Insight

April 28, 2016

Taking Action on Student Debt: The Administration Costs Taxpayers Billions

In the latest effort to pander to student borrowers, the White House press office released a fact sheet in conjunction with a multi-agency messaging campaign touting a new initiative to assist in managing student debt. The goal of the message is to promote participation in the Pay as You Earn initiative (PAYE), an income based repayment program.

Income Based Repayment (IBR) programs are intended to provide better access to higher education and make student loans more manageable, but these programs cost taxpayers billions of dollars. AAF has written about the mounting costs for some time now (see here, here, here, and here), and last year the $22 billion shortfall projected in the president’s budget, largely attributed to the rapid growth of PAYE, was large enough to catch the attention of national news media.

This administration, however refuses to be deterred. Along with the fact sheet, the Consumer Financial Protection Bureau (CFPB) is seeking public comment on their idea of offering consumers a Payback Playbook. This effort essentially duplicates the efforts of the Department of Education’s loan servicers by contacting troubled borrowers and suggesting that they would be better off in one of the IBR programs. It is unclear that having a second federal agency hounding student borrowers will improve repayment.

In addition, the Council of Economic Advisers highlighted six data points that they argue show recent improvements in student debt trends. Of particular interest, highlighted in the blog post, is the data they present on Pay as You Earn and other income-driven repayment (IDR) plans.

“As of the first quarter of fiscal year 2016, nearly 5 million (roughly 1 in 5) borrowers with federally-managed debt were enrolled in IDR plans. The share of borrowers with federally-managed debt enrolled in IDR has quadrupled over the last four years from 5 percent in the first quarter of fiscal year 2012 to 20 percent at the same point in 2016.”

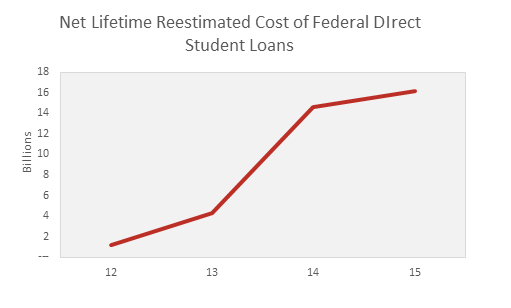

Using this same timeframe, AAF dug into the Federal Credit Supplements to evaluate the re-estimated costs of student lending. As a refresher, every year the federal government estimates the costs for new cohorts of loans for the coming fiscal year, and re-estimates the cost of the prior year. As reflected in the chart below, since 2012 the estimated cost for the Federal Direct Student Loan Program has grown from $1.2 billion to nearly $16.2 billion. These increasingly popular income-based repayment programs are effectively adding billions of unadvertised costs to the direct loan program – costs borne by the taxpayer.

Rather than doubling down on expensive programs, policymakers should focus on solutions that offer real debt free financing such as college savings plans and income share agreements. Solutions like these ensure access and outcomes, and reduce the regulatory burdens on institutions of higher education that lead to tuition increases.