Insight

May 29, 2024

Highlights of CBO’s Long-Term Alternative Scenarios Report

Executive Summary

- The Congressional Budget Office’s (CBO) latest Long-Term Budget Outlook projects that federal debt held by the public will rise from 99 percent of gross domestic product (GDP) at the end of Fiscal Year (FY) 2024 to 166 percent of GDP by the end of 2054; CBO’s projections assume current law and are based on its February economic forecast.

- In a new report, CBO analyzed eight alternative scenarios and their impact on the long-term fiscal outlook: Six scenarios examined how changes in economic conditions affect the budget outlook and two looked at how changes in budgetary conditions impact it; under these scenarios, debt could be as low as 99 percent of GDP by the end of FY 2054 or as high as 307 percent of GDP.

- In all but one scenario, debt will continue to grow as a share of the economy over the long term; high debt levels slow economic growth and place upward pressure on interest rates.

Introduction

The Congressional Budget Office’s (CBO) latest Long-Term Budget Outlook projects that federal debt held by the public will rise from 99 percent of GDP at the end of FY 2024 to 166 percent by the end of 2054. CBO’s long-term budget projections assume current law and are based on its February economic forecast. In a new report, CBO analyzed eight alternative scenarios to show how changes in economic and budgetary conditions would affect the long-term fiscal outlook. Under CBO’s alternative scenarios, debt could be as low as 99 percent of GDP by the end of 2054 or as high as 307 percent of GDP. High debt levels slow economic growth and place upward pressure on interest rates.

