The Daily Dish

September 13, 2022

August CPI Preview

At 8:30 a.m., the Bureau of Labor Statistics will release the August report on the Consumer Price Index (CPI). There is good reason to expect top-line inflation to be zero or negative, but don’t be fooled. There will be no reason for a victory dance or for the Fed to change course.

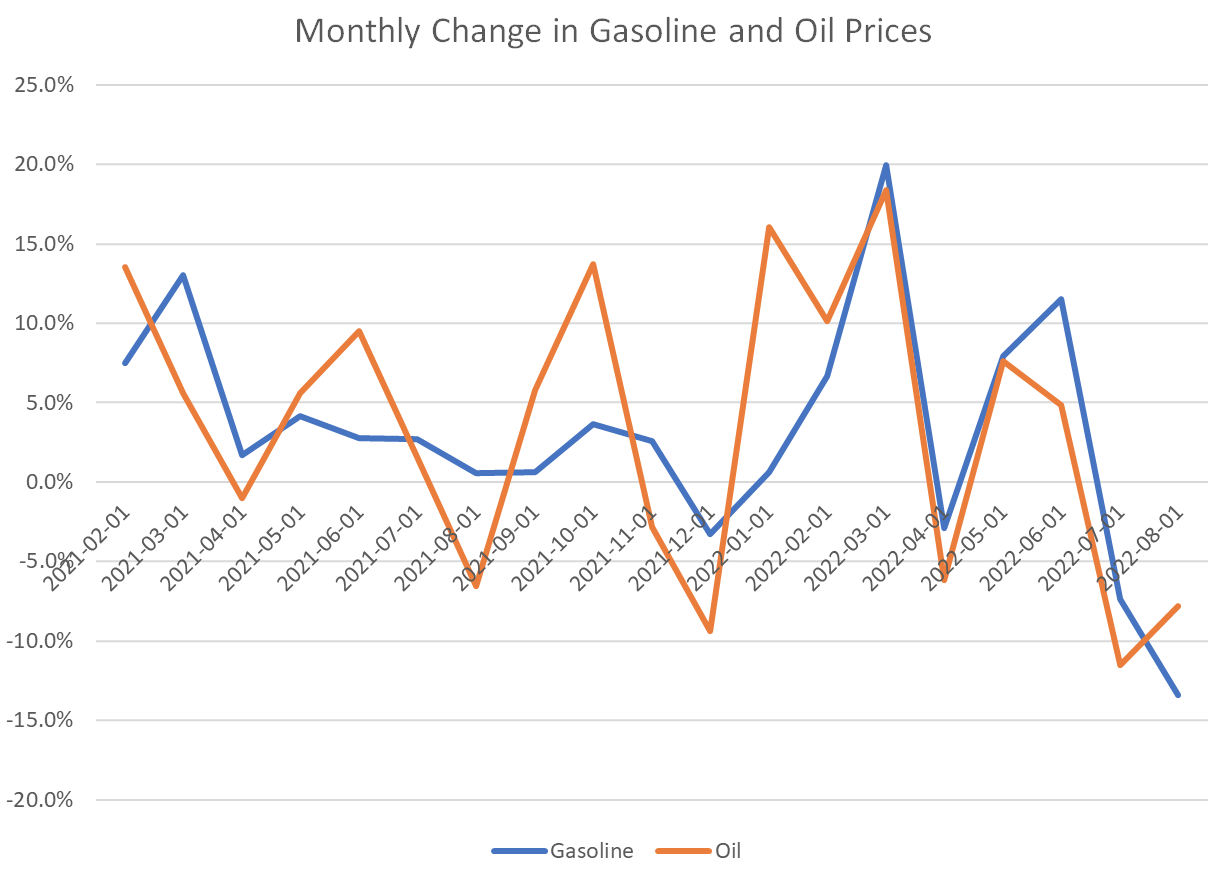

The key action recently has been the sharp decline in global oil and gasoline prices (shown below).

