Insight

September 6, 2022

Student Loans and the Biden Administration, So Far

Update: On November 16, a federal judge granted a final settlement to a federal class action lawsuit that will forgive about $6 billion in federal student loans for over 200,000 borrowers. As of mid-November, the Biden Administration has forgiven about $40 billion for about 1.9 million borrowers through various targeted forgiveness mechanisms and the federal class action lawsuit settlement. In the meantime, the federal courts have put an injunction on the Biden Administration’s $10,000–$20,000 blanket forgiveness, putting the proposal on hold indefinitely.

Executive Summary

- On August 24, President Biden announced a $10,000 blanket federal student loan forgiveness plan; this follows a host of other student loan forgiveness initiatives that, together with blanket forgiveness, will provide some level of loan forgiveness to every federal student loan borrower and provide full forgiveness to nearly half of all borrowers.

- None of the administration’s proposals reform the key challenges of higher education: Student loan forgiveness in any form and amount does nothing to raise educational attainment or lower costs but instead simply transfers the debt liability of student loan borrowers to taxpayers.

- Student loan forgiveness may in fact make higher education costlier for everyone by introducing a moral hazard to the federal student loan system that could encourage reckless borrower practices and reduce institutional incentives to lower tuition rates.

Through a combination of targeted forgiveness, blanket forgiveness, term of payment changes, and extended payment pauses, all federal student loan borrowers, regardless of income or assets, will receive forgiveness of some level under this proposal.

Please see related graphics here and here.

Introduction

On August 24, President Biden announced a $10,000 blanket federal student loan forgiveness plan. The White House reports up to 43 million holders of federal student loans could receive forgiveness under the plan, and roughly 20 million holders would see their balances completely forgiven. According to publicly available data, when combining the Biden Administration’s various student loan forgiveness initiatives, all federal student loan holders will receive forgiveness in some amount, with nearly half of all federal student loan borrowers receiving full forgiveness on their outstanding balances.[1], [2]

Blanket loan forgiveness solves none of the underlying challenges of higher education, but instead creates a host of new problems. It does nothing to increase educational attainment or lower costs. Instead, it transfers the debt liability of the borrowers who received the loans to the taxpayers. Blanket loan forgiveness then introduces a new set of disincentives for future borrowers to pay back what they owe, presenting a clear moral hazard. It also reduces the incentives for higher education institutions to lower tuition since their students’ loans were ultimately subsidized; it may also increase the incentive for these institutions to raise tuition in anticipation of future government bailouts.

Even before announcing this blanket forgiveness plan, the Biden Administration proposed and enacted many other federal student loan forgiveness initiatives. Like blanket loan forgiveness, these initiatives do nothing to raise educational attainment or lower costs. They simply transfer the debt of student loan borrowers to taxpayers without reform. Finally, these initiatives could potentially allow the Biden Administration, and future administrations, to continue extending federal student loan forgiveness without having to enact another round of blanket forgiveness.

Below is a review of the various actions the Biden Administration has taken on federal student loans to date.

$10,000 Blanket Loan Forgiveness

On August 24, President Biden announced $10,000 blanket loan forgiveness for borrowers of federal student loans who make less than $125,000 per year and for married borrowers whose combined spousal income is less than $250,000 per year. The order’s provision to increase the amount of forgiveness for Pell Grant recipients, who are usually of lower-income backgrounds, would likely reduce the regressive nature of blanket loan forgiveness. The prescribed income caps are at least in the 89th percentile of 2021 U.S. annual income distributions, meaning lower, middle, and even still many higher-income borrowers will receive forgiveness in some amount. The White House has reported up to 43 million borrowers will receive forgiveness under its plan. As of the second quarter of 2022, there were 43.0 million unduplicated holders of federal student loans.[3] Combining this figure with the borrowers that have received forgiveness under existing targeted mechanisms, as explained in more detail below, suggests that every borrower of federal student loans will receive some amount of forgiveness under the administration’s plan. The White House also reports that roughly 20 million borrowers—almost half of all federal student loan holders—will have their entire balances forgiven.

Blanket loan forgiveness simply shifts the costs of education to taxpayers. Americans who did not attend college are now liable for the tuition bills of Americans who did. Blanket loan forgiveness also introduces a new set of disincentives for future borrowers to pay back what they owe, presenting a clear moral hazard. Blanket loan forgiveness does nothing to increase educational attainment or lower costs. Colleges also now have less incentive to lower tuition rates, since their students were just bailed out by the federal government via loan forgiveness. Combine that with the borrowers’ new motivation to take out loans while expecting future forgiveness, a clear moral hazard, it is likely that blanket loan forgiveness could conversely raise post-secondary education costs.