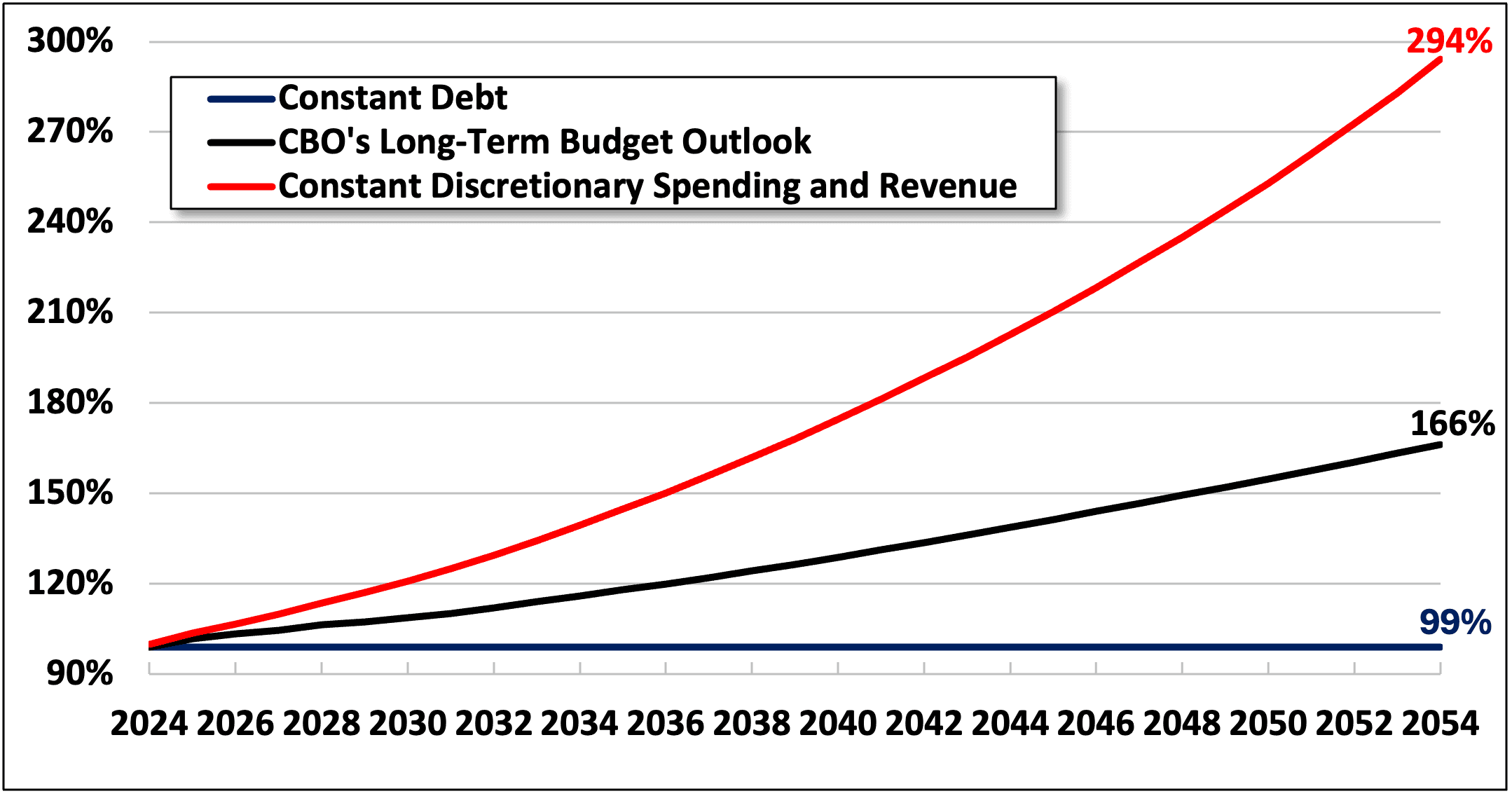

How Changes in Budgetary Conditions Affect CBO’s Long-Term Budget Outlook

CBO analyzed two scenarios in which budgetary conditions differ from those in its long-term baseline. Under its baseline, CBO expects discretionary spending to average 5.1 percent of GDP over the Fiscal Year (FY) 2024 to 2054 period and revenue to average 18.2 percent of GDP. If instead discretionary spending and revenue were held constant at their 30-year historical averages as a share of GDP – 7.0 and 17.2 percent of GDP, respectively – debt would rise to 294 percent of GDP by the end of 2054. Economic output in 2054 would be 5 percent lower and interest rates 80 basis points (0.8 percentage points) higher.

CBO also looked at the impact of holding debt constant at CBO’s FY 2024 projection of 99 percent of GDP through 2054. To do this, policymakers would need to generate $54.4 trillion of long-term deficit reduction – the net effect of $31.8 trillion of primary savings and $22.6 trillion of interest savings. That would be equivalent to cutting all projected annual primary (non-interest) spending by 10 percent or increasing projected annual revenue by 11 percent. Assuming the savings are evenly distributed between primary spending cuts and revenue increases, annual non-interest spending would have to be slashed by 5 percent and annual revenue increased by 5 percent.

Under the stable debt scenario, CBO estimates economic output in 2054 would be 3 percent higher and interest rates 40 basis points (0.4 percentage points) lower. Income per person in 2054 would be $5,500 higher.

Changes in Budgetary Conditions Affect the Long-Term Budget Outlook

Source: Congressional Budget Office.

How Changes in Economic Conditions Affect CBO’s Long-Term Budget Outlook

CBO’s alternative scenarios generally account for the fact that high budget deficits and debt levels “crowd out” private investment, which leads to slower economic growth and higher interest rates. In its report, CBO estimates that for every new dollar the federal government borrows, private investment falls by 33 cents. This means that investors are purchasing government bonds instead of making productive investments in private capital.

In one scenario, CBO estimated that removing the effect of government borrowing on private investment – that is, assuming no crowd out – would cause debt to rise to only 130 percent of GDP by the end of FY 2054, compared to 166 percent under current law. Economic output would be nearly 6 percent higher and interest rates 70 basis points (0.7 percentage points) lower than in CBO’s long-term baseline. At the same, income per person – as measured by real gross national product – would be $8,700 higher in 2054.

In another scenario, CBO assumed the effect of government borrowing on private investment (crowd out) is twice as strong, meaning that for every new dollar the federal government borrows, private investment falls by 66 cents. Under such a scenario, debt would rise to 307 percent of GDP by the end of FY 2054, economic output would be 19 percent lower, and interest rates 200 basis points (two full percentage points) higher than in CBO’s long-term baseline.

Sensitivity of Private Investment to Government Borrowing Affects Long-Term Budget Outlook

Source: Congressional Budget Office.

