The Daily Dish

July 5, 2022

Parsing the Data – Do They Say Recession?

A full-blown recession watch has gripped the media. How should one think about that?

First, note that the National Bureau of Economic Research (NBER) is the official arbiter of recessions in the United States. The NBER Business Cycle Dating Committee “emphasizes that a recession involves a significant decline in economic activity that is spread across the economy and lasts more than a few months” and bases its decisions on a variety of indicators that “include real personal income less transfers, nonfarm payroll employment, employment as measured by the household survey, real personal consumption expenditures, wholesale-retail sales adjusted for price changes, and industrial production.”

There are two items to highlight. The NBER is looking for something that lasts for months, while much of the economic commentary tends to focus only on the most recent month’s data. Second, it is looking across a broad set of indicators; there is no single up or down in a data series that dictates the decision.

Second, and unfortunately, “the committee tends to wait to identify a peak until a number of months after it has actually occurred” – that is, the process does not operate in real time. As a result, many commentators rely on the rough rule of thumb that two consecutive declines in gross domestic product (GDP) indicate a recession. First-quarter GDP growth was below zero, so all eyes are on the July 28 release of the first estimate of 2nd quarter GDP growth.

Third, considerable focus has been on households and their spending. Consumer sentiment is at record lows, fueling this concern. Until the May release of personal income and outlays, however, real consumer spending had been on the rise. Yet single month of weak spending data raised the volume on the notion that a recession is imminent.

