Research

November 15, 2019

Fully Implementing the Affordable Care Act

While enacted in 2010, the Affordable Care Act (ACA) has never been fully implemented. The Health Insurance Marketplaces and partial Medicaid expansion were implemented in 2014, but under the Obama Administration full implementation was prevented by states that were slow to take up the federal money for Medicaid expansion. Under the Trump Administration, the penalty for the individual mandate has been set to $0, and Cost-Sharing Reduction (CSR) payments to insurers have been discontinued, among other things.

This report details the findings of the Center for Health and Economy (H&E) analysis – relying on its Under-65 Microsimulation Model – of a scenario where every state expands Medicaid and the individual market policies of the ACA are fully implemented. All impacts projected in this report are relative to H&E’s July 2019 Baseline.[1] As with all projections, the estimates are associated with some degree of uncertainty.

KEY FINDINGS:

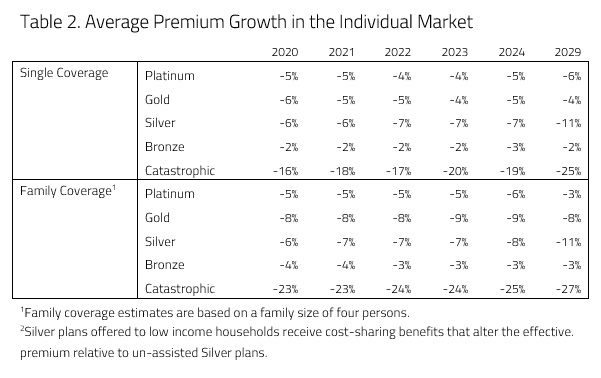

- Premium Impact: Driven by the return of the CSR payments, premiums are expected to fall by 2 to 11 percent by the year 2029 for qualified health plans (QHPs) in the individual market. Silver plans are expected to see the largest reduction.

- Coverage Impact: A fully implemented ACA would lead to a decrease in the number of uninsured, primarily because of the Medicaid expansion but also because of lower premiums. Initially, there would be a decrease in the uninsured of roughly 4 million people. By 2029, the decrease the uninsured would be around 3 million relative to the baseline.

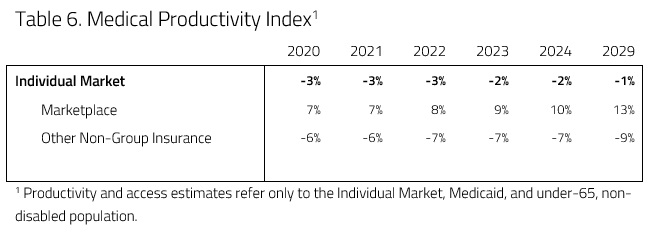

- Medical Productivity: The scenario would lead to a 1 percent decrease in medical productivity by 2029.

- Provider Access: The scenario would lead to a 16 percent increase in provider access by 2029.

- Budget Impact: The scenario is expected to increase spending by $170 billion between 2020 and 2029. The reintroduction of the individual mandate penalty is expected to increase revenues by $36 billion. The net budgetary impact of the fully implemented ACA is an increased deficit of $136 billion.

ANALYSIS

This analysis uses a microsimulation model developed for use by H&E. The model employs micro-data available through the Medical Expenditure Panel Survey to analyze the effects of health policies on the health insurance plan choices of the under-65 population, and it interprets the resulting impact on national coverage, average insurance premiums, the federal budget, and the accessibility and efficiency of health care. The following provisions and subsequent assumptions are included in this score.

- Full implementation would take effect on January 1, 2020.

- Every state would expand Medicaid to include adults up to 133 percent of the Federal Poverty Level (FPL).

- The individual mandate penalty is restored to the level it was before the Tax Cuts and Jobs Act of 2017. In 2018, the individual mandate penalty was the greater of $695 for each uninsured adult or 2.5 percent of yearly household income. For each successive year after 2018, the penalty was the greater of $695 indexed to an inflation rate of CPI-U plus 1 (a factor of roughly 1.02) or 2.5 percent of yearly household income.

- For 2020, it was assumed the individual mandate penalty was the greater of $723 per household adult or 2.5 percent of household income.

- Those subject to the penalty are those who are not enrolled in a QHP.

- Congress appropriates the funds for CSR payments to insurers.[2]

