Research

July 13, 2020

Tax Day 2020: Despite Fewer Forms, Costs and Hours Stay Steady

EXECUTIVE SUMMARY

- The total projected cost of Internal Revenue Service (IRS) paperwork is $196.7 billion annually – a small decrease from last year’s projection.

- After consecutive years of double-digit percentage increases in the total number of forms issued by the IRS, forms have decreased by 9 percent since last Tax Day.

- A number of other researchers have estimated tax compliance burdens, and while these studies offer a range of estimates, they are remarkably similar in magnitude and direction.

INTRODUCTION

COVID-19 has impacted virtually every aspect of American life in 2020, and Tax Day was no exception. Typically April 15, the Internal Revenue Service (IRS) announced in March that this year’s filing deadline would be pushed to July 15. The Treasury Department recognized the likely challenges that the pandemic posed to households and businesses and administratively delayed (subsequent to the declaration of a national emergency under the Stafford Act) the federal income tax filing and payments.

That postponement had little effect on the annual cost of complying with tax paperwork, however. This study finds that the current annual cost is $196.7 billion, a mere 0.3 percent decrease from 2019. According to data from the Office of Information and Regulatory Affairs (OIRA), the estimated aggregate time burden required to complete IRS forms, when rounded, decreased slightly from 2019 to 7.98 billion hours. This figure breaks down to 52 hours per taxpayer.[1]

METHODOLOGY

AAF researched every active IRS Office of Management and Budget Control Number (collections of information or recordkeeping requirements) on reginfo.gov, the government website that houses all federal paperwork information (as of July 10, 2020, for the purposes of this study). That search found 497 unique Information Collection Reviews (ICRs), which is how OIRA segments different paperwork requests from federal agencies, all of which contained IRS estimates of expected responses and burden hours. The IRS estimates the costs for just 14 of these ICRs, however, totaling $96.5 billion. To project costs for the rest, AAF applied the Bureau of Labor Statistics’ estimated average hourly wage for compliance officers ($35.03). The methodology is consistent with AAF’s previous Tax Day research.

RESULTS

The most noteworthy change from 2019 was a 9 percent decrease in the number of IRS forms – reversing a two-year trend of double-digit percentage increases. The total number of hours and projected cost each declined slightly from last year’s study.