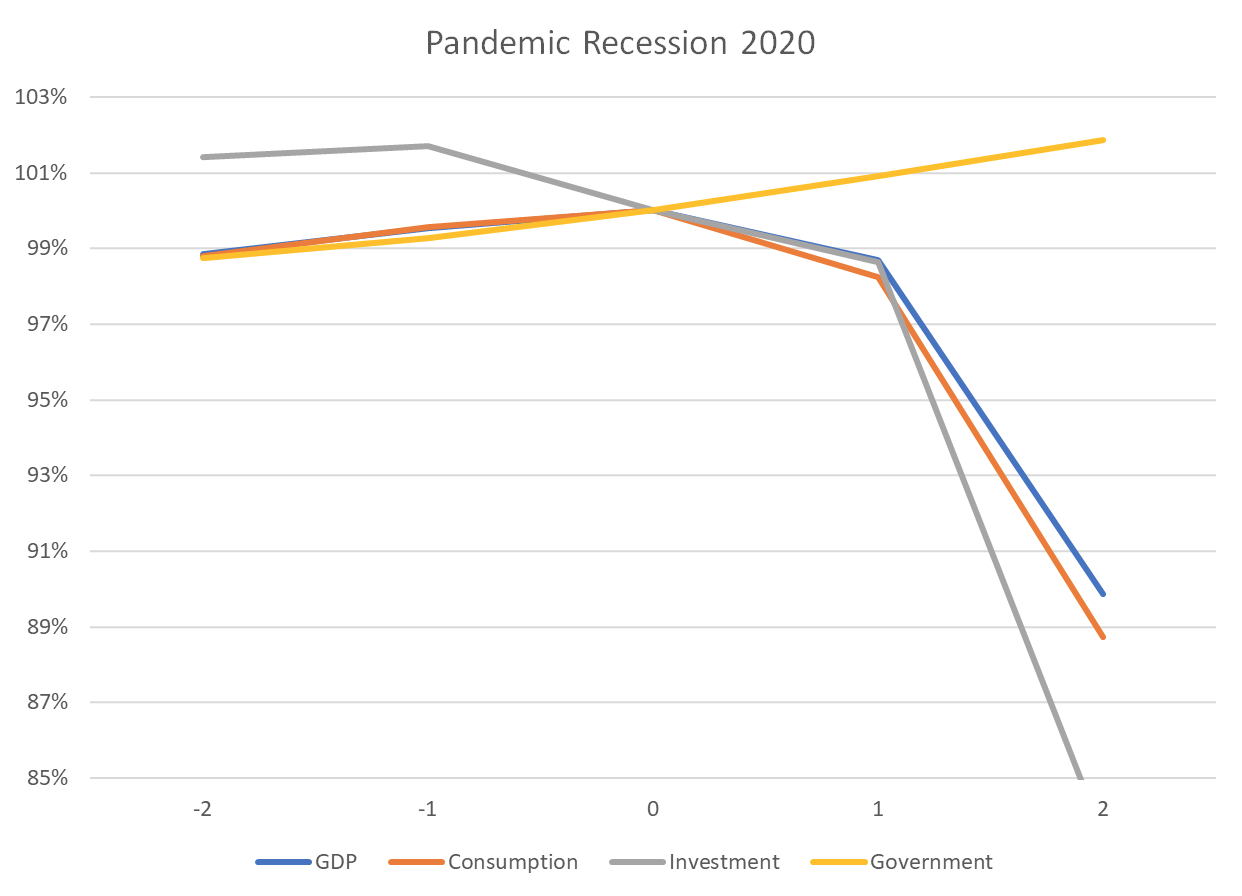

Eakinomics thinks this reasoning places too much weight on the most recent recession, which is more the anomaly than the rule. In the chart below, “0” represents the quarter designated by the NBER as the business cycle peak. The height of each line represents the value as a percent of its level at the peak quarter. So, by definition, GDP was 100 percent of the peak value in the peak quarter, and it declined sharply as time elapsed one and two quarters from the peak. Notice, however, that the decline in GDP was more than exceeded by a decline in consumer spending and business investment spending.

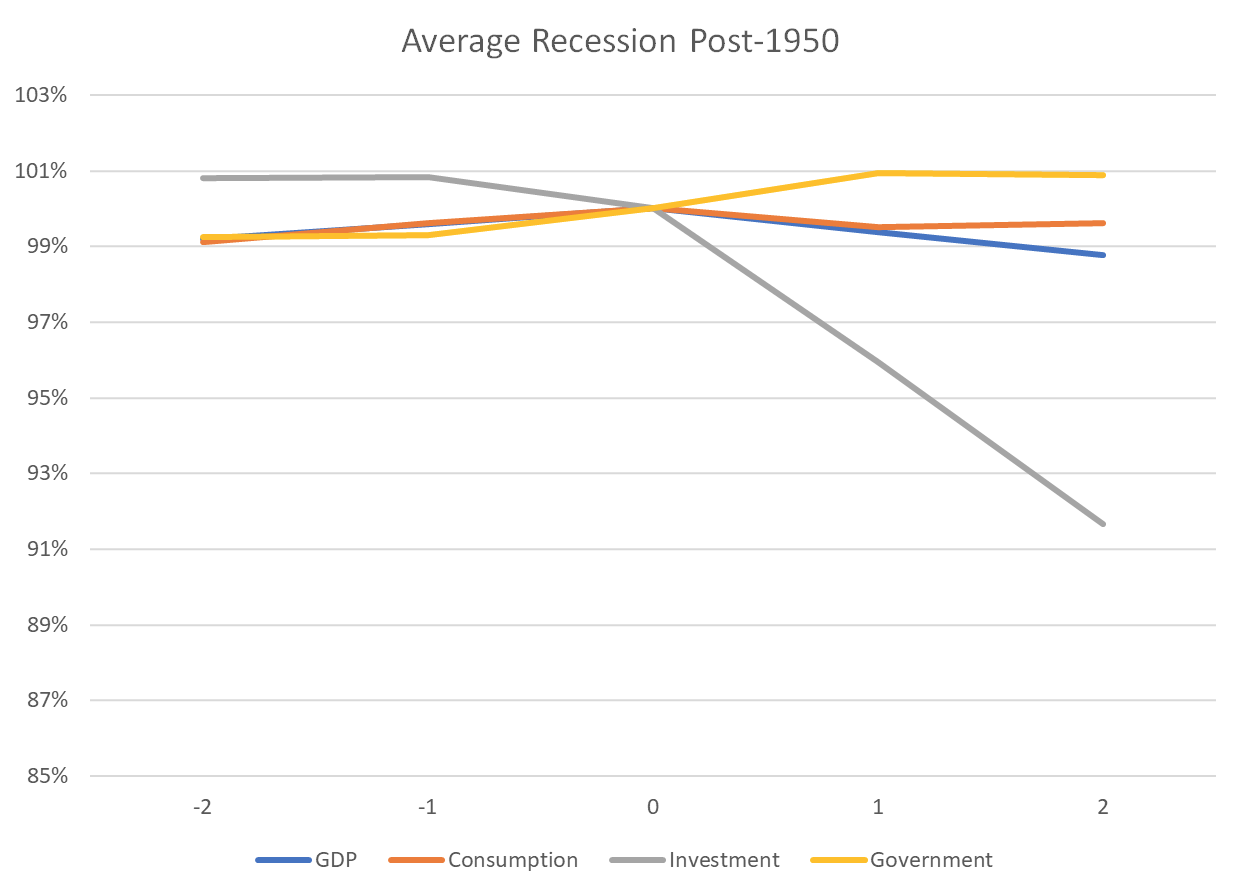

The behavior of household spending is the deviation from the norm. A similar chart (below) shows the average performance in all the recessions after 1950 and prior to the pandemic. Notice, first, that the pandemic recession was extraordinarily steep; the “typical” recession is much milder (and that is what people should be looking for). Second, household spending, on average, holds up much better than GDP as the economy weakens. One shouldn’t be focusing solely on consumption spending to indicate a downturn.

