The Daily Dish

October 3, 2023

Symptoms of Labor Market Cooling

Today at 10 a.m., the Bureau of Labor Statistics (BLS) will release the data from the Job Openings and Labor Turnover Survey (JOLTS) for August. This provides another data point on the Federal Reserve’s success in cooling the overheated U.S. labor market. Most observers are focused on Friday’s employment report for September, but JOLTS contains a useful measure of the decline in jobs that occurs without creating unemployment.

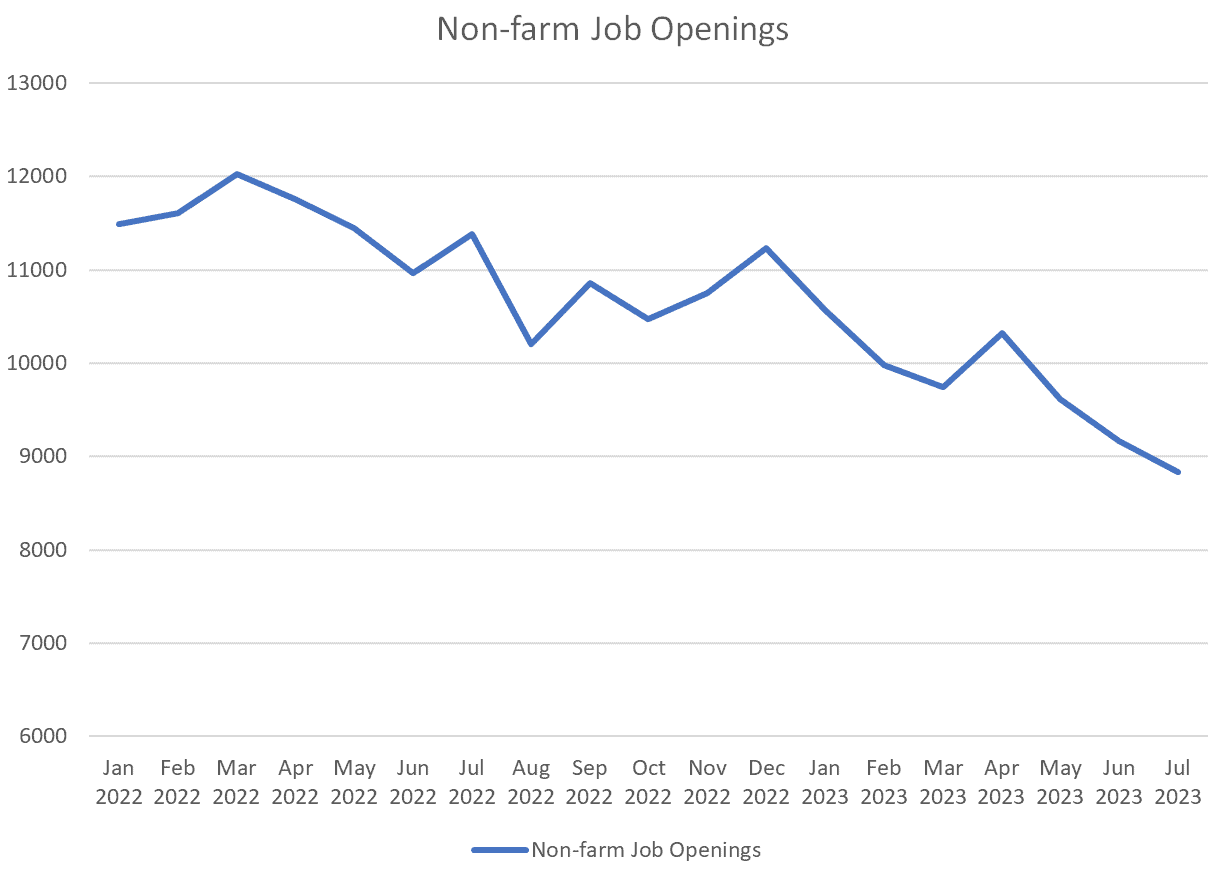

Specifically, JOLTS contains a monthly measure of the number of job openings in the economy. The recent data is graphed below and shows that the number of openings peaked at 12 million in March of 2022. Coincidentally, the Fed began its current tightening cycle in the same month. Notice that as labor demand cools, one way to see evidence of this is for firms to offer fewer jobs.

This is exactly what has occurred over the past almost year and a half. In July, the number of openings stood at 8.8 million, down 3.2 million from the peak. Notice that if the same number of actual jobs were eliminated, the unemployment rate would rise by 1.9 percentage points, putting it at 5.7 percent instead of 3.8 percent.

Professional and business services led the way with 31.7 percent of the decline in job openings. This was followed (in order) by trade, transportation, and utilities (20.7 percent); retail trade (18.7 percent); education and health services (14.9 percent); and manufacturing (11.1 percent). The remainder of the industries contributed the final 2.9 percent.

Does this mean that the labor market has cooled and the soft landing is assured? Alas, no.

In addition to the relatively disguised cooling from fewer jobs being offered, there are observable demands for labor. In particular, Friday’s employment report will contain data on aggregate payrolls – the combination of jobs, hours per week per job, and average hourly pay. This is a convenient indicator of the state of labor demand – the willingness of employers to hire and pay workers.

The year-over-year growth of aggregate payroll is graphed below. The growth of labor demand peaked at just below 12 percent in February 2022 and was down to 6.1 percent in August. The decline of nearly 50 percent is good news. The bad news is that 6 percent is roughly double the rate consistent with returning inflation to the 2 percent target.

This week’s data will provide additional insights into the cooling of labor demand, and whether it will continue to do so in a smooth, non-disruptive fashion.

Fact of the Day

Across all rulemakings this past week, agencies published $2.6 billion in total costs but cut nearly 390,000 annual paperwork burden hours.