Research

November 20, 2017

Tax Reform Cuts Big Energy Subsidies, Boosts Support for Emerging Competitors

Summary

- The House version of the Tax Cuts and Jobs Act (TCJA) would cut federal tax subsidies to fossil fuels, wind power, and electric vehicles; AAF estimates these changes would save taxpayers nearly $18 billion over 10 years.

- The distribution of subsidies would pare back preferences for big incumbent energy industries, and include more competing industries under existing tax provisions. This would modestly level the energy competition playing field.

- Tax reform should aim to make the U.S. tax code more pro-growth and internationally competitive—not to reform energy policy. While the TCJA would make some positive changes to energy provisions, it does not eliminate the government’s use of tax subsidies for energy policy.

Introduction

The House version of the Tax Cuts and Jobs Act (TCJA) includes several changes to energy tax provisions as well as a slew of changes to tax treatments for businesses, corporations, and individuals. As members of Congress face what the Ways and Means Committee Chairman has called the “ferocity of the status quo,” changes to energy tax provisions have been contentious. It is important to consider what the role of energy provisions in tax policy are, and if the changes in the TCJA move the United States closer to good policy.

Energy and Tax Policy 101

In the 1970s, the U.S. economy was held hostage by foreign oil producers that embargoed the United States to protest its foreign policy. Embargoes, along with other events that constrained energy trade, caused the price of oil to quadruple. It was these events that gave rise to federal energy policy as we know it today—the idea that it is essential to national security for the federal government to impose policies that ensure access to energy sources, a concept of “energy security.” Tax policy has also been influenced by the events of the 1970s, and for decades the United States has given preferential tax treatment to domestic energy producers.

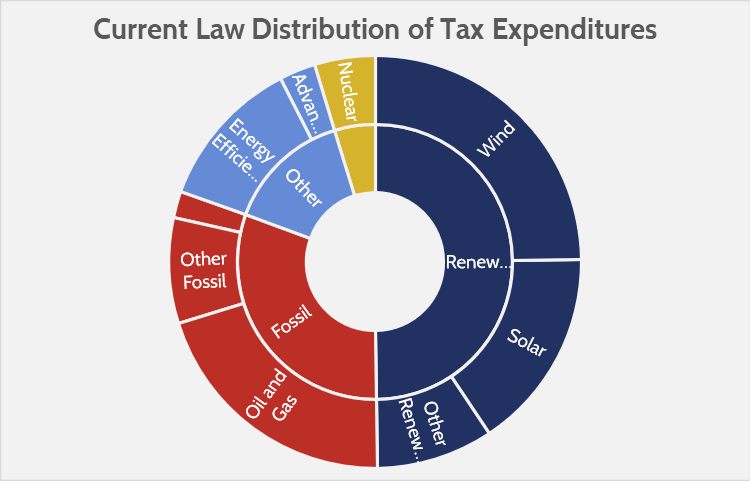

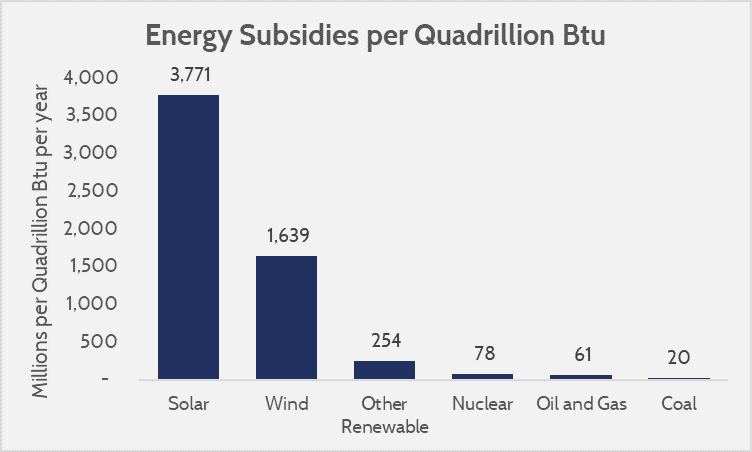

Over time, as new energy sources have entered the market, they have struggled to compete with incumbents that are buoyed by existing tax preferences. The result has been that new energy tax provisions have been made over the years, and nearly every form of energy in the United States is subsidized in one way or another. Below is a pie chart of the distribution of energy subsidies, including tax treatment for domestic manufacturing and pipelines (Section 199, Master Limited Partnerships, etc.), as well as an estimation of subsidies relative to the energy produced (measured in British thermal units).