The real downward pull comes from the decline in business investment (including inventory investment). Investment has softened a touch in the 1st quarter, but there is no indication of a sharp drop-off consistent with recession history.

The demand for goods and services is one aspect of economic performance. Another perspective on the economy is the labor market, which has been red hot. The most reliable labor market indicator of recession troubles is the weekly data on new claims for unemployment insurance – a sign of layoffs. Initial claims remain at historic lows.

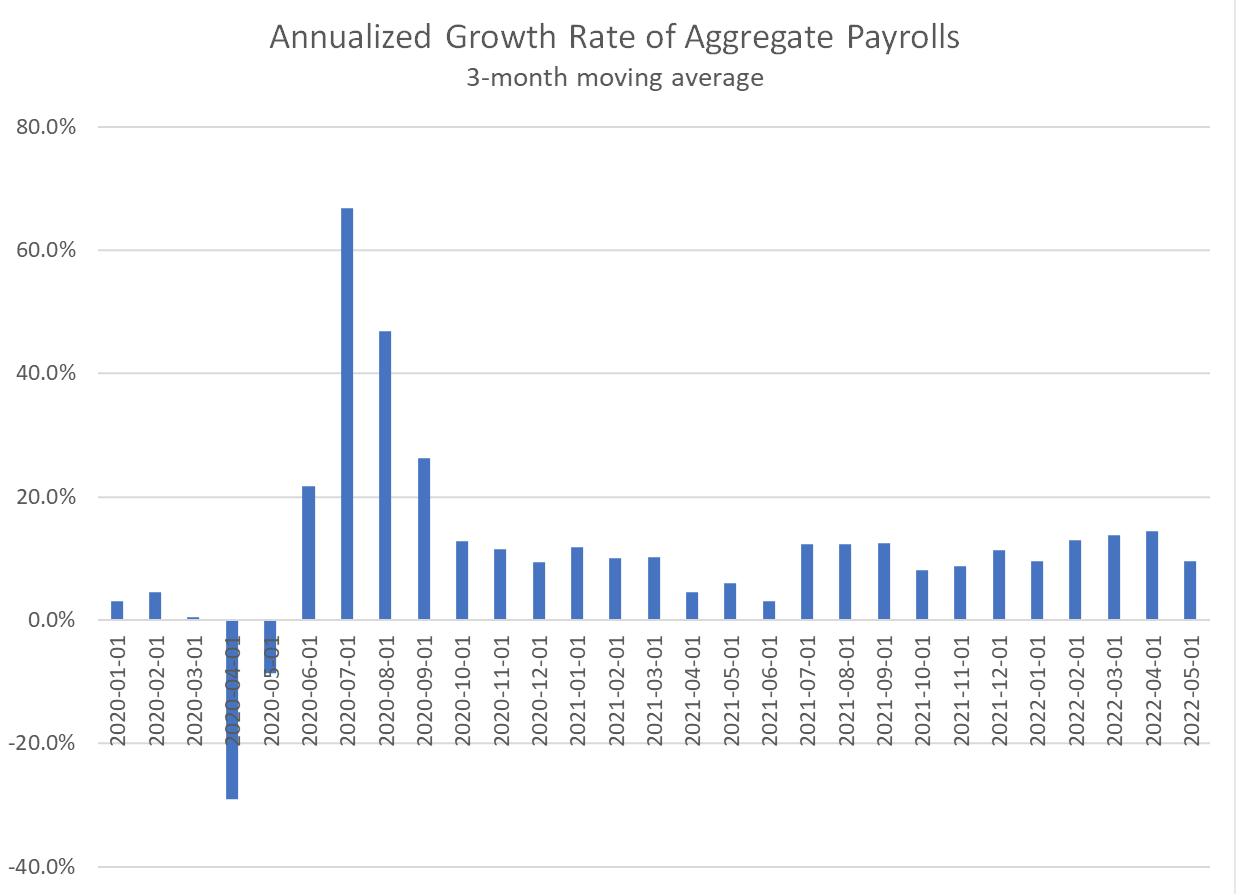

The reading is consistent with the data on labor demand. The final chart (whew! Three charts before coffee!) below tracks the growth of business payrolls. Payroll is the combination of employees, weekly hours of employees, and average hourly earnings – an omnibus measure of the demand for labor inputs. As the graph indicates, the three-month average of annualized growth in payrolls remains near 10 percent and has been high for months.

It is wise to be cautious and on alert for the economy to soften. That is, after all, the game plan of the Federal Reserve. And some of the data are sobering. But those data are a far cry from the economy heading over a cliff and into a recession this month.

Fact of the Day

The FDA estimates its proposed rule to make some prescription drugs OTC would save consumers an average of $26.70 per drug purchase.