Insight

September 23, 2019

Competing Proposals to Reform Medicare Part D

Executive Summary

In the past few months, Congress has put forward several proposals to lower prescription drug costs. One proposal considered and approved by the Senate Finance Committee (Finance) is the Prescription Drug Pricing Reduction Act (PDPRA) of 2019. Among its several provisions, this legislation included a redesign of the Medicare Part D Prescription Drug Program, similar to the American Action Forum (AAF) proposal from August 2018. Speaker Pelosi recently released another drug pricing reform package that also included an alternative proposal to redesign the Part D benefit structure. This paper analyzes those two proposals relative to current law and the AAF proposal.

- All of the pending proposals seek to put downward pressure on prescription drug prices by realigning incentives in the Medicare Part D program, specifically by requiring manufacturer rebates (at least) in the catastrophic phase of the benefit rather than the coverage gap. Shifting the discount to this phase ensures the mandatory discount increases along with a drug’s price.

- While the plans are conceptually similar, the varying parameters of the proposals result in significantly different impacts for the various stakeholders, with both the Finance and Pelosi proposals increasing drug manufacturer liability to an unprecedented level.

- This study analyzes how these plans would be expected to impact spending in 2022, looking just at those drugs for which annual spending is high enough to require a rebate payment if a beneficiary took only that drug. Under the AAF proposal, it is estimated that drug manufacturers would pay a minimum of $4.1 billion in rebates on such drugs in 2022. The Finance proposal would yield an estimated $8.4 billion in rebates from those drugs. The Pelosi plan would result in $23.1 billion in rebates.

Comparing the Proposals to Reform Medicare Part D

The current structure of Medicare Part D has several notable problems. Because insurer liability is now quite limited beyond the deductible, insurers have little incentive to keep beneficiaries out of the coverage gap and catastrophic phases. Further, drug manufacturers lack strong incentives to keep their prices down. The result of this lack of incentives is that the government is paying an increasing share of Part D’s cost in the catastrophic phase, and the government’s overall costs are rising. Finally, the current structure leaves some beneficiaries with very high costs even in the catastrophic phase. The American Action Forum (AAF) proposal illustrates how benefits can be restructured to realign incentives and market forces employed to put downward pressure on prices.

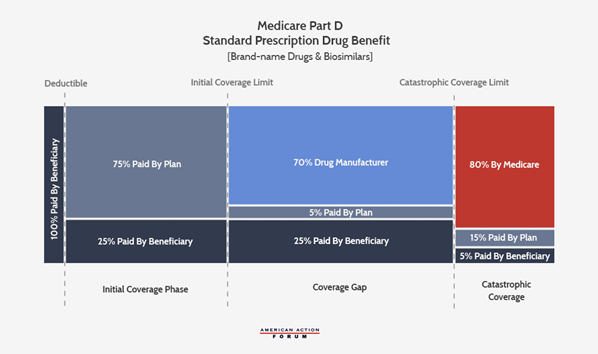

Current Law

The following graphic illustrates the current Part D benefit structure. Most recently reformed in 2018, drug manufacturers now pay 70 percent of costs in the coverage gap while insurers pay just 5 percent during that phase. The federal government covers 80 percent of costs in the catastrophic phase and beneficiaries pay 5 percent of catastrophic costs, with no out-of-pocket (OOP) cap.

