Insight

February 7, 2024

Highlights of CBO’s Update to the Budget and Economic Outlook for 2024–2034

Executive Summary

- According to new projections from the Congressional Budget Office (CBO), the national debt will eclipse the highest levels in U.S. history by the end of fiscal year 2028.

- Since CBO’s last budget baseline update in May of 2023, the net effect of spending caps enacted under the Fiscal Responsibility Act, as well as other economic and technical factors, reduces projected deficits by $1.4 trillion over 10 years.

- CBO projects weaker near-term growth, incrementally more persistent inflation, and higher interest rates than previously projected – however, this is in part a feature of stronger economic performance since CBO’s last estimate.

Introduction

The Congressional Budget Office (CBO) released its updated budget and economic outlook, which provides Congress with a 10-year budget and economic baseline to assess the cost of legislation. Since the last full update in February of 2023, and budget update in May of 2023, only one major piece of legislation has materially affected the budget outlook: the Fiscal Responsibility Act (FRA), which imposed caps on discretionary spending. Nevertheless, this legislation ultimately altered the budget outlook more than the net effects of CBO’s other revisions to the budget and economic outlook. Beyond the enactment of the FRA, the most substantial evolutions in the current outlook reflect the complex dynamics of an economy navigating the last mile of disinflation, while still running historically aberrant structural deficits. The budgetary and economic outlook reflects the costs of those recent challenges, both in the incremental accumulation of debt and the growing cost of servicing that additional debt.

What’s Changed?

The current CBO budget outlook is incrementally improved from CBO’s May 2023 budget outlook. This improvement is almost entirely driven by CBO’s projections of savings from the FRA projected over the budget window. CBO estimates the FRA will save $2.6 trillion over the next decade in discretionary spending and associated debt service. It is important to note, however, that unlike changes to tax rates or mandatory programs, the FRA caps apply to discretionary spending, which is revisited annually, and only for two years. Beyond this change, the budget outlook was most affected by CBO’s revised economic outlook, which presumes higher interest rates than previously estimated. These revisions increase CBO’s interest costs estimates related to previous projections by over $1.1 trillion. These features combine with more modest economic and technical factors to reduce cumulative deficits over the period 2024–2033 by $1.4 trillion compared to CBO’s last estimate.

The Budget Outlook: By the Numbers

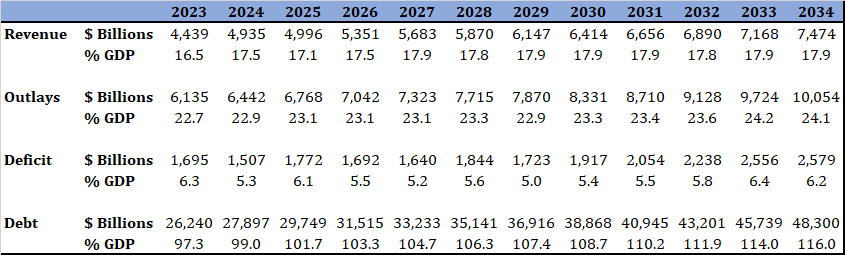

Taxes: By the end of the 10-year budget window, tax revenues will amount to 17.9 percent of gross domestic product (GDP). Tax revenues will average 17.8 percent of GDP over the next 10 years, 0.4 percentage points above the 17.4 percent historical average. CBO previously estimated that tax revenues would average 18.0 percent of GDP over the budget window.

Spending: CBO estimates that, by the end of the budget window, overall spending will total 24.1 percent of GDP, and will average 23.4 percent of GDP – 3 percentage points higher than the 60-year historical average of 20.4 percent of GDP. The only other 10-year period during which spending was higher on average spanned both World War II and the Korean War. Entitlement, or mandatory, spending will remain roughly 60 percent of federal outlays over the next decade. It comprised 61 percent of federal outlays in 2023, up from 59 percent in 2013 and 33 percent in 1973.

Deficits: CBO projects that the United States will run a unified federal budget deficit of $1.5 trillion in 2024, or 5.3 percent of GDP. This follows a $1.7 trillion deficit recorded in 2023, and a $1.4 trillion deficit recorded in 2022. Notwithstanding the record deficits posted in 2020 and 2021, the highest nominal deficit ever previously recorded was $1.4 trillion in 2009. The deficit will average 5.7 percent of GDP over the 2025–2034 period, never falling below $1 trillion, and ultimately eclipsing $2 trillion in 2031.

Interest Payments: Interest payments on the debt will reach $1.6 trillion in 2034. For context, the Tax Cuts and Jobs Act was estimated to cost $1.45 trillion over a decade. Interest payments are projected to increase over 50 percent as a share of federal outlays, rising from 11 percent of total federal spending in 2022 to over 16 percent of federal spending in 2034. Interest payments are already larger than any other federal agency’s operating budget except for the Department of Defense’s.

Debt Held by the Public: Borrowing from the public is projected to increase as a share of the economy under current law, reaching 116.0 percent of GDP in 2034. In 2028, the debt is expected to reach the highest level as a share of GDP in U.S. history, surpassing the 106.1 percent record from 1946 following the end of World War II.

The Economic Outlook: By the Numbers

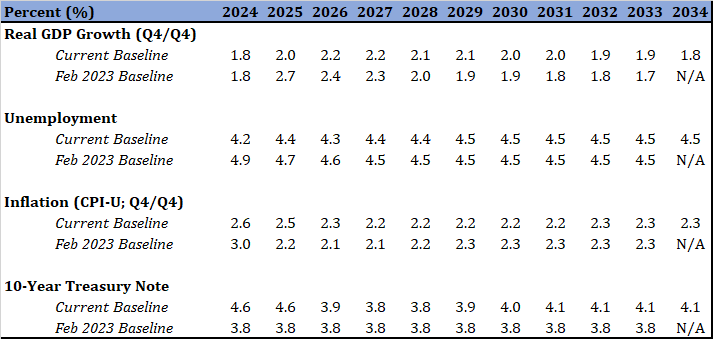

CBO projects real GDP growth to average 2.0 percent over the budget window. Over the same period (2024–2034), real GDP similarly averaged 2.0 percent in CBO’s February 2023 projection, but for somewhat different reasons. CBO’s 2023 projection had a uniquely pessimistic outlook for growth in 2023 (note that CBO has since released short-term, incremental updates) which the economy outperformed substantially. Accordingly, in CBO’s current baseline projections, the economy is beginning 2024 from a much stronger position than CBO previously estimated. With higher growth, CBO estimates inflation will be lower in the near term, but incrementally more persistent. Relatedly, CBO assumes interest rates will be higher over the budget window than previously estimated. Indeed, compared to CBO’s previous projection, the yield on a 10-year Treasury security would average 30 basis points higher than previously forecast over the budget window. Essentially, CBO was assuming something of a “hard landing” in 2023 that did not materialize.