Insight

March 8, 2017

Step 1: The House Reconciliation Bill to Repeal and Replace Obamacare

The House Republicans’ plan to repeal and replace the Affordable Care Act (ACA) was released on Monday evening. Under this legislation, there will be a multi-year transition period from the ACA to the new policy. During this transition, most people will likely see either minimal or no changes to their current coverage options and financial assistance. Most of the substantial changes will take effect at the beginning of 2020. The following is a summary of the legislation, but it should be noted that this legislation must still go through mark-up in multiple committees in the House and also pass the Senate. It is possible that changes will be imposed throughout the process. Further, additional pieces of legislation are likely to follow this reconciliation legislation to provide additional reforms.

The Transition Period

In regards to the individual insurance market, very few changes will occur in 2017.

Individuals

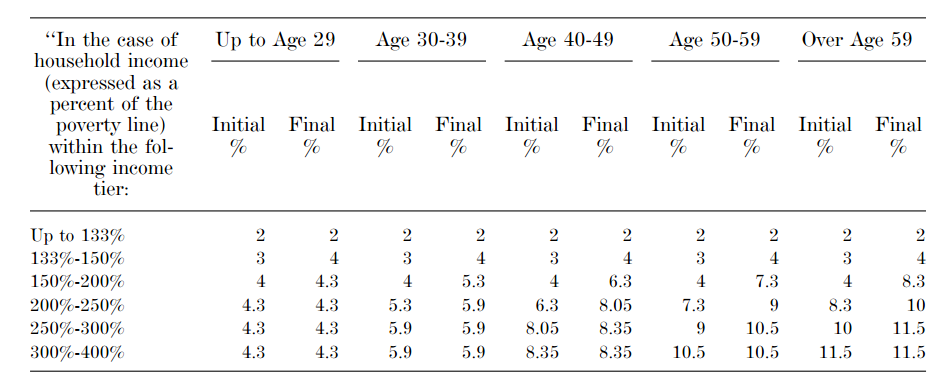

The ACA’s health insurance subsidies will continue to exist and be based on income, but will now be adjusted by age as well during the transition period, such that younger individuals are required to pay less in order to encourage these healthier individuals to join the market and balance the risk pool. Below is a chart from the House Ways and Means Committee legislative text showing the range of the maximum percentage of a household’s income that would be required to be spent on health insurance in order to receive a subsidy; any cost beyond this amount will be covered by the subsidies provided by the ACA, as amended by this legislation.

This legislation expands the definition of a qualified health plan, and thus the types of plans that may be purchased with the help of a subsidy, such that individuals will be able to use the tax credits to buy catastrophic plans and plans not sold through an Exchange beginning in 2018 (though the tax credits for plans purchased off-Exchange are not advanceable). Insurers will no longer be required to offer plans at both the Silver and Gold metal levels. Individuals enrolled in plans that were grandfathered or grandmothered under the ACA will continue to be ineligible for tax credits.

The individual mandate penalty is retroactively repealed for 2016 (as well as the employer mandate penalty) and all future years.

Health Savings Accounts (HSAs) will become significantly more valuable beginning in 2018. The maximum contribution limit will be increased to match the out-of-pocket limit permitted in a high deductible health plan, and so long as an individual establishes an HSA within 60 days of their effective coverage date, the account will be treated as though it was established when coverage began. This will allow any expenses incurred in those two months to be covered by HSA funds even if the account had not yet technically been established. Also beginning in 2018, the limit on contributions to a flexible spending accounts imposed by the ACA will be repealed.

States

Beginning in 2018, States will receive federal funding through the Patient and State Stability Fund for the purpose of stabilizing the individual insurance market in their state. These funds may be used to establish high-risk pools or other programs to assist with the cost of providing care to high-risk and high-cost individuals not insured through their employers; to promote access to preventive services, dental and vision care, and mental health and substance abuse services; to encourage insurers to participate in the markets and provide consumers with an array of options; and to provide financial assistance to individuals for their premium and out-of-pocket health care costs. These funds must be used to provide payments to insurers for 75 percent of the cost of claims over $50,000 (not exceeding $350,000). These funds will be available from 2018-2026, with $15 billion available in the first two years and $10 billion for each following year, though these funds are subject to state matching requirements beginning in 2020. The cost-sharing subsidies provided by the ACA will be eliminated beginning in 2020, when the transition to the new system takes effect.

The Individual Market Under the American Health Care Act (AHCA)

Advanceable, Refundable Tax Credits

Beginning in 2020, a new advanceable, refundable tax credit will be available to all individuals who do not have employer-sponsored insurance or are not eligible for Medicaid in their state. This tax credit will increase with a person’s age, beginning at $2,000 for individuals under 30 and gradually increasing to $4,000 for individuals 60 and older. The credit will begin to phase-out for individuals with income over $75,000 (or $150,000 for joint filers) by 10 percent for each dollar of income over that threshold. For families, the tax credits are additive, and available for up to five family members, not to exceed $14,000. (If a family has more than five individuals, the five oldest members will be used to calculate the amount of the tax credit available.) Below is a chart showing the amount of the tax credits that will be available to households, based on age, income, and household size.

