Insight

May 18, 2023

Options to Encourage Small Business Health Coverage Offerings

Executive Summary

- The end of the public health emergency and, as a result, the continuous Medicaid enrollment provisions in the spring of 2023 will lead to the shift of millions of individuals off Medicaid coverage and onto other sources of insurance.

- Small businesses, which employ 61.7 million people – but only a third of which offer health benefits – present an opportunity to provide more individuals with higher quality and generally less costly employer-sponsored insurance while avoiding increased reliance on the federal government for insurance coverage.

- Policy options including association health plans, reformed self-insurance regulations, improved tax incentives, and expanded telehealth benefit options provide a way to increase the number of small businesses offering health benefits to employees.

Introduction

With the end of the public health emergency (PHE) and, as a result, the Medicaid continuous enrollment provision of the American Rescue Plan Act (ARPA), millions are expected to be disenrolled from Medicaid over the coming months. A previous American Action Forum (AAF) insight discussed the rough estimates of how many individuals are expected to be disenrolled and what their potential insurance options are: the Affordable Care Act (ACA) Marketplace, employer-sponsored insurance (ESI), and public programs including Medicaid and the Children’s Health Insurance Program (CHIP). This paper explores the positives and negatives of those coverage options and examines ways to improve access to ESI through our nation’s largest employers, small businesses. Current statute and regulations create cost and compliance barriers for small businesses trying to provide health insurance to their employees. These barriers include rules discouraging forming association health plans (AHPs), regulatory barriers on self-insurance, insufficient tax incentives, and the end of telehealth exemptions that will make it more difficult for employees to access telehealth care.

Access, Outcomes, and Cost in Government-run Programs

According to an Urban Institute report, almost everyone disenrolled from Medicaid, either due to ineligibility or bureaucratic mistakes, would have access to some form of insurance coverage.[1] These coverage sources include the ACA Marketplace, ESI, or Medicaid and CHIP (eligible individuals who were mistakenly disenrolled from Medicaid can still re-apply), and other low-enrollment options that this paper does not cover. Given the heavy focus of the last decade on providing coverage to individuals, it is important to understand why all forms of coverage are not equal, or even beneficial to the enrollee, before explaining the benefits of increased private coverage.

Medicaid

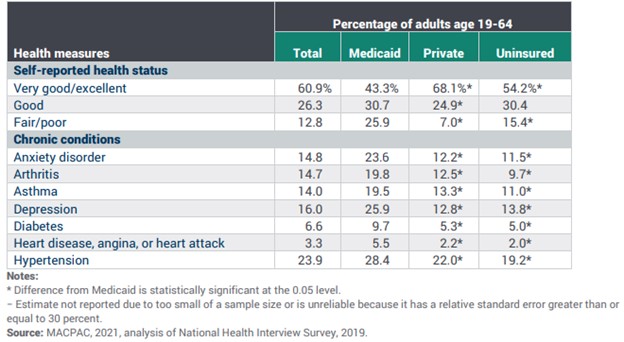

Throughout the PHE, the Biden Administration and others often celebrated the increased enrollment in Medicaid, but were also concerned about what would happen when the PHE was finally lifted.[2] Medicaid and CHIP enrollment had grown by 21.2 million individuals from February 2020–December 2022, when 92.3 million individuals were enrolled in the programs.[3] While this meant more people were covered, it is important to note that coverage should not be confused with better health outcomes and access to care. Medicaid in particular has shown negligible effects on health outcomes and scattered effects on access to care. While numerous studies have shown expanding Medicaid increases utilization of preventive health services and primary care, as well as expanded access to medications and reduced financial concerns around health care, other studies have shown little difference in health outcomes.[4] Of note, a 2012 experimental study on Oregon’s Medicaid expansion lottery in 2008 found that while mental health outcomes improved, measured clinical outcomes of blood pressure, cholesterol, and proxies for diabetes for individuals in the expansion population of the state’s program showed no more improvement compared to individuals who were not selected in the lottery (and were thus uninsured).[5] A 2018 study of state Medicaid expansion through the ACA found no effect on risk behaviors or health indicators such as smoking, alcohol consumption, or body mass index, nor on self-reported health measures including overall health, days in poor mental health, and days in poor physical health when compared to states that that did not expand Medicaid.[6] A variety of other studies that rely on self-reporting by beneficiaries have indicated general health improvements over the uninsured population, but these are contradicted by a 2021 Medicaid and CHIP Payment and Access Commission (MACPAC) report showing that adult beneficiaries on Medicaid routinely reported significantly worse levels of self-reported health status and chronic conditions compared to both privately insured and uninsured individuals (see figure 1).

