Research

September 1, 2021

Assessing State-Level Adult-Use Cannabis Taxation

Executive Summary

- Eighteen states and the District of Colombia have “decriminalized” the recreational use of cannabis products and begun establishing regulatory structures for allowing retail sales to adults.

- These 18 jurisdictions have imposed tax policies on cannabis sales that vary considerably but nevertheless reflect several common features, including taxation by sale price, weight, or to a lesser degree, potency.

- The average, state-level effective tax on cannabis products is 18.79 percent.

- Compared to alcohol, cannabis is much more heavily taxed, but it is more lightly taxed than cigarettes.

Introduction

The policy landscape with respect to the use and distribution of cannabis (marijuana) is evolving rapidly. Where the cannabis “legalization” was once somewhat of a fringe policy area, it is now the domain of state tax authorities, eager for new sources of revenue. Yet the legal status of cannabis in the United States remains complicated. Notwithstanding the majority of states that have authorized medical cannabis use and the 18 states that have “legalized” recreational cannabis use for adults, both uses – medical and recreational – remain illegal under federal law. State law cannot supplant federal statutes, so even though these state-level markets are often described as having been “legalized,” the descriptor remains a term of art.

Nevertheless, the pace of establishing recreational cannabis markets in states has only accelerated since Colorado and Washington enacted taxable markets beginning in 2012. State tax policies have evolved accordingly. While each state has established unique tax policies, the tax structures imposed by states on recreational cannabis do reflect a somewhat limited range of approaches with respect to the applicable tax base and rates. The effective tax imposed by states on recreational cannabis also tends to reflect a moderate degree of variation. Compared to other “sin” taxes, cannabis is much more heavily taxed than alcohol, but is less heavily taxed than cigarettes.

State Taxation of Cannabis

At present, 18 states and the District of Colombia have “decriminalized” the recreational use of cannabis products and begun establishing regulatory structures for allowing retail sales to adults. As of July 2021, regulated and taxable markets are only operating in 11 of these states. The remaining 7 jurisdictions are either in the process of establishing regulated retail markets or are otherwise delayed. South Dakota, which is not included in these tabulations, passed a ballot initiative in 2020 providing for adult, recreational cannabis use, but that measure is facing legal challenges in the state courts. Federal restrictions have precluded the District of Columbia from establishing a local regulated market.

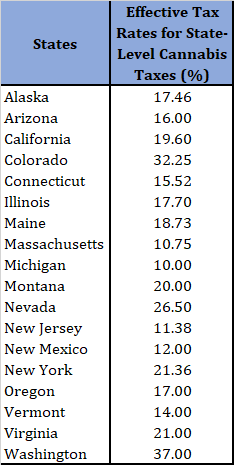

Table 1: State Recreational Cannabis Markets

Each of these 18 jurisdictions have unique approaches to the reform of the criminal and civil penalties associated with cannabis possession, use, and distribution – in other words, the establishment of regulatory institutions for the administration of these markets. The diversity of policy approaches to state-level cannabis policies also applies to taxation.[1] The 18 states that have enacted policies establishing taxable recreational cannabis markets have created 18 unique tax environments for recreational cannabis sales.

Table 2: State Cannabis Tax Policies

The design of these levies varies considerably with respect to the applicable rates and bases. In general, these tax policies can be grouped as weight-based, potency-based, and price-based. Nine states simply apply excise taxes on the sales price of cannabis products, while others apply tax at several layers of the supply chain. Some states, such as Colorado and Nevada, apply excise taxes at the wholesale and retail levels. In some states, such as California, Colorado, and Nevada, the state bases the wholesale tax on price levels established by state regulatory authorities. Other states apply hybrid approaches that tax cannabis differently throughout the supply chain, such as California, which applies a fixed, weight-based tax on cultivators combined with a final sales tax. Three states – Connecticut, New York, and Illinois – have enacted cannabis levies that are, at least in part, based on the THC content of the underlying product. THC is the key psychoactive component of cannabis. This approach would be akin to taxing the ethanol content of alcoholic beverages or nicotine content of tobacco products.

