Insight

July 13, 2021

Potential Cost Implications of Expected New “Generic” Insulins

Executive Summary

- New insulin products are coming to market, including the first biosimilar insulins, which could yield savings for patients and taxpayers of more than $2.5 billion per year.

- Downward price pressure may come not only from manufacturer competition, but as a result of low-cost retailers such as Wal-Mart selling authorized generics.

- Savings from insulin competition, however, will be limited by the pricing and rebate structure of the drug market in the United States, and as a result, these new competitor insulin products are likely to have a limited impact on Medicare and Medicaid’s balance sheets.

Introduction

Recent reports indicate that multiple new insulin products, including the first biosimilars, are coming to market with the potential to provide significant savings for patients and taxpayers. As previous research from the American Action Forum shows, costs for insulin products have risen substantially over the past several decades, reaching roughly $6,000 annually per user in 2018. Based on current cost and prevalence trends, the United States could soon be spending between $61 billion and $121 billion on insulin by 2024, depending on whether prices increase at the long-term historical rate or follow the more recent slowdown.[1] The introduction of new insulin products could make the latter more likely and significantly bend that cost curve. Because of the existing market incentives to offer high-price, high-rebate drugs, however, patient out-of-pocket savings and government savings may be limited for either product.

New Products

Bringing new competitor products to market has not been a simple feat. In fact, given the patent lengths on innovator products as well as regulatory hurdles, there was no regulatory pathway for biosimilar insulin product approval until March 2020. A total of three new insulins are currently or will soon be available to patients—two produced by a competitor company, and one manufactured by the producer of the original biologic (also called an authorized generic).

Different forms of insulin are prescribed for patients with different needs. The diversity of products naturally complicates how easily new products can be substituted and means that product competition for one form of insulin does not necessarily produce broad price competition. Since insulin typically requires a delivery device, manufacturers often must also compete based on whether insulin is offered in a vial or in some other format that is easier to inject.

The first new product is an identical version of Novo Nordisk’s existing Novolog, a rapid-acting insulin, which will also be produced by Novo Nordisk. This product will be sold exclusively at Wal-Mart and Sam’s Club.[2] The product is offered in a standard vial or its more easily injectable FlexPen, but sold under the ReliOn name. Novolog is among the most commonly used insulin products in the United States.[3] The cash price will be $72.88 for the vial and $85.88 for the FlexPen, a discount which Wal-Mart states is between 58 percent and 75 percent.[4]

Viatris also recently announced it is developing two biosimilar insulin products (one rapid-acting and one long-acting), both of which it expects will be approved with interchangeability status in mid-July.[5] According to company documents, one will be biosimilar to Novolog (the same product newly offered by Wal-Mart) and the other to Sanofi’s Toujeo product, which comes in two injection pen options.[6] Toujeo is much more expensive than other long-acting insulins and is used by a small share of insulin users.

Current Insulin Market

More than 8 million Americans currently use insulin to control their diabetes.[7] Rapid and long-acting insulins are the most commonly used insulin products and tend to be the most expensive insulin products on the market.[8]