Figure 1. Selected Health Measures for Adults Age 19–64 by Insurance Status, 2019[7]

Medicaid has also struggled to provide its enrollees with meaningful access to services. The 2021 MACPAC report found that adults on Medicaid were less likely to have a regular source of care (85.6 percent) compared to privately insured individuals (90.2 percent), though significantly more likely than uninsured individuals (59.1 percent).[8] Other studies have found that expansion states have a significant increase in residents delaying medical care due to longer wait times.[9],[10] This is not entirely surprising. The Medicaid population increased again during the pandemic, but the supply of physicians did not. While 95.6 percent of physicians accept private insurance, only 74 percent accept Medicaid.[11] A MACPAC analysis found that Medicaid expansion had no effect on physicians’ decision to accept Medicaid, and that Medicaid acceptance rate differences between states were only associated with payment rates – the higher the payment rate, the higher the rate of Medicaid acceptance.[12]

The overall cost of Medicaid is another major concern that should be kept in mind, particularly since the vast majority of states do not have the ability to use deficit spending to fund their health and welfare programs. The continuous enrollment provision enacted as part of the Families First Coronavirus Response Act (FFCRA) is largely responsible for the 9.2 percent growth in Medicaid expenditures in 2021 (the latest Medicaid data available), reaching over $734 billion.[13] 2020 had also seen a major jump in the growth of Medicaid expenditures at 9.3 percent from 2019 as a result of continuous enrollment provision, while in 2019, they only grew 4.6 percent from 2018.[14] The continuous enrollment provision, like the original ACA Medicaid expansion, was largely targeted at adults, and the expansion population seemed to have a crowd-out effect on traditional Medicaid and CHIP enrollees. A 2022 Mercatus Center study found that while spending growth was similar between expansion and non-expansion states, expansion states spent only 5.9 percent more per capita on children in 2019 than in 2013, while non-expansion states increased spending on children by 22.7 percent and average health care spending in the United States increased by 27 percent, indicating a shift in resources away from children toward expansion adults. It is possible that the growth of adults on Medicaid due to the continuous enrollment provisions further added to this crowd-out effect.

ACA Marketplace

Most individuals being disenrolled from Medicaid would qualify from the enhanced advance premium tax credits (APTCs) first implemented in ARPA and later extended until 2025 by the Inflation Reduction Act (IRA). These enhanced APTCs would provide zero-premium coverage on Silver-level Marketplace plans for individuals making up to 200 percent of the federal poverty level (FPL) and have a sliding scale of additional subsidies limiting individual premiums to a maximum of 6 percent for individuals making up to 400 percent of the FPL.[15] The enhanced APTCs have made the ACA Marketplace an attractive option as state and federal policymakers consider how to ensure coverage for disenrolled individuals. Moving individuals disenrolled from Medicaid onto the ACA Marketplace is a simple solution that requires policymakers to do almost nothing. This coverage is not without drawbacks, however, for the beneficiary, the federal government, and the U.S. health care system as a whole.

Like Medicaid, ACA Marketplace plans have more limited networks than private insurance. A 2020 study of insurance networks for large-group employer-based plans, small-group employer-based plans, Marketplace plans, Medicaid managed care (MMC), and Medicare Advantage (MA) plans looked at overall network breadth – meaning the percentage of hospitals or primary care physicians (PCPs) within a 60-minute drive – and exclusivity, meaning the percentage of overlapping hospitals or physicians shared with other networks across 50 states.[16] This paper focuses on network breadth alone. Below, figure 2 illustrates the study’s findings for both the average network breadth for each type of insurance, broken down by type of clinical care (PCP, cardiology, and acute care hospitals), as well as the percentage of large or extra-large PCP networks (specific percentages for other clinical types were not given in the study). Large networks were defined as those with between 40–60 percent of in-network PCPs within a 60-minute drive, and extra-large networks were defined as those with more than 60 percent of in-network PCPs within a 60-minute drive.

