The Daily Dish

September 5, 2024

The IRA and CHIPS: Where Are They Now?

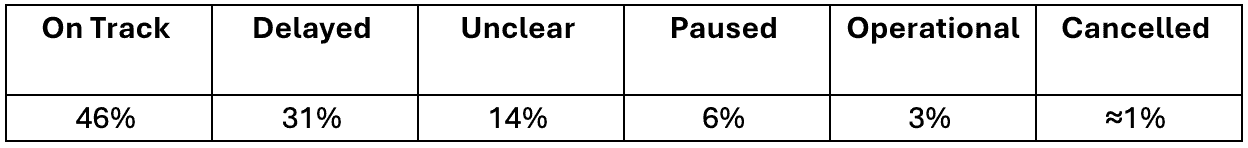

Just over two years ago, the Inflation Reduction Act (IRA) and CHIPS and Science Act set out to dispense hundreds of billions of dollars in new spending and tax breaks for various manufacturing, climate, and infrastructure projects. To hear President Biden tell it, the IRA and CHIPS are working flawlessly and have ushered in an investment renaissance – yet a Financial Times report published August 12 paints an entirely different picture, showing that large manufacturing investment initiatives are currently delayed or paused and only 3 percent of these projects are operational. If the goal of the IRA and CHIPS funds was that they would help complete, or at least begin, manufacturing projects, they fell well short. Less than 50 percent of these projects are on track.

Figure 1: Status of Tracked Investments over $100 Million (Source: Financial Times)

There are several reasons why IRA and CHIPS projects are stalling out. First, demand for many clean technologies, such as electric vehicles, is slowing down. What’s more, overproduction in China of other green products such as solar cells and critical minerals is also making it difficult for U.S. companies to compete at lower prices and lock in large investments. Second, the current macroeconomic environment, especially the relatively high interest rates, is making it more expensive for the private sector to borrow and commit to capital-intensive projects. Third, in response to the Financial Times report, a Senior Fellow at the American Council for Capital Formation highlighted the general regulatory and permitting hurdles that are slowing the rollout of funds. Other roadblocks include the Department of Commerce’s effort to prioritize work with underrepresented groups and requirements that companies submit plans on how they will train and employ a diverse workforce. These requirements, combined with the rising cost of construction, are leading companies such as Taiwan Semiconductor Manufacturing Co. to recalibrate their investment plans.

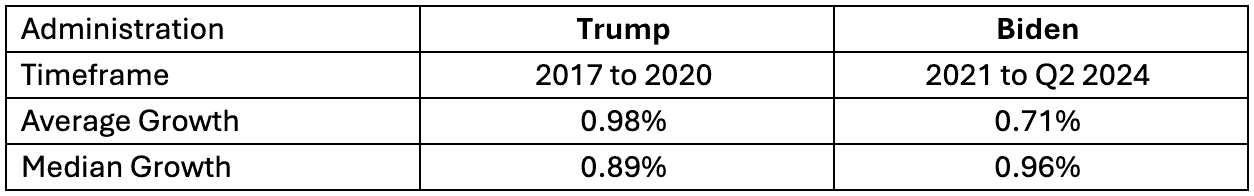

While the main factor hindering the IRA and CHIPS projects is unclear, what is clear is that the claim of a never-before-seen investment boom is an exaggeration. Depending on which metric you use, investment growth in the United States is virtually unchanged between the Trump and Biden Administrations. Put simply, $400 billion in handouts to preferred industries may not have the immense economic payoff the Biden Administration suggests.

Figure 2: Growth in Real Gross Private Domestic Investment Comparison (Source: Federal Reserve Bank of St. Louis).

Fact of the Day

As of August 28, the Fed’s assets stood at $7.1 trillion.