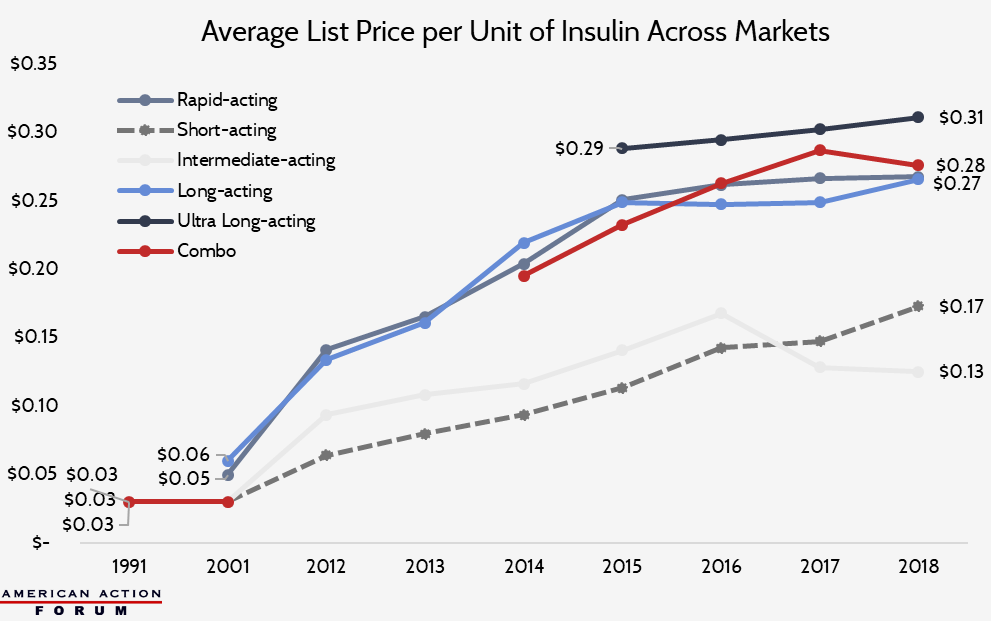

The list price of insulin per milliliter in the United States has increased substantially over the past several decades, as shown in the chart below, though price growth has slowed in the past few years.[9]

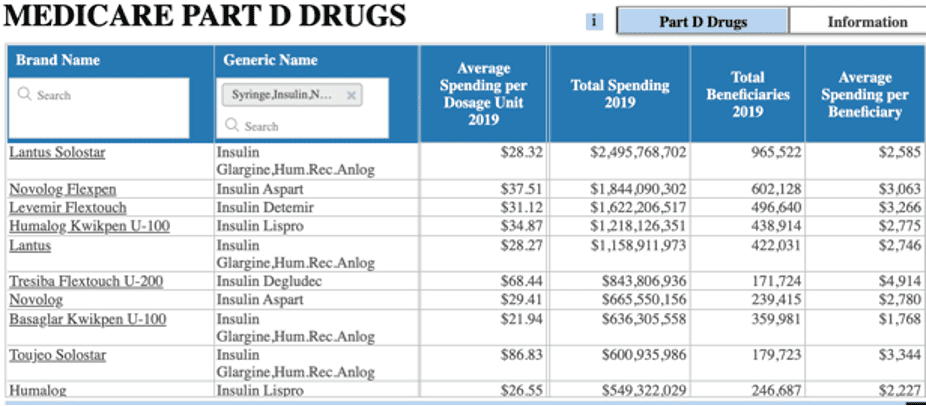

Who, specifically, is paying these prices? Three-fourths of all insulin costs accrue to individuals insured through government insurance programs (Medicare, Medicaid, Children’s Health Insurance Program, or the Indian Health Service).[10] In 2019, spending on insulin reached $12.8 billion in Medicare Part D and $3.5 billion in Medicaid. As shown in the table below, average spending per dosage unit (100 units/mL) for all rapid-acting and long-acting insulin types in both Medicare Part D and Medicaid (when excluding Toujeo) is roughly $30 to $34. Most insulin vials typically consist of 10 milliliters, making the average cost of an insulin vial 10 times that. Notably, however, these figures represent the list price and do not account for discounts and rebates, which can average between 30 and 50 percent in the insulin market.[11]

Which of the many insulin products could the new entrants replace? Novolog, for example, is an insulin aspart product (a rapid-acting kind of insulin), and all aspart products accounted for one-fourth ($3.1 billion) of all insulin costs in Medicare Part D in 2019.[12] Of these insulin aspart products, Novolog makes up 80 percent of the sales ($2.5 billion) and 87 percent of Part D insulin aspart users. For Medicaid, Novolog products similarly account for 85 percent of insulin aspart sales ($588.5 million) and 87 percent of such claims.[13] Therefore, two new Novolog-style products could reasonably be expected to produce downward price pressure overall.

The other forthcoming insulin competitor is a long-acting insulin glargine product. Glargine products accounted for 40 percent of all Part D insulin spending at $5.1 billion in 2019.[14] Medicaid spending on this form of insulin reached nearly $1.5 billion that year (43 percent of Medicaid’s insulin cost), with 4.2 million claims.[15] The pending biosimilar product, however, is only a direct substitute for Toujeo, which accounts for a much smaller share of insulin spending: 14 percent in Part D and 4 percent in Medicaid. Because Toujeo is among the most expensive insulin products per dose, substantial savings to Medicare and Medicaid will depend on whether the new product incentivizes patients to shift away from other glargine products.

