Insight

June 18, 2025

Highlights of the 2025 Social Security and Medicare Trustees’ Reports

Executive Summary

- The Social Security and Medicare Trustees today released their annual reports on the financial status of the nation’s two largest entitlement programs; the reports reiterate a past conclusion: Social Security and Medicare are approaching insolvency.

- The Medicare Trustees estimate the Medicare Hospital Insurance (Part A) trust fund will be insolvent by 2033, at which point Medicare Part A benefit spending will be slashed by 11 percent.

- The Social Security Trustees estimate the Social Security Old-Age and Survivors Insurance trust fund will deplete its reserves by 2033 and the Social Security Disability Insurance trust fund will remain solvent at least through 2099; the theoretically combined Social Security trust funds will be insolvent by 2034, at which point all beneficiaries regardless of age, income, or need will face a 19 percent benefit cut.

- These projections show that both Social Security and Medicare are on the verge of bankruptcy and highlight the need for policymakers to enact trust fund solutions sooner rather than later to prevent across-the-board benefit and spending cuts.

Introduction

Today, the Social Security and Trustees released their annual reports on the financial status of the nation’s two largest entitlement programs. Like past reports, the 2025 Social Security and Medicare Trustees reports conclude that Social Security and Medicare are approaching insolvency. The Medicare Trustees estimate the Medicare Hospital Insurance (HI) trust fund, which funds Medicare Part A, will be insolvent by 2033. The Social Security Trustees estimate the Social Security Old-Age and Survivors Insurance (OASI) trust fund will deplete its reserves by 2033 and the Social Security Disability Insurance (SSDI) trust fund will remain solvent at least through 2099. On a theoretically combined basis, assuming dedicated revenue is reallocated in the years between OASI and SSDI insolvency, the Social Security trust funds will be insolvent by 2034.

The Long-term Solvency of Medicare

Today, the Medicare Trustees released their 2025 report on the financial status of the Medicare program. The report delivered yet another reminder to policymakers and the public that Medicare is undeniably going bankrupt.

The Medicare Trustees estimate the Medicare HI trust fund will be insolvent by 2033. While the bankruptcy projection may snag the headlines, there are three key budgetary numbers that shouldn’t go unnoticed.

| -$510.5 Billion | Medicare Annual Cash Flow in 2024

· In 2024, Medicare spent $1.1 trillion on medical services for the nation’s seniors but only collected $611.6 billion of revenue from payroll taxes and monthly premiums. · Medicare Part A ran a $28.7 billion surplus in 2024. The HI surplus represented 1.4 percent of the federal budget deficit in 2024.

|

| $7.38 Trillion | Medicare’s Cumulative Cash Shortfall Since 1965

· Medicare has faced a cash shortfall every year since its creation except in 1966 and 1974. · Medicare covers its cash shortfalls by “borrowing” unrelated tax revenue. |

| 26 Percent | Medicare’s True Contribution to the National Debt

· The nation’s fiscal trajectory is unsustainable, and Medicare is a primary source of red ink. · Medicare’s cash shortfall is responsible for about a quarter of the national debt. |

Sources: Centers for Medicare and Medicaid Services and authors’ calculations.

Continuing with the Medicare status quo is unsustainable. Balancing Medicare’s annual cash shortfalls under the existing system would prove devastating to seniors and failing to reform the status quo would result in the following:

| $6,482 Increase | Annual Premium Increase Needed to Balance Medicare Part B

· In 2024, the Medicare Part B (physicians) cash deficit was $408 billion. · Seniors’ premiums for physicians would need to increase by 292 percent to cover the deficit, meaning the typical annual physician premium cost for seniors would increase by $6,482, from $2,220 to $8,702. |

| $2,889 Increase | Annual Premium Increase Needed to Balance Medicare Part D

· In 2024, the Medicare Part D (prescription drugs) cash deficit was $126.4 billion. · Seniors’ premiums for prescription drugs would need to increase by 655 percent to cover the deficit, meaning the annual drug premium cost to seniors would increase by $2,889, from $441 to $3,330. |

Sources: Centers for Medicare and Medicaid Services and authors’ calculations.

