factors that may lead to understating the cost, the estimate assumes that only workers between the ages of 15 and 50 will participate because that is the population of women the Census Bureau analyzed when gauging instances of child birth. This may put downward pressure on the cost estimate of the program as it is likely that some older adults, particularly male workers or adopting parents, will welcome newborn children. In addition, introducing federal benefits for parental leave may lead to more parents having children and, consequently, a higher take-up rate than 4.6 percent. Since it is impossible to predict how much more often parents would have children, we are unable to estimate a potential increase in the take-up rate. Finally, the existence of paid parental leave benefits would likely lead to longer duration of leave than the 6.5 weeks used for unpaid leave under the FMLA. In this paper, we gauge the potential impact of longer parental leave durations by estimating the cost if all participating workers used all 12 weeks of leave and found the budgetary cost of the program would grow to $8.1 billion annually.

The factors that put upward and downward pressure on the cost estimate likely cancel each other out in several instances. However, since we lack the necessary information to fully account for these effects, it is impossible to determine the net effect on the cost estimate.

[33] Lindsay M. Monte and Renee R. Ellis, “Fertility of Women in the United States: 2012,” US Census Bureau, July 2014, https://www.census.gov/library/publications/2014/demo/p20-575.html.

[34] Klerman et al., “Family and Medical Leave in 2012.”

[35] Civilian employment averaged 148.8 million in 2015. See Federal Reserve Bank of St. Louis, Federal Reserve Economic Data, s.v. “Civilian Employment Level,” https://fred.stlouisfed.org/series/CE16OV.

[36] See US Census Bureau, “Living Arrangements of Children: 1960 to Present,” https://www.census.gov/hhes/families/files/graphics/CH-1.pdf.

[37] Data from the CDC show that approximately 60 percent of births are to married parents.

[38] Tax Policy Center, “What Is the Earned Income Tax Credit (EITC)?,” http://www.taxpolicycenter.org/briefing-book/what-earned-income-tax-credit-eitc; and Steve Holt, “The Role of the IRS as a Social Benefits Administrator,” American Enterprise Institute, July 2016, http://www.aei.org/publication/the-role-of-the-irs-as-a-social-benefit-administrator/.