Figure 2. Network Breadth by Insurance Type

| Insurance Type | Clinical type | Average Network Breadth | L or XL Breadth Networks |

| Large-group | |||

| PCP | 57.3% | 81.3% | |

| Cardiology | 68.5% | ||

| Acute care hospital | 59.5% | ||

| Small-group | |||

| PCP | 45.7% | 60.3% | |

| Cardiology | 57.1% | ||

| Acute care hospital | 58.8% | ||

| Marketplace | |||

| PCP | 36.4% | 40.3% | |

| Cardiology | 45.6% | ||

| Acute care hospital | 51.0% | ||

| MMC | |||

| PCP | 32.2% | 32.8% | |

| Cardiology | 46.0% | ||

| Acute care hospital | 43.9% | ||

| MA | |||

| PCP | 47.4% | 68.3% | |

| Cardiology | 58.7% | ||

| Acute care hospital | 47.3% |

As the chart above demonstrates, large-group insurers have the largest networks in every category, while small-group and MA networks closely mirror each other as the next-largest networks, with the exception of acute care hospital breadth, where small-group insurers are nearly even with large-group insurers. Marketplace plans and MMC both mirror each other closely as well, and dramatically lag large-group, small-group, and MA plans in terms of network breadth in nearly all categories. In practical terms this means that working-age individuals who don’t get insurance through their employer have much more limited access to providers than individuals who do.

Additionally, premiums and deductibles in the Marketplace are generally higher than those offered by ESI plans. Average premiums before the enhanced APTCs in the ACA Marketplace for a benchmark plan (the second-lowest cost Silver-tier plan) are considerably higher ($5,472 annually, or $456 a month) than the average worker contribution to ESI premiums for single coverage in 2022 ($1,327 annually, or $110.58 a month).[17],[18] In 2022 for ESI plans, the average annual worker contribution at a small firm was $1,209, while at large firms it was $1,370.[19] Figure 3 demonstrates the effect the enhanced APTCs will have on premiums by household income, based on the 2022 FPL. It is notable that only when an individual made less than 242 percent of the FPL in 2022 do the ACA premiums drop below those of small firms.[20]

Figure 3. ACA Individual Premiums After Accounting for Enhanced APTCs

| Single-Person Income as Percent of FPL | Lowest Annual Premium | Highest Annual Premium |

| Up to 150.0% | $0.00 | $0.00 |

| 150.0% up to 200.0% | $0.00 | $543.60 |

| 200.0% up to 250.0% | $543.60 | $1,359 |

| 250.0% up to 300.0% | $1,359 | $2,446.20 |

| 300.0% up to 400.0% | $2,446.20 | $4,620.60 |

The average annual deductible for ESI single coverage in 2022 was $1,763. At small firms, the average annual deductible was $2,543, while at large firms it was $1,493.[21] Again, Marketplace plans are significantly more expensive. For those with Silver-tier plans who qualify (incomes between 200–250 percent of the FPL) for cost-sharing reductions, the average annual deductible is $4,205, while for those who do not qualify (incomes above 250 percent of the FPL), the average annual deductible is $4,890.[22] For those with incomes between 150–200 percent of the FPL, the average deductible drops sharply to $755, and for those below 150 percent of the FPL, the average deductible is $97.[23] It should be noted that only individuals making less than $27,180 qualify for significantly reduced deductibles in the latter two options, while the median personal income for full-time U.S. workers in 2022 was $57,200.[24]