Potential Impact of New Products

New competitors for large swaths of the patient population should produce savings for payors. But estimating the real-world price reduction potential of these products involves many more variables. Since most of the government’s (and the country’s) insulin costs come from Medicare Part D, it is important to understand the effects of the program’s pricing and rebate structure. As explained here and here, Medicare Part D encourages high-priced, high-rebate drugs more than lower list prices. In fact, the program does not necessarily reward even the lowest net price, as insurers and pharmacy benefit managers profit from greater rebates and lower net-price products may be hindered by rebate walls. Thus, when considering the potential savings a new product in the market may offer, it is typically most important to consider the size of the rebate that may be offered rather than the product’s list or net price. Given how little is publicly known regarding product-specific rebates, however, estimating potential savings becomes quite difficult.

In this analysis, because patients pay out of pocket (OOP) based on list prices and the government’s drug-specific costs (paid through reinsurance) are tied to the list price, savings calculated are based on the non-discounted spending amounts reported by the Centers for Medicare and Medicaid Services. Discounts and rebates are paid to insurers and used to reduce premiums, and thus not reflected in drug-specific spending amounts.

Rapid-Acting Insulin

The introduction of two new Novolog-equivalent insulin products would seem to suggest price competition should be significant, but because of the aforementioned market dynamics, this may not be the case.

In 2019, one vial (10 mL) of Novolog cost, on average, $294 in Medicare Part D and $283 in Medicaid, before discounts. Novo Nordisk has in the past reported steep discounts, claiming that while its list price for Novolog increased 353 percent between 2001 and 2016, the net price increased just 36 percent during that period, suggesting a 70 percent discount from the list price.[16] The net price of its Flexpen increased just 3 percent, according to company documents, while its list price increased 270 percent from 2003 to 2016, indicating a discount rate of 62 percent.[17] Assuming the same discount rates, the average net price of Novolog in 2019 would be approximately $88 per vial and $143 per Flexpen.

Wal-Mart has already announced it will sell its Novolog at $72.88 per vial, which will be the OOP cash price to patients. With the standard drug plan, Medicare patients pay 25 percent co-insurance on the list price of a drug, which translates to $73.53. In other words, the cash price for Wal-Mart’s insulin would beat the average OOP cost for Part D patients by $0.65. Given that patients needing to take insulin are likely also taking other medicines, it would be highly unlikely that it would be in patients’ financial interest to pay cash for insulin rather than use insurance to work toward meeting the deductible, particularly for such a small OOP savings.[18] As such, it does not seem Wal-Mart is likely to attract many Medicare patients with its new insulin offerings. Medicaid patients, who pay a very small amount OOP if anything, are also not likely to purchase from Wal-Mart.[19] Thus, these products are likely only to attract the uninsured and possibly some insured patients with poor prescription drug coverage. Similarly, for the Novolog Flexpen, the standard Medicare Part D patient OOP cost in 2019 is estimated at $93.77. With a cash price of $85.88, Medicare, Medicaid, and well-insured patients using the Flexpen are also unlikely to purchase from Wal-Mart rather than through their insurance plan for the same reasons. The government, therefore, is unlikely to see savings from Wal-Mart‘s offerings.

The biosimilar rapid-acting insulin to be offered by Viatris, on the other hand, has greater potential to move the market, particularly if granted an interchangeability designation and priced more competitively. That said, price competition here refers to the size of the rebate more than list price or net price, as described above. Thus, the list price for this biosimilar insulin may only be slightly discounted relative to Novolog. At a 10 percent discount and assuming all Novolog users switched products, Medicare reinsurance and patient savings would total $250 million annually, based on 2019 usage rates; Medicaid would save $69 million. Any savings from rebates would be reflected in lower premiums for all Medicare patients.

Alternatively, without the influence of the rebates and the option to compete simply by offering a lower price, savings across Medicare and Medicaid could be quite substantial. If the biosimilars were priced at a 75 percent discount from the price of a Novolog vial and a 65 percent discount from the price of a Novolog Flexpen (to compete with the net price of those products), savings for Medicare and Medicaid could total $2.1 billion per year, based on 2019 use.

