Insight

October 22, 2024

The Expansion of BRICS

Executive Summary

- The BRICS organization – founded by Brazil, Russia, India, China, and South Africa – will be holding a summit from October 22–24, during which it is expected to announce the addition of new bloc members and provide further details on BRICS Pay, an alternative international payment system.

- BRICS Pay is a vital component of the bloc’s plan to become less reliant on the U.S. dollar (USD) and the to circumvent USD as a payment intermediary by replacing it with blockchain technology and an alternative to the SWIFT financial payment system.

- While BRICS Pay is currently not a viable global alternative to SWIFT, the expansion of BRICS to include nearly half of the global population and gross domestic product may lead to its wider use, diminishing the use of USD and with it the soft power of the United States.

Introduction

From October 22–24, the countries that make up BRICS (Brazil, Russia, India, China, South Africa), as well as several other countries with emerging economies, will be attending a summit in Kazan, Russia. This summit is expected to include the addition of more members into the informal bloc, sending the message that alternatives to Western institutions are gaining traction. One such alternative includes BRICS Pay, a global payment platform similar to a digital wallet that will allow countries within BRICS to circumvent the Society for Worldwide Interbank Financial Telecommunication (SWIFT) – which is the network for nearly all financial transactions – and therefore the use of the U.S. dollar (USD). Instead of relying upon USD, as is the case with 88 percent of foreign exchange transactions and 54 percent of export invoices, the nearly 4 billion people already in a BRICS country will have the option of utilizing blockchain technology, digital tokens, and local currencies to make purchases. This has the potential to make waves on both the consumer-spending and country-wide levels as these governments fine-tune alternate payment and financing systems.

The current SWIFT system relies heavily upon USD for international banking and finance, giving the United States a certain degree of power of the global financial system. This “dollar dominance” provides the United States a greater ability to issue sanctions against countries that upset U.S. interests, as well as allow it the option to outright remove a country’s access to SWIFT, effectively cutting that country off from the world economy and freezing its assets. This geopolitical move was used against Russia at the outset of its invasion of Ukraine and was a catalyst for countries diversifying away from USD toward gold as well as searching for systems that eliminate the inherent risk of being isolated from the global economy. BRICS Pay is not yet at the point where it can replace SWIFT, but its wider use (which is almost inevitable given the demographic and economic size of BRICS) will reduce the share of USD used in global transactions prove a challenge to the United States’ ability to hold outsized power over the international financial system.

What Is BRICS?

The BRICS countries are an informal group of emerging economies initially established by Brazil, Russia, India, China, and South Africa in 2009. Although each of these countries has unique and sometimes competing geopolitical interests, their common desire to counter the influence of Western-dominated institutions has united them under the BRICS umbrella. The bloc stands as an alternative to other international organizations such as the Group of Seven (G7), an informal forum of economically powerful democratic countries, as well as the World Bank and International Monetary Fund (IMF). The growing economic might of BRICS and its low priority for spreading democratic principles has attracted dozens of countries to join or apply for membership. Last year, BRICS (now BRICS+) saw its membership nearly double with the addition of Iran, Egypt, Ethiopia, and the United Arab Emirates. Argentina and Saudi Arabia were also invited to join in 2023; however, Argentina withdrew admission plans upon the election of Javier Milei, who sought closer relations with the United States. Saudi Arabia has accepted but not yet officially joined.

Figure 1: BRICS and BRICS+ Economic Indicators (Weighted by Population)

| Share of Global GDP 2024 | Share of Global Population 2024 | Median Age | Fertility Rate | GDP per Capita | Average Income 2022 | Average Democracy Index | |

| BRICS | 25.0% | 40.2% | 34 | 1.5 | $8,274 | $7,813 | 6.7 |

| BRICS+ | 26.4% | 44.5% | 33 | 1.7 | $7,901 | $7,476 | 3.0 |

Sources: Our World in Data, Worldometer, International Monetary Fund

Economically, the founding countries are not all on the same playing field, as real gross domestic product (GDP) per capita has grown 138 percent in China, 85 percent in India, 13 percent in Russia, 4 percent in Brazil, and declined by 5 percent in South Africa between 2008 and 2021. China is the unrivaled heavyweight within BRICS as it represented roughly 70 percent of the countries’ collective total GDP in 2022 and represents 64 percent of GDP within BRICS+ in 2024. As Figure 1 displays, the expansion of BRICS has had a noticeable impact on the blocs’ demographics and overall share of GDP but at the expense of its democracy score. When comparing BRICS to the G7, it becomes clear that the group of democratic countries is by far more economically powerful on a per-capita basis, but when adjusted for purchasing power parity (PPP), BRICS eclipses that competing bloc.