Notwithstanding the diversity of tax structures applied by states to the sale of cannabis products, the rates largely cluster in the teens. The average, state-level effective tax on cannabis products is 18.79 percent.

Table 3: Effective Tax Rates for State-Level Cannabis Taxes[2]

Two conspicuous outliers, Colorado and Washington, tax cannabis sales at effective rates in excess of 30 percent. It is likely no coincidence that these were the first two states in the United States to enact taxable, recreational cannabis markets. Follow-on states have subsequently imposed lower effective taxes.

Sin Taxes: A Comparison of Effective Rates

The taxation of beer, wine, liquor, and tobacco is the most analogous to the taxation of cannabis. Alcohol and tobacco are explicitly exempted from the Controlled Substances Act because their recreational consumption would otherwise render them regulated under the prongs of the Act. They are very much America’s approved vices. The relative tolerance of these vices, however, is borne out in how they are taxed.

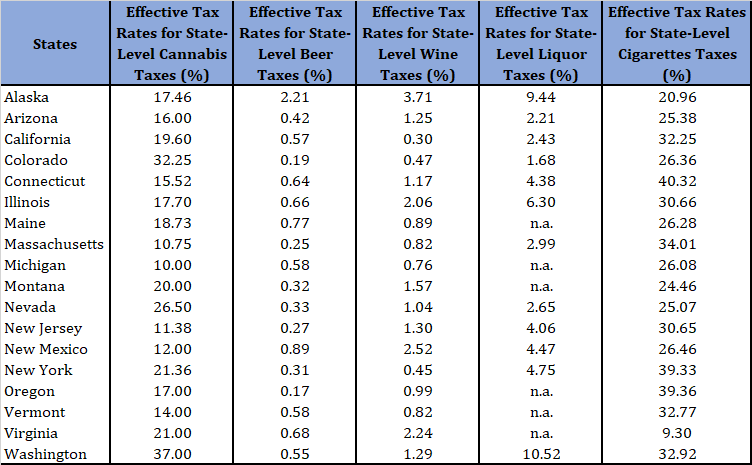

Table 4: Effective Tax Rates for Cannabis, Beer, Wine, Liquor, and Cigarettes[3]

At the state-level, tobacco is taxed at substantially higher effective rates than alcohol and cannabis. On average, the effective state-level tax rate on cigarettes is 10.24 percentage points higher than cannabis. Cannabis, however, is taxed at significantly higher effective rates than beer, wine, and liquor, on average. In only one instance, Washington state’s effective tax on hard liquor, is an effective tax rate on liquor higher than the lowest effective rate on cannabis (that applied in the state of Michigan).

Excise taxes, unlike general consumption or income taxes, tend to have relatively narrow bases and are often characterized by higher rates, as cannabis and cigarette tax rates make clear. These tax policy design choices tend to reflect tension between policies postured to discourage the taxable activity, while still maintaining a viable revenue source for the taxing jurisdiction. In general, the higher the tax, the more the source of the revenue is discouraged. With respect to cannabis, which reflects an evolving and complicated legal status, another key parameter for tax policy design is the degree to which tax policies may push activity into unregulated markets, where the product is likely still being sold to varying degrees.[4]

Conclusion

State-level taxation of adult-use cannabis is a rapidly evolving policy landscape. In 2012, two states adopted policies that “legalized” adult-use cannabis, and just 9 years later, there are 18 states with laws on the books establishing regulated, taxable, adult-use cannabis markets. Comparing taxes on adult-use cannabis to other “vices” is instructive on how state policy is postured towards cannabis. At present, the taxation of cannabis is more akin to heavily taxed cigarettes. It is unclear if the direction of state-level cannabis tax policy will increasingly reflect that of tobacco, which is heavily taxed and has declining use, or alcohol, for which the tax climate is somewhat more accommodating.