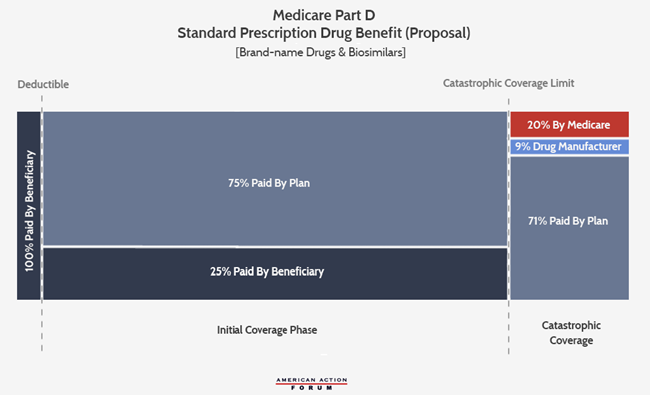

AAF Proposal

The AAF proposal addresses the aforementioned problems by making several changes, shown below: It increases insurer liability in the catastrophic phase, moves the required manufacturer rebates to the catastrophic phase, and places a cap on beneficiaries’ OOP liability. The accounting firm Milliman modeled this plan and current law to find the parameters at which the expected manufacturer rebates under this proposal would be equal to what is expected under current law from 2020-2029. It estimated that an OOP cap of $2,500 would yield manufacturer rebates roughly equal to current law if manufacturers paid a 9 percent discount in the catastrophic phase for all beneficiaries.[i] Following MedPAC’s lead, the AAF proposal sets the government’s reinsurance liability at 20 percent, leaving insurers liable for 71 percent of costs in the catastrophic phase.

