Insight

October 15, 2024

FTC Finalizes a Smaller Merger Tax, but a Tax Nonetheless

Executive Summary

- On October 10, the Federal Trade Commission (FTC), in collaboration with the Department of Justice, released its finalized changes to the premerger notification form and rules implementing the Hart-Scott-Rodino Act, which established the federal premerger notification program.

- While the reporting requirements in the finalized set of rules were noticeably pared back from the June 2023 proposed rule, its effect will be that of a tax on mergers by threatening to delay deals and deter merger activity.

- The burden of the final rule imposed on businesses, according to the FTC’s own estimate, includes a per-filing average of 68 additional paperwork burden hours, adding a total of $139.3 million for all filings.

Introduction

On October 10, the Federal Trade Commission (FTC), in collaboration with the Department of Justice, released its finalized changes to the premerger notification form and rules implementing the Hart-Scott-Rodino (HSR) Act. The new rule – unanimously approved by the five-member commission – marks the first significant change to the HSR filing process since the HSR Act was enacted over 45 years ago. The new rule will go into effect 90 days after it is published in the Federal Register.

The HSR Act, enacted in 1967, established the federal premerger notification program, and requires certain businesses planning a merger or acquisition to notify both the FTC and Department of Justice Antitrust Division (DOJ) before closing the deal. The current filing threshold is for deals valued at more than $119.5 million. The law also mandates a 30-day waiting period to afford the agencies time to determine if the deal violates antitrust law, including Section 7 of the Clayton Act, which prohibits mergers that may substantially lessen competition or tend to create a monopoly. The finalized rule is intended to provide the agencies with more information to better screen for anticompetitive mergers. Yet the increased cost imposed on businesses seeking to merge will likely serve as a tax that is designed, in part, to deter merger activity.

At the same time as the finalized rule, the FTC also announced it would lift its temporary suspension of grants of early termination – which went into effect in 2021 – once the final rule goes into effect. With that announcement, firms involved in competitively benign mergers can once again request early termination from the agencies, which, if granted, would allow them to close the deal prior to the 30-day waiting period. The FTC also introduced a new online portal through which stakeholders, market participants, and the public can submit comments to the agency regarding transactions that may be under review.

Although pared back from the proposed rule (NPRM), the final rule will significantly increase the burden on merging parties – including small businesses and firms looking to consummate competitively benign mergers. The increased cost from an average estimated additional 68 hours per filing to complete the paperwork is an additional $139.3 million (calculated using the 3,515 filings during fiscal year 2023). This additional burden will serve as a tax that will likely delay deals and threaten to deter merger activity.

Comparing the NPRM and Final Rule

FTC Commissioner Melissa Holyoak’s statement on the final rule described the trade-off between supporting a pared back final rule and the risk of the majority pushing through the much more burdensome rule as outlined in the NPRM. The American Action Forum previously discussed the NPRM. Holyoak explained that the final rule “does not align exactly with my preferences. But I have worked to curb the excesses of the NPRM in meaningful ways that would not have happened absent my support.” Commissioner Andrew Ferguson echoed this sentiment, calling the NPRM a “nonstarter,” and adding that “were I the lone decision maker, the rule I would have written would be different from today’s Final Rule. But it is a lawful improvement over the status quo.”