Appendix: State Recreational Cannabis Tax Policies

States with Active Taxable Cannabis Markets

Alaska

In November 2014, voters in Alaska approved Ballot Measure 2, which established a regulated and taxable cannabis market. As of 2019, the state of Alaska imposes a tax on wholesale transfers of cannabis from cultivators or cannabis product manufacturers. The state applies a $50 per ounce tax on mature cannabis buds or “flower.” Immature or abnormal buds are taxed at $25 per ounce. Clones, a cutting from a cannabis plant that could be grown, are taxed at $1 per clone.[5]

Arizona

In November of 2020, Arizona voters approved proposition 207, which provides for a regulated, taxable, recreational cannabis market in the state of Arizona. The state requires cannabis retailers to be licensed by the Department of Health and must pay two levels of tax.[6] First, retailers must pay the transaction privilege tax (TPT), which operates like a state and local sales tax. The TPT for cannabis sales mirrors that applied to other retail sales.[7] The state also applies a 16 percent Marijuana Excise Tax (MET) based on purchase price.

California

California imposes two layers of tax specific to the sale of cannabis. The state imposes a tax on cannabis cultivators of $9.25 per ounce of flower, $2.75 per ounce for dried leaves, and $1.29 per ounce for whole cannabis plants. The state also imposes a 15 percent excise on sales. The state, however, imposes this tax based on a mark-up rate set by the state twice yearly. The excise tax is collected by distributors to retail outlet and remitted to the state.[8] The state and local governments also apply their general sales tax to cannabis sales.

Colorado

In 2012, Coloradans voted to amend the state constitution to allow for a regulated, adult-use cannabis market, one of the first two U.S. states to “legalize” recreational cannabis sales. As of 2021, the state levies two layers of tax specific to the sale and distribution of Cannabis. First, Colorado imposes a 15 percent excise tax on the first sale or transfer from a retail cultivation facility to a retail cannabis store or retail product manufacturing facility.[9] The tax is applied to an average market rate set by the state.[10] The state also imposes a 15 percent tax on the final sales price of cannabis products to consumers, a somewhat higher rate than the 2.9 percent state sales tax rate.[11]

Illinois

June of 2019, Illinois enacted a law to provide for regulated, taxable, cannabis market. The state imposes a 7 percent tax on the gross receipts from the first sale of adult-use cannabis from cultivators. The state also imposes the Cannabis Purchaser Excise Tax, which is a tax imposed on retail cannabis products. The tax depends on the potency of the cannabis products and is based on the THC content – the primary psychoactive ingredient – in the cannabis product. For cannabis with THC levels of 35 percent or less, a 10 percent sales tax applies, while a 25 percent rate applies to cannabis with THC levels in excess of 35 percent. For infused products, a 20 percent tax is applied.[12] The state also applies its 6.25 percent sales tax.[13]

Maine

In 2016, Maine voters passed a ballot initiative to establish a regulated, taxable, adult-use market in the state. As of 2021, the state levies an excise tax on cultivators based on the weight and type of cannabis sold to retailers. The state levies a tax of $335 per pound, $94 per pound, $1.50 per pound, and 30 cents per pound for flower and whole plants, cannabis trim, immature plants, and seeds, respectively.[14] Additionally, the state levies a 10 percent retail excise tax based on the final purchase price of cannabis products sold.[15] The state’s 5.5 percent sales tax also applies to sales of adult-use cannabis products.

Massachusetts

In 2016, Massachusetts voters passed a ballot initiative to establish a regulated, taxable, adult-use market in the state. As of 2021, the state imposes a 10.75 percent excise tax based on the final purchase price of the cannabis product. The state also levies its 6.25 percent general sales tax on marijuana purchases.[16]

Michigan

In 2018, Michigan voters passed a ballot initiative that would provide for a regulated, taxable, adult-use market in the state. As of 2021, the state imposes a 10 percent excise tax on the retail sale price of cannabis products. The state also imposes the 6 percent sales tax on retail cannabis sales.[17]