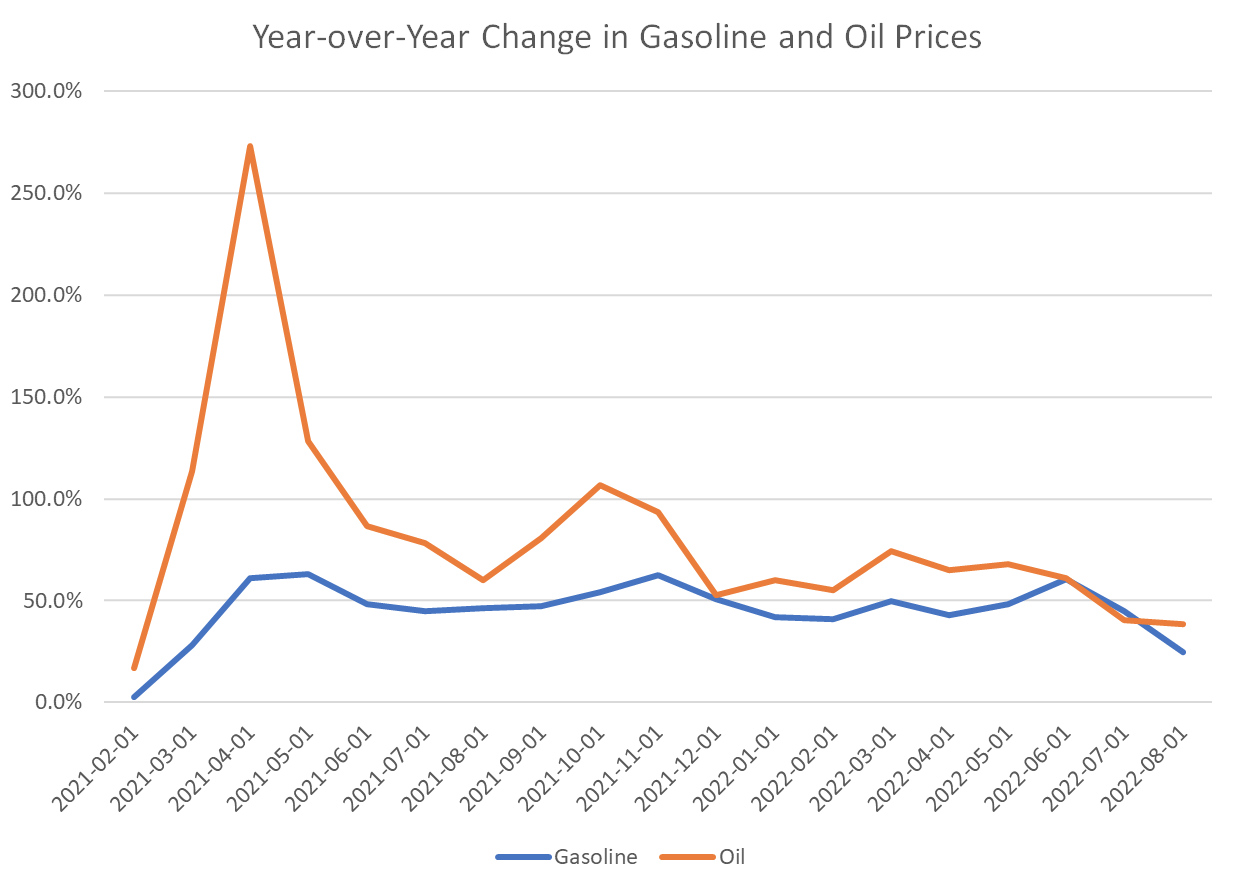

We saw the same pattern in July. Oil prices were down over 11 percent, while gasoline prices dropped over 7 percent. The result was enough to drive top-line CPI inflation to zero for the month of July. But year-over-year CPI inflation remained elevated at 8.5 percent, in part because over a full year, both oil and gasoline prices are up dramatically (see below).

Indeed, energy makes up only roughly 15 percent of the typical budget. So, despite the decline, in July the essentials – food, energy, and shelter – rose by over 11 percent year-over-year.

