Research

January 4, 2017

United States: Net Exporter of Natural Gas, Why Strong Domestic Policy is Essential

Summary

- The United States is now a net exporter of natural gas, and a thriving natural gas market is a boon for the domestic economy.

- The U.S. is poised to be the number three exporter on the world market in the next 5 years

- The cumulative nominal value of natural gas exports between 2016 and 2040 will be near $1.63 trillion USD based on present value.

- Using todays spot price for natural gas, exports could bring in over $9.6 billion in earnings before interests and taxes each year.

The United States has officially become a net exporter of natural gas, edging out imports in the past month. According to the Wall Street Journal, the U.S. has been exporting, on average in November, 7.4 billion cubic feet of gas a day. In November alone, total U.S. consumption of natural gas rose by 6% according to the Energy Information Agency (EIA).

This week, the Henry Hub spot price for natural gas was $3.48 per million British thermal units (MMBtu), using that price, natural gas exports would amount to nearly $26 million in earnings before interests and taxes each day or just over $9.6 billion per year.

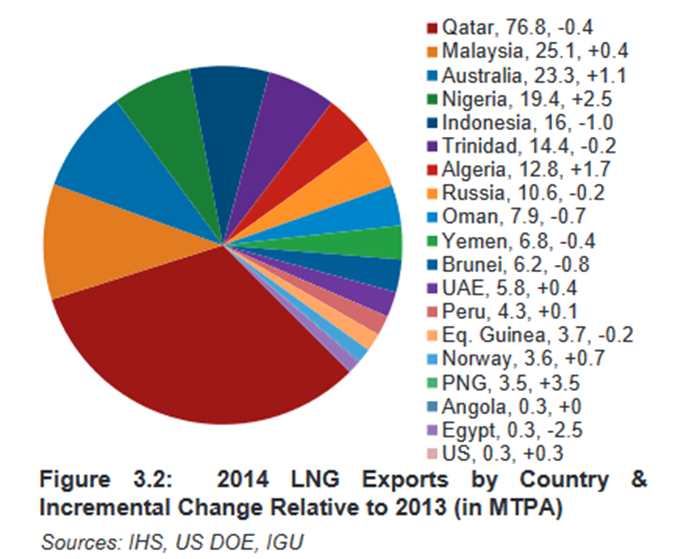

Since the U.S. started exporting natural gas in February 2016, the world market has seen a major shift as U.S. supply adds to the global mix. Before that the global supply was dominated by countries such as Qatar, Malaysia, Nigeria and Indonesia as well as Australia. For now, U.S. gas is readily available and comparatively cheaper to produce, and is expected to take over the number 3 spot in the next few years[i]. The image above represents 2014 liquefied Natural Gas (LNG) exports by country before the U.S. was a net exporter.

Today the U.S. is exporting natural gas via pipeline, vessel and truck to Canada, Mexico, Argentina, Barbados, Brazil, Chile, China, India, Japan, Portugal, Taiwan and the United Arab Emirates.

A May 2016 EIA report forecasted that much of the growth in natural gas exports will occur before 2030, as increased domestic natural gas supply satisfies new demand internationally with the development of LNG export capacity and growing demand for pipeline exports, and domestically, particularly in the industrial and electric power sectors.

Pro-Growth Policy Needed

Despite the U.S.’s new status as a net exporter, there are still many obstacles to overcome. According to a previous American Action Forum report (AAF), U.S. policy does not allow exportation of natural gas without approval from the Federal Energy Regulatory Commission (FERC) and the Department of Energy (DoE). The approval requirement stems from a law set in 1938 which requires these contracts to be deemed “in the public interest.” The challenges of an ambiguous requirement being evaluated by regulators is leading to an approval process taking up to 4 years instead of 8 weeks One such policy that was included in the failed Senate version of the Energy Policy Modernization Act (EPMA) is accelerating the LNG Export Application Process.

According to another report by the American Action Forum, all applications for the export of LNG must be approved by the Federal Energy Regulatory Commission (FERC). The EPMA could be a boon to LNG exporters by putting a time limit of 45 days on the decision process for FERC.