The cost to the federal government for ACA subsidies is also quite high, particularly when viewed per enrollee. In 2022, the Congressional Budget Office (CBO) projected that $89 billion was spent on subsidies for the ACA Marketplace in 2022, which looks small when compared to the $316 billion spent on support for ESI through the tax exclusion granted to ESI benefits.[25] CBO further projects that, assuming the APTCs are allowed to expire in 2025, ACA subsidies will cost $111 billion in 2032, while ESI support will cost $612 billion in the same year. The fiscal cost-benefit ratio changes significantly when viewed per enrollee, however. In 2022, CBO projected that the federal government spent an average of $2,000 per enrollee in ESI support that year and estimated that spending would grow to $3,860 per enrollee in 2032. In comparison, CBO projected the federal government spent $5,820 per enrollee in ACA Marketplace subsidies in 2022 and expects that number to grow to $9,120 in 2032.[26] Again, those Marketplace subsidy numbers assume that Congress will allow the enhanced APTCs to expire in 2025. Given historical congressional reluctance to end temporary health care subsidy programs, it is likely that the enhanced APTCs, and the enhanced federal spending, will continue.

Why Small Business Plans?

AAF has written previously about the benefits of ESI. In fiscal terms, ESI provides around $1.5 trillion in value above the cost of the employer-sponsored tax exclusion. This includes $800–900 billion in private valuations for enrollees, $400–500 billion in employer profits and tax revenue net the cost of the tax exemption, $200 billion in reduced reliance on subsidized government insurance, and $40 billion [27] As noted above, ESI plans are able to obtain broader provider networks at reduced costs for the majority of working Americans.

While 97.3 percent of firms with 50 or more employees offered health insurance in 2021, only 31.9 percent of firms with fewer than 50 employees (the definitional cutoff of a small business) did so.[28] This is down from a peak of 47.2 percent in 2000, and down from 34.8 percent since 2013.[29] In the Agency for Healthcare Research and Quality chart referenced here, two noticeable dips can be seen in the last 15 years: the Great Recession from 2008–2011, followed by a somewhat stable period, then another beginning in 2014, the first year of ACA implementation and continuing through 2016 until another period of stabilization.[30] There are several reasons for this: Health care costs over the last 25 years have climbed almost exponentially and beyond the reach of smaller firms, ACA regulations on small group plans made it more expensive for small businesses to comply and offer plans, and the ACA Marketplace reduced the need for small businesses to offer health insurance when competing for employees with other firms – employees could still have coverage even if their employers did not offer it.

These latter two reasons are seemingly by design – they attack ESI without directly going after major firms’ and labor unions’ benefit packages and add more people to government-backed coverage programs, be it through the Marketplace or Medicaid expansions. The more individuals covered by these programs, which are expensive for the individual and have small networks, the more political pressure on the government to increase subsidization and benefits in these programs, making them more attractive and encouraging more small businesses to shed coverage. It is not difficult to see how this sort of spiral results in the continued expansion of federally-funded, government-managed health coverage.

In terms of the percentage that offer health benefits, small businesses have a lot of room to grow compared to large businesses and present a bulwark against the further federalization of health coverage. While small firms account for 61.7 million workers (or 46.4 percent of all U.S. employees), less than a third of small businesses offer coverage.[31] The next sections focus on options on which Congress could readily take action to reduce the regulatory and financial burden on small businesses and enable more of them to offer coverage.

Options to Encourage ESI Offerings by Small Businesses

Association Health Plans

AHPs are a legal instrument that allows smaller firms to group together to purchase insurance. The ability to purchase insurance as a group mimics the advantage of large-group insurance plans, which can use economies of scale to negotiate better deals for beneficiaries. While AHPs are technically allowed under the Employee Retirement Income Security Act (ERISA) of 1974, the current regulatory requirements for forming an AHP are so strict as to make them impractical and their use has dramatically declined since the implementation of the ACA.[32] For example, current statute requires that a group forming an AHP must be a “bona fide group,” generally defined by the Department of Labor (DOL) as an employer group with a “commonality of interest” beyond merely providing health insurance. Specifically, the “commonality of interest” standard tests if the “group or association has a sufficiently close economic or representational nexus to the employers and employees that participate in the plan”.[33] There are many reasons for the bona fide requirements, but they generally were meant to ensure DOL was only regulating employment-based arrangements under ERISA, rather than commercial insurance plans that are typically regulated by states. At present, the bona fide requirements have been strictly interpreted, and most groups bringing multiple employers together to purchase health care have had those plans regulated based on the size of the individual employer purchasing a plan, and thus generally relegated to the small-group market. Additionally, a 1983 law exempts AHPs from ERISA pre-emption, meaning that AHPs are subject to additional state regulations on top of federal regulations.[34]

