Insight

October 17, 2024

Gamesmanship Concerns Weaken the HSR Merger Report, Dissenting Commissioners Warn

Executive Summary

- On October 10, the Federal Trade Commission (FTC), together with the Department of Justice, released the Hart-Scott-Rodino Annual Report for Fiscal Year 2023, providing insight into merger enforcement actions and summary statistics of merger activity.

- Republican Commissioners Melissa Holyoak and Andrew Ferguson dissented and warned that inconsistent methodologies and definitions for counting transactions “invites gamesmanship” into the report and that the timing of the release – immediately before an election – was likely politically motivated.

- Congress should be wary that the antitrust enforcement agencies likely overstated their reported successes in merger enforcement and the possible politicization of the HSR report process.

Introduction

On October 10, the Federal Trade Commission (FTC), together with the Department of Justice (DOJ), released the Hart-Scott-Rodino Annual Report for Fiscal Year 2023. The report offers insight into merger enforcement actions and provides summary statistics of merger activity.

The release of the report came with controversy, however. The two Republican FTC commissioners, Melissa Holyoak and Andrew Ferguson, dissented and warned of inconsistent methodologies and definitions for counting transactions and enforcement actions that “invite gamesmanship” and that the timing of the report’s release – immediately prior to the election – was likely politically motivated.

Congress should be wary that the antitrust enforcement agencies overstated their reported successes and likely used the report for political gain. Congress should consider requiring the agencies to provide clear definitions and methodologies or risk devaluing the information presented in the report.

Hart-Scott-Rodino Annual Report

As previously discussed by the American Action Forum (AAF), the Hart-Scott-Rodino Annual Report provides insights into merger enforcement actions and offers several statistical tables summarizing merger transactions.

In fiscal year 2023, the FTC and DOJ received 1,735 adjusted merger transactions, a steep drop off from the surge in volume activity in 2021 and 2022, as seen in Figure 1. Nearly one in four transactions reported to the agencies was valued at $1 billion or more.

Figure 1

*Source: HSR Report Appendix A

The agencies also reported that their temporary suspension of early termination – a practice that allowed mergers and acquisitions that posed no competitive concerns to close quickly – remained in effect for the entire fiscal year. None of the 780 requests was granted. AAF previously discussed how this needless and costly burden delays the consummation of mergers that present no threat to competition, including merger activity vital to small businesses. Yet the agencies announced that this temporary suspension would be lifted once the new rules governing the HSR premerger notification program go into effect.

The HSR report also showed that the rate of second requests – a process that requires companies to submit additional information to the agencies concerning the transaction and triggers an additional waiting period – was steady at 2 percent of adjusted transactions and shown in Figure 2.

