Research

July 21, 2016

New York Law Would Wipe Out Half a Billion Dollars of Value for Airbnb Hosts

The New York Senate has passed a new law that would prohibit the advertisement of apartments, tenements, and flat houses for purposes other than “permanent residence.” While the law still needs to be signed by the governor, it is clearly targeting Airbnb rentals that don’t fall under the definition of a permanent resident. Using price and listing information from early June, AAF has calculated that nearly $500 million in gross revenue could be lost in New York City in a year if hosts are not allowed to list on Airbnb.

As AAF noted before, new technologies like Airbnb allow for trade in services and goods to expand, since producers and consumers can be brought to the bargaining table, and dramatically reduce the costs of that interaction.

However, the expansion of these services has faced pushback. Toward the end of 2014, New York State Attorney General Eric Schneiderman released a report on Airbnb, which has served as a guidepost for legislators in the state and highlighted three animating questions in the debate:

- Are the new platforms fueling a black market for unsafe hotels?

- By bidding up the price of apartments in popular areas, do short-term rentals make metropolitan areas like New York City less affordable?

- Is the influx of out-of-town visitors upsetting the quiet of longstanding residential neighborhoods?

On the first question, there is actually no statistical evidence in the report of unsafe conditions, just sworn affidavits by a fire chief and a building inspector. As the fire chief notes, fire regulations have changed in the last 30 years, driven by the horrific MGM Grand fire in Las Vegas in 1980 that killed 80. However, the vast majority of these deaths were caused by toxic fumes that came from building materials, not ingress and egress issues, which are often cited. It should also be noted that the MGM had nearly 2,000 rented rooms when the fire broke out, which cannot be easily applied to Airbnb listings.

On the second question, it is probably the case that Airbnb is increasing rental prices, but by how much is still undetermined. Airbnb conducted its own study on the matter and found that its was responsible for a rent increase for one-bedroom apartments in San Francisco of $19 per month.

Lastly, many worry that the influx of out-of-town visitors is upsetting the quiet of longstanding residential neighborhoods. Much like the attorney general’s report, our analysis finds that Manhattan and Brooklyn host the majority of Airbnb’s listings, but these are areas with a lot of pedestrian foot traffic.

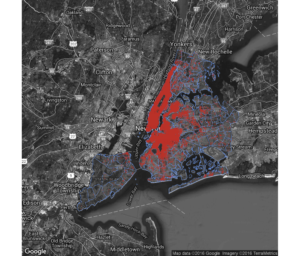

Using tools that scrape listings from the website, Inside Airbnb routinely compiles Airbnb data for New York City; the most recent data set dates from June 2, 2016 and provides the raw numbers for this analysis. Below is a density map of that data with an outline of New York City’s Neighborhood Tabulation Areas, the official demarcations for the city.

The density of the Airbnb listings seems to be correlated with high traffic areas.

New York City provides data on traffic by neighborhood, with 1 being low pedestrian traffic and 5 signaling high traffic. Below is a table of the top ten neighborhoods by Airbnb listings and traffic ratings.

| Neighborhood | Traffic Rating | Number of Listings per 1000 People |

| Williamsburg | 1 | 99 |

| East Village | 4 | 42.5 |

| Midtown | 5 | 36.1 |

| Bedford-Stuyvesant | 3 | 33.5 |

| Hell’s Kitchen | 5 | 29.9 |

| Greenpoint | 2 | 25 |

| SoHo-TriBeCa-Civic Center-Little Italy | 5 | 22.6 |

| Long Island City | 2 | 19.8 |

| West Village | 4 | 18.4 |

| Harlem | 4 | 17.3 |

Because the pedestrian data is from 2013, changes in recent years aren’t reflected. For example, Williamsburg, Greenpoint, and Long Island City have all experienced rapid growth and with it, the traffic is likely to have increased. Regardless, the correlation between neighborhood traffic and Airbnb listings is positive and moderate (r=.5). This suggests that high traffic areas are getting more listings while those quiet neighborhoods aren’t.

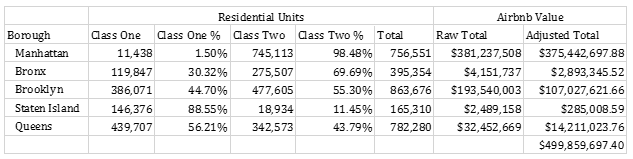

As currently written, the new law would make it “unlawful to advertise occupancy or use of dwelling units in a Class A multiple dwelling,” which is to be occupied for permanent residents. Because permanent residents must reside in Class A dwellings for at least 30 days, any advertisement for occupancy of 29 days or fewer would be a violation. New York’s multiple dwelling law does allow for carve-outs, so some of the current listings would be exempt from this wholesale ban. Using the collected data from Inside Airbnb, only those listings marked as “Entire home/apt,” which have a minimum number of nights of 29 and fewer were selected and analyzed because they satisfy the requirements of the law. To calculate the value of this group, the price per night is multiplied by the total number of available nights for each listing.

Given that some homes or apartments would not be included under this law because they do not satisfy the Class A multiple dwelling definition, each of the five boroughs were adjusted by the ratio of these buildings in each borough. Every year, New York City provides a summary of the number of residential units in their assessment of taxable real estate. While not perfect, the distinction between Class One and Class Two for taxing purposes gives a broad estimate of the number of units that would be affected by this change, with Class Two units facing the new law. The raw totals for each of the five boroughs were weighted to give the total, nearly $500 million.

If this law were to pass, the entire state of New York would be affected. However, because New York City is an important global city and has made a push for opening its data, the effect can be estimated. The result would be nearly half of a billion dollars’ worth of economic activity rid from the books.