- Forms: 1,217

- Hours: 7.98 billion

- Total Projected Cost: $196.7 billion

- Average Hours per Paperwork Submission: 7.8

FORMS

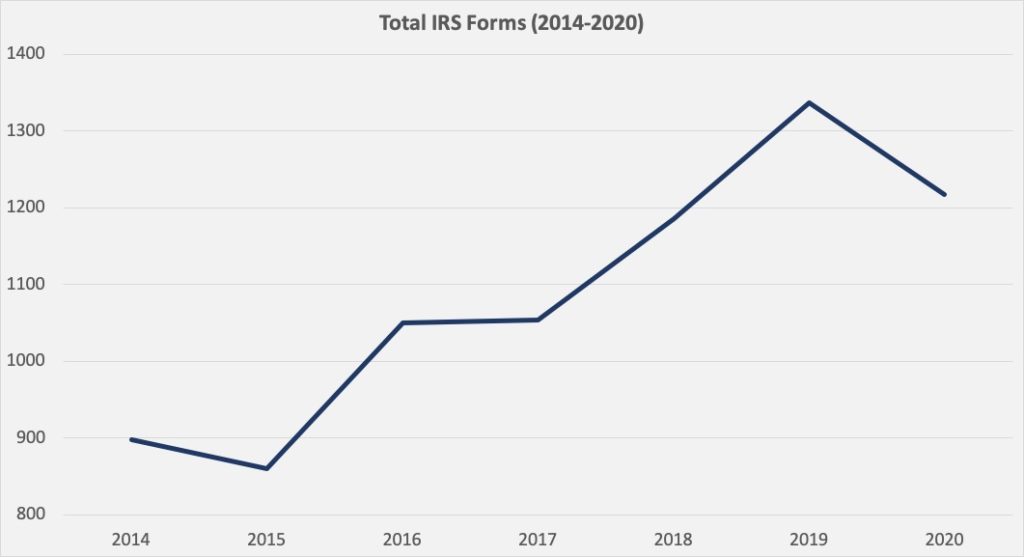

Between 2015 and 2019, IRS forms increased 55 percent, reaching a high of 1,337 last year. That number dropped to 1,217 for 2020, a 9 percent decrease. Despite the reduction, it is still the second-highest number of forms since AAF began its annual review in 2014. The chart below tracks the trajectory of IRS forms since then.

About half of the decline in forms come from ICRs that were discontinued at the request of IRS since April 2019 (62). Unfortunately, the publicly available paper trail available from OIRA only shows that it approved each IRS request to discontinue the collection; it does not explain why the IRS requested each discontinuation.

The remaining reduction comes from net changes in active forms that were revised over the past 15 months. Most of this reduction comes from a 34-form drop in the U.S. Business Income Tax Return. The other major contributor to the reduction is the return for tax exempt organizations, which was reduced by 16 forms.

Despite the notable reduction in forms for the Business Income Tax Return, it still has more than double the forms of any other ICR. Its 389 forms make up 32 percent of all IRS forms. The Individual Income Tax Return comes in second with 193, followed by the return for tax exempt organizations with 87. No other ICR has more than 23 forms.

COSTLIEST ICRs

The number of forms is largely correlated to the costliest ICRs. Again, the Business Income Tax Return and Individual Income Tax Return are at the top of the heap. The following ICRs are those with compliance costs of more than $10 billion annually. Combined, they comprise 84 percent of all IRS paperwork compliance costs.

| Collection | Cost ($ Billions) |

| U.S. Business Income Tax Return | 61.6 |

| U.S. Individual Income Tax Return | 33.3 |

| Proceeds from Broker and Barter Exchange Transactions | 23.6 |

| Employer’s Quarterly Federal Tax Return | 20.3 |

| Form 4562 – Depreciation and Amortization | 15.7 |

| U.S. Income Tax Return for Estates and Trusts | 10.8 |

The U.S. Business Income Tax Return remains the largest source of burden from IRS paperwork. According to IRS estimates, it takes 12 million filers an average of 279 hours to complete the return annually at a total cost of $61.6 billion. By comparison, the IRS estimates that it takes the 173 million filers of the U.S. Individual Tax Return 10 hours per return, for a total cost of $33.3 billion.

Five ICRs have an average hourly cost above $100. These five collections are:

| Collection | Cost/Hour |

| Continuing Education Provider Application and Request for Provider Number | 801.70 |

| Affordable Care Act Internal Claims and Appeals and External Review Disclosures | 503.41 |

| Status as a Grandfathered Health Plan under the Patient Protection and Affordable Care Act | 165.23 |

| Annual Return/Report of Employee Benefit Plan | 149.32 |

| Notice of Medical Necessity Criteria under the MHPAEA | 134.14 |

ALTERNATIVE MEASURES OF TAX COMPLIANCE COSTS

A number of studies have attempted to capture the cost to the taxpayer and the economy of administering the U.S. tax system. A 2019 study by the Bipartisan Policy Center provides an excellent survey of recent estimates.[2] The Taxpayer Advocate Service (TAS) has also reviewed recent attempts at capturing the cost of the U.S. tax code, noting that experts have embraced a range of methodologies for these calculations.[3] TAS, for example, estimated the 2015 cost of income-tax compliance at $195 billion. The Tax Foundation estimated that compliance costs amounted to $406 billion in 2016.[4] Subsequent estimates that include additional cost considerations and alternative approaches to monetizing the hours spent complying with the tax code alters these estimates considerably. Fichtner and Feldman completed a thorough assessment of the costs that the U.S. tax code extracts from the economy through complexity and inefficiency, beyond TAS’s estimate. According to the authors, in addition to time and money expended in compliance, foregone economic growth and lobbying expenditures amount to hidden costs estimated to range from $215 billion to $987 billion.[5]