Premium Impact

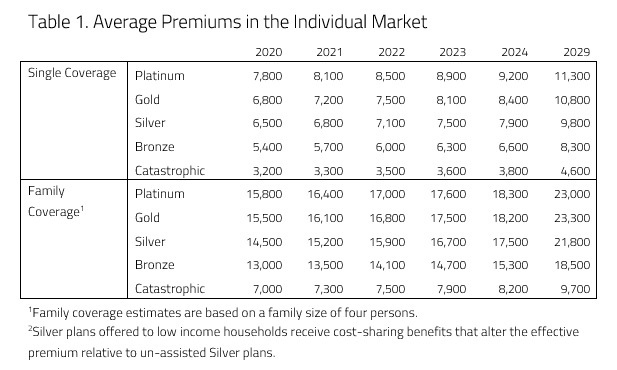

H&E health insurance premium estimates are based on five plan design categories offered in the Individual Market: Platinum, Gold, Silver, Bronze, and Catastrophic. Under current law, the cost-sharing designs of the four metallic categories correspond to approximate actuarial values: 90 percent, 80 percent, 70 percent, and 60 percent, respectively. Catastrophic coverage plans refer to two different kinds of health insurance plans. First, Catastrophic coverage can mean plans that reimburse medical expenses only after members meet a high deductible—a maximum of $7,900 for an individual under current law. Second, Catastrophic coverage includes Short-Term Limited Duration plans. All premium estimates reflect health insurance prices without any federal subsidies and reflect the average premiums of plans actually purchased in the marketplace. They do not represent an average of all the offerings in the marketplace.

Table 1 below presents the average premiums for the purchased plans in each category between 2020 and 2029.

There are two main sources of downward pressure on premiums: the reintroduction of CSR payments to insurers and the individual mandate penalty. H&E estimates that the reintroduction of CSR payments to insurers would allow insurers to decrease premiums for Silver plans, as the Silver metal level includes plans with increased cost sharing.H&E estimates that a fully implemented ACA would lower insurance premiums in every category, especially premiums for Silver and Catastrophic plans.

Another policy change that would lead to decreases in premiums is the individual mandate. The mandate would place downward pressure on premiums as people who are otherwise healthy purchase insurance in the individual market to avoid the penalty. The mandate penalty would also have a profound effect on the market for Catastrophic plans. Anyone who purchases a Short-Term Limited Duration Insurance (STLDI) plan would be subject to the penalty. Likewise, anyone above the age of 30 would be subject to the penalty as the ACA stipulates that Catastrophic plans are only available for those under the age of 30. As a result, many people above the age of 30 would purchase other QHPs. Therefore, under a fully implemented ACA, the group of people purchasing Catastrophic coverage would be overwhelmingly younger than it is currently, leading to a decrease of 25 to 27 percent in the premiums of purchased Catastrophic plans by the year 2029.

Coverage Impact

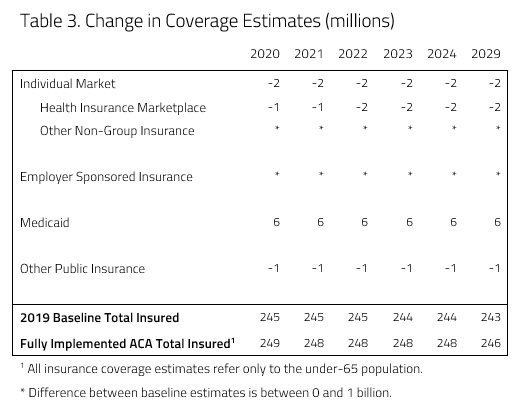

H&E insurance coverage estimates reflect health insurance choices for the under-65 population. H&E estimates that the fully implemented ACA would result in increases in the insured population of 4 million in 2020 and 3 million in 2029 relative to H&E’s 2019 baseline. Table 3 below shows the overall projected insurance levels.

H&E expects enrollment to increase in the Medicaid program (see Table 3, below). If every state expanded Medicaid, it is expected that Medicaid enrollment would increase by 6 million relative to the baseline. With Medicaid eligibility expanding to 133 percent of the FPL in every state, expansion will be accompanied by a decrease in individual market enrollment as people previously eligible for tax credits and cost-sharing subsidies become newly eligible for Medicaid and sign up. Furthermore, H&E expects some of this decrease to be offset as a result of the mandate penalty imposed on those who choose to go uninsured or purchase a non-QHP.

As can be seen in Table 3, it is expected that the Medicaid expansion will also draw a small number of people currently enrolled in other forms of public insurance like the Veterans Health Administration and the Indian Health Service. It is expected that there will be a decrease of roughly 1 million enrolled in other public insurance by the year 2021.

Productivity and Access

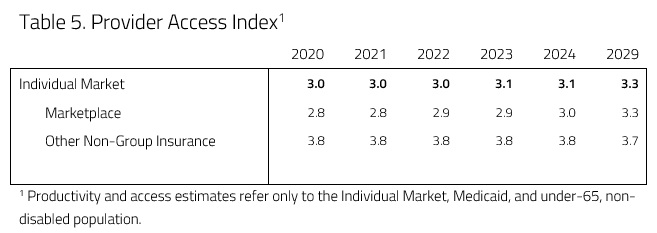

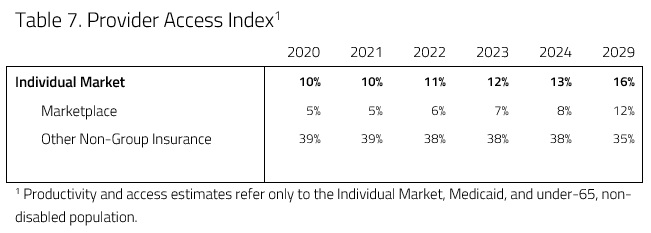

In an attempt to evaluate access and productivity in the health care system, H&E estimates the Medical Productivity Index (MPI) and the Provider Access Index (PAI). Health insurance plan designs are associated with varying degrees of access to desired physicians and facilities, as well as incentives that promote or discourage efficient use of resources. H&E estimates each index by attributing productivity (i.e. efficiency) and access scores to the range of plan designs available and uses the changes in plan choices to project the evolution of health care quality. These scores are provided in Tables 4 and 5 below.

