The Daily Dish

July 29, 2024

Catching Up on the Economy

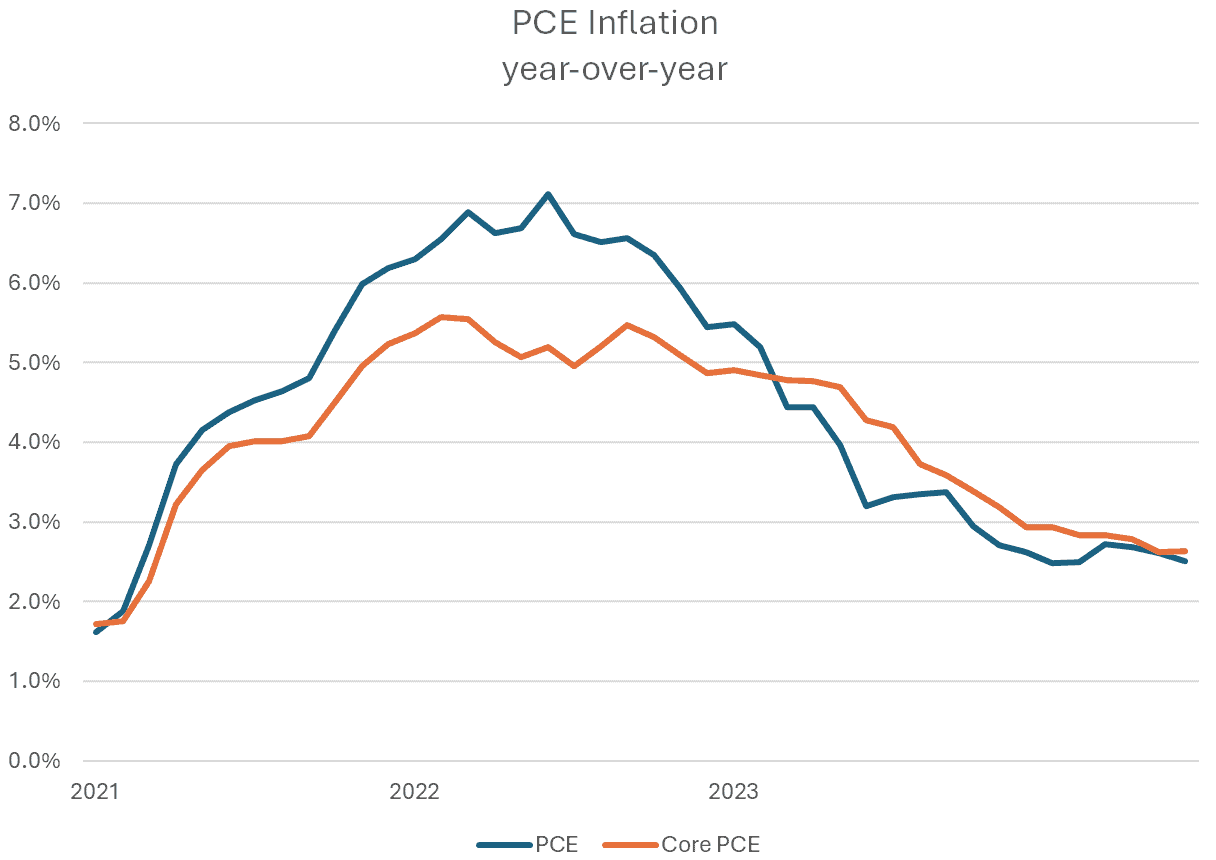

This past Friday the Bureau of Economic Analysis (BEA) released the June data for personal income and outlays, which include the price index for personal consumption expenditures (PCE price index). The PCE price index is the Federal Reserve’s preferred measure of inflation. Despite it coming in a bit hotter than expected (see chart) – core PCE inflation was unchanged – talk of a Fed rate cut ramped up.

Writing in The Wall Street Journal Fed whisperer Nick Timiraos argued: “The Fed’s newfound readiness to cut rates reflects three factors: better news on inflation, signs that labor markets are cooling and a changing calculus of the dueling risks of allowing inflation to remain too high and of causing unnecessary economic weakness.”

Count me unconvinced.

