Insight

June 15, 2016

Direct Student Loan Interest Rates: Saves Money for Borrowers, Costs Taxpayers in the End

In what is now an annual exercise, the Department of Education released the new interest rates for direct loans for the 2016 – 2017 academic year on May 13th. This marks the fourth rate change for the Federal Direct Lending Program since the Bipartisan Student Loan Certainty Act of 2013 was signed into law.

The 2013 changes amended provisions in title IV (Student Assistance) of the Higher Education Act (HEA) that called for annual interest rates on Federal Direct Student Loans to be 6.8 percent – a rate that students, parents, and advocates all agreed was too high. In the place of a static rate, the legislation established a new formula based off the 10-year Treasury note plus a small percent adjustment (depending on the type of loan) to ensure that the rates borrowers paid more accurately reflected current market rates.

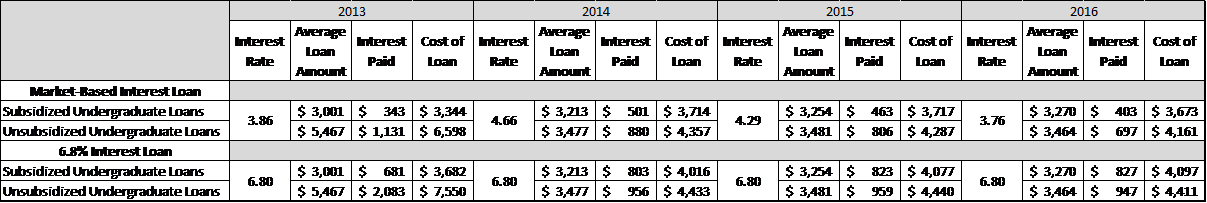

This common sense change ensured that student borrowers would not incur additional unnecessary costs while financing a higher education. In fact, with this rate change we are able to calculate just how much students have saved while pursuing a 4-year degree. Using estimates established in the Congressional Budget Office baseline for the direct lending program, Table 1 (below) reflects the average loan amount and the actual cost of the loan including interest using the standard repayment plan. Under the bipartisan Student Loan Certainty Act, interest rates have stayed below 5 percent.

Table 1. Comparing Annual Costs of Direct Loans: Market Rates vs. 6.8% Statutory Rate

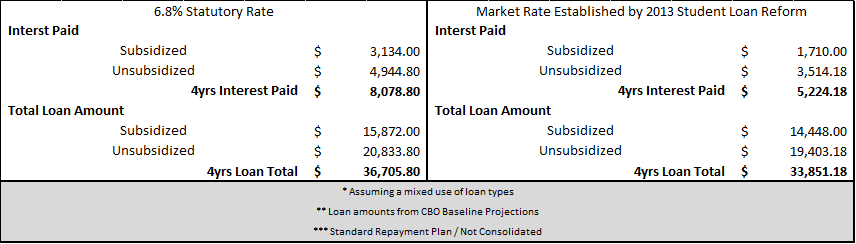

In total, students have saved approximately $2,855 in cost associated loan financing – not an insignificant amount given the average semesters tuition at a four-year state school is a little over $4,000 and at a two-year school just over $1,700. Table 2 (below) reflects the differences in four year totals.

Table 2. Interest Accumulated and Total Costs Comparisons

However, while these savings appear to be good news for current borrowers, interest rate do not address the problems tuition costs. . As higher education economist, Carlo Salerno writes, “In general rates and rate changes themselves aren’t very interesting from the standpoint of student aid policy. They don’t really influence the college-going decision and the way eligibility is calculated means they don’t curtail borrowing. Moreover, with the growth of income-based repayment programs, which ties payments to a borrower’s monthly income and forgives any outstanding balance after 20 to 25 years, borrowers need not care about interest rates lowering monthly payments because the repayment programs cap them based off of the borrowers adjusted-gross income. Why be concerned with having to potentially extend your loan term when income-driven repayment rewards making timely monthly payments by writing off any residual balance off after 20 years? In the end, the ones that benefit most from declining interest rates are the schools themselves, meaning that the less expensive a loan appears the more students are likely to borrow allowing for schools to charge higher tuition and fees knowing that student borrowers will just take on the more debt to cover the cost.”

In short, the time for a complete overhaul of student aid policies and programs has long since passed. With the federal government holding $1.2 trillion in student debt where nearly 40 percent of borrowers fail to make payments, tinkering around the edges with interest rate adjustments and repayment plans that end up adding to the costs aren’t going to fix a broken system.