Source: AAF estimates based on EIA, JCT, and Treasury data.

Ideally, energy tax policy would promote the most efficient means of energy production while minimizing government preferences. The current law is far from that, with many provisions that are specific to certain energy types, giving them distinct advantages or disadvantages that are disconnected from broad policy goals (e.g. energy security, pollution abatement, etc.).

While having no subsidies is ideal, if the government is intent on providing subsidies to achieve energy policy goals they should be better designed. Tax subsidies are most effective when neutral in their treatment of what technology achieves those goals, and whatever subsidy is in place should be designed to minimize displacement of private sector capital. To that effect, subsidizing well-established incumbent energy producers likely has little benefit, as the marketability of those sources and their ability to raise capital is well proven. Subsidies would have the most benefit for emerging technologies that may not have yet achieved economies of scale, or have other reasons they are unable to attract private sector capital that are unrelated to limitations of their economic potential.

The key takeaway is that the current system allows the government to create significant advantages for specific energy sources, and “better” can be defined as anything that reduces those preferences and defers more power to market choice.

Changes in Taxes

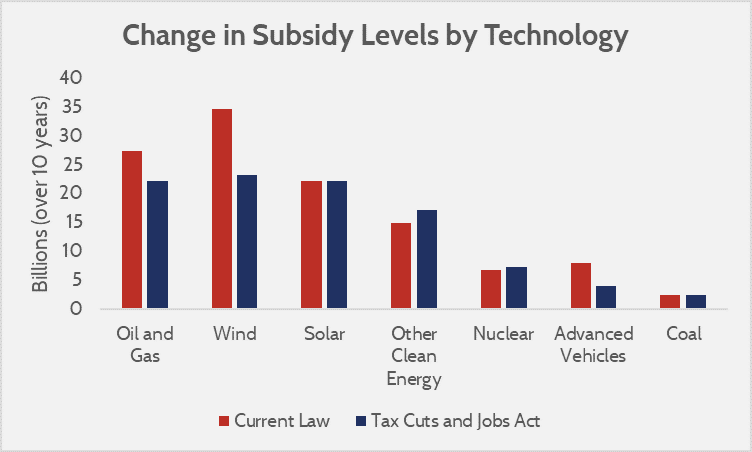

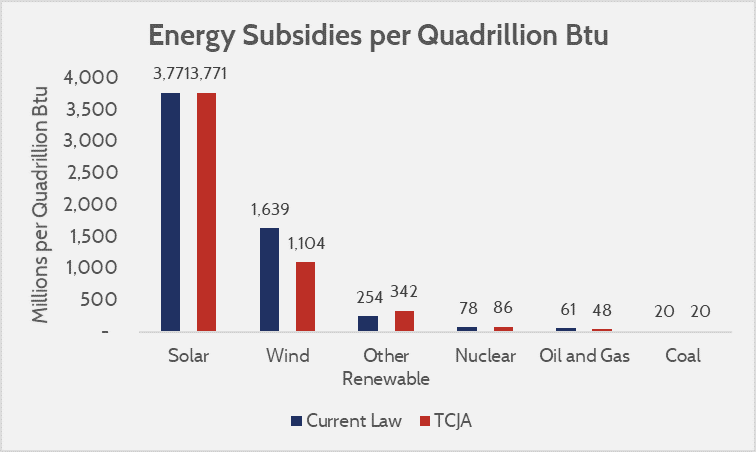

The TCJA proposes several significant changes to energy tax provisions. It will eliminate domestic manufacturing tax credits for oil and gas ($9.1 billion), eliminate the inflation adjustment for new renewable sources claiming a production tax credit ($12.3 billion), eliminate the electric vehicle tax credit ($4 billion), renew tax credits for advanced nuclear power plants ($-0.4 billion), and allow a wider array of emerging clean energy technologies to claim the same tax credits as solar ($-2.3 billion). Below is an AAF estimate showing the new distribution of subsidies by technology, as well as the new distribution relative to energy produced. Note that the subsidy level for solar appears to be unchanged because the changes to its subsidy will occur in the out-years of the projection.

