Insight

June 18, 2024

Highlights of CBO’s June Update to the Budget and Economic Outlook for 2024 to 2034

Executive Summary

- The Congressional Budget Office’s (CBO) latest Budget and Economic Outlook projects that federal debt held by the public will rise from 99 percent of gross domestic product (GDP) at the end of Fiscal Year (FY) 2024, to a record 106.2 percent of GDP by 2027, and later to 122 percent of GDP by the end of 2034.

- Budget deficits will total 6.3 percent of GDP ($22.1 trillion) over the FY 2025 to FY 2034 budget window and will reach 6.9 percent of GDP ($2.9 trillion) by 2034; spending will total 24.1 percent of GDP ($84.9 trillion) and revenue will total 17.8 percent of GDP ($62.8 trillion) over the next decade.

- Since CBO’s last baseline in February, the net effect of legislative, economic, and technical changes increased projected deficits by $2.5 trillion over the FY 2024 to FY 2034 period.

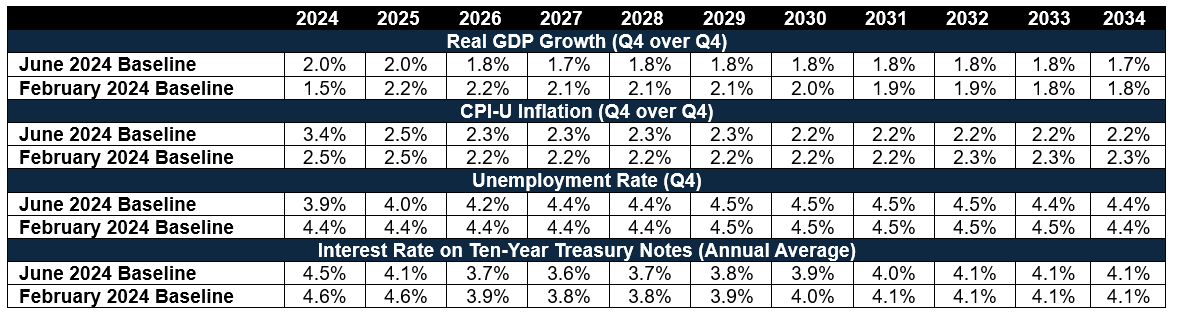

- CBO projects weaker near-term economic growth, incrementally more persistent inflation, and lower interest rates than previously projected.

Introduction

The Congressional Budget Office (CBO) has released its June 2024 Budget and Economic Outlook, which updates its February 2024 Budget and Economic Outlook to account for subsequent legislation and executive actions, recent trends in inflation, economic growth, interest rates, immigration, and other factors. Overall, the budget outlook has worsened since February due to both legislative and technical changes. Projected deficits over the Fiscal Year (FY) 2024 to FY 2034 period are $2.5 trillion higher than CBO estimated in February and debt held by the public is projected to reach 122 percent of gross domestic product (GDP) by the end of 2034, six percentage points higher than CBO’s February estimate of 116 percent of GDP.

What’s Changed?

The budget outlook has worsened since CBO’s February 2024 budget outlook. CBO now projects deficits to total $24.0 trillion over the FY 2024 to FY 2034 period, which is $2.5 trillion above its February projection of $21.5 trillion. This deterioration reflects the net effect of a $1.6 trillion increase in projected deficits from legislative changes, a $638 billion decrease from economic changes, and a $1.5 trillion increase from technical changes.

Legislative Changes

Of the $1.6 trillion of deficit increases from legislative changes, $1.3 trillion is attributable to an increase in CBO’s projection of discretionary spending over the FY 2024 to FY 2034 period. CBO updated its baseline to include the budgetary effects of the $95 billion of emergency supplemental funding to Ukraine, Israel, and the Indo-Pacific region, as well as the Consolidated Appropriations Act of 2024 and the Further Consolidated Appropriations Act of 2024 that funded the federal government for the rest of FY 2024. The remaining $262 billion of deficit increases from legislative changes includes $14 billion of net mandatory spending reductions and revenue decreases from the rescission of $20 billion of enhanced Internal Revenue Service funding and $248 billion of higher debt service costs.

Technical Changes

Of the $1.5 trillion of deficit increases from technical changes, $314 billion is due to higher projections of Medicaid spending. CBO revised its FY 2024 projection of Medicaid spending upward by $47 billion to reflect higher-than-anticipated Medicaid spending thus far. The $267 billion increase in projected Medicaid spending over the 2025 to 2034 period is driven by higher projected Medicaid enrollment, projected growth in directed payments in Medicaid managed care, and a proposed rule that would allow states to pay hospitals and nursing facilities at the average commercial payment rate. Another $266 billion of deficit increases comes from assumed greater uptake of premium tax credits, while $164 billion comes from regulations and executive actions around student debt and a change in CBO’s expectations of how individuals and businesses will utilize the Inflation Reduction Act’s energy tax credits. Other technical changes added $760 billion to deficits, largely due to the debt service effects of the technical adjustments CBO made to its projections.