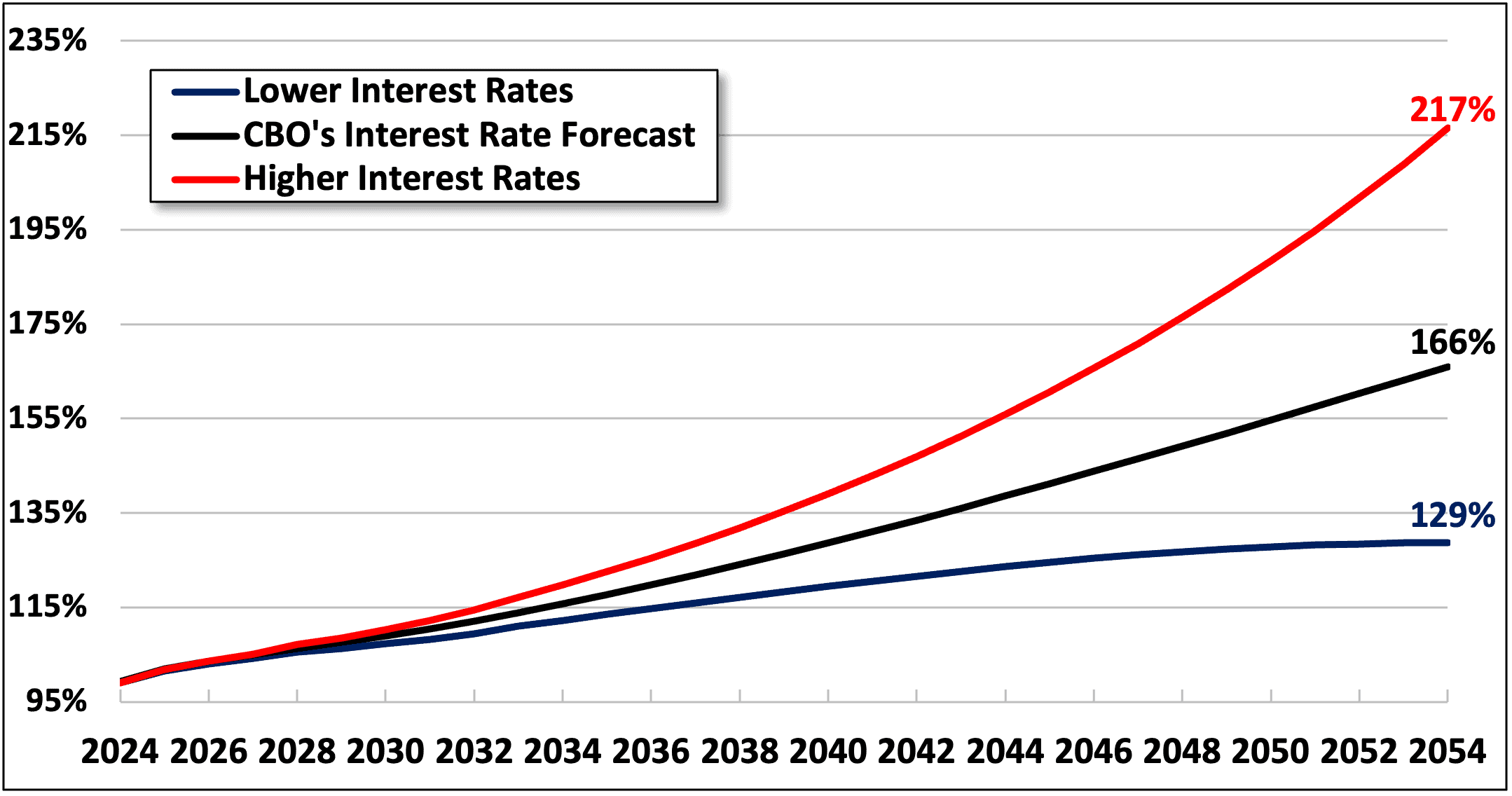

CBO also examined how higher or lower interest rates relative to its economic forecast affect the long-term budget outlook. Under its baseline, CBO expects the average interest rate on federal debt held by the public to rise by about 70 basis points (0.7 percentage points) between FY 2024 and 2054, from 3.3 percent to 4.0 percent. If instead the average interest rate was to be five basis points higher in 2024, and then subsequently increased by five basis points per year to reach 5.8 percent by 2054 (180 basis points or 1.8 percentage points higher than in CBO’s long-term baseline), debt would rise to 217 percent of GDP by the end of 2054, compared to 166 percent under current law. Economic output in 2054 would be 2 percent smaller and income per person $3,900 lower.

Alternatively, if the average interest rate on debt held by the public was the same in 2024 and then subsequently increased by roughly one basis point per year so that it reached 2.2 percent by 2054 (180 basis points or 1.8 percentage points lower than in CBO’s long-term baseline), debt would rise to only 129 percent of GDP by the end of 2054, economic output would be 2 percent larger, and income per person $3,000 higher.

Higher or Lower Interest Rates Affect the Long-Term Budget Outlook

Source: Congressional Budget Office.

In addition, CBO looked at how faster or slower growth in total factor productivity (TFP) relative to its economic forecast affects the long-term budget outlook. Under its baseline, CBO expects TFP to grow an average of 1.1 percent per year. If TFP grew 0.5 percentage points faster per year than in CBO’s long-term baseline, debt would rise to only 124 percent of GDP by the end of FY 2054, compared to 166 percent under current law. Economic output in 2054 would be nearly 17 percent higher and interest rates 50 basis points (0.5 percentage points) higher than in CBO’s long-term baseline. Income per person in 2054 would be $20,800 higher.

On the other hand, if TFP grew 0.5 percentage points slower per year than in CBO’s long-term baseline, debt would rise to 211 percent of GDP by the end of 2054. Economic output in 2054 would be about 14 percent lower and interest rates 50 basis points (0.5 percentage points) lower than in CBO’s long-term baseline. Income per person in 2054 would be $17,400 lower.

Faster or Slower Growth in Total Factor Productivity Affects the Long-Term Budget Outlook

Source: Congressional Budget Office.

Conclusion

CBO’s report shows that changes in economic and budgetary conditions significantly impact the long-term budget outlook. In all but one of CBO’s alternative scenarios, debt would continue to grow as a share of the economy over the long term. The faster debt grows, the more it will cause economic growth to wane and interest rates to rise.

Faster or Slower Growth in Total Factor Productivity Affects the Long-Term Budget Outlook