Source: JCT score of TCJA, JCT Tax Expenditures, Treasury, and AAF estimates.

The upshot is that the changes modestly level the playing field. The advantages of specific energy sources are slightly diminished. On net, the changes would raise $17.8 billion over 10 years, which would be used to cut other taxes. Relative to the status quo, the TCJA will make some welcome changes.

The TCJA does not significantly reform the use of tax policy as a tool for energy policy. However, this was never expected. The principal purpose of the TCJA is to move the United States to a more competitive tax system; the fact that it would slightly reduce government preferences for energy sources while slightly broadening the tax base (to pay for tax cuts elsewhere) is an improvement on the status quo. Outside the scope of tax policy, there are governmental preferences for certain forms of energy (e.g. insurance provisions for nuclear power plants, the Renewable Fuel Standard, etc.). Even if the TCJA repealed all energy subsidies it would not be a substitute for comprehensive energy policy reform that clearly defined goals and designed provisions that are agnostic to how the goals are achieved.

Conclusion – The 10,000 Foot View

The changes in the TCJA are a modest, though positive, paring back of controversial energy subsidies. In the Joint Committee on Taxation’s (JCT) score of the TCJA, the energy provisions alone were scored to save $13.4 billion. A broader estimate that includes projected changes to domestic manufacturing tax preferences and other provisions puts the energy savings at $17.8 billion over 10 years. The biggest subsidy cuts are to incumbents that arguably offer the least benefit for the subsidies (as the private sector is already funding them), and there is a modest boost to support emerging competitors. Interestingly, provisions for some potential competitors — like hydropower — are missing, meaning the TCJA is still a far cry from a technologically neutral tax treatment of energy sources.

Appendix – Industry Specific Observations

Note: All revenue estimates over 10 years. Values from JCT score of the TCJA, estimates from Treasury of similar past proposals, and AAF estimates produced from past research. For more specific information, refer to AAF’s primer on energy tax credits in tax reform.

Oil and Gas

The oil and gas sector lose a major subsidy in the form of the “Section 199” tax break for domestic manufacturing. The Treasury Department last year estimated the value of that tax break for oil and gas specifically at $9.1 billion (the value used in AAF’s estimate), but earlier estimates pegged the value much higher—up to $19.4 billion.

A big provision, the percentage cost over depletion tax credit ($8.2 billion) remains.

A new tax provision will allow the oil and gas sector to deduct production from foreign subsidiaries, and the JCT estimates the value will be $3.9 billion. However, bear in mind that a major focus of the TCJA is to move to a territorial system that ends taxation of American companies’ foreign subsidiaries, so this “new” tax break merely moves the oil and gas sector in line with other multinational industry tax treatments after reform.

Somewhat of an unknown is how a tax provision for natural resource pass-throughs known as a Master Limited Partnership (MLP) will change. An MLP is essentially a publicly traded corporation that is treated as a pass-through, allowing it to pass all its revenue onto its partners and avoid corporate taxation altogether. The wrinkle is if the tax preference value of an MLP is equal to their exemption from corporate income taxes, or if the value is equal to their advantage over alternative pass-through status. For this analysis, it is assumed that if MLPs were unable to claim MLP status, they would have to be incorporated and subject to corporate taxes. AAF estimated (based on a 5-year JCT estimate of tax expenditures) that the tax expenditure value of MLPs is around $10.3 billion over 10 years, a value that it is assumed reflects avoiding a 35 percent corporate tax rate. After the TCJA, MLPs would be able to claim status as a “passive” pass-through entity, and pass 100 percent of their revenues on to partners at the business tax rate of 25 percent (instead of the individual tax rate, which it is assumed would generally be the top rate of 39.6 percent for MLP partners). In this sense, the new value of the MLP is the value of avoiding the 20 percent corporate tax rate, plus the value of being taxed at 25 percent rather than 39.6 percent. AAF estimates the new value to be $10.2 billion, mostly unchanged because the value of avoiding a lower corporate rate is lessened.

