Research

June 22, 2016

Discounting Consumers: How DOE’s Wishful Thinking Leads to Higher Costs, Fewer Jobs

Summary

- Regulators use discount rates to understand the benefits and costs of regulations. Discount rates, which are similar to interest rates, are the acknowledgement that costs and benefits may accrue immediately or over time.

- Discount rates have a huge impact on whether an agency advances or abandons a regulation. The Department of Energy routinely employs low discount rates in a bid to make regulations seem less costly.

- The American Action Forum found that 1 in 8 consumers would bear higher net costs on products due to DOE energy efficiency standards.

- DOE regulations have had a severe impact on the manufacturing industry. If many of these regulations had not been implemented, there would be 19,000 more jobs in the industry.

Introduction

How does agency math lead to more regulation? The American Action Forum (AAF) reviewed 15 rules issued by the Department of Energy (DOE) between 2010 and 2015 and found that discount rates drove favorable assumptions buried in the Department of Energy’s (DOE) regulatory analyses have profound implications for consumers and manufacturers. For example, at a three percent rate, the agency’s claimed climate benefits from these rules are roughly $5.6 billion. At a five percent rate, those benefits shrink to $1.5 billion, and they decline even further as they approach the rate of seven percent that the Office of Management and Budget recommends that agencies use as the “default” in most benefit-cost analyses. Using favorable rates can turn a rule with net costs into one with net benefits and by DOE’s own admission, roughly 1 in 8 consumers will suffer net costs as a result of these new energy efficiency standards. Although the agency’s figures are just projections, an empirical AAF analysis found the cumulative result of past DOE rules has shrunk employment in the heating, ventilation, and air conditioning (HVAC) industry by 19,200 jobs or 15 percent from 2003 to 2013.

Manipulating Rates

Discount rates occupy a relatively hidden space in the regulatory world. Often misunderstood or unknown by the general public, discount rates are simply an acknowledgement that costs and benefits do not take place during the same time horizon. To correct for this asymmetry, regulators discount the costs and benefits that may accrue immediately or in the distant future. To the layperson, discount rates can be generally compared to interest rates, in that they measure how much something is ultimately going to cost against its benefits. For example, an automobile that costs $20,000 with an interest rate of 3 percent over 5 years will ultimately cost $23,000. But to the consumer, the benefit in paying that premium is that they will have that car now, versus having to save $20,000 and then buying it later. Whether it is automobiles or air conditioners, consumers generally prefer present consumption to any future benefits that a regulation might deliver. Discounting future costs and benefits is an essential component to regulation and past research has found changes in the discount rate can easily swing a rule with net benefits to a measure with net costs.

Discount rates play a role in how DOE calculates the Lifetime Cost Cycle (LCC) savings for a given device in order to justify which standard level they establish. In other words, over the life of a product, will consumers reap benefits from reduced operating costs or net burdens from the higher up-front purchase price? If the former, then the agency will likely proceed. If the latter, then the regulation could be abandoned.

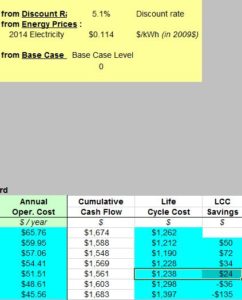

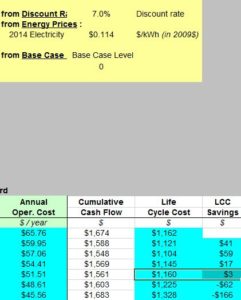

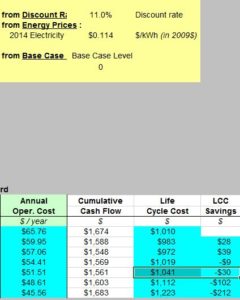

If these savings are discounted more heavily (at a higher rate) than DOE presumes, then they do not provide as strong a rationale for the increase in the product’s original purchase price. Take, for instance, this efficiency rule regarding refrigeration equipment. The images below (taken from DOE models) capture how the discount rate can affect the LCC savings calculations for a “Standard-Size Top-Mount Refrigerator-Freezer.”