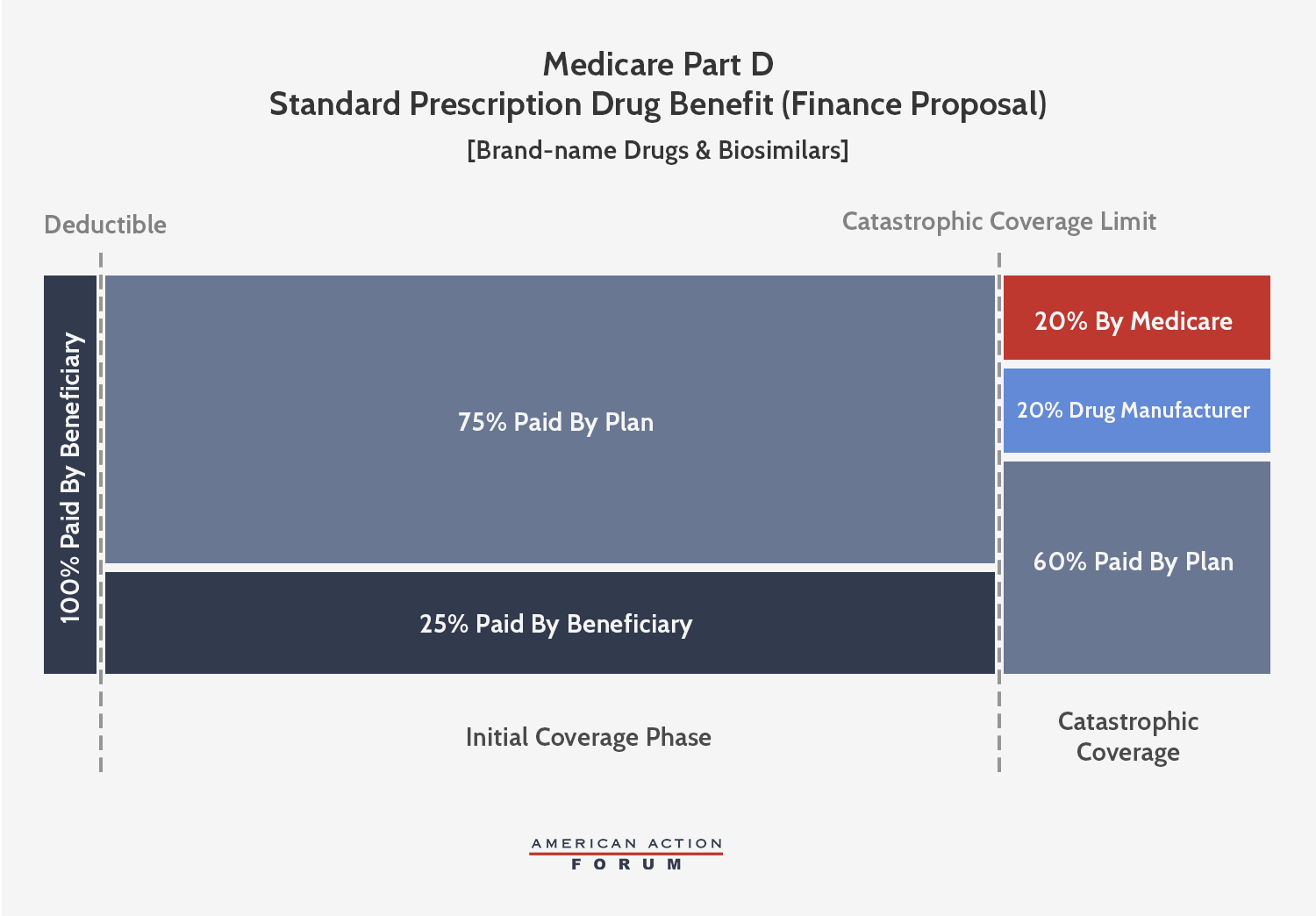

Senate Finance Proposal

The Senate Finance Committee’s (Finance) Prescription Drug Pricing Reduction Act (PDPRA) of 2019 includes a similar conceptual framework to the AAF proposal, but the OOP limit and the catastrophic phase liabilities are different. The Finance proposal, which would be phased-in beginning in 2022, sets an OOP limit of $3,100, equal to the amount of OOP spending before the catastrophic threshold expected under current law. The proposal would require brand-name and biosimilar drug manufacturers to pay a 20 percent rebate for all drug costs incurred after the beneficiary reaches the catastrophic phase, more than double what AAF proposed. Insurer liability in the catastrophic phase would gradually increase to 60 percent by 2024. Federal reinsurance would be reduced to 20 percent for brand-name drugs and biosimilars and 40 percent for generic drugs by 2024.