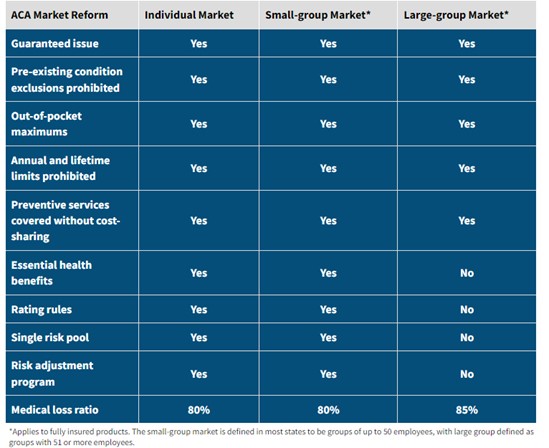

The small-group market has distinct disadvantages compared to the large-group market under the ACA in terms of regulatory structure (see figure 4) as well as user fee requirements for small-group and individual market plans (from 2.25–2.75 percent of premiums, not counting additional state taxes on these plans) and disadvantages when it comes to medical loss ratio requirements: Small-group plans can devote 20 percent of premiums to profit and overhead, while large-group plans can only devote 15 percent, meaning small-group plan enrollees see less of their premiums going toward benefits.

Figure 4. Regulatory Differences in the ACA by Plan Size

Source: American Academy of Actuaries Magazine

AHPs present an option to help small businesses and their employees address the deficiencies of the small-group market. In 2018, the Trump Administration attempted to create a more flexible regulatory scheme to allow more AHPs to form and allow more individuals (such as self-employed and “gig” workers) to join, among other reforms.[35] In 2019, however, this rule was challenged by 11 states and subsequently vacated by the courts; the case currently sits in abeyance in the Court of Appeals for the D.C. Circuit.[36] The courts found that DOL’s actions exceeded the authority provided it by Congress, clearly indicating the need for congressional action on this matter. The Paragon Health Institute (Paragon) has suggested multiple reforms to make AHPs more practical and accessible, including increased flexibility on the bona fide and commonality of interests standards, expanding AHPs to gig workers, and anti-fraud, good governance, and transparency provisions.[37] Congressman Tim Walberg (R-MI) has recently introduced legislation, the Association Health Plans Act, with some provisions similar to those proposed by Paragon, though the legislation completely disposes of the commonality of interest standard.[38]

Self-insurance and Stop-loss Protection

Many large employers are able to self-insure their plans, meaning that instead of purchasing a plan from an insurer, they will pay the full cost of the plan. While this assumes more financial risk, it allows the employer to better manage administrative costs and tailor plans to suit their employee’s’ specific needs. Self-insured plans are also exempt from several ACA and state-mandated coverage requirements, including requirements to cover all essential health benefits defined under the ACA.

Because of the financial risk of self-insurance, many small businesses are reluctant to self-fund. This financial risk can be mitigated through stop-loss insurance, whereby a small business can insures itself, depending on the arrangement, against particularly high individual claims and/or large aggregate claims. In an effort to prevent more businesses from offering less-regulated health benefits through self-insurance, however, some states have created high “attachment points” – the dollar amount of a claim for which a self-insured fund is responsible before stop-loss insurance can kick in.[39] These state-mandated attachment points may be too high for small businesses to afford, making self-insurance impractical.