The first set of calculations uses DOE’s default discount of 5.1 percent. The other two utilize the OMB standard seven percent rate and an 11 percent rate found in Chesson & Viscusi (2000), although some surveys suggest middle-to-low-income households have discount rates exceeding 20 percent. Looking at the “Efficiency Level 4” (see the highlighted cells), DOE’s chosen efficiency level for this product, the LCC savings fall from $24 down to $3 and then down to negative $30 (representing net costs). Because of the higher discount rate, consumers will not reap nearly the benefits that DOE estimates during the lifetime of the product, and in such instances, consumers will bear net costs from the rule.

Federal regulators are instructed to use discount rates, typically of three and seven percent. As administration guidance notes, “Benefits and costs do not always take place in the same time period. When they do not, it is incorrect simply to add all of the expected net benefits or costs without taking account of when the [sic] actually occur. If benefits or costs are delayed or otherwise separated in time from each other, the difference in timing should be reflected in your analysis.” A three percent rate represents, “the real rate of return on long-term government debt,” and a seven percent rate captures, “the average before-tax rate of return to private capital in the U.S. economy.” However, White House guidance notes the “default” discount rate should be seven percent. Yet, for many recent DOE regulations, this seven percent rate is omitted.

In fact, for virtually all recent analyses, the seven percent rate is excluded for a substantial portion of the benefits. AAF reviewed every DOE rulemaking since 2010 that estimated benefits for the Social Cost of Carbon (SCC), which represents the damages associated with a release of carbon emissions in a given year. In a survey of 15 rulemakings, the benefits resulting from SCC from fewer carbon emissions ranges from a low of seven percent to a high of 37 percent of total benefits. The average is roughly 21 percent at a three percent discount rate. In other words, SCC represents more than 20 cents of every $1 of DOE benefits and manipulating discount rates can play an important role in the final benefit-cost calculation.

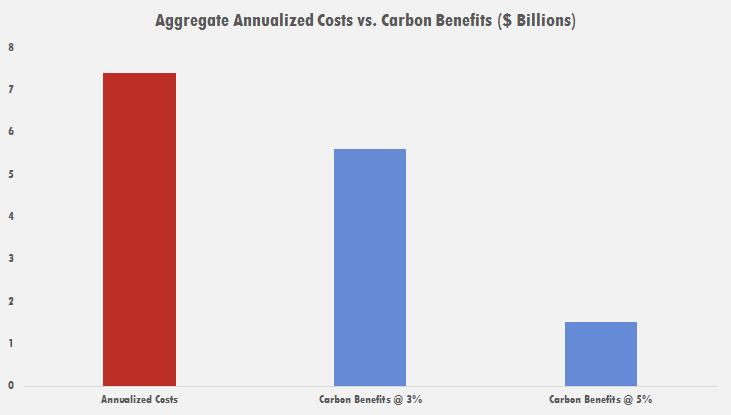

The aggregate carbon benefits for these 15 rules is $5.6 billion at a three percent rate, which is actually substantially less than the consumer and manufacturer costs: $7.4 billion. Even at a low three percent rate, these rulemakings are saved by high “private” benefits, the value some consumers save through lower operating costs. (However, the discussion below on consumer impacts demonstrates that many fail to materialize.) These aren’t clean air or climate benefits, just DOE “correcting” market behavior.

As much as the math works against DOE when comparing costs to climate benefits at a three percent rate, the figures grow worse for the agency closer to the “default” rate of seven percent. Because the agency omits the seven percent rate, they include a five percent rate instead. At that rate, the $5.6 billion in carbon benefits are reduced to just $1.5 billion, which means the annual costs of those measures dwarf benefits by almost 5:1. When analyzing the five percent rate, the costs exceed the carbon benefits in all but one of the 15 rulemakings since 2010. The chart below compares costs, SCC at a three and five percent, and clean air benefits, which represent lower NOx emissions.

