Research

October 29, 2021

Creating a Health Coverage Cliff: Implications of Changes to Build Back Better’s Insurance Provision

Executive Summary

- The Build Back Better “Framework”—released by the White House on October 28—would extend the American Rescue Plan Act of 2021’s enhanced premium tax credits (PTCs) for individual market coverage under the Affordable Care Act, while also providing subsidized individual market insurance to the Medicaid coverage gap population in non-expansion states, both through 2025.

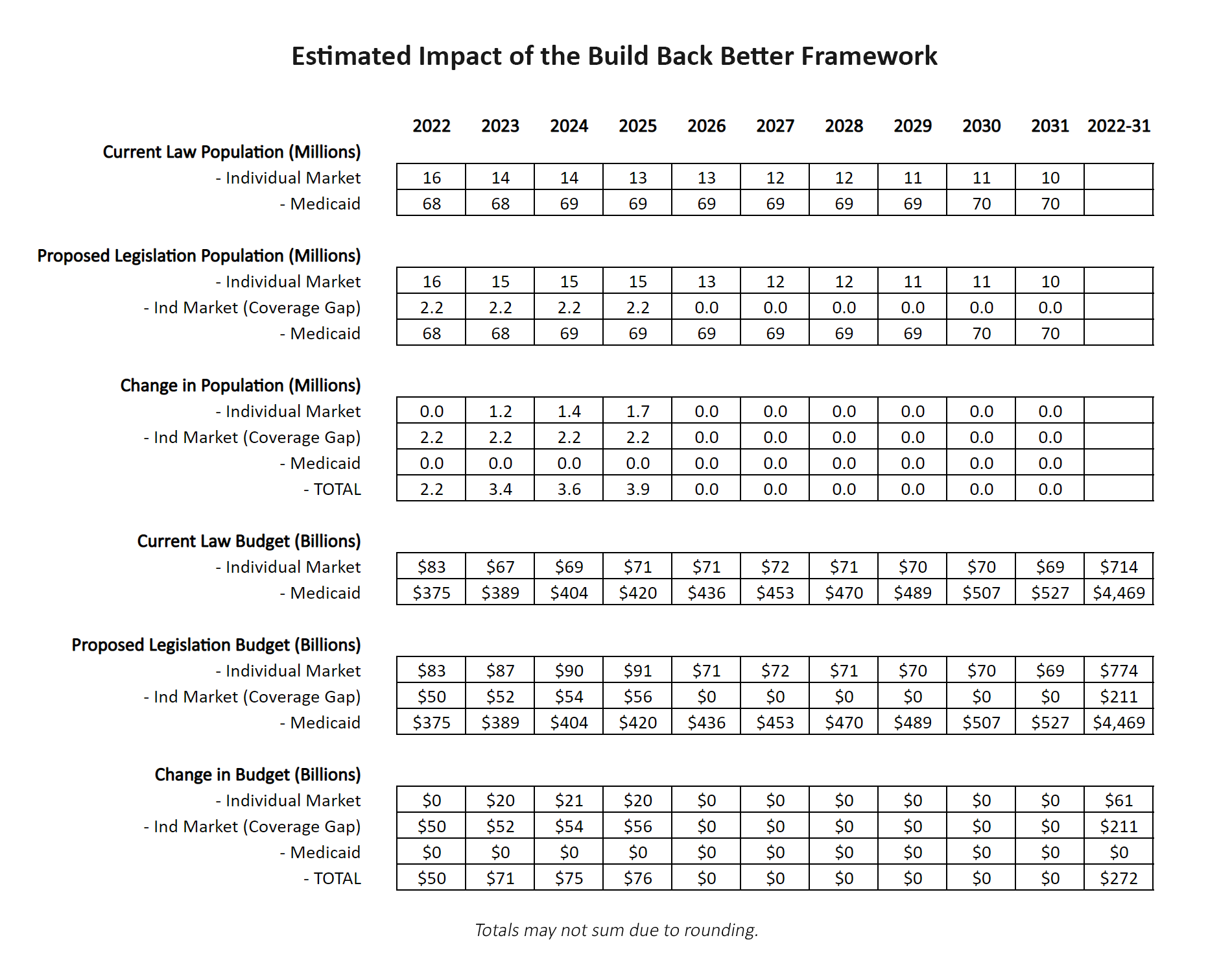

- The American Action Forum’s Center for Health and Economy (H&E) finds that extending the enhanced PTCs through 2025 would increase the number of people enrolled in subsidized individual market coverage by 1.2 million in 2023, 1.4 million in 2024, and 1.7 million in 2025, at a cost of $20-$21 billion annually relative to current law, before reverting to the baseline in 2026.

- H&E further finds that covering the 2.2 million individuals in the Medicaid coverage gap through subsidized individual market coverage from 2022-2025 would cost $211 billion relative to current law.

- In total, H&E finds that the provisions would increase the number of insured individuals by 2.2 million in 2022, increasing to 3.9 million in 2025 relative to current law, and would cost $272 billion; coverage and spending numbers would, however, revert to current law in 2026.

Background

Earlier drafts of the Build Back Better (BBB) proposal would have permanently extended the enhanced premium tax credits (PTCs), limited the subsidized individual market insurance for the coverage gap population to three years rather than four, and established a new, fully federal Medicaid program to cover that population starting in 2025. The American Action Forum’s Center for Health and Economy (H&E) previously modeled those provisions; that modeling, along with detailed explanations of the provisions modeled, is available here.

Changes from Previous Modeling

H&E’s updated analysis deviates from the previous work in that the enhanced PTCs are only available through 2025, rather than the entire budget window, the provision of individual market coverage for the Medicaid coverage gap population is extended an additional year through 2025, and no provision for Medicaid-like coverage for the coverage gap population is included after 2025. Additionally, the impact of the Biden Administration’s year-round open enrollment for those under 150 percent of the federal poverty level (described in the previous analysis) terminates at the end of 2025 along with the enhanced PTCs.

Cost and Coverage Impact

As shown in Table 1, H&E finds that extending the enhanced PTCs through 2025 would increase the number of people enrolled in subsidized individual market coverage by 1.2 million in 2023, 1.4 million in 2024, and 1.7 million in 2025, at a cost of $20-$21 billion annually relative to current law, before reverting to the baseline in 2026.

Additionally, H&E finds that covering the 2.2 million individuals in the Medicaid coverage gap through subsidized individual market coverage from 2022-2025 would cost $211 billion relative to current law.

In total, the BBB “framework” released by the White House on October 28, 2021, would increase the number of insured individuals by 2.2 million in 2022, increasing to 3.9 million in 2025 relative to current law, and would cost $272 billion.

Conclusion

Temporarily extending the American Rescue Plan Act’s enhanced PTCs through 2025 and providing temporary subsidized individual market coverage to the 2.2 million people in the Medicaid coverage gap below 100 percent of the federal poverty level through 2025 as proposed in the most recent iteration of BBB would increase the number of insured individuals by 2.2 million in 2022, increasing to 3.9 million in 2025 relative to current law, and would cost $272 billion.

Significantly, these provisions would also create a coverage cliff, as H&E modeling shows that both coverage and spending revert to current law in 2026. This would leave the same populations the proposals authors seek to provide assistance to back where they were in 2020 come 2026. It would be left to the 119th Congress and whoever occupies the White House after the 2024 presidential election to address this new coverage cliff.