The Executive Branch’s Stewardship of Medicare

An Evaluation of the Executive Branch’s Medicare Stewardship

Each year, the Medicare Trustees report provides a nonpartisan evaluation of the president’s stewardship of Medicare. Prepared annually for Congress by the Office of the Chief Actuary, the report offers unparalleled detail on the financial operations and actuarial status of the Medicare program. In short, it’s where every administration’s soaring Medicare rhetoric meets fiscal reality. So far, President Trump has resisted undertaking significant Medicare reform. The 2025 Medicare Trustees report provides a sense of what the future may look like should Medicare continue to remain unchanged, and why sooner or later broader Medicare reform is inevitable.

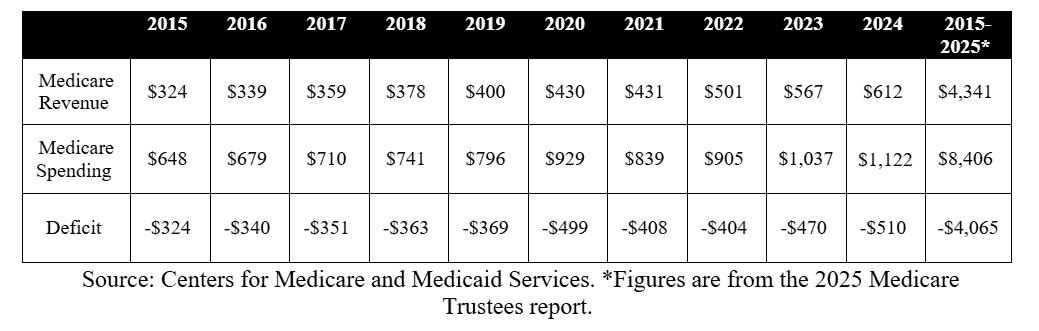

Medicare Financial Operations (Billions of dollars)

The first Trump Administration oversaw a $1.6 trillion cash shortfall over four years (2017–2020). The Biden Administration oversaw its own $1.6 trillion cash shortfall over four years (2021–2024). This year will also be impactful due to the enactment of recent changes to coverage under the Medicare program, including cost-sharing and out-of-pocket caps, which are expected to increase government outlays. In short, Medicare’s fiscal trajectory guarantees bankruptcy.

With such unprecedented levels of cash shortfalls continuing through the budget horizon, maintaining the status quo ensures that Medicare will soon not exist for today’s seniors, let alone future generations of Americans. These rising costs and the measures necessary to cover them will increasingly harm seniors if Medicare reform is not undertaken.

| Medicare and Medicaid Will Cost $1.9 Trillion in 2025 | Medicare Costs Will Continue to Rise

· At their current pace, Medicare and Medicaid will cost approximately $1.9 trillion in 2025. · The budget shortfall remains imminent, even as Medicare premiums and deductibles rise. |

Sources: Centers for Medicare and Medicaid Services and authors’ calculations.

The Long-term Solvency of the Theoretically Combined Social Security Trust Funds

Today, the Social Security Trustees released their 2025 report on the financial status of the Social Security program. The report shows that the financial outlook for the nation’s primary safety net for retirees, survivors, and the disabled will fail to meet its promises to future seniors in the absence of meaningful reform.

The Social Security Trustees estimate the OASI trust fund will deplete its reserves by 2033 and the SSDI trust fund will remain solvent at least through 2099. On a theoretically combined basis, assuming dedicated revenue is reallocated in the years between OASI and SSDI insolvency, the Social Security trust funds will be insolvent by 2034, one year earlier than last year’s estimate. The report demonstrates the program’s structural imbalance that puts the retirement benefits of millions of retirees and their survivors as well as disabled workers at risk.

The year 2034 is only nine years away, which means that Social Security will go bankrupt when today’s 58-year-olds reach the normal retirement age of 67 and today’s youngest retirees – those retiring at age 62 – turn 71.

| $136 Billion | Social Security’s Contribution to the Debt in 2024

· In 2024, Social Security spent $1.5 trillion but only collected $1.3 trillion in non-interest income (payroll tax collections and benefit tax collections). · This is the 15th consecutive year in which Social Security has run a cash deficit, with the program running a $1.1 trillion cumulative cash deficit since 2010. |

| $25.1 Trillion | Social Security’s Open-group Unfunded 75-year Liability

· Social Security’s promised benefits exceed projected payroll tax revenue and trust fund redemptions by $25.1 trillion. · Social Security faces a 75-year actuarial imbalance of 3.8 percent of taxable payroll – 0.3 percentage points higher than last year’s estimate of 3.5 percent of taxable payroll. |

| Nine Years | · The theoretically combined Social Security trust funds (OASI and SSDI) will be exhausted in nine years.