Comparing Annual Costs to SCC and Clean Air Benefits

| Rulemaking Standard | Annual Costs | SCC @ 5% | Clean Air Benefits | Net Costs |

| Air Conditioning and Heating | $711 million | $362 million | $135 million | $214 million |

| Fluorescent Lamps | $841 million | $98 million | $21 million | $722 million |

| External Power Supplies | $147 million | $22 million | $1 million | $124 million |

| Commercial Refrigeration Equipment | $256 million | $73 million | $3 million | $180 million |

| Industrial Electric Motors | $517 million | $166 million | $23 million | $328 million |

| Walk-in Coolers and Freezers | $511 million | $86 million | $17 million | $408 million |

| Residential Furnace Fans | $358 million | $90 million | $6 million | $262 million |

| Electric Transformers | $266 million | $58 million | $9 million | $199 million |

| Microwave Ovens | $58 million | $255 million | $22 million | -$219 million |

| Clothes Washers | $185 million | $35 million | $5 million | $145 million |

| Residential Refrigerators | $1.5 billion | $162 million | $21 million | $1.3 billion |

| Fluorescent Lamp Ballasts | $363 million | $20 million | $2 million | $341 million |

| Clothes Dryers | $160 million | $11 million | $2 million | $147 million |

| Small Electric Motors | $264 million | $32 million | $4 million | $228 million |

| Water Heaters | $1.2 billion | $46 million | $8 million | $1.1 billion |

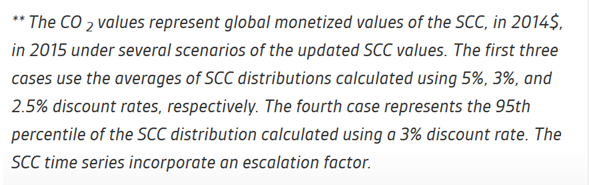

Buried in footnotes, the agency admits it cherry picks the favorable SCC figures and excludes the “default” rate of seven percent. The picture below the footnote demonstrates how DOE purposefully omits the seven percent rate and instead relies on lower rates to bolster benefits and the case for regulation. If DOE were interested in using a midpoint between three and seven percent, they could have employed the five percent rate, which is half-way between three and seven. However, at that rate, costs would have exceeded carbon benefits in all but one regulation.

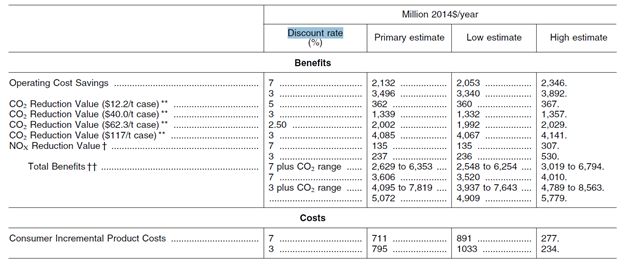

The chart below captures how DOE chooses certain threshold rates for some categories of benefits, but omits rates for others. As shown below, the agency clearly employs a seven percent rate for NOx reductions, representing clean air benefits. But for SCC, it employs an extreme scenario at 3 percent, 2.5 percent, 3 percent, and 5 percent. Even though one of the largest benefit components, SCC, excludes a seven percent rate, overall benefits are then packaged into standard three and seven percent rates. This gives the appearance of an apples-to-apples comparison of costs and benefits at standard rates even though one of the benefit inputs contained substantially lower rates. Had DOE actually followed guidance for executive agencies and used a “default” seven percent rate for carbon benefits, its regulatory portfolio would have undoubtedly been more difficult to justify.

Omitting standard discount rates is not the only way DOE can manipulate benefit-cost analysis. The agency also employs discount rates to project manufacturer and consumer behavior. Typically, for manufacturer rates, DOE relies on marginal figures, but uses average figures for consumer rates; the latter likely represents lower-than-average consumer preferences. These lower consumer discount rates imply individuals place an incredible value on future potential benefits and will pay higher upfront costs to achieve greater efficiency in the future, making it easier to justify regulation.