Figure 2: BRICS+ vs the G7 Economies in 2024

| Share of Global GDP | Share of Global GDP (PPP) | Share of Global Population | GDP per Capita | Average Income 2022 | Average Democracy Index | |

| BRICS+ | 26.4% | 35.5% | 44.5% | $7,901 | $7,476 | 3.0 |

| G7 | 44.7% | 29.7% | 9.6% | $61,735 | $59,805 | 8.3 |

| Difference | 69% | -16% | -78% | 681% | 700% | 177% |

Sources: Our World in Data, Worldometer, International Monetary Fund

BRICS Financial Institutions and BRICS Pay

BRICS nations have collaborated extensively on developing alternative financial payment networks to compete with SWIFT, which could incorporate the widely discussed BRICS common currency. Each member of BRICS, except for South Africa, has developed its own national payment systems with independent retail banking to avoid reliance on U.S. banks. In terms of cross-border payment cooperation, there exists the BRICS Interbank Cooperation Mechanism (BICM), the New International Payment System (NIPS), and BRICS Pay. Each of these financial payment systems is designed to limit the ability of Western nations to target assets or halt financial messaging in the case of sanctions.

BRICS Pay is a digital payment platform that would use NIPS to facilitate transactions between consumers of member countries. The intermediary currency could be the New Silk Road BRICS Token (NSRB), which is a blockchain technology. To use this, someone would open BRICS Pay to convert their local currency into NSRB to make a purchase. The NSRB would flow through NIPS processing centers and clearing banks to the deposit account of the recipient who can then convert it into their local currency. Currently, there are no defined conversion rates between NSRB and BRICS currencies, but one NSRB is supposed to equal $100 for the sake of stability. NSRB is currently worth somewhere between which does not necessarily bode well for currency stability.

Figure 3: The BRICS Financial System vs SWIFT

| Financial Communication System | Example Payment Platform | Primary Intermediary | Integrated Countries |

| SWIFT | Apple Wallet | USD | 200 |

| NIPS | BRICS Pay | Blockchain | Up to 9 |

Source: BRICS Business Council; Society for Worldwide Interbank Financial Telecommunication

