Insight

February 9, 2017

The U.S. Does Not Have $50 Trillion in Fossil Fuel Resources

Summary

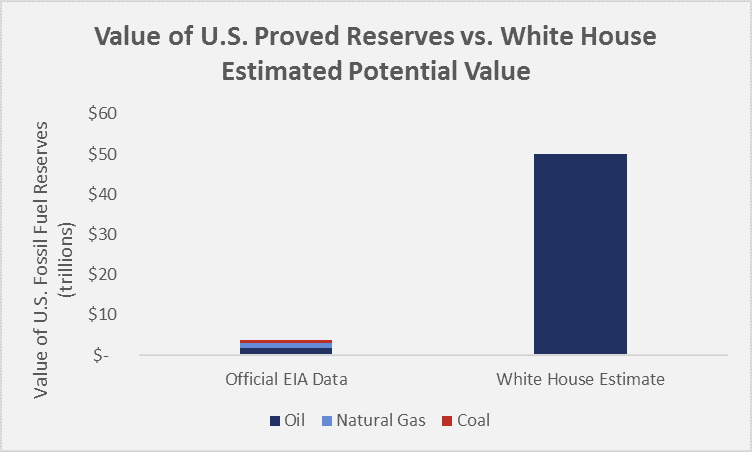

- The White House’s official energy policy aims to lift restrictions on fossil fuel extraction to capitalize on America’s untapped resources, which the White House estimates to have a potential value of $50 trillion.

- While the U.S. has significant fossil fuel assets ($3.82 trillion), they do not reach the White House’s estimated value of $50 trillion.

- Such estimates rely on outdated information, and do not differentiate technically recoverable resources from ones that are economically viable to extract.

Introduction

On January 20th, the White House revealed its America First energy plan on its website. The plan promised to curtail federal policies that obstruct the exploration of America’s “estimated $50 trillion in untapped shale, oil, and natural gas reserves.” While this is a sensible policy, the administration should temper its expectations, since $50 trillion is likely an overestimation of potential resource value.

Where does the $50 Trillion Estimate Come From?

On its website, the White House does not cite the source of its $50 trillion figure. It most likely originates from a book on the consequences of federal energy policy, Fueling Freedom: Ending the Mad War on Energy.

According to an analysis by Coleman, all of the oil and gas resources under federal lands and offshore that could be recovered with existing technologies amount to at least $1.5-trillion-worth of barrels over the next twenty years. At the current price of $35 a barrel, this would increase GDP by $50 trillion over two decades.[1]

The editing error of $1.5-trillion-worth of barrels is likely meant to refer to the 1.5 trillion barrels of estimated recoverable oil within the Green River shale formation, which is primarily within federal land. At $35 per barrel, the value comes out to around $50 trillion. W. Jackson Coleman, an energy lobbyist, gave testimony to the Senate Energy and Natural Resources Committee in 2011 that is cited in the book—but a $50 trillion estimate is not part of his written testimony.

Is $50 Trillion Accurate?

While $50 trillion in fossil fuel assets would be a massive windfall, it is unfortunately not accurate. Using the Energy Information Administration’s (EIA) official proved reserves (last updated December, 2016), the U.S. has about $3.82 trillion in proved fossil fuel resources (at current prices).

The reason for this extreme discrepancy is in the difference of using proved reserves as a metric versus technically recoverable. It is true that the USGS estimated there is over 1 trillion barrels of technically recoverable oil in the Green River shale formation (near equal to the world’s entire proved reserves), but none of it is known to be commercially recoverable. Different shale formations have varying physical properties, and the most commonly used methods of shale oil extraction are ineffective on Green River shale. The Green River shale formation is a bust, and its oil reserves are not proved because they are not economically viable to extract. Ergo, it is fallacious to assume that they will contribute any value at all to the economy.

Furthermore, the expectation that normal market conditions would apply if such quantities of oil were easily extracted is highly optimistic at best. To put this in perspective, the U.S. energy revolution, which disrupted global oil markets and caused prices to fall by over 70 percent from peak to valley, represented a doubling of U.S. oil production from 5 million barrels per day to almost 10 million barrels per day. That huge increase in production represented a bump of only about 5 percent in global oil production. Over a 20-year period, if 1.5 trillion barrels more oil was produced by the U.S., it would increase U.S. production by over 2,000 percent, and global oil production would triple. Under such a scenario, oil would no longer be measured in dollars, but in pennies. The idea that even under such a massive glut that such quantities of oil would be economical to extract, or could contribute $50 trillion to the economy, is unrealistic.

Most important of all, is understanding that federal regulation on fossil fuels is not so disruptive to energy production that it prevents tens of trillions of dollars in value. The American Action Forum has repeatedly written on the problems federal regulation pose to energy markets, and tabulates the expected economic impact.[2] While an easing of federal regulations on oil would almost certainly result in some economic benefit, there is no data to support the idea that it could ever cause fossil fuel assets to reach a value of $50 trillion.

The Policy Relevance of Such Estimates

When the White House submits its budget to Congress, there will be an estimate of revenues from federal lands, and tax income that will include the fossil fuel industry. At Fueling Freedom’s estimate, they anticipate $10-20 trillion in federal revenue over a 20-year period, or at least $500 billion per year.[3] Such an amount would essentially eliminate the federal deficit. It is imperative that the government does not attempt to use exaggerated or unreliable estimates of increased fossil fuel revenue, since this could diminish the incentive for the necessary fiscal discipline to balance the budget.

Conclusion

The U.S. has significant fossil fuel resources, but not in the quantities that are claimed by the White House. When crafting policy, the U.S. government should not rely on potential revenue estimates that are not supported by official data. When citing such large figures for potential value, the federal government should ensure that they are carefully sourced, to avoid disseminating misleading or conflicting information.

[1] Stephen Moore and Kathleen Hartnett White, Fueling Freedom: Exposing the Mad War on Energy, Regnery Publishing, (May, 2016). Ch. 11, page 176.

[2] https://www.americanactionforum.org/research/examining-the-economic-costs-of-the-administrations-coal-moratorium/; https://www.americanactionforum.org/research/administration-policy-closes-majority-of-public-lands-to-energy-exploration/; https://www.americanactionforum.org/research/outer-continental-shelf-oil-gas-leasing-review-economics/; et cetera.

[3] Fueling Freedom, Ch. 11, page 176.