The agency generally assumes consumers have access to less expensive funding, e.g. cash, checking, and savings accounts, to purchase expensive new energy efficient products like furnaces and air conditioners. As the agency argues, “The approach assumes that in the long term, consumers are likely to draw from or add to their collection of debt and asset holdings approximately in proportion to their current holdings when future expenditures are required.”

Strangely, and perhaps not too surprisingly, the agency has never corroborated this claim with evidence that consumers draw on financing in proportion to their holdings. For instance, a new HVAC unit can cost close to $8,000, meaning for most middle-income consumers and some high-income households, these purchases will be financed by debt since the average household only has about $3,000 in liquid assets through cash and checking deposits.

For many middle-and-low income consumers, the actual discount rate DOE assumes is far lower than the reality (as will be discussed below). For many rulemakings, the agency assumes low-to-middle income consumers have discount rates as low as four percent. As debt is the primary instrument to finance many expensive products, like furnaces and air conditioners, the actual consumer rates likely approach ten percent and higher. Indeed, there is a surplus of evidence showing consumer discount rates exceeding 20 percent for low-income households.

Finally, there is always the possibility that the discount rates DOE employs bear no relation to actual consumer preferences in the real world. There is a growing body of evidence that, for many low-to-middle-income consumers, the agency employs drastically lower discount rates, making it easier to regulate. In “Rational Discounting for Regulatory Analysis,” Professor Kip Viscusi, arguably one of the foremost scholars on benefit-cost analysis, conducted a survey of actual consumer discount rates. He and his coauthor were interested in determining time preferences for how individuals valued delayed benefits. In contrast to the standard three and seven percent rate, Viscusi found preferences ranging from 12.7 percent to 14.3 percent. He concluded, “People have a strong preference for policies that generate immediate benefits.”[i]

As noted above, actual discount rates can vary, but are still routinely higher than those employed by DOE. Although the agency takes liberty with SCC discount rates, it is equally happy to ignore the existing literature on the high discount preferences for consumers. Because “private” savings comprise 80 percent of DOE’s recent regulatory benefits, the agency is almost completely reliant on those figures. If higher, or actual consumer discount rates are employed, the rules with net benefits quickly turn into net costs. As Sofie Miller of the GW Regulatory Studies Center found, DOE’s furnace fan rule reported net benefits at a three and seven percent discount rate. However, using discount rates from the available literature, which represents a median-income consumer, this rule quickly turns to net costs of more than $1 billion.

Why does all of this matter? The idea of discount rates might seem like an esoteric mathematical concept, but this important input drives much of the regulatory state. Tweaking discount rates or ignoring actual consumer rates and preferences can make or break the case for a particular rule. Discount rates are a crucial component in the regulatory world and minor tweaks can justify a regulation or turn it into an economic canard. Just take the example of the SCC at three and five percent. At three percent, recent DOE regulations generate $5.6 billion in benefits; at five percent, this figure drops to $1.5 billion. Furthermore, constantly deflating actual consumer preferences and discount rates can complete the final piece of the regulatory picture.

DOE often wants to have it both ways: survey manufacturers for their preferences and rely on the marginal discount rates, but rely on lower average rates for consumers. These tiny regulatory levers, nudged in the one direction or another, can spell success or failure for the future of a rule. For DOE, given its $173 billion imposition since 2009, the nudge often comes down against the consumer and manufacturer.

Harm to Consumers

As AAF has catalogued in the past, and repeatedly, regulators routinely play with data in a way that justifies more regulation and ultimately leads to higher prices for consumers. This is a reality that even DOE acknowledges. In our previous work, AAF found that the ten largest agency rulemakings could lead to $2,380 in higher prices for consumers. A hypothetical consumer who purchases a refrigerator, furnace fan, and water heater could face a higher cumulative purchase price of $620 because of new rules.

Regulators might acknowledge these higher prices, but counter that consumers who keep these more efficient products during the payback period will reap greater energy savings, and on net, these savings will exceed the higher upfront purchase price. However, that assumes a homogenous consumer, all of whom have the same preferences, the same discount rate, and will keep the product long enough to realize savings assumed by regulators. Reality is far different than the friendly confines of federal offices.