Long-Acting Insulin

Toujeo, manufactured by Sanofi, is one of the more expensive insulin products in the U.S. market. While Sanofi has released a report stating that the net price of its insulin products was 25 percent lower in 2018 than 2012 and that it paid an average rebate of 55 percent across all its products in 2018, there is no information regarding rebates specific to Toujeo.[20] Without knowledge of typical discounts and rebates offered by Toujeo, it is difficult to know exactly how low Viatris would need to price its product (or how great a rebate would need to be offered) to be competitive with that specific product, but some scenarios can be considered based on average discount rates in the insulin market.

If the biosimilar were offered at a 10 percent discount from Toujeo’s list price, Medicare and Medicaid savings would total $78 million per year, based on 2019 use rates if all Toujeo users switched.

Again, if the biosimilar could compete simply based on price, rather than a rebate, and was offered at 60 percent less than the price of Toujeo (assuming a rebate from Toujeo of 55 percent) and all Toujeo users switched products, Medicare and Medicaid savings could total $468 million per year based on 2019 usage.

Because Toujeo currently captures such a small share of the insulin market, Viatris may consider pricing more competitively with other insulin glargine products in an attempt to gain a greater share of the market. If the list price for the biosimilar were set at $28 per dosage unit (compared with a current average of $31/unit of all insulin glargine products) and all such users switched to the biosimilar, Medicare spending would decline $400 million annually and Medicaid spending would decrease $200 million (after accounting for the Medicaid “best price” discount of 23.1 percent).

Not all insulin products are well-suited for all patients, however, and switching products can cause unwelcome side effects and allergic reactions; this reality makes it unlikely that all patients would switch simply because of the opportunity to save money.[21] As such, these estimates are likely an upper bound of potential savings.

Conclusion

The steadily increasing price of insulin and market dominance of a handful of manufacturers has made patients and policymakers desperate for greater competition in the market. While that competition is beginning to emerge, the pricing dynamics of the market make it unlikely that significant savings will accrue. Savings could be much more substantial if products were able to compete on net price, rather than the size of the rebate.

[1] https://www.americanactionforum.org/research/insulin-cost-and-pricing-trends/

[2] https://corporate.walmart.com/newsroom/2021/06/29/walmart-revolutionizes-insulin-access-affordability-for-patients-with-diabetes-with-the-launch-of-the-first-and-only-private-brand-analog-insulin

[3] https://www.pharmaceutical-technology.com/features/featurethe-worlds-top-selling-diabetes-drugs-4852441/

[4] https://corporate.walmart.com/newsroom/2021/06/29/walmart-revolutionizes-insulin-access-affordability-for-patients-with-diabetes-with-the-launch-of-the-first-and-only-private-brand-analog-insulin

[5] https://www.jdsupra.com/legalnews/viatris-expects-first-interchangeable-3265477/

[6] https://investor.viatris.com/static-files/24f3ae32-15dc-4bd5-a438-8ad7070e0b6f

[7] https://www.americanactionforum.org/research/insulin-cost-and-pricing-trends

[8] https://www.americanactionforum.org/research/insulin-cost-and-pricing-trends/

[9] https://www.americanactionforum.org/research/insulin-cost-and-pricing-trends/

[10] https://care.diabetesjournals.org/content/diacare/suppl/2018/03/20/dci18-0007.DC1/DCi180007SupplementaryData.pdf

[11] https://www.americanactionforum.org/research/insulin-cost-and-pricing-trends/#_ednref25

[12] https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/Information-on-Prescription-Drugs/MedicarePartD

[13] https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/Information-on-Prescription-Drugs/Medicaid

[14] https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/Information-on-Prescription-Drugs/MedicarePartD

[15] Authors’ calculation based on CMS Medicaid Drug Spending Dashboard data: https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/Information-on-Prescription-Drugs/Medicaid

[16] https://www.americanactionforum.org/research/insulin-cost-and-pricing-trends/

[17] https://www.novonordisk-us.com/media/perspectives/our-perspectives.html

[18] https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4161641/, https://drc.bmj.com/content/3/1/e000075, https://www.healthline.com/health/diabetes/medications-list#other-drugs

[19] https://www.commonwealthfund.org/publications/issue-briefs/2020/sep/not-so-sweet-insulin-affordability-over-time

[20] https://www.sanofi.us/-/media/Project/One-Sanofi-Web/Websites/North-America/Sanofi-US/Home/corporateresponsibility/Prescription_Medicine_Pricing_2019.pdf

[21] https://www.americanactionforum.org/research/understanding-the-insulin-market/