These state mandates can be avoided through AHPs, which are regulated under ERISA. Ensuring that stop-loss coverage remains federally permissible, as well as ensuring that it is unburdened by excessive federal and state regulation, will be crucial to ensuring small businesses in AHPs are able to self-insure in a practical way. To this end, Representative Bob Good (R-VA) has introduced the Self-Insurance Protection Act, which would limit the ability of federal agencies to regulate stop-loss insurance and preempt states from banning the purchase of stop-loss insurance by any employee benefit plan under ERISA. Additionally, Paragon has suggested that Congress encourage “level-funded” plans (which confer some of the benefits of a self-funded plan to small and mid-sized businesses without the same expense or risk), while requiring self-funded AHPs to have stop-loss insurance covering both high-cost individual and aggregate eventualities.[40]

Tax Credits

As noted above, the small-group market has all the regulatory requirements of the individual market with none of the scale advantages of the large-group market, making health benefits a costly prospect for small businesses. To address this, the ACA created a small business health care tax credit.[41] This tax credit is extremely limited in both value and utilization, however. To qualify, employers must have fewer than 25 full-time equivalent employees, pay an average wage of no more than $50,000 in 2014 dollars ($64,844.43 in 2023), offer a qualified health plan through the small-group market, and pay at least 50 percent of the cost of employee-only (excluding family or dependents) coverage. The maximum amount of the tax credit equals 50 percent of premiums paid and is only available for two consecutive tax years. As with other ACA provisions mentioned above, this credit almost seems designed to be impractical – a campaign line about helping small businesses that in reality does very little to help. The proof of the tax credit’s ineffectiveness is in the utilization numbers: In 2016 (the last year for which data was available from the Internal Revenue Service), only around 7,000 firms out of around 30 million took advantage of the tax credit.[42]

Congress has several options to make this tax credit more practical. First, Congress could raise the employee limit to 50 full-time equivalent employees to make the credit available to all small businesses. Second, it could remove the average wage cap, which is itself an incentive for small businesses to keep wages down. Third, in conjunction with reforms to AHPs, Congress could expand this credit to small businesses in an AHP or attempting to provide level-funded plans. As noted previously, federal tax subsidies of ESI are significantly cheaper per enrollee than ACA subsidies and provide significantly more economic value in addition to improved access to larger provider networks and lower costs to the enrollee. Finally, Congress should consider raising the value of the credit, though that may prove prohibitively expensive when added to these other reforms.

Telehealth Benefits

The PHE granted employers some flexibility to provide stand-alone telehealth benefits to employees who did not qualify for employer coverage, often because they were seasonal or part-time. While not the same as full coverage, telehealth allows increased access to care for employees in a manner that is cost effective for both the employee and the health system at large. The end of the PHE has brought an end to these benefits, and Congress should act to ensure that these separate telehealth plans remain an option for employers and employees.

Conclusion

The end of the PHE and the continuous enrollment provisions are creating major changes in sources of insurance, namely moving individuals off Medicaid and onto the ACA Marketplace or ESI. These changes are not a negative occurrence – rather, they provide an opportunity for policymakers to re-examine our nation’s health coverage strategy and explore and expand options for coverage. Small businesses present the best bargain in this moment: Small firms that offer health plans generally procure stronger provider networks and lower costs for enrollees than ACA plans and offer a bulwark against the increasing federalization of health coverage. By increasing options for small businesses to provide coverage through AHPs, better-designed tax incentives, and telehealth benefits, policymakers can ensure that more individuals have not merely an insurance card, but true coverage that is less expensive and of higher quality.

[1] https://www.urban.org/sites/default/files/publication/104785/what-will-happen-to-unprecedented-high-medicaid-enrollment-after-the-public-health-emergency_0.pdf

[2] https://www.americanactionforum.org/weekly-checkup/should-we-celebrate-medicaids-record-enrollment/

[3] https://www.kff.org/coronavirus-covid-19/issue-brief/analysis-of-recent-national-trends-in-medicaid-and-chip-enrollment/#:~:text=After%20declines%20in%20enrollment%20from,steadily%20increase%20(Figure%201).