Buried within DOE analyses are predictions about the percentage of consumers who will not benefit from the new standards. In other words, it’s a calculation of the number of people who will be forced to bear higher prices, but receive no reward, immediate or long-term, from new regulation. The range of percentages varies from a low of zero, assuming all consumers will benefit, to as high as 58 percent. The American Action Forum found, for rules promulgated from 2007 to present, an average of 12.6 percent of consumers would not benefit from new energy efficiency standards. In other words, 1 in 8 consumers would pay higher prices, but would not be able to recoup that “regulatory tax” later through lower operating costs.

In one rulemaking for residential furnace fans, DOE outlines its life-cycle costs and payback periods for various product classes, as it does for most regulations. In that analysis, it projects the percentage of consumers expected to experience no impact, a net cost, and a net benefit. Once that final tally is done for costs and benefits, DOE and other agencies routinely tout the higher benefit totals. For the furnace fan measure, DOE notes annual costs at $358 million, compared to benefits of $1.7 billion. However, 80 percent of the benefits derive from “private” consumer savings, not environmental benefits, and even the agency acknowledges many consumers will experience net costs. For the furnace fan rule, this figures varies from a low of five percent to as high as 30 percent. On average, roughly, one-in-five consumers who purchase a new furnace fan will bear net costs because of the regulatory action. In the agency’s 2011 rule for clothes dryers, it predicted roughly one-in-seven consumers would experience net costs because of the rulemaking. In some product segments, roughly one-in-three would bear more costs than benefits.

Regardless of the exact number from each product, below the topline numbers highlighted in press releases is the reality that millions of Americans will head to the store and purchase a new product that will result in a substantial regulatory tax. Frequently, consumers have no knowledge they’ll end up on the wrong side of DOE’s math and assumptions. Given DOE routinely estimates 1 in 8 consumers will end up losing out on new efficiency standards, perhaps the agency should make this math clearer for the public or else pursue regulatory alternatives.

Impact on Manufacturers

The manufacturing sector is also undoubtedly affected by regulation because of conversion and other costs to meet changing regulation standards. This increase in costs can potentially lead to a decrease in employment and establishments as a result of closures or outsourcing. Indeed, as DOE has routinely admitted in the past, “[T]he range indicates the total number of U.S. production workers in the industry who could lose their jobs if all existing production were moved outside of the United States.” Beyond the predicted declines in employment, the actual decline of employment among a variety of manufacturing industries due to regulation has been noted in a recent AAF study.

Take, for example, the HVAC manufacturing industry in particular. In 2002, there was a major rule that resulted in a 30 percent increase in minimum energy efficiency standards for air conditioning units. There were also additional regulations following the 2002 ruling that affected the HVAC industry, including a 2010 regulation on water heaters, and 2011 regulations on commercial refrigeration products and walk-in coolers and freezers, and yet another rule for air conditioning units and heat pumps, among others. For the sake of this study, all of these regulations will be lumped up into one regulation period consisting of the years after 2002. This will provide a rough estimate of the general effects of these regulations in that period.

Methodology

To measure the impact of regulation on HVAC manufacturing employment and establishments, we use two separate regression models that estimate the relationship between employment or establishments and the regulation period on the national level[ii] for the years 1998-2013. The employment and establishment numbers are broken down by employment size of a firm[iii] (1-4, 5-9, 10-19, 20-49, 50-99, 100-249, 250-499, 500-999, 1,000) and can be found in the County Business Patterns. The regulation aspect of the model is a binary variable that is 0 for the years before the regulation period, 1998-2002, and 1 for the regulation period, 2003-2013. After running the regression, we can determine the percent of jobs or establishments that were lost for each firm size by combining the coefficients of the regulation period’s binary variable with the firm size and regulation period’s interaction variable. With this number, we can calculate the loss of jobs and establishments for the year 2013.

We also include a number of controls in this model that may influence employment or establishments in the manufacturing industry. These controls include the HVAC manufacturers’ new orders of durable goods from the M3 survey and the HVAC manufacturers’ value of production from the Industry Productivity program to control for any demand changes for HVAC products. To control for economic changes including the Great Recession, we use the employment gains and losses by firm size across all industries from the Business Employment Dynamics.