These estimates provide valuable context and, despite some differences, are noteworthy for the relative similarity in magnitude and direction. These estimates do not reflect costs associated with the changes from the Tax Cuts and Jobs Act (TCJA), which substantially reformed individual and business taxation. For many taxpayers on the individual side, the TCJA likely made filing incrementally less onerous. According to a more recent study by the Tax Foundation, for individual filers the TCJA reduced the cost of compliance by $3.1 billion to $5.4 billion.[6] Regulatory implementation with respect to the business and international provisions remains a work in progress. Indeed, Treasury only issued final regulations concerning the deductions for global intangible low-taxed income (GILTI) and foreign-derived intangible income (FDII), among the most significant elements of the new international tax regime established by the TCJA, in the second week of this month. According to a 2020 Government Accountability Office analysis, as of the end of fiscal year (FY) 2019, “Treasury had not issued 27 planned proposed regulations for business and international provisions,” which does present compliance challenges for taxpayers and tax authorities.[7]

Other measurements beyond mere time and pecuniary estimates reflect the cost of compliances. Tax compliance is so onerous for individual taxpayers that over 90 percent used a preparer or tax software to submit their returns.[8] TAS uses the IRS’s ability to answer taxpayer telephone calls and its ability to respond to taxpayer correspondence as key metrics for taxpayer service. TAS reports the IRS received 76.8 million calls to its customer service lines in FY2019, which is down from FY2018 by about 900,000 calls. TAS reports that over 65.4 percent of calls from the toll-free number were answered in FY2019, with an average speed of an answer at just over 11.3 minutes.[9] Despite fewer calls, the answer rate is down by nearly 10 percentage points, and the average speed to answer has slowed by nearly 4 minutes.

Understandably, these figures will likely look substantially different in next year’s TAS report to Congress, given the substantial upheaval leveled at the economy in general and tax administration specifically owing to the COVID-19 pandemic.

CONCLUSION

The delay in the tax filing deadline had no discernable effect on the cost of complying with tax paperwork. Despite the first drop in the total number of IRS forms in five years, taxpayers are still projected to spend close to $200 billion per year complying.

[1] Internal Revenue Service Research, Applied Analytics, and Statistics, Statistics of Income Division, Fiscal Year Return Projections for the United States Publication 6292 (Rev. 6-2020) Washington, D.C. 20224, (Table 3).

[2] https://bipartisanpolicy.org/report/tax-administration-compliance-complexity-and-capacity/

[3] National Taxpayer Advocate. “Annual Report to Congress.” Taxpayeradvocate.irs.gov. Internal Revenue Service Web. https://taxpayeradvocate.irs.gov/Media/Default/Documents/2016-ARC/ARC16_Volume1.pdf; See also Government Accountability Office (GAO), GAO-05-878, Tax Policy: Summary of Estimates of the Costs of the Federal Tax System (Aug. 2005), http://www.gao.gov/new.items/d05878.pdf.

[4] https://taxfoundation.org/compliance-costs-irs-regulations/

[5] Fichtner, Jason J. and Jacob M. Feldman, “The Hidden Costs Of Tax Compliance.” Mercatus Center 2015 Web. http://mercatus.org/sites/default/files/Fichtner-Hidden-Cost-ch1-web.pdf

[6] https://taxfoundation.org/different-methods-calculating-tax-compliance-costs/#_ftn12

[7] https://www.gao.gov/assets/710/704836.pdf

[8] https://www.gao.gov/assets/700/699000.pdf

[9] https://taxpayeradvocate.irs.gov/Media/Default/Documents/2019-ARC/ARC19_Volume1.pdf