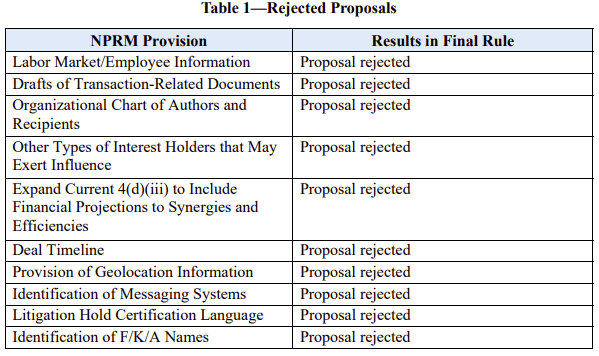

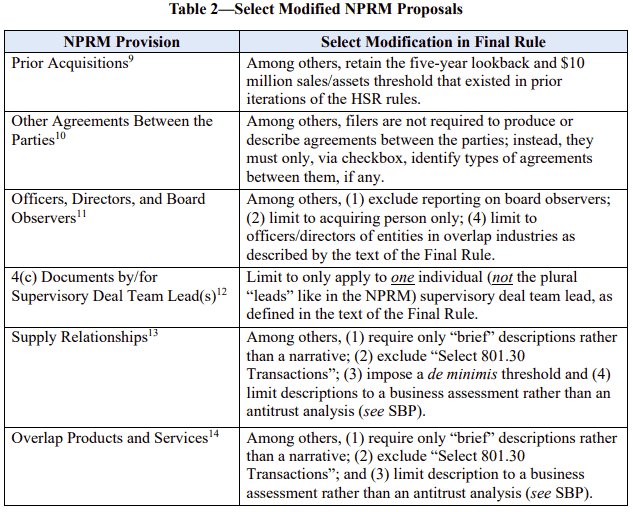

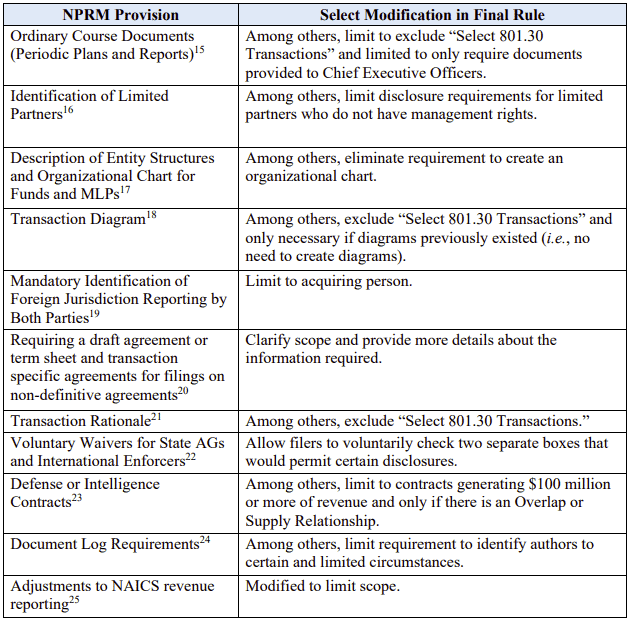

Much of Holyoak’s statement outlined the major differences between the NPRM and the final rule. She noted that 10 of the 29 primary proposals in the NPRM were rejected entirely, and only two of the remaining 19 remained without modification. Holyoak provided a series of tables (included below) noting the differences.

Table 2 (cont.)

Perhaps the most notable change – and most controversial among the NPRM proposals – was the removal of the labor market information requirements. The FTC is clearly concerned with potential harms to post-merger labor markets in merger reviews, including its challenge to the merger between grocery store chains Kroger and Albertsons.

In the NPRM, the FTC explained its need for this information, asserting that “if a firm has a history of labor law violations, it may be indicative of a concentrated labor market where workers do not have the ability to easily find another job.” Yet as Holyoak explained, there was no evidence “empirical or otherwise” to support this claim. Moreover, requiring firms to submit data on Standard Occupational Classification (SOC) codes would be of “limited value because SOC codes by themselves are not sufficient to define a relevant labor market for antitrust purposes.”

The final rule also eliminates the requirement for merging parties to provide drafts of transaction-related documents with the HSR filing. While the FTC will still have access to these documents if it issues a second request – which is a more detailed investigation that requires companies to submit additional information and triggers an additional waiting period – Holyoak explained that the “burden of producing drafts would have outweighed any perceived benefit.”

Net Cost

The cost estimate of the final rule was significantly reduced compared to the proposed rule.

The FTC projected that an average of 107 additional hours – nearly four times as long as the current form – and an added total cost of $350 million would be needed to fulfill the new requirements. This estimate was based on a projected 7,096 filings for fiscal year 2023 at a cost of $460 per hour: 107 additional hours x $460/hour x 7,096 filings = $350 million. The additional average estimated cost per filing would have been – had the NPRM become the final rule – $49,220.

The estimated cost of the final rule is an average additional 68 hours – an average low of 10 hours and an average high of 121 hours – for an additional total of $139.3 million to meet the new reporting requirements. The final rule estimate included a new hourly wage estimate of $583 compared to the $460 hourly rate used in the NPRM and the actual number of filings in fiscal year 2023 of 3,515: 68 additional hours x $583 per hour x 3,515 filings = $139.3 million This result would be an additional cost of $39,644 per filing, on average.

While the burden was pared back, the final rule nevertheless imposes an increased burden on firms seeking to merge. In other words, the new rules serve as a tax that threatens to delay deals and deter merger activity. The American Action Forum previously discussed this “merger tax.”

Early Termination and Online Comment Portal

Part of the HSR Act includes a mandatory 30-day waiting period for the transaction to close to afford the agency time to determine if the deal violates antitrust laws. If the agency determines that the merger or acquisition presents no competitive threat, it can terminate the waiting period and allow the transaction to close early – known as early termination.

On February 4, 2021, the FTC, with support from the DOJ, announced the suspension of early termination. Rebecca Kelly Slaughter, then acting chair of the FTC, pointed to “historically unprecedented volume of filings during a leadership transition amid a pandemic” as the reason to suspend the program.

Historically, early termination requests constituted between 70 percent and 80 percent of all transactions reviewed by the agencies. Of those transactions, between 71 percent and 83 percent were granted early termination, making up more than half of all transactions.

Coinciding with the final rule’s release, the FTC announced it would lift its temporary suspension on early termination of HSR filings. Reinstituting this process will enable competitively benign or procompetitive mergers to close more quickly.

The FTC also introduced a new online portal that allows market participants, stakeholders, and the public to directly submit comments on proposed transactions that may be under agency review. While public engagement led to many of the changes to the HSR final rule, there are downside risks associated with such policy. An example of this was presented in the FTC’s recent interim staff report on pharmacy benefit managers (PBMs). The report was filled with comments the FTC received from the public, but as Commissioner Andrew Ferguson explained in his concurring statement, many of the comments were anonymous and should be treated with “circumspection.” Yet, as he explained, “the [report] nevertheless ascribes those anonymous submissions to independent pharmacies, or pharmacies generally, and treats their contents as fact.” Ferguson added that “many of the other comments…were submitted by entities who contract with PBMs…who…may have an incentive to instigate regulatory action against PBMs to improve their bargaining position.” Similar pitfalls are likely to emerge with the new online portal. Comments submitted anonymously – or even those identifiable – on behalf of the merging parties’ competitors and treated as fact could lead to overenforcement.

Conclusion

The FTC’s finalized rules governing the HSR Act represent a dramatically scaled-back set of rules compared to the original NPRM. Yet while the estimated total cost burden of an additional 68 paperwork burden hours per filing at $139.3 million is noticeably smaller, the effect will be that of a tax that will likely delay deals and threaten to deter merger activity.