· The horizon to exhaustion remains the shortest since 1982. |

Sources: Social Security Administration and authors’ calculations.

The Social Security Trustees’ report paints a troubled picture of Social Security’s financial health and demonstrates that the present course is unsustainable. Social Security is now contributing to the annual deficit, while promised benefits exceed planned funding by over $25 trillion. The implications of failing to reform the status quo are:

| 19 Percent | Reduction in Benefits in 2034

· After the exhaustion of the Social Security trust funds, Social Security revenue will only be able to cover 81 percent of the promised benefits, which means all beneficiaries regardless of age, income, or need will face a 19-percent benefit cut. · The projected benefit cut climbs to 28 percent by 2099. |

| 29 Percent | Payroll Tax Increase

· Absent reforms to restore Social Security’s long-term solvency, payroll taxes would need to be increased immediately by 29 percent (3.7 percentage points), from 12.4 percent to 16.1 percent. |

Sources: Social Security Administration and authors’ calculations.

The Long-term Solvency of the Social Security Old-Age and Survivors Insurance Trust Fund

The 2025 Social Security Trustees report shows that OASI program remains unsustainable and will be unable to meet the needs of current and future beneficiaries absent significant reforms.

The Social Security Trustees estimate the OASI trust fund will exhaust its reserves by 2033. The report also makes clear several additional structural challenges that endanger the millions of current and future retirees and survivors who rely on this program.

| $167 Billion | OASI’s Contribution to the Debt in 2024

· In 2024, the OASI program spent $1.3 trillion but only collected $1.2 trillion in non-interest income. · This is the 15th consecutive year in which the OASI program has run a cash deficit, with the program running a $1.1 trillion cumulative cash deficit since 2010. |

| $26.1 Trillion | OASI’s Open-group Unfunded 75-year Liability

· Social Security’s promised retirement and survivors’ benefits exceed projected payroll tax revenue and trust fund redemptions by $26.1 trillion. |

| 8 Years | Eight Years Until the OASI Trust Fund is Depleted

· The horizon to the OASI trust fund’s exhaustion is one year earlier than last year’s report. · Eight years is the second-shortest horizon until OASI trust fund exhaustion since 1982. |

| 72 Million | Number of OASI Beneficiaries in 2033 (Exhaustion Year)

· Nearly 72 million retirees and their survivors are projected to receive OASI benefits in the year the trust fund is projected to become insolvent. · The 72 million figure is composed of nearly 66 million retired workers and their auxiliaries and nearly 6 million survivors. |

Sources: Social Security Administration and authors’ calculations.

The Long-term Solvency of the Social Security Disability Insurance Trust Fund

The 2025 Social Security Trustees report shows continued improvement to the financial outlook for the SSDI program.

The Social Security Trustees estimate the SSDI trust fund will remain solvent over the 75-year projection window. This marks the fourth time since 1983 that the SSDI program has been sustainable over the long term. The program faced solvency challenges in recent years that required a payroll tax reallocation in 2015.

| -$31 Billion | SSDI’s Contribution to the Debt in 2024

· In 2024 the SSDI program was in balance, but the program has added $82 billion to the national debt since 2010. · Recent improvements to the SSDI program’s cash position reflect a significant decline in benefit applications and awards. |

| -$968 Billion | SSDI’s Open-group Unfunded 75-year Liability

· Social Security’s promised disability benefits are funded over the long term, a reflection of the recent improvement and payroll tax reallocation. |

Sources: Social Security Administration and authors’ calculations.

The 2025 Social Security Trustees report makes clear that the primary federal entitlement program remains unsustainable. On its present course, the program is on track to reduce benefits by 19 percent for all beneficiaries regardless of age, income, or need in just nine years if steps are not taken to shore up its finances.