For more information on the administration’s recently announced $10,000 blanket student loan forgiveness plan, please visit here.

Targeted Forgiveness

Since entering office, the Biden Administration has used existing targeted mechanisms to provide as much federal student loan forgiveness as possible, up until its blanket forgiveness announcement on August 24. Through these targeted mechanisms, the Biden Administration has canceled about $34 billion for about 1.7 million borrowers:

- $9.6 billion for about 175,000 borrowers through Public Student Loan Forgiveness;

- $9 billion for about 425,000 borrowers through Total and Permanent Disability Discharge;

- $1.2 billion for about 100,000 borrowers through Closed-School Discharge; and

- $14.5 billion for about 1.1 million borrowers through Borrower Defense.

These programs were created by Congress to codify certain standards under which the Department of Education (ED) can cancel students’ outstanding federal loan balances. The Biden Administration has mainly used borrower defense, which allows ED to cancel outstanding balances for students who can successfully show they were misled or defrauded by their higher-education institution. The Biden Administration has so far focused these targeted mechanisms on forgiving the debt of for-profit college students, but it could expand the targeted mechanisms to students of non-profit public and private universities, as well. Additional information about how this could be expanded can be found below, in Proposed Regulatory Changes on Federal Student Loans Including a New Income Driven Repayment Plan.

Additionally, on August 4, a federal court preliminarily approved an ED proposal to settle a federal class action lawsuit that would forgive about $6 billion for an additional 264,000 borrowers.[4] This decision stands out among others: Whereas the Biden Administration had previously used its statutory authority to provide forgiveness through the targeted mechanisms, the administration is relying on the federal courts to provide more student loan forgiveness than it would otherwise be able to do.

Public Student Loan Forgiveness Waiver and Expanded Income Driven Repayment Credits

In October 2021, the Biden Administration announced a “limited Public Student Loan Forgiveness (PSLF) waiver” to expand the amount of forgiveness borrowers could receive under the program. Under PSLF, borrowers of federal student loans who have worked for a non-profit organization or the government and have made a certain number of payments on their student loans are eligible to have their outstanding balances completely forgiven. As explained by studentaid.gov, “under the new rules, any prior payment made will count as a qualifying payment, regardless of loan type, repayment plan, or whether the payment was made in full or on time. All you need is qualifying employment.” By relaxing the standards that determine what kinds of payments qualify under PSLF, more borrowers will receive credit toward receiving forgiveness under PSLF. The Biden Administration is expanding the eligibility of borrowers to receive forgiveness under PSLF, many of whom are reflected in the above section.

In April, the Biden Administration announced changes to federal student loan income driven repayment (IDR) plans. An IDR sets a borrower’s monthly payments on their student loans at an amount that is not higher than a specified percentage of the borrower’s income, usually 10 percent. There are four types of IDRs which, depending on the type, allow the borrower to receive automatic forgiveness for any remaining balance after making 20–25 years of qualifying payments. Like the PSLF waiver, the Biden Administration is relaxing the standards that determine what kinds of payments qualify under IDRs and allowing more borrowers to potentially receive credit toward forgiveness.

For more details on PSLF waiver, visit here.

For more information on the changes announced to IDRs in April, visit here.

Payment Pause Extensions

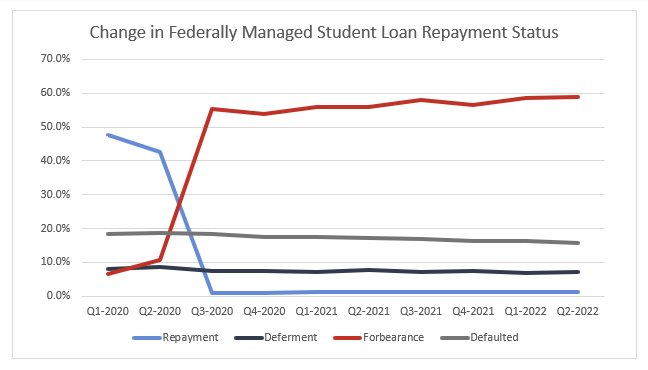

In the third quarter of 2020, more than half of federal student loan borrowers entered forbearance under the provision in the Coronavirus Aid, Relief, and Economic Security Act that allowed them to pause principal and interest payments in response to the COVID-19 pandemic. As of the second quarter of 2022, still more than half of federal student loan borrowers are in forbearance. President Trump extended the pause twice. On August 24, in addition to announcing the $10,000 blanket loan forgiveness and other proposals, President Biden extended the pause in repayment for the seventh and what the administration claims is the final time. The pause in repayment is now slated to end on December 31, 2022. Payments on outstanding balances of federal student loans are expected to start once again in the new year.