[4] https://www.texaspolicy.com/wp-content/uploads/2020/04/Blase-Balat-Medicaid-Expansion.pdf

[5] https://www.nejm.org/doi/full/10.1056/nejmsa1212321

[6] https://www.cato.org/research-briefs-economic-policy/early-effects-affordable-care-act-health-care-access-risky-health

[7] https://www.macpac.gov/wp-content/uploads/2012/06/Access-in-Brief-Adults-Experiences-in-Accessing-Medical-Care.pdf

[8] Ibid.

[9] https://www.nejm.org/doi/full/10.1056/NEJMsa1612890

[10] https://www.healthaffairs.org/doi/full/10.1377/hlthaff.2017.0830

[11] https://www.shadac.org/news/14-17-physician-Mcaid-SHC

[12] http://www.macpac.gov/wp-content/uploads/2019/01/Physician-Acceptance-of-New-Medicaid-Patients.pdf

[13] https://www.cms.gov/research-statistics-data-and-systems/statistics-trends-and-reports/nationalhealthexpenddata/nhe-fact-sheet

[14] https://www.cms.gov/newsroom/press-releases/cms-office-actuary-releases-2019-national-health-expenditures

[15] https://www.americanactionforum.org/insight/the-inflation-reduction-acts-health-care-provisions/

[16] https://jamanetwork.com/journals/jamanetworkopen/fullarticle/2774285

[17] https://www.kff.org/health-reform/state-indicator/average-marketplace-premiums-by-metal-tier/?currentTimeframe=0&selectedDistributions=average-benchmark-premium&sortModel=%7B%22colId%22:%22Location%22,%22sort%22:%22asc%22%7D

[18] https://files.kff.org/attachment/Report-Employer-Health-Benefits-2022-Annual-Survey.pdf

[19] Ibid.

[20] https://www.kff.org/interactive/subsidy-calculator/#state=&zip=&income-type=percent&income=242%25&employer-coverage=0&people=1&alternate-plan-family=&adult-count=1&adults%5B0%5D%5Bage%5D=21&adults%5B0%5D%5Btobacco%5D=0&child-count=0

[21] Ibid.

[22] https://www.kff.org/slideshow/cost-sharing-for-plans-offered-in-the-federal-marketplace/

[23] Ibid.

[24] https://www.bls.gov/news.release/pdf/wkyeng.pdf

[25] https://www.cbo.gov/system/files/2022-06/57962-health-insurance-subsidies.pdf

[26] Ibid.

[27] https://www.americanactionforum.org/insight/the-value-of-employer-sponsored-health-insurance-a-summary/

[28] https://datatools.ahrq.gov/meps-ic?type=tab&tab=mepsich3ntl

[29] Ibid.

[30] Ibid.

[31] https://www.forbes.com/advisor/business/small-business-statistics/#:~:text=Nearly%20half%20of%20all%20U.S.,even%20have%20employees%20at%20all

[32] https://paragoninstitute.org/wp-content/uploads/2023/04/AHP-Policy-Brief-FINAL-202304251653.pdf

[33] https://www.federalregister.gov/d/2018-12992/p-20

[34] 29 U.S.C. §1144(b)(6)(A).

[35] https://www.federalregister.gov/documents/2018/06/21/2018-12992/definition-of-employer-under-section-35-of-erisa-association-health-plans#h-7

[36] https://edworkforce.house.gov/uploadedfiles/4.26.23_health_care_costs_hearing_white_testimony_final.pdf

[37] https://paragoninstitute.org/wp-content/uploads/2023/04/AHP-Policy-Brief-FINAL-202304251653.pdf

[38] https://www.congress.gov/bill/118th-congress/house-bill/2868?q=%7B%22search%22%3A%5B%22association+health+plans+act%22%5D%7D&s=1&r=1

[39] https://content.naic.org/sites/default/files/inline-files/SLI_SF.pdf

[40] https://paragoninstitute.org/wp-content/uploads/2023/04/AHP-Policy-Brief-FINAL-202304251653.pdf

[41] https://www.irs.gov/affordable-care-act/employers/small-business-health-care-tax-credit-and-the-shop-marketplace

[42] https://edworkforce.house.gov/uploadedfiles/4.26.23_health_care_costs_hearing_white_testimony_final.pdf