Nevada

In 2016, Nevada voters passed a ballot initiative to establish a regulated, taxable, adult-use market in the state. As of 2021, the state imposes a 15 percent excise tax on wholesalers based on the fair market value of the relevant cannabis product as determined by the state. The state of Nevada further imposes a 10 percent retail excise tax based on the final sales price of a cannabis product. The regular 4.6 percent statewide sales tax also applies to cannabis sales.[18]

Oregon

In 2014, voters in Oregon passed a ballot initiative providing for a regulated and taxable adult-use cannabis market. As of 2021, retailers, which must be licensed by the Oregon Liquor Control Commission (OLCC), must apply a retail sales tax of 17 percent for all recreational marijuana sold.[19]

Washington

In 2012, voters in the state of Washington passed a ballot initiative providing for the establishment of a regulated, taxable, adult-use cannabis market. Cannabis retailers must collect a 37 percent excise tax on the final purchase price of any sales. Additionally, recreational cannabis retailers must also remit state business and occupation taxes (0.471 percent) and the state sales tax of 6.5 percent, in addition to any local levies.[20]

States that have Enacted Regulated Cannabis Market Policies but are Not Yet Active

Connecticut

In July of 2021, the state of Connecticut enacted Senate Bill 1201, which establishes a regulated, taxable, adult-use retail cannabis market in the state.[21] The law imposes several layers of tax on the sale of recreational cannabis. The state will impose a potency-based excise tax of 0.625 cents per milligram of THC for cannabis flower and 0.9 cents per milligram of THC for all other product types. Additionally, retailers must also collect the 6.35 percent sales tax and a 3 percent municipal sales tax on cannabis sales. Sales are anticipated to begin by the end of 2022. [22]

Montana

In 2020, Montana voters approved a ballot initiative to provide for a regulated, taxable, adult-use cannabis market. The state subsequently enacted legislation to establish such a market, and, when sales begin in 2022, to impose a 20 percent excise tax on the final sales price of cannabis products sold by retailers.[23]

New Jersey

In 2020, voters in New Jersey approved a ballot initiative providing for the establishment of a regulated, recreational cannabis market in the state. The governor signed enabling legislation that, among other provisions, established a Cannabis Regulatory Commission. The Commission is authorized to impose an excise tax on cultivators that varies with the average retail price of cannabis. If the average price is $350 per ounce or more, the tax may be no more than $10 per ounce. If the average price is between $250 and $350, the tax may be no more than $30 per ounce. If the price is less than $250, but more than $200, the tax may be up to $40 per ounce. If the price is less than $200 per ounce, the Commission may impose a tax of up to $60 per ounce.[24] Cannabis purchases will be subject to the state general sales tax 6.625 percent. Localities will also have the option to impose an additional 2 percent sales tax on purchases. As of July 2021, legal sales and tax collection had not yet begun.

New Mexico

In 2021, the state legislature passed and the governor signed legislation establishing a regulated, adult-use cannabis market in the state of New Mexico. Among other provisions, the legislation establishes an excise tax of 12 percent on the sales price of cannabis products before 2025, thereafter increasing by one percentage point per year until reaching 18 percent in 2030.[25] The state also imposes its normal 5.125 percent gross receipts tax, as do sub-state jurisdictions, such that retailers would face additional tax of 5.5 percent to 8.1875 percent on receipts.[26]

New York

In March of 2021, the state legislature passed and the governor signed legislation establishing a regulated, adult use cannabis market in the state of New York. The new law establishes two layers of tax on cannabis sales. The state will levy a tax on wholesale transactions based on potency, at rates of 0.5 cents per milligram of THC for flower, 0.8 cents per milligram of THC for concentrates, and 3 cents per milligram of THC for edibles.[27] In addition, the law establishes a 9 percent state and 4 percent local excise tax based on the final retail sale. Retail sales have been estimated to begin in 18-24 months.[28]

Vermont

In October of 2020, the governor of Vermont allowed legislation passed in September to become law without his signature. The statute provides for the regulation and taxation of recreational cannabis use in the state of Vermont.[29] The new law establishes a 14 percent cannabis excise tax on the final sale price of cannabis products, in addition to the existing 6 percent state general sales tax.[30] Sales are expected to begin in the fall of 2022.