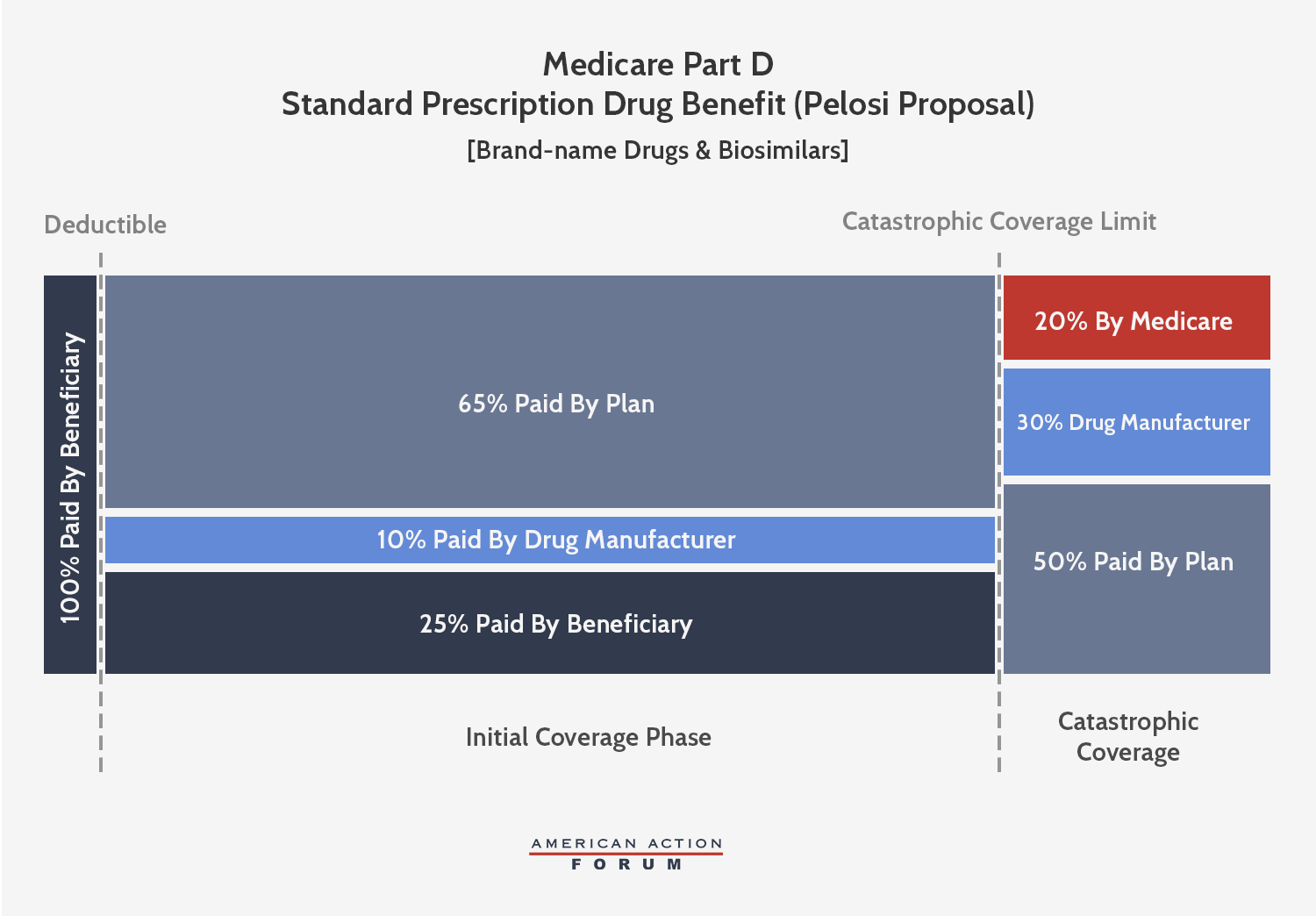

Pelosi Proposal

Speaker Pelosi’s proposal is also conceptually similar to the AAF proposal, but, like the Finance proposal, sets different parameters that extract even more money from manufacturers. This plan would cap beneficiary OOP spending at $2,000—about $600 less than what a beneficiary reaching catastrophic coverage pays in 2019. Brand-name and biosimilar drug manufacturers would be required to pay a 30 percent discount for all drug costs incurred after the beneficiary reaches the catastrophic phase, more than triple what AAF proposed. Further, manufacturers would be required to pay 10 percent of costs in the initial coverage phase, as well, meaning rebates will be required for all drugs taken after a beneficiary reaches the deductible. Insurer liability in the initial coverage phase would thereby be reduced to 65 percent when a beneficiary takes a brand-name drug or biosimilar. In the catastrophic phase, insurer liability would increase to 50 percent for brand-name drugs and biosimilars and 80 percent for generic drugs, while federal reinsurance would cover the remaining 20 percent.

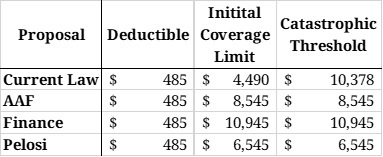

As you can see in Table 1, all three proposals would eliminate the coverage gap that currently exists, reducing the number of coverage phases to three.

Table 1: Coverage Phase Thresholds

Estimating the Impact

The Maximum Rebate Per Drug

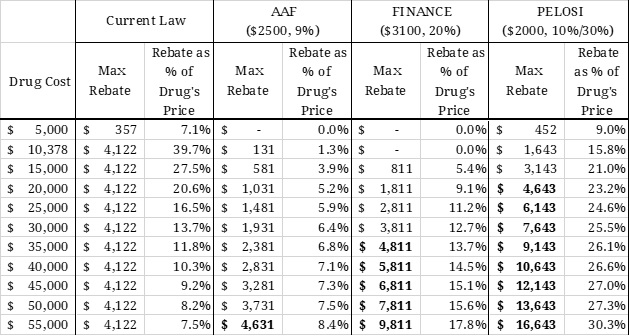

Under each proposal, the required rebate amount for a given drug can be calculated based on the drug’s price. As shown in the second and third columns of Table 3, the current coverage gap rebate shrinks proportionately as the price of the drug increases because the rebate amount is capped indirectly. For example, a drug costing $10,378 (the lowest cost at which the maximum rebate must be paid) pays a rebate equal to nearly 40 percent of the cost of the drug. A drug priced at $55,000, on the other hand, pays the same rebate amount, but that amount is equal to only 7.5 percent of the drug’s price. Thus, the current benefit design is more harmful to lower-priced drugs. If the rebate were required in the catastrophic phase of coverage, however, it would no longer be capped, and the required rebate amount would increase, both nominally and as a share of the drug’s price, as the price increases, as shown under each of the proposals. As a result, more of the burden of the rebates would be placed on the higher-priced drugs, as shown by the various proposals.