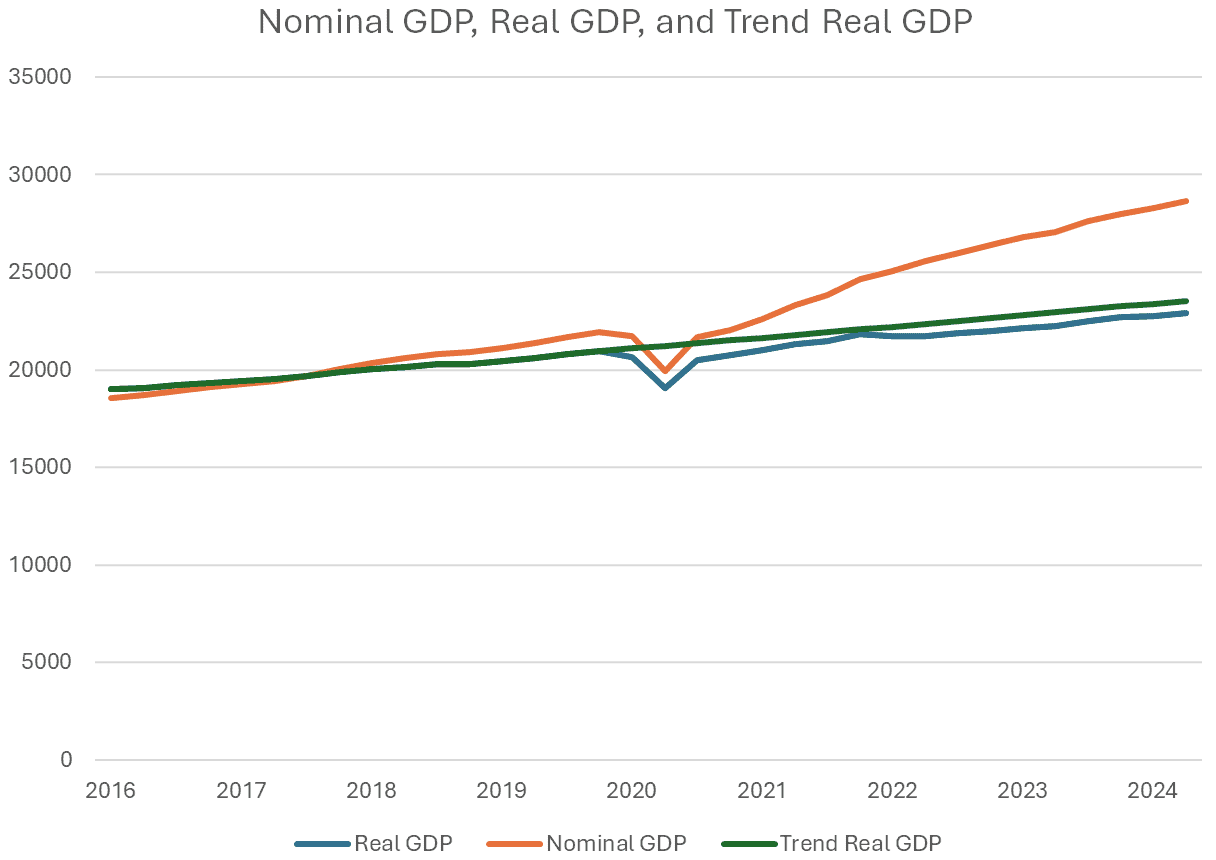

The Fed’s tools – interest rates and the size of the balance sheet – work by affecting aggregate demand spending in the economy. That’s good because demand remains the inflation problem. One way to see this is shown below. The green line is a simple measure of the pre-pandemic trend growth of real gross domestic product (GDP), extended to the present. As one can see, actual real GDP (blue line) is essentially back at the trend, meaning that the factors of aggregate supply – capital, labor, technologies, and those infamous supply chains – are back to trend. Any remaining resistance to disinflation must come from excess aggregate demand, which is how nominal GDP (reflecting the higher prices) got so far above real GDP.

Now, Eakinomics has worried a lot about the state of aggregate demand recently, especially the household sector. But Friday’s report showed a second consecutive month of solid growth in real disposable income and real consumption spending. The household sector just is not falling apart. More generally, last week’s report on 2nd quarter GDP shows that real final purchases by domestic purchasers (those affected by Fed policy) have not grown slower than a 1.7 percent annual pace since the 1st quarter of 2023 and have averaged 2.8 percent over that period. In the first two quarters of 2024, they have been an identical 2.6 percent. Demand growth is not faltering in a way that suggests the need for a pre-emptive rate cut.

Recall that in his Jackson Hole speech that outlined the logic of the tightening cycle, Chair Powell argued that the most serious error would be to ease prematurely, something Timiraos suggests is being rethought. Well, another part of that speech emphasized the importance of inflation expectations in the inflation process. This should give the Fed pause because inflation expectations have stalled in the area of 3 percent.

Consumers are far from confident that inflation will return to the 2 percent target. Why is the Fed?

In sum, the labor market and other supply considerations are not central to the decision; the state of aggregate demand is central. The evidence does not support the notion that demand is faltering and that the risk of recession suddenly outweighs the risk of sustained higher inflation. Indeed, the latter is exactly what households anticipate – and dislike.

Fact of the Day

Spending on federal health care and retirement programs constitutes 45 percent of the federal budget and is projected to rise to 51 percent of the budget by 2034 and to 79 percent by 2054 under current law.