Virginia

In April of 2021, the Virginia state legislature enacted legislation providing for a regulated, taxable adult-use cannabis market in the state.[31] Under the new law, the state will impose a 21 percent excise tax on the final retail sale of cannabis products. The law also allows local jurisdictions to levy an additional 3 percent tax on such sales.[32] Legal sales are not authorized until 2024.

[1] See Appendix for summaries of state-level cannabis tax policies.

[2] Based on either dispensary (if available) or street price for a high quality ounce of flower, as reported in http://budzu.com/, a price index cited by NPR

[3] See https://www.taxpolicycenter.org/statistics/excise for tax rates; effective tax rates based on beer, wine, and liquor prices from https://www.cnbc.com/2019/02/01/how-much-a-case-of-beer-costs-in-every-us-state.html, https://apps.who.int/gho/data/node.main.A1117?lang=en; https://www.tobaccofreekids.org/assets/factsheets/0202.pdf

[4] See https://taxfoundation.org/recreational-marijuana-tax/ for key considerations in designing taxes for recreational cannabis.

[5] http://tax.alaska.gov/programs/programs/index.aspx?60000

[6] https://azdor.gov/news-events-notices/news/new-tpt-and-excise-tax-law-adult-use-marijuana

[7] https://azdor.gov/sites/default/files/media/TPT_RATETABLE_07012021.pdf

[8] https://www.cdtfa.ca.gov/industry/cannabis.htm#Overview

[9] https://tax.colorado.gov/marijuana-excise-tax

[10] https://tax.colorado.gov/average-market-rate

[11] https://tax.colorado.gov/marijuana-sales-tax

[12] https://www2.illinois.gov/rev/research/taxinformation/other/Pages/Cannabis-Taxes.aspx

[13] https://mytax.illinois.gov/_/

[14] http://legislature.maine.gov/statutes/36/title36sec4923.html

[15] https://www.maine.gov/revenue/taxes/sales-use-service-provider-tax/rates-due-dates

[16] https://www.mass.gov/service-details/massachusetts-tax-rates

[17] https://www.michigan.gov/taxes/0,4676,7-238-43519_97293_97308—,00.html

[18] https://tax.nv.gov/FAQs/Retail_Marijuana/

[19] https://www.oregon.gov/DOR/programs/businesses/Pages/marijuana.aspx

[20] https://dor.wa.gov/taxes-rates/taxes-due-marijuana

[21] https://cga.ct.gov/2021/ACT/PA/PDF/2021PA-00001-R00SB-01201SS1-PA.PDF

[22] https://portal.ct.gov/office-of-the-governor/news/press-releases/2021/06-2021/governor-lamont-signs-bill-legalizing-and-safely-regulating-adult-use-cannabis

[23] https://legiscan.com/MT/text/HB701/2021

[24] https://www.njleg.state.nj.us/2020/Bills/PL21/16_.PDF

[25] https://ccd.rld.state.nm.us/wp-content/uploads/2021/04/CH4-HB2-SPECIAL_SESSION-2021.pdf

[26] https://www.tax.newmexico.gov/businesses/tax-tables/

[27] https://legislation.nysenate.gov/pdf/bills/2021/s854a

[28] https://www.post-journal.com/news/page-one/2021/06/delays-loom-for-state-marijuana-program/

[29] https://governor.vermont.gov/press-release/governor-phil-scott-announces-action-s54-s119-and-others

[30] https://legislature.vermont.gov/Documents/2020/Docs/ACTS/ACT164/ACT164%20As%20Enacted.pdf

[31] https://lis.virginia.gov/cgi-bin/legp604.exe?212+sum+HB2312

[32] https://lis.virginia.gov/000/senatecannabisreenrolled.pdf