Note though that even though the score of the MLP is mostly unchanged, that is because the value of avoiding a 20 percent corporate tax rate is less than the value of avoiding a 35 percent tax rate. In terms of after-tax income, the change could be a boon to MLP partners that will now be taxed at a 25 percent rate, rather than a 39.6 percent top rate for personal income.

Wind

Under the TCJA, the Production Tax Credit (PTC) will lose the inflation provision for new sources. The PTC is a direct subsidy to electricity producers from preferred sources per kilowatt-hour (a set value of 1.5 cents per kilowatt hour). AAF estimates that 92 percent of subsidies from the PTC go to wind power. JCT estimates the provision will save $12.3 billion, and the Treasury’s estimate of the value of the PTC is $37.6 billion, so the new tax treatment will be $25.3 billion, about $23.3 billion of which will go to wind power.

Solar

Under current law, investments in solar power can claim a tax credit equal to 30 percent of their investment under an Investment Tax Credit (ITC). This value is scheduled to phase out over time, but has no total sunset and reduces to a value of 10 percent indefinitely. The TCJA would put a permanent sunset to the ITC, ending it entirely in 2028. The subsidy cut that this reflects is not reflected in the score, because the savings would occur after the 2018-2027 window that the TCJA is scored in. However, the Treasury estimated that the ITC would cost $0.29 billion in 2026 in their 2017-2026 tax expenditure estimate, so the subsidy cut to solar power from 2028 onward is likely near that value.

Other Clean Energy Sources

The TCJA would restore ITC eligibility to several competing clean energy sources, as well as expand eligibility for credits for residential clean energy or efficiency improvements. The JCT scored those provisions in the TCJA at $1.2 billion and $1.1 billion respectively, and that increase in subsidy comes entirely from adding new technologies to the existing tax provisions, so a total increase of $2.3 billion in subsidies for those energy sources.

Nuclear

The TCJA “clarifies” that the advanced nuclear tax credit will be renewed every 8 years, or in other words the TCJA extends the credit. It also allows for looser rules on how the funds for the credits can be distributed. Overall, this change would increase subsidies for advanced nuclear power (not the existing nuclear fleet) by $0.4 billion.

Advanced Vehicles

Advanced vehicles (electric vehicles, alternative fuel vehicles, etc.) receive some tax credits under the current law based on fuel type. The TCJA would repeal the tax credit for electric vehicles, cutting subsidies for those vehicles by about $4 billion, while not touching an existing $4 billion in credits for vehicles using alternative fuels.

Coal

Under current law, coal receives two big tax credits: a treatment of revenue from coal extraction as capital gains (resulting in a preferred tax rate of 20 percent), and a credit for clean coal facilities (ones that use carbon capture technology). These subsidies, which AAF estimates at $1.6 billion combined, remain unchanged. Note that some subsidies that would benefit coal, like pollution control facilities at electric power plants, are not included in this estimate or any TCJA scoring.

Exclusion of Provisions

AAF did not attempt to estimate changes to energy efficiency provisions, as some tax credits will be included in changed provisions and the TCJA did not address any tax provisions specific to energy efficiency.

AAF also did not attempt to measure changes to tax credits pertinent to expensing, as the TCJA will allow more industries to claim expensing. The TCJA did not repeal or modify energy-specific expensing provisions, but such actions would likely be moot as there may be no difference between currently available expensing for energy activity and newly available provisions.

Some changes, like an adjustment to the enhanced oil recovery tax credit, are included in estimates but not mentioned in text due to their small size or the small difference between current law tax provisions and proposals under the TCJA.