Chart 1: Change in Federally Managed Student Loan Repayment Status[5]

Proposed Regulatory Changes to Federal Student Loans, Including a New Income Driven Repayment Plan

On July 13, the Department of Education proposed new regulatory changes to five federal targeted student loan forgiveness programs. ED also proposed changes to interest capitalization on federal student loans. As mentioned above, the Biden Administration has used four of these mechanisms since entering office to enact targeted loan forgiveness, mostly for former students of for-profit universities.

The proposed changes would ease the programs’ eligibility requirements and allow the Biden Administration to identify and forgive the loans of more borrowers. More specifically, the Biden Administration could begin forgiving the federal student debt of large swaths of students at even public and private non-profit universities. This could potentially allow the Biden Administration to continue providing de-facto blanket loan forgiveness, without having to propose another round of blanket loan forgiveness in the form of the August 24 announcement.

In the August 24 blanket forgiveness announcement, the Biden Administration also proposed a wholly new IDR plan. Under this plan, the specific repayment percentage would decrease to 5 percent for undergraduate borrowers, and after making 10 years of payments, the borrower would receive automatic forgiveness on any remaining balances. Borrowers would essentially pay half of the amount they normally do for half the amount of time. That means borrowers would receive more debt forgiveness under these plans, since they lower the number of payments and duration of repayment. Like the administration’s other loan forgiveness actions, the forgiveness extended through IDRs does nothing to increase educational attainment or lower costs. This is another attempt by the Biden Administration to continue expanding federal student loan forgiveness without necessarily announcing another round of blanket forgiveness.

Based on statutory rules, ED must finalize any of these proposals by November 1 in any given year for the proposed changes to go into effect in July of the following year. Therefore, the earliest these proposed changes could go into effect would be July 1, 2023.

For more information on the proposed regulatory changes to the targeted mechanisms, visit here.

“Fresh Start” Initiative

On August 17, ED released details on its Fresh Start initiative, which was originally announced in April. Fresh Start would last for one year after the end of the current pause on repayment of federal student loans (December 31, 2022). Borrowers who have defaulted on either their direct federal loans, Perkins Loans held by ED, or Federal Family Education Loans (FFEL) prior to the start of the student loan repayment pause on March 13, 2020, are eligible. Upon entering Fresh Start, borrowers would enroll in a new repayment plan on their defaulted loans and then would again be eligible to receive new federal student aid. They would not face any collections associated with their defaulted loan such as wage garnishments or tax refunds withheld. ED would then halt reporting on loans that have been delinquent for seven or more years and report the defaulted loans for eligible borrowers to credit reporting agencies as “current.”

The purpose of Fresh Start is to allow defaulted borrowers to take out additional federal student loans so they can finish their degree, and to help them pay off their balances faster since they would have completed the degree. The administration has touted the program as a “pathway for additional education.” Through Fresh Start, ED would essentially identify students who are the least likely to pay back their student loans and give them even more loans. The administration’s initiative would not pave a way for additional education, but rather repeat the same policies as before while expecting a different result.

Conclusion

The Biden Administration has pursued numerous federal student loan forgiveness policies from standalone initiatives, such as the PSLF waiver, the proposed regulatory changes to expand existing targeted mechanisms, and the recently announced blanket forgiveness plan. Student loan forgiveness introduces new problems at high costs. The federal student loan system will now be subject to a strong moral hazard that encourages reckless borrower practices. There is now a disincentive for future borrowers from all income backgrounds to repay their loans. These future borrowers will also be motivated to take out larger loans than necessary, since they have reason to expect future forgiveness. Colleges will also have less of an incentive to lower tuition and costs—but in fact may be prompted to raise prices—under the assumption that the federal government will provide more student loan forgiveness in the future. Student loan forgiveness in any amount and form is not educational reform. For all of the problems it creates, the policy does not raise educational attainment or bring down the cost of college; conversely, it is likely to raise costs while again requiring taxpayers to foot the bill.

[1] https://www.whitehouse.gov/briefing-room/statements-releases/2022/08/24/fact-sheet-president-biden-announces-student-loan-relief-for-borrowers-who-need-it-most/

[2] https://studentaid.gov/data-center

[3] https://studentaid.gov/data-center/student/portfolio

[4] https://www.washingtonpost.com/education/2022/08/04/student-loan-settlement-approved/

[5] https://studentaid.gov/data-center/student/portfolio