Table 3: Rebates Required Under Various Reform Proposals

Stakeholder Liability and Total Rebates Collected

Rebates under the Finance proposal would be more than double the rebate required by the AAF proposal. The Pelosi proposal will require rebates that are at least 3.6 times the amount required by the AAF proposal. The bolded numbers indicate the “break-even price” (at which point the rebate amount required under the proposals is equal to the currently required rebate amount). This price would be significantly lower under the Finance proposal, and lower still under the Pelosi proposal, than the break-even price for the AAF proposal. The break-even price under AAF’s proposal in 2022 is $54,342. In other words, manufacturers would spend the same amount on rebates much more quickly under the Finance or Pelosi proposal than under the AAF proposal.

Next, using spending and utilization data from 2017 provided in the CMS Medicare Part D Drug Spending Dashboard, AAF estimates some of the expected costs to the various stakeholders in 2022—the first year that these proposals would be implemented. Only drugs for which estimated average annual per beneficiary spending exceeds the threshold at which a rebate would be required is included in the estimate of total rebates that must be paid; thus, these estimates represent the low-end of the amount likely to be collected. Additional assumptions and limitations are explained in the appendix.

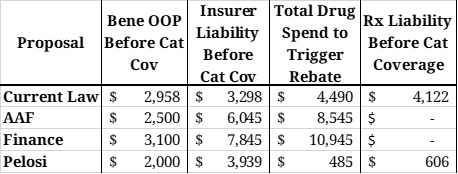

Table 4: Liability Before the Catastrophic Phase

Table 4 illustrates various stakeholder liabilities and relevant spending thresholds on an individual level, assuming a beneficiary incurs enough costs to reach catastrophic coverage taking only brand-name drugs and/or biosimilars. Under all reform proposals, beneficiaries would not owe anything more once they reach the catastrophic phase; under current law, beneficiaries must continue to pay 5 percent of all costs in the catastrophic phase. OOP spending before the catastrophic phase would be closest to that expected under current law in the Finance proposal. Insurer liability before the catastrophic phase, shown in Column 3, would be closest to current law liabilities under the Pelosi proposal.

Column 4 is the amount of total drug spending that must be incurred before a drug manufacturer is required to pay a rebate. Under current law, rebates are required in the coverage gap; under the Pelosi proposal, rebates would be required once a beneficiary reaches their deductible. Under the AAF and Finance proposals, rebates would not be required until the beneficiary reaches catastrophic coverage. As shown in the last column, the minimum amount of total drug spending that must be incurred to reach the catastrophic phase is lowest under the Pelosi proposal, followed by the AAF proposal; the Finance proposal would require slightly more spending than current law.

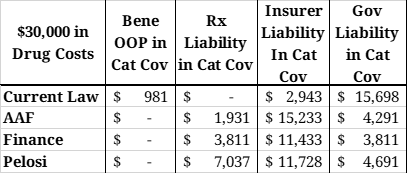

Table 5: Liability in the Catastrophic Phase with $30,000 in Drug Costs

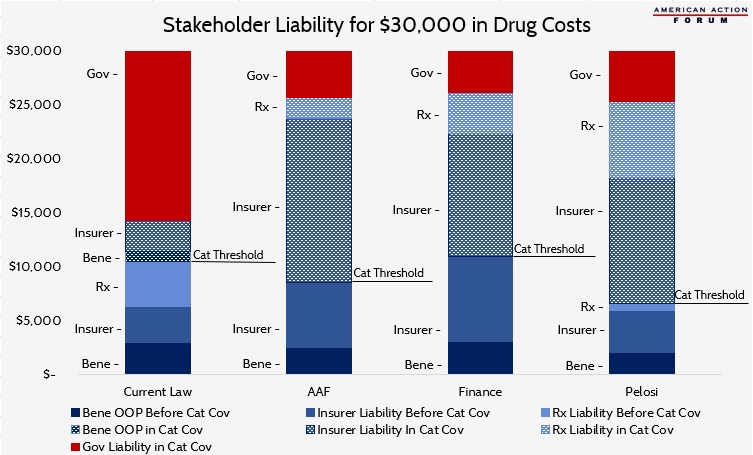

Table 5 shows the costs that would be covered by each stakeholder in the catastrophic phase for a beneficiary with $30,000 in brand-name or biosimilar drug costs. The chart below illustrates total costs by payer for the same scenario. Each proposal will significantly reduce government liability. Total manufacturer liability is smallest under the AAF proposal and largest under the Pelosi proposal. Insurer liability is most limited under current law and highest under the AAF proposal.