Figure 2

*Source: HSR Report Appendix A

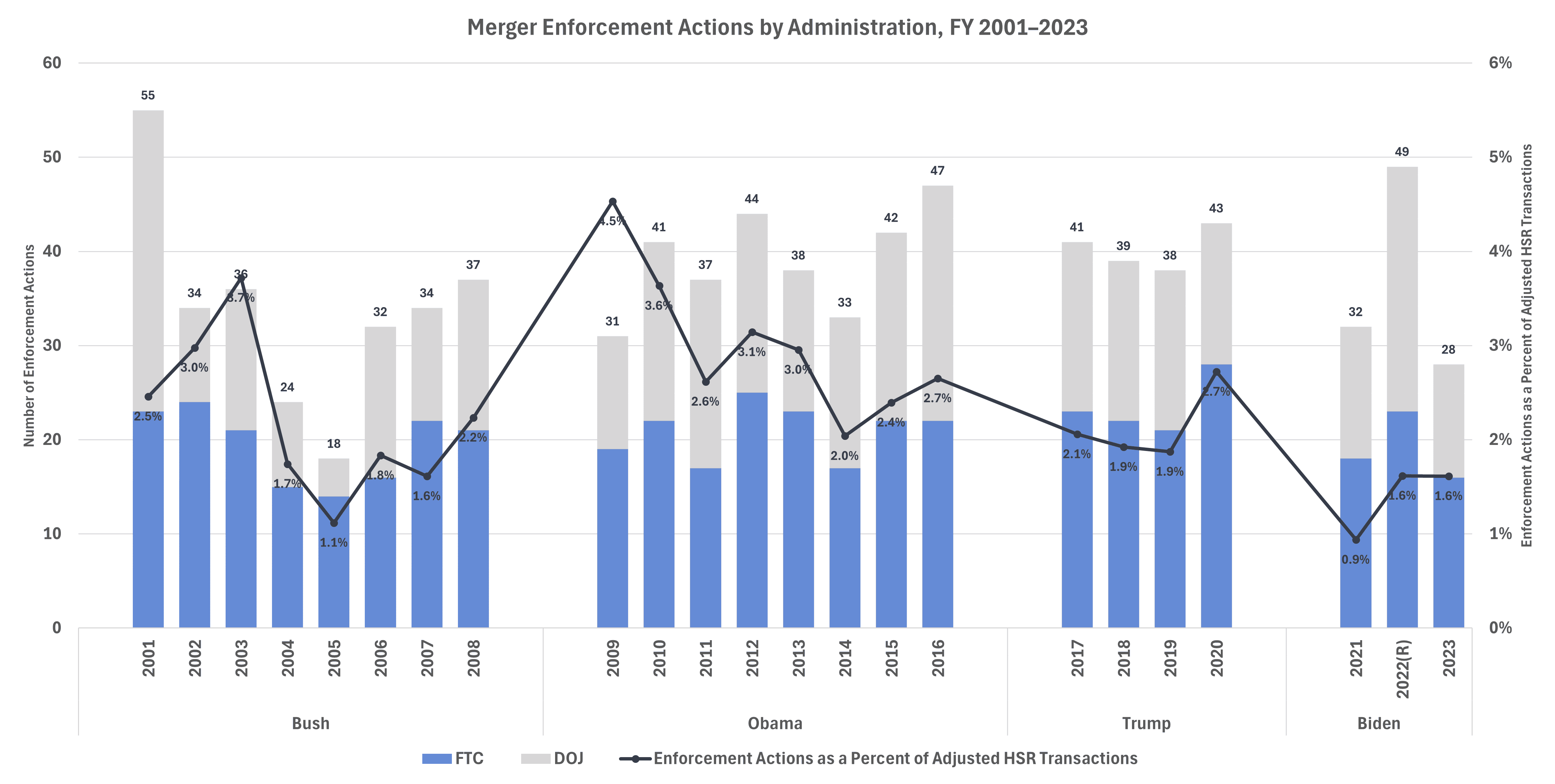

As discussed by AAF earlier this year, the more aggressive stance in opposition to mergers at the FTC and DOJ during the Biden Administration has yet to translate into increased enforcement. The FY 2023 HSR report offered no evidence of an increase in the rate of enforcement. Indeed, the number of merger enforcement actions has generally been lower than that of the immediate three prior administrations. Figures 3 and 4 detail the enforcement actions taken by the agencies and Figure 5 shows merger enforcement actions by administration.

Figure 3

*Source: HSR 2023 Report

Figure 4

*Source: HSR 2023 Report

Figure 5

*Source: HSR Competition Reports FY 2001—2023, 2022 data were revised

The FTC’s announcement of the report stated that revisions were made to the number of enforcement actions taken by the agency in FY 2022. The FTC originally stated that seven mergers were abandoned or restructured. That number was revised to five. Additionally, the 2022 report stated that the FTC issued 11 consent orders, while the correct number is 12. This brought the total merger enforcement actions during the year from 24 to 23.

Two Commissioners Dissent

The annual HSR report does not attract much attention outside of the competition and antitrust practitioners and policy observers. This report, however, is likely to garner much broader attention as Republican Commissioners Melissa Holyoak and Andrew Ferguson each issued fiery dissents opposing the report’s release.

Commissioner Holyoak questioned the agency’s criteria about which transactions should go in the report. She noted that the HSR report “counts an abandoned transaction as a win in the HSR Annual Report even though the parties to the transaction never made an HSR filing – a practice that has apparently been used for many years by the Commission (author’s emphasis).” She explained that this practice likely led to the inflation of the reported figures and serves as a “vehicle by which [the Commission can] take credit for abandoned mergers despite the transaction having no relationship to the operation of the HSR Act.” She warned that this practice “prevents consistent treatment of the tabulated numbers across administrations and invites gamesmanship in a Congressionally mandated report.”

Commissioner Ferguson echoed the need for “clear criteria about which transactions should go in the report” to avoid such gamesmanship. Ferguson also explained that even the methodologies used by the FTC and DOJ differ, “making it difficult to compare the agencies’ respective reports, and diminishes the value of the report.” Perhaps most concerning from Ferguson’s dissent was the likely political nature of the timing of the FTC’s release. He noted that under Chair Lina Khan, the FTC “has not submitted this report to Congress earlier than November 8, and once did not issue it until February of the next year.” He stated that the report “is the first such report the Commission will have submitted to Congress before Election Day since the Chair assumed her office. And it is being released on the heels of the Democratic presidential candidate’s economic policy plan calling for greater merger enforcement.” Ferguson went on to say, “I doubt the concurrence of these events is a coincidence.”

Fergson’s accusation of a politicized process came just two days after House Committee on Oversight and Accountability Chair James Comer sent a letter to Chair Khan requesting information related to several of her appearances at numerous campaign events with Democrats seeking election or re-election. The letter stated that the committee “is continuing to investigate the politicization of the Federal Trade Commission under her leadership” and how such activity “undermines the FTC’s independence and its mission to protect American consumers regardless of partisan affiliation.” Moreover, the letter questioned whether these appearances “as the head of an independent, bipartisan federal commission…complied with all the relevant laws and ethical guidelines.”

Congress should heed Commissioners Ferguson and Holyoak’s advice and mandate that the FTC and DOJ create a consistent methodology for the HSR report so that it is able to fully understand the agencies’ performance.

Conclusion

The antitrust agencies’ annual HSR report offered details into the merger enforcement regime under President Biden and suggests the frequency of enforcement is, in fact, lower than that of prior administrations despite the rhetoric of a more aggressive regime.

The report’s release was not without controversy, as dissenting Commissioners Holyoak and Ferguson accused the agency of gamesmanship that inflates its reported successes. Moreover, one of the dissents suggested that the timing of the report’s release was decided with political considerations. Congress should be wary of the results of the HSR report and the document’s possible politicization.