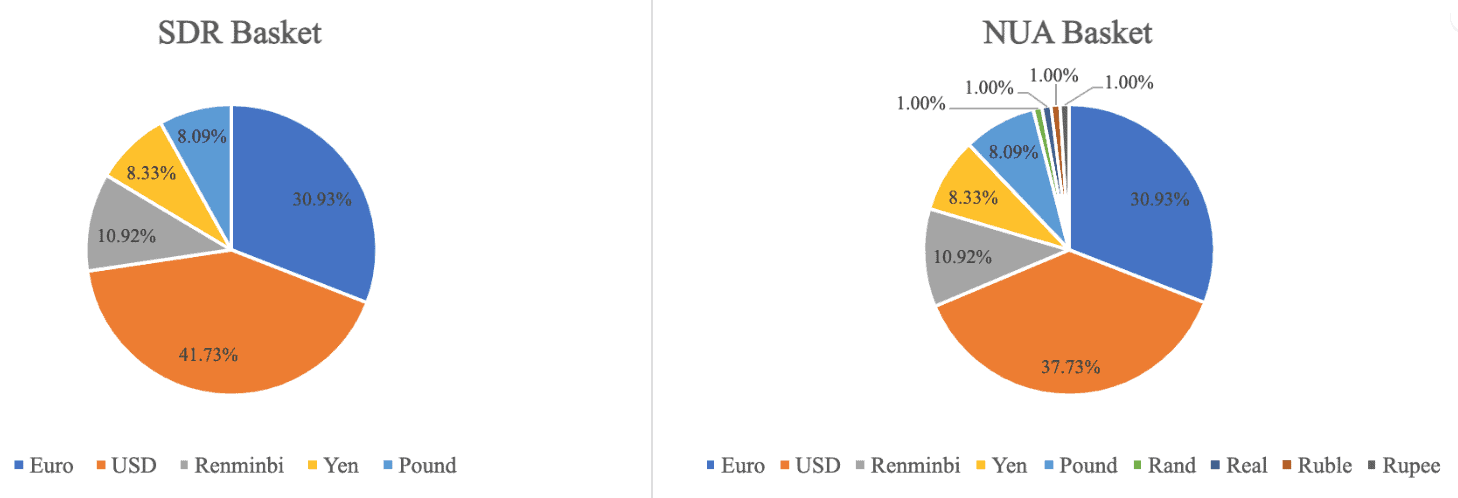

The NIPS and BICM systems could also use the Special Drawing Rights (SDR) basket or a New Unit of Account (NUA) basket as intermediaries for financial transactions between banks if NSRB does not live up to expectations. In any case, blockchain technology is the foundation for BRICS overcoming dependency on USD in the future. For now, BRICS Pay has limited scope and has not been widely rolled out to citizens, but the BRICS Business Forum held a summit last week to demonstrate its capabilities. The recent launch of BRICS Pay will allow people to register for cards using a QR code in order to begin making purchases.

Figure 4: SDR Basket vs NUA Basket of Currencies

Source: BRICS Business Council

Conclusion

The BRICS summit will mark an important milestone for BRICS if it announces any major initiatives surrounding BRICS Pay or other payment system developments. This would be the first time since the end of World War II that any rival financial payment system would gain traction among a significant portion of the global economy. A successful BRICS Pay would only add to the strong economic appeal of the bloc and provide greater competition with Western institutions as more countries become BRICS members. While adoption takes time, desire among the international community to de-risk from potential economic sanctions means that alternate payment systems such as BRICS Pay will only gain traction moving forward at the expense of transactions using USD.

Appendix

The New Development Bank (NDB), the BRICS version of the World Bank, holds approximately $100 billion in capital for various types of development projects. Each founding country has an equal stake of close to 20 percent of this investment pool, but BRICS+ countries have begun buying shares as well. While the portfolio financing of the New Development Bank has historically exceeded 60 percent in USD, 2021 annual funding was denominated only 31 percent in USD as the euro and renminbi replaced the dollar. While still small compared to the World Bank, this trend represents a shift away from reliance on USD.

Figure 5: Currency Composition of the BRICS New Development Bank

| Currency | Percent of Total Project Financing | Percent of 2021 Project Financing (latest annual report available) |

| United States Dollar | 65.0% | 31.1% |

| Chinese Renminbi | 18.4% | 31.8% |

| Euro | 9.9% | 37.1% |

| South African Rand | 4.5% | – |

| Swiss Franc | 1.9% | – |

| Indian Rupee | 0.3% | – |

Source: New Development Bank

The Contingent Reserve Arrangement (CRA), the BRICS version of the International Monetary Fund (IMF), provides financial support in the case of a liquidity crisis with roughly $100 billion in commitments, the largest being from China at $41 billion. Under the current CRA system, a local currency is swapped for USD in the case of a liquidity crunch, but each country can only request 30 percent of its entitled amount while the remaining 70 percent is linked to an IMF conditionality agreement. In comparison, the IMF has SDR where countries cash in SDR that are linked to a basket of currencies for liquidity. Therefore, the CRA is heavily dependent on the IMF and arguably more reliant on USD than SDR, which bodes well for dollar dominance within this institution.

Figure 6: The CRA vs the IMF

| Organization | Form of Liquidity | Total Available Liquidity |

| International Monetary Fund | SDR Currency Basket | $935.7 billion |

| Contingent Reserve Arrangement | U.S. Dollar | $100 billion |

Source: South African Institute of International Affairs; International Monetary Fund