Research

June 26, 2024

Promises Not to Touch Social Security Mean Big Cuts for Beneficiaries

Executive Summary

- According to the Social Security Trustees, the Social Security Old Age and Survivors Insurance (OASI) trust fund will exhaust its reserves and become insolvent by 2033; upon insolvency, all beneficiaries regardless of age, income, or need will see their benefits slashed by 21 percent across the board.

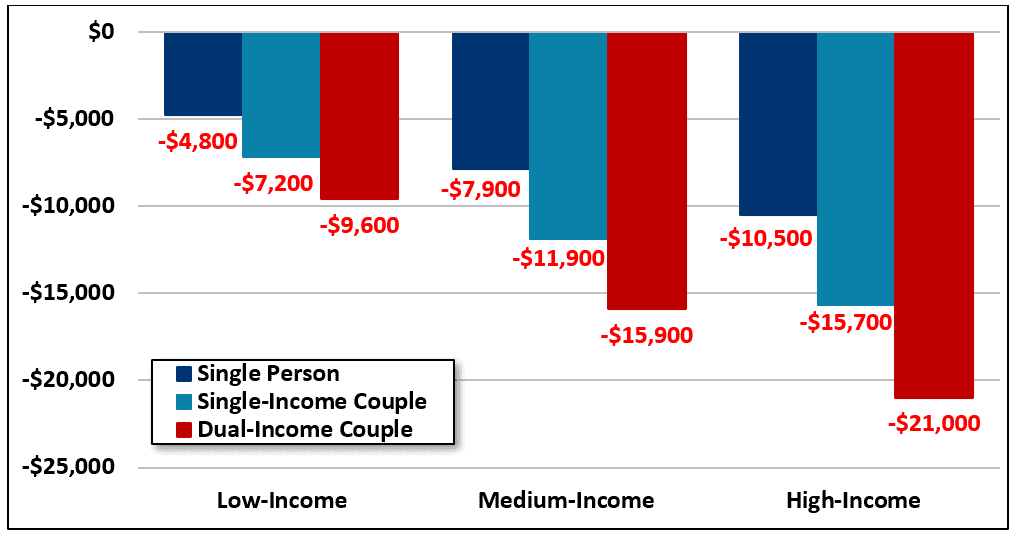

- The magnitude of the 21 percent benefit cut would vary for different types of retirees and for retirees across the income spectrum: A newly retired middle-income single retiree, for example, would see their annual benefits slashed by $7,900, a middle-income, single-income couple would face an $11,900 cut, and a middle-income, dual-income couple would see their annual benefits cut by $15,900.

- The pledge not to touch Social Security by the two leading presidential candidates and lawmakers on Capitol Hill is not a promise to protect benefits, but an implicit endorsement of a 21 percent across-the-board benefit cut in just nine years.

Introduction

According to the Social Security Trustees, the Social Security Old-Age and Survivors Insurance (OASI) trust fund – which currently pays monthly benefits to nearly 60 million retired workers, their spouses and children, and their survivors – is projected to exhaust its reserves and become insolvent by the end of calendar year 2033. That means the OASI trust fund will run out when today’s 58-year-olds reach the normal retirement age of 67 and today’s youngest retirees – those retiring at age 62 – turn 71.

Under the law, the OASI trust fund does not have borrowing authority, so upon insolvency it will be unable to borrow from the Treasury to close the gap between dedicated revenue and spending and continue to pay benefits in full. The Social Security Trustees estimate that in 2033, the OASI trust fund will have enough dedicated revenue to pay 79 percent of scheduled benefits. That means all OASI beneficiaries regardless of age, income, or need will see their benefits slashed by 21 percent across the board.

Measuring the Magnitude of a 21 Percent Benefit Cut

The magnitude of the 21 percent cut in annual benefits varies for different types of retirees and for retirees across the income spectrum.

A low-income, single worker retiring at the normal retirement age in 2033 would see their annual benefits slashed by $4,800[1]. Whereas they would have received $22,900 in annual benefits under a solvent Social Security system, they would receive $18,100 once the OASI trust fund becomes insolvent and the 21 percent benefit cut takes effect. A middle-income, single retiree would face a $7,900 cut, which would reduce their benefits from $37,900 to $30,000. A high-income, single retiree would see their benefits slashed by $10,500, from $50,000 to $39,500.

For couples, a typical low-income, single-income couple would see their annual benefits cut by $7,200, meaning their annual benefits would decline from $34,400 to $27,200. A middle-income, single-income couple would face an $11,900 cut, which would reduce their benefits from $56,800 to $44,900. A high-income, single-income couple would see their benefits slashed by $15,700, from $75,000 to $59,300

A typical, low-income, dual-income couple would see their annual benefits cut by $9,600, meaning their benefits would fall from $45,800 to $36,200. A middle-income, dual-income couple would face a $15,900 cut, which would decrease their benefits from $75,700 to $59,800. A high-income, dual-income couple would see their benefits reduced by $21,000, from $100,000 to $79,000.

Magnitude of 21 Percent Benefit Cut for Different Types of Retirees

Sources: Social Security Administration and author’s calculations. Figures show the projected benefit cut for single persons and couples retiring in 2033 in constant 2033 dollars.

Conclusion

The two leading presidential candidates and lawmakers on Capitol Hill have pledged not to touch Social Security, declaring it “off the table” for reform. While this pledge is framed as a promise to protect benefits, it is actually an implicit endorsement of a 21 percent across-the-board benefit cut for over 70 million beneficiaries when Social Security’s retirement fund runs out in just nine years. Action should be taken soon to make Social Security solvent and prevent abrupt benefit cuts.

[1] All figures presented in this analysis are rounded to the nearest $100.