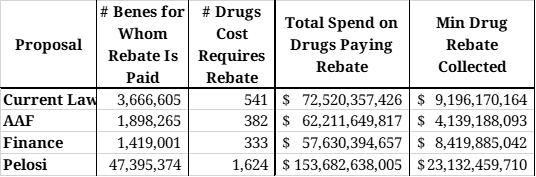

Table 6: Required Rebates

Table 6 illustrates the number of drugs and beneficiaries for which a rebate will be required under each of the plans, as well as the expected total rebates to be collected for those drugs.

Under the AAF proposal, an estimated 382 drugs would have an average cost per beneficiary exceeding $8,545 in 2022 and will be provided to nearly 1.9 million beneficiaries at a total cost of $62.2 billion. Spending above the catastrophic threshold for these drugs will equal an estimated $46.0 billion. If a 9 percent rebate were required from drug manufacturers for all spending in the catastrophic phase, $4.1 billion in rebates would be collected on these drugs alone in 2022. Given that modeling found this rate would provide roughly equivalent rebate collections as current law, and it is estimated that $9.2 billion in rebates would be collected under current law, more than half of the rebates collected under the AAF proposal would be paid for drugs costing less than $8,545, and are not included in this estimate.

For the Finance proposal, it is estimated that the manufacturers of 333 drugs provided to 1.4 million beneficiaries will be required to pay a rebate based on their cost alone. Spending above the catastrophic threshold for these drugs will equal an estimated $42.1 billion. A 20 percent rebate in the catastrophic phase would yield $8.4 billion in rebates on just these drugs in 2022. Similar to the AAF proposal, it is likely that half of expected rebates will be paid for drugs costing less than $10,945, and thus are not accounted for in this estimate.

The Pelosi proposal would impact exponentially more drugs because rebates will be required after just $485 in spending. An estimated 1,624 drugs provided to 47.4 million seniors would trigger the initial rebate threshold. Total spending on these drugs is estimated at $153.7 billion in 2022. Requiring manufacturers to pay 10 percent of costs incurred between the deductible and the catastrophic phase will yield an estimated $8.0 billion in rebates. Nearly one-fourth of those drugs (428), provided to an estimated 2.4 million beneficiaries, are also expected to trigger the catastrophic threshold rebate, which would result in $15.1 billion in discounts. Thus, manufacturer liability under the Pelosi proposal would total an estimated $23.1 billion in 2022. Because most drugs would trigger the rebate requirement on their own, this estimate likely captures most of the total rebates that would be collected under Pelosi’s plan. Based on this estimate, drug manufacturers would be required to pay roughly 12 percent of the program’s total costs.

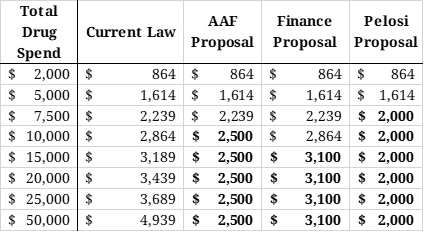

Beneficiary OOP Costs

The last table shows the various OOP requirements that would be required of beneficiaries under current law as well as the various proposals at various total drug costs. Under the AAF proposal, beneficiaries would benefit from the $2,500 OOP cap after $8,545 in total drug costs. Under the Finance proposal, the $3,100 OOP cap would not reduce beneficiaries’ OOP liability, relative to current law, until total drug spending surpassed $10,945 in total drug costs. Under the Pelosi proposal, beneficiaries would begin to see OOP savings after just $6,545 in total drug costs.

Table 7: Out-of-Pocket Requirements Under Various Proposals

Implications

The AAF proposal was designed, not to extract additional funds from the pharmaceutical industry, but rather to create natural market pressures to control costs. The Finance and Pelosi proposals, on the other hand, will require significantly larger discounts from the pharmaceutical industry. The discount rates may be large enough to actually be detrimental to the industry and may result in reduced investment for future innovation. And that is to say nothing of the numerous other hits to the industry included in other sections of each of the bills, as discussed here and here.