| Tax Credits by Income for Singles (2020) | |||||

| Age | $ 70,000 | $ 80,000 | $ 90,000 | $ 100,000 | Phase-out Income |

| 1-29 | $ 2,000 | $ 1,500 | $ 500 | $ – | $ 95,000 |

| 30s | $ 2,500 | $ 2,000 | $ 1,000 | $ – | $ 100,000 |

| 40s | $ 3,000 | $ 2,500 | $ 1,500 | $ 500 | $ 105,000 |

| 50s | $ 3,500 | $ 3,000 | $ 2,000 | $ 1,000 | $ 110,000 |

| 60-64 | $ 4,000 | $ 3,500 | $ 2,500 | $ 1,500 | $ 115,000 |

| Tax Credits by Income for Family of 4 (2020) | |||||

| Age | $ 140,000 | $ 160,000 | $ 180,000 | $ 200,000 | Phase-out Income |

| 1-29 | $ 8,000 | $ 7,000 | $ 5,000 | $ 3,000 | $ 230,000 |

| 30s | $ 9,000 | $ 8,000 | $ 6,000 | $ 4,000 | $ 240,000 |

| 40s | $ 10,000 | $ 9,000 | $ 7,000 | $ 5,000 | $ 250,000 |

| 50s | $ 11,000 | $ 10,000 | $ 8,000 | $ 6,000 | $ 260,000 |

| 60-64 | $ 12,000 | $ 11,000 | $ 9,000 | $ 7,000 | $ 270,000 |

Continuous Coverage

This legislation would maintain the prohibition on excluding from coverage anyone with a pre-existing condition and medically underwriting them. However, in order to encourage individuals to remain continuously insured, beginning in plan year 2019 (or 2018 if an individual enrolls during a Special Enrollment Period in that year), an insurer may impose a surcharge of 30 percent of what the individual’s premium would otherwise be for up to one year if an individual is uninsured for more than 63 days in the 12 months prior to enrollment; after that year, the penalty would cease.

Medicaid

This legislation will provide some significant reforms to the Medicaid program, but not a complete repeal of the ACA’s Medicaid provisions. The most significant change to the program under the ACA was expansion of Medicaid eligibility to childless adults earning up to 133 percent of the federal poverty level (FPL) for whom the federal government would pay for at least 90 percent of their expenses. This legislation will allow this Medicaid eligibility expansion to continue, but beginning in 2020, only those already enrolled in the program without more than a month break in coverage will continue to receive federal funding at the enhanced matching rate (EFMAP). States choosing to continue to enroll “expansion population” adults beyond 2019 will only receive federal funding at the state’s traditional match rate (FMAP). States must reverify eligibility for expansion population adults every six months; any state that fails to do so may be charged a civil monetary penalty of $20,000 for each individual improperly enrolled.

States that chose not to expand Medicaid will receive extra funding—a total of $10 billion will be distributed over five years—to assist with health care costs for the needy. These funds may be used to increase Medicaid provider payments; the cost of any increase in reimbursement rates will be matched at 100 percent by the federal government in calendar years 2018-2021 and at 95 percent in 2022, up to the state’s allotment limit. States will receive a portion of the $2 billion provided each year for this purpose based on the number of individuals in the state in 2015 with income below 138 percent of the FPL relative to the number of such individuals in all the non-expansion states in 2015. This formula provides each state a funding allotment proportional to its share of the number of individuals who were otherwise eligible under Medicaid expansion, except for the fact that their state did not expand their Medicaid program.

The disproportionate share (DSH) payment cuts imposed by the ACA will be repealed in October 2017 for non-expansion states, and in October 2019 for expansion states. States will no longer be able to make presumptive eligibility determinations for all Medicaid eligibility categories; this allowance will only be available for children, pregnant women, and breast cancer and cervical cancer patients. Similar to new rules imposed on individuals attempting to enroll in an Exchange plan during a Special Enrollment Period, eligibility must be verified prior to enrollment, with coverage being retroactively effectuated to the month in which the individual applied upon verification.

Funding Reform

Beginning with fiscal year 2020, Medicaid will be transformed into a per capita allotment financing model. The allotment for each eligibility category in each state will be based on FY2016 state spending levels, increased each year by the medical care component of the Consumer Price Index for all urban consumers (CPI-U). Any state that exceeds their aggregated target spending levels for a year will face reduced Medicaid funding in the following fiscal year. Certain payments, such as DSH payments and administrative expenses, and individuals would be exempt from the capped allotment. Particularly, children enrolled through a CHIP Medicaid expansion program, individuals entitled to medical assistance coverage of breast and cervical cancer treatment, dual-eligible individuals who have their Medicare cost-sharing covered by Medicaid, and individuals eligible for ESI premium assistance would all be excluded from the capped funding allotments.

Miscellaneous

This legislation will provide an additional $422 million for community health centers in fiscal year 2017, but will rescind all funding to the Prevention and Public Health Fund (established by the ACA) in fiscal year 2019 and beyond. States will be allowed, starting next year, to expand the age-rating premium allowance from 3:1 (as required by the ACA) to 5:1, to more closely reflect the difference in health care costs for 21-year-olds, relative to 64-year-olds. Individuals who receive a subsidy in excess of the amount for which they are eligible under the ACA will be required to repay that overpayment. The actuarial value requirements for the ACA’s essential health benefits will be sunset in 2020, and the ACA’s small business tax credit will no longer be available in 2020. Finally, all of the taxes imposed by the ACA will be repealed beginning in 2018, except the Cadillac tax—its implementation will be delayed to 2025.