Economic Changes

CBO expects economic changes to reduce projected deficits by $638 billion over the FY 2024 to 2034 period. $601 billion comes from higher revenue collections due to economic changes. Higher asset values increased anticipated capital gains realizations and estate and gift tax receipts. A downward revision in CBO’s projection of Federal Reserve remittances – due to higher projected near-term interest rates in CBO’s economic forecast – partially offset the revenue increase from economic changes. The remaining reduction in projected deficits comes from lower net projections of spending and debt service costs

The Budget Outlook by the Numbers

Revenues

CBO projects that total federal revenue collections will rise from 17.2 percent of GDP ($4.9 trillion) in FY 2024 to 18.0 percent of GDP ($7.5 trillion) by FY 2034. For comparison, the 50-year historical average for revenue is 17.3 percent of GDP. Over the 2025 to 2034 period, revenue will total 17.8 percent of GDP ($62.8 trillion). Income tax revenue will total 9.6 percent of GDP ($33.7 trillion), payroll tax revenue will total 5.9 percent of GDP ($20.9 trillion), corporate tax revenue will total 1.3 percent of GDP ($4.7 trillion), and other revenue (including excise taxes and customs duties) will total 1.0 percent of GDP ($3.5 trillion). In February, CBO estimated that total revenue collections would total 17.8 percent of GDP ($62.6 trillion).

Spending

CBO estimates that total federal spending will rise from 23.9 percent of GDP ($6.8 trillion) in FY 2024 to 24.9 percent of GDP ($10.3 trillion) by 2034. For comparison, the 50-year historical average for spending is 21.0 percent of GDP. Over the 2025 to 2034 period, spending will total 24.1 percent of GDP ($84.9 trillion). Entitlement, or mandatory, spending, will total 14.6 percent of GDP ($51.4 trillion), or 61 percent of all federal spending. Discretionary (defense and nondefense) spending, meanwhile, will total 5.8 percent of GDP ($20.5 trillion), or 24 percent of all federal spending. In February, CBO estimated that total federal spending would total 23.5 percent of GDP ($82.7 trillion).

Deficits

CBO projects that the United States will run a unified federal budget deficit of $1.9 trillion in FY 2024, or 6.7 percent of GDP (in February, CBO projected the 2024 deficit would total $1.5 trillion, or 5.3 percent of GDP). This follows the $1.7 trillion (6.3 percent of GDP) deficit recorded in 2023 and the $1.4 trillion (5.4 percent of GDP) deficit recorded in 2022. Notwithstanding the COVID-driven record deficits observed in 2020 and 2021, the highest nominal-dollar deficit ever recorded was $1.4 trillion in 2009. CBO expects deficits to total $22.1 trillion (6.3 percent of GDP) over the 2025 to 2034 period, eclipsing $2 trillion by 2031 and ultimately growing to $2.9 trillion (6.9 percent of GDP) by 2034.

Interest Payments

Interest payments on the national debt will nearly double, rising from $892 billion in FY 2024 to $1.7 trillion by FY 2034. Interest payments are projected to increase over 50 percent as a share of federal outlays, rising from 11 percent of total federal spending in 2023 to over 17 percent of federal spending by 2034. And at a projected cost of $892 billion in 2024, interest payments are projected to surpass the $858 billion the federal government is projected to spend on Medicare this year and the $849 billion it’s projected to spend on national defense. As a share of the economy, interest will reach a new record of 3.14 percent of GDP in FY 2024 (the prior record was 3.10 percent in 1991) and grow further to 4.1 percent of GDP by FY 2034.

Debt Held by the Public

Borrowing from the public is projected to increase as a share of the economy under current law, reaching 122.4 percent of GDP by the end of FY 2034. In 2027, debt is expected to reach its highest level as a share of GDP – 106.2 percent – in U.S. history, surpassing the 106.1 percent of GDP from 1946 following the end of World War II (in February, CBO projected debt-to-GDP would surpass the prior record a year later, in 2028). In nominal dollars, debt held by the public will increase by $23.1 trillion, from $27.6 trillion today to $50.7 trillion by the end of 2034. Debt in 2034 will be $2.4 trillion higher than CBO’s February projection of $48.3 trillion.

Comparing CBO’s June 2024 and February 2024 Budget Projections

Source: Congressional Budget Office.

The Economic Outlook by the Numbers

CBO projects inflation to remain elevated this year, with Consumer Price Index (CPI) inflation totaling 3.4 percent and then falling to 2.5 percent in 2025. From there, CBO expects CPI inflation to average 2.3 percent per year thereafter. CBO expects its projected slowdown in inflation to be accompanied by a modest near-term increase in the unemployment rate, from 4.0 percent today to 4.4 percent by the end of 2024 through 2028 and to 4.5 percent through 2033. CBO expects the unemployment rate to fall slightly back to 4.4 percent by the end of 2034.

Following strong real GDP growth of 2.5 percent last year, CBO expects real GDP growth to slow to 2 percent this year and remain at that level through 2025. Starting in 2026, CBO expects growth to dip below 2 percent and remain between 1.7 and 1.8 percent through 2034. Though CBO projects relatively strong economic growth, it expects interest rates to remain high. Specifically, it expects the average interest rate on ten-year Treasury notes to total 4.5 percent this year, fall to a low of 3.6 percent by 2027, and then tick back up to 4 percent in 2030 and to 4.1 percent in 2031 and beyond.

Comparing CBO’s June 2024 and February 2024 Economic Projections

Source: Congressional Budget Office.