The impact to beneficiaries depends on two primary components: any change in OOP costs and the change in premiums. High-cost beneficiaries who are expected to reach the catastrophic phase under current law will certainly benefit from lower OOP costs under either the AAF or Pelosi proposals and will very likely benefit from the Finance proposal. The Milliman analysis of the AAF proposal estimates that beneficiaries would save up to $41.3 billion in OOP costs from 2020-2029. A preliminary estimate of the Finance proposal from the Congressional Budget Office found that beneficiaries would save $20 billion in OOP costs as a result of the redesign. Beneficiaries with lower costs may be worse off under these proposals, as they may experience higher premiums without the benefit of reduced OOP costs.

Higher premiums, however, would be indicative of a better functioning insurance program. Premiums reflect expected insurer liability. The premise of these plans, in part, is that increasing insurer liability will increase their incentive to control costs. The proposals also aim to reduce OOP expenses for those with the highest costs; doing so typically requires shifting costs to the insurer, though, in Part D, the government and drug manufacturers also pay some of the costs. To the degree that insurer liability rises, premiums will necessarily rise proportionately. Because insurer liability is expected to be lowest under the Pelosi proposal, premiums would likely be lowest under her plan, including relative to current law. This is despite setting the lowest OOP cap, because her plan shifts significantly more liability to the drug manufacturers. CBO found that premiums would likely be reduced by just less than $1 billion under the Finance proposal, relative to current law, as a result of the redesign (plus another $5 billion reduction associated with inflation rebate penalties). Premiums would likely be highest under the AAF proposal where insurers would have the greatest liability, relative to the other plans and current law. Milliman predicted premiums would rise by $33.9 billion, over 10 years, under the AAF proposal (if behavioral assumptions proved true) which would provide beneficiaries with overall net savings of $7.4 billion.

Conclusion

In the 16 years since Congress created the Medicare Part D program, the prescription drug market, insurance structure, and pricing practices have changed. Patterns have emerged that make it clear the current system is encouraging undesirable behaviors that increase costs for the government and consumers. Reforming the benefit structure in a way that realigns the financial incentives of both the insurers and drug manufacturers may help to reverse these trends by putting downward pressure on drug prices. Such a substantial reform, however, requires careful consideration of the many trade-offs that will result from those changes. Putting too much pressure on drug prices could instead result in reduced innovation, fewer new treatments, and restricted access to medicines.

Appendix

Assumptions and Methodology

In the estimates for total rebates collected, it is assumed that the average cost per beneficiary using a given drug will increase 6 percent from 2017 to 2022. Utilization of each drug is assumed to increase 16 percent, equal to the expected increase in program enrollment during that time, according to the latest Medicare Trustees Report. The deductible under all proposals is assumed to be $485, as the Trustees estimate for 2022. In the current law estimate, the initial coverage limit is assumed to be $4,490 (also from the Trustees Report). For all other proposals, the initial coverage limit (also the catastrophic limit) was calculated based on the plan’s OOP cap. For these estimates, it is assumed that beneficiaries only take drugs for which a manufacturer would be required to pay a rebate. These estimates also assume no behavioral changes.

Further, only drugs for which estimated average annual per beneficiary spending exceeds the threshold at which a rebate would be required is included in the estimate of total rebates that must be paid; thus, these estimates represent the low-end of the amount likely to be collected. That said, the estimates for rebate collections under current law and Pelosi’s plan are likely much closer to the total collection amount than the estimates for the AAF and Finance proposals. This is because the rebate collections begin at a lower spending threshold and thus more of the total program spending is captured.

Limitations

It is important to note that these estimates do not account for any new drugs that have come to market or are expected to come to market after 2017. Further, these estimates do not include rebates that will be required from all other drugs provided after a beneficiary surpasses the threshold for which rebates are required but have an average annual per beneficiary cost that is less than the rebate threshold. Conversely, these estimates do not exclude drugs that may be generic products.

[i] Current law does not require manufacturers to pay Coverage Gap discounts for low-income subsidy (LIS) beneficiaries.