Results

Starting with employment, we estimate that there would be 19,200 more jobs, a 15.1 percent increase, in 2013 if the regulations were never enacted. These estimates are especially significant for the firm with more than 100 employees as shown in the table below. Firms with more than 1,000 employees would benefit the most from no regulations in that time period where 9,500 more jobs, a 52.1 percent increase, would exist in 2013. For firms with more than 100 employees, there would be 20,000 more jobs. When considering that there are only 127,000 employees in HVAC manufacturing in 2013, this hypothetical increase would vastly expand the employment for the HVAC manufacturing industry.

|

Regulations Impact on Employment |

||

| Firm Size | Percent Change with Regulations | 2013 Impact |

| 10-19 | 11.1%*** | 400 |

| 20-49 | 0.5% | 0 |

| 50-99 | 2.9% | 400 |

| 100-249 | -10.5%** | -3,300 |

| 250-499 | -6.7%* | -2,100 |

| 500-999 | -30.4%*** | -5,100 |

| 1,000+ | -52.1%*** | -9,500 |

| Total | -19,200 | |

| ***Significant at the 1% Level **Significant at the 5% Level *Significant at the 10% level |

||

When looking at establishments, we estimate that an additional eight establishments existed in 2013, less than a 1 percent increase, because the regulations were in effect. The positive correlation between establishments and regulation is only exhibited in firms with less than 100 employees, but only the firms with 10 to 19 employees had significant results. However, the firms with 10 to 19 employees had the largest difference where 25 additional establishments were added due to regulation. However, the establishments with more than 100 employees had both a negative and significant correlation due to regulation. For the firms with more than 100 employees, there would be an additional 41 establishments, a 12.5 percent difference, if the regulations were never enacted.

|

Regulations Impact on Establishments |

||

| Firm Size | Percent Change with Regulations | 2013 Impact |

| 1-4 | 2.4% | 10 |

| 5-9 | 2.5% | 7 |

| 10-19 | 9.9%*** | 25 |

| 20-49 | 1.6% | 5 |

| 50-99 | 1.1% | 2 |

| 100-249 | -10.1%*** | -20 |

| 250-499 | -8.3%** | -7 |

| 500-999 | -35.4%*** | -8 |

| 1000+ | -42.6%*** | -6 |

| Total | 8 | |

| ***Significant at the 1% Level **Significant at the 5% Level |

||

Conclusion

Discount rates might appear to be an esoteric concept, but these little-known rates have profound implications for consumers and manufacturers across the country. As research has shown, using rates that reflect consumer preferences can take a regulation with net benefits and quickly turn it into one with net costs for society. These discount rates have helped to justify regulations that increased prices on consumers and helped to drive down employment in the manufacturing sector. In the future, discount rates should reflect actual consumer preferences.

Despite lofty projections of energy savings, cost savings, and environmental benefits that often bear little relation to reality, the main effect of these rulemakings is to force consumers to purchase products that are already available to them, but that they have declined to choose to purchase on their own. These rules represent, in reality, a hidden tax on consumers – taxes that result in higher up-front prices for products and lower overall manufacturing employment in the United States.

[i] A 2002 paper in the Journal of Economic Literature underscores that certain low discount rates for consumers might not be warranted. As Viscusi and others have noted, many consumers tend to have high discount rates for future benefits, that is they value present consumption, not wanting to wait more than a decade for a stream of energy efficiency benefits. The 2002 paper conducted a comprehensive literature review of time discounting and consumer preferences. Here is just a sampling of the surveyed discount rates: 7 percent to 345 percent, 23 percent, 10 percent to 12 percent, 26 percent to 69 percent, 13 percent to 31 percent, and 28 percent to 147 percent.

[ii] The study was done at the national level due to missing data at the state level. As a result of this, the results have a wider margin of error.

[iii] Due to missing values, only the establishments are listed for firm sizes 1-4 and 5-9.