The Daily Dish

October 13, 2022

Health Care Inflation

Inflation is everywhere, with the result that everyone has to write about inflation. The latest installment came from Politico and was entitled: Health care inflation is coming for Biden. That sounds ominous. The article made two basic points:

- “It usually takes a year or more for the supply chain bottlenecks and rising wages that drive up prices to factor into the contracts that dictate what consumers and insurance plans pay.”

- “The Federal Reserve Bank of Dallas last month estimated that the rate of health care inflation will almost double between mid-2022 and mid-2023 as insurance starts to factor in surging labor costs for hospitals and health networks.”

So, expect higher costs for the services of providers and, as a result, higher premiums for the health insurance that covers those costs. Doesn’t sound crazy.

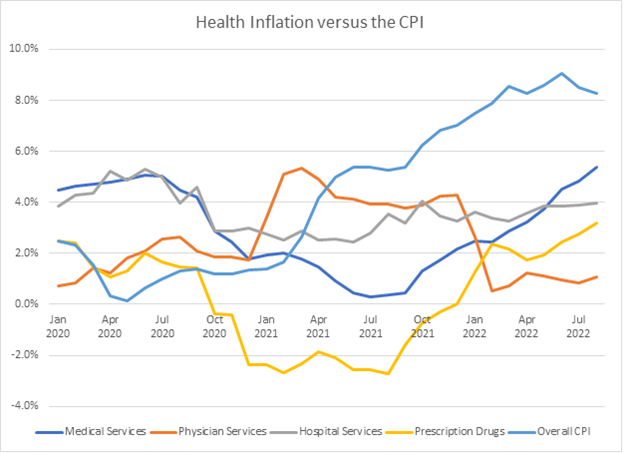

The first thing to notice is that this is a forecast of inflation. To date, it has just not happened. The chart (below) compares year-over-year inflation from January 2020 for the overall Consumer Price Index (CPI) to indicators of health care inflation, namely: medical services, physician services, general and surgical hospital services, and prescription drugs. These are all indicators of the cost of services that feed into insurance premiums. (Note: these are data from the CPI and reflect the prices paid by consumers when they buy, for example, prescription drugs.)

The basic pattern is pretty simple. Prior to the second quarter of 2021, by and large health inflation was higher than the CPI; since then, roles have been reversed. Health inflation is not the current inflation problem. Politico notes this: “Until recently, inflation in the health care sector was relatively mild compared to other areas of the economy like rental housing and consumer goods. But that’s only because it usually takes a year or more for the supply chain bottlenecks and rising wages that drive up prices to factor into the contracts that dictate what consumers and insurance plans pay for health care.”

The remainder of the argument is that future health-services inflation will be higher because of rising supply costs. But that is no different than any other good or service in the economy if health care inflation is going to spiral north over the next 1-2 years; so is everything else, which is essentially making the prediction that the Fed will fail in spectacular fashion.

Instead, the Fed is engaged in lowering inflation expectations so that retail prices are not pressured upward because of higher labor and supply costs. And it is simultaneously reducing the growth of demand in the economy, so that actual prices increase moderately. There are unique features to health care, but buildings, facilities, electricians, IT techs, and other parts of the production process are subject to the same market pressure inside and outside of health care.

Health inflation may rise modestly for a (very) short while, but my money is on the Fed.

Fact of the Day

The EPA estimates that its rule on emissions standards for boilers and process heaters will impose $265 million in compliance costs for affected facilities.