Provider access in the individual market is expected to increase under the plan. This is largely a result of a shift of consumers from Catastrophic coverage and STLDIs to QHPs because of the individual mandate penalty. This interaction leads to a 16 percent increase in provider access by the year 2029. H&E expects medical productivity to decrease relative to the 2019 baseline projection as a result of the scenario, as Table 6 below demonstrates. As the individual mandate precludes enrollment in non-QHP plans, enrollment in Catastrophic coverage and STLDI plans would decrease. Because of this decline, medical productivity decreases outside of the exchanges as people enroll in higher actuarial value plans. Higher actuarial value means lower medical productivity (or efficiency), as people are more likely to pursue health care services. At the same time, the reintroduction of CSR payments to insurers caused premiums for Silver plans to decrease, creating more separation between Gold and Silver plans. As the premiums of Silver plans decrease relative to Gold, a greater share of people enroll in Silver plans leading to more medical productivity because of their lower actuarial value. These offsetting shifts in the individual market interact to decrease medical productivity by 1 percent in 2029 relative to the baseline.

Budgetary Impact

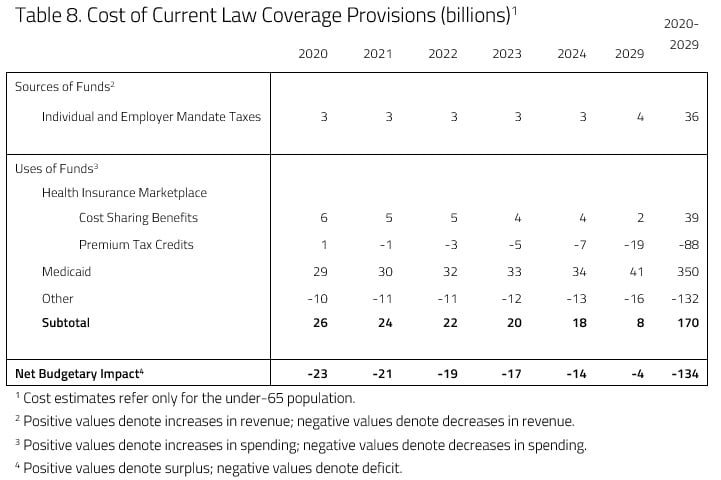

H&E projects that a fully implemented ACA would lead to a net increase in the budget deficit of $134 billion, relative to the current H&E baseline, over the next decade. H&E assumes an increase of $36 billion in revenue due to the reintroduction of the individual mandate penalty. Meanwhile, a fully implemented ACA would lead to an increase in spending of $170 billion that results mainly from increased enrollment in Medicaid from the expansion.

Though spending is expected to increase by $170 billion, there are various offsetting increases and reductions in spending. As mentioned above, the Medicaid expansion would be the source of the largest increase in spending, as Medicaid spending is expected to increase by $350 billion over the 10-year window. The reintroduction of CSR payments is expected to increase spending also. H&E expects cumulative CSR spending to reach $39 billion by the year 2029.

There are various areas, however, where there are reductions in spending. The expansion population will be made up of many that are currently receiving premium tax credits in the individual market. As individuals currently enrolled in private insurance through the individual market shift to Medicaid coverage and the reintroduction of CSR payments, tax credit spending is expected to decrease by $88 billion over 10 years. Moreover, Medicaid is expected draw people out of other forms of public insurance, resulting in another offsetting decrease in spending of $132 billion over the budget window.

Uncertainty in Projections

H&E uses a peer-reviewed micro-simulation model of the health insurance market to analyze various aspects of the health care system.5 As with all economic forecasting, H&E estimates are associated with substantial uncertainty. While the estimates provide a good indication on the nation’s health care outlook, there are a wide range of possible scenarios that can result from policy changes, and many current assumptions are unlikely to remain accurate over the course of the next 10 years.

One significant source of uncertainty is what effects the reintroduction of the individual mandate penalty will have on the marketplace. The mandate’s purpose is to force individuals and households to purchase insurance and reduce premiums. After a 2-year increase in the mandate penalty, it is possible that the updated mandate penalty has greater or smaller effects on the premium decreases recorded in this report.

[1] https://www.americanactionforum.org/research/health-and-economy-baseline-estimates/

[2] These were payments to insurers who offered Silver plans with reduced cost sharing (required by the ACA) to help them absorb losses incurred. Congress never appropriated the money for these payments, however, so the Trump Administration discontinued them in 2017.