With regard to the impact of future trade decisions on LNG exports, it remains to be seen what the incoming administration’s approach to trade with Mexico, one of the key U.S. LNG importers, will be. For that reason, other markets are currently being explored for exporting, including countries that have Free Trade Agreements with the U.S. like Singapore and South Korea

Value of LNG Exports

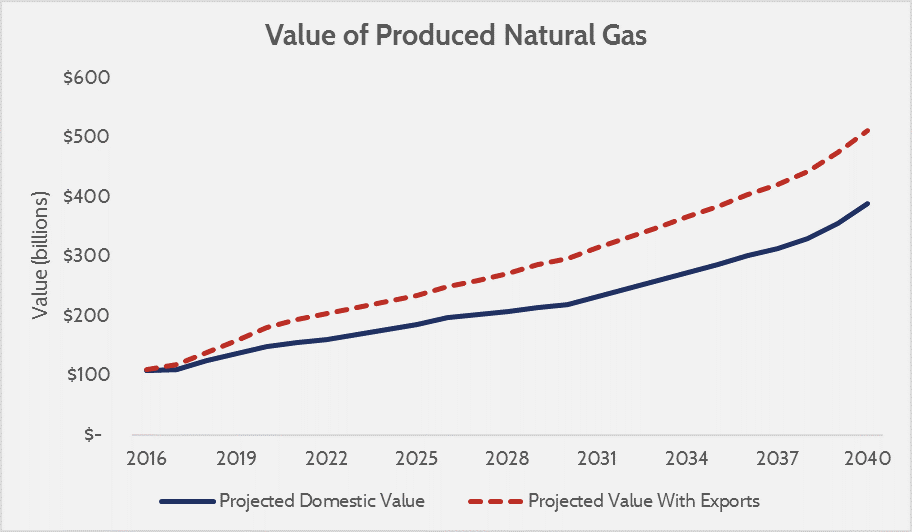

According to a previous AAF report, the cumulative nominal value of natural gas exports between 2016 and 2040 is expected to be $1.63 trillion USD. The graph below shows the estimated production value of domestically consumed natural gas versus the total value.

Source: EIA International Energy Outlook 2016, and American Action Forum estimates.

For North American natural gas producers, adding the capability to export liquefied natural gas grants access to the highest value export markets which makes the value of exported LNG higher[iii]. By 2020 annual federal government revenues from natural gas exports could reach $2.7 billion, $4 billion by 2026, and $8.3 billion by 2040. Cumulatively from 2016-2040 this would amount to $118 billion in federal revenue[iv]. AAF determined this value by applying EIA projections of natural gas production and consumption to projections of natural gas prices, as well as LNG price estimates we derived from applying a coefficient to oil prices (LNG prices are commonly indexed to oil).

AAF research estimates the annual trade value of natural gas exports will reach $31.8 billion annually by 2020, which would reduce our trade deficit by 7.3 percent. By 2026 the annual trade value would be $51.8 billion, and by 2040 it would be $123 billion.

Benefits of LNG Exports

Exporting LNG has presented itself as a major opportunity for the U.S. as it will increase domestic production and allow for new infrastructure development in the U.S. which will in turn create jobs. According to the Center for Liquefied Natural Gas (CLNG) , LNG exports will grow the U.S. manufacturing base, generate billions of dollars in additional royalties and new government revenues and expand the benefits of U.S. trade due in part by technological advancements that allow the U.S. to both meet consumer demand without impacting domestic prices. A report by CLNG cites Administration that every $1 billion dollars of exports could potentially create 6,000 domestic jobs. The report goes on to cite that the jobs created would not be limited to the energy sector but would span into the steel industry, turbine manufacturing, pipefitting and other industries[v].

According to a report by the Congressional Research Service, The Department of Energy (DOE’s) most recent price study concluded that greater LNG exports “result in higher levels of real gross domestic product (GDP), which more than offsets the adverse impact of somewhat higher energy prices.” The impacts that the offsets will have will be passed down to the consumer. The report goes on to say that increased production could result in increased revenue for local, state, and federal governments (through taxes, royalty payments, and economic development), more employment, an improved international trade balance, and reductions in natural gas flaring.

Conclusion

The domestic economic benefits that natural gas exports bring to the table are immense and need pragmatic polices to match. Streamlining permitting and creating a sustainable and hospitable place on the world market will be key for the next Congress and administration. The U.S. was stagnant on LNG trade for 60 years, so we have plenty of lost time to make up for.

[i] http://www.igu.org/sites/default/files/node-page-field_file/IGU-World%20LNG%20Report-2015%20Edition.pdf

[ii] https://www.americanactionforum.org/research/restricting-natural-gas-exports-harms-economy/

[iii] http://fuelmarketernews.com/why-export-markets-matter-to-north-american-natural-gas/

[iv] https://www.americanactionforum.org/research/restricting-natural-gas-exports-harms-economy/

[v] http://www.lngfacts.org/resources/Benefits_of_LNG_Exports.pdf