The same will be true today in the August numbers. The top-line will be driven by the 13 percent decline in gasoline prices and 7 percent decline in oil prices. So, when the White House breaks out in its we-misused-the-Strategic-Petroleum-Reserve-and-it-worked dance, simply ignore. This is more likely just evidence that the China economy has as much life as the Patriot’s offense right now.

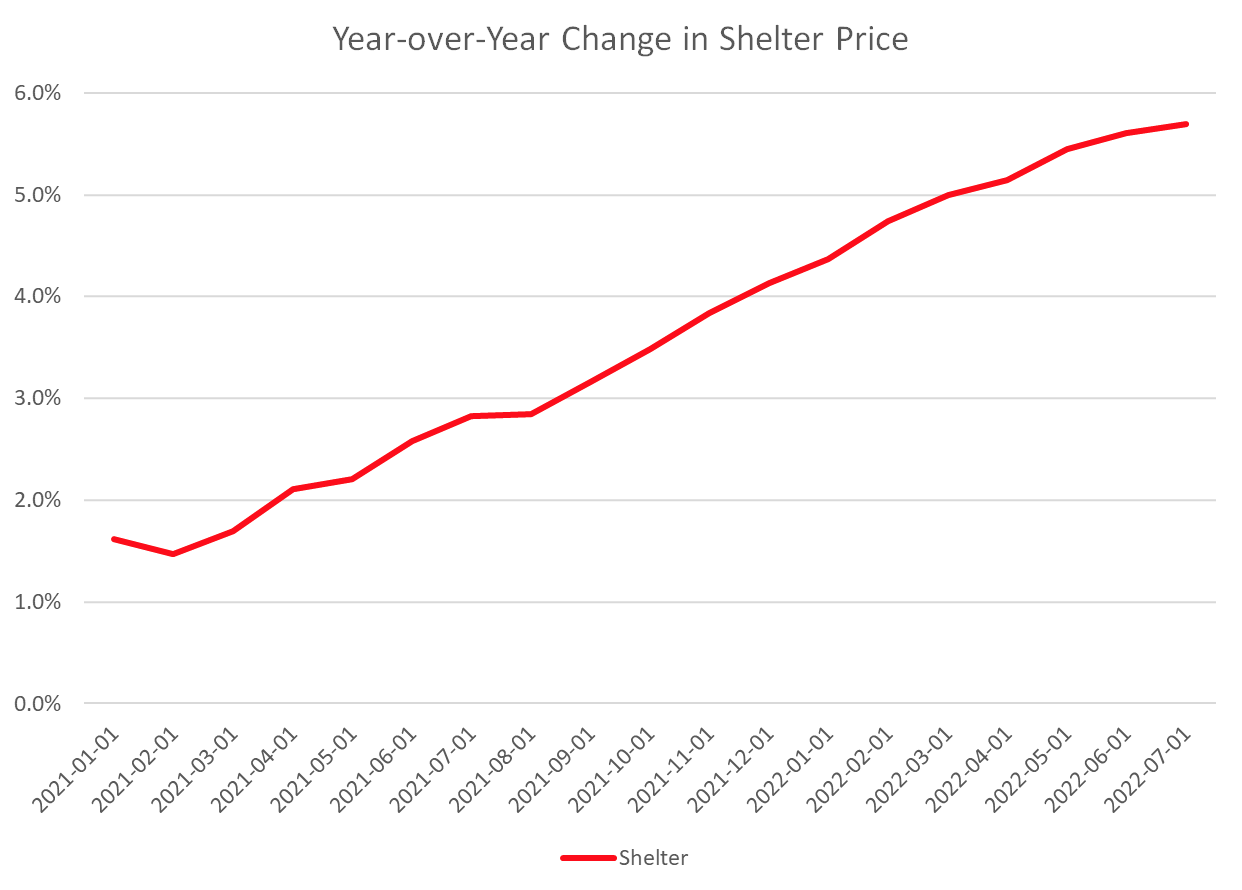

A better place to focus one’s attention remains shelter price inflation. Shelter constitutes one-third of the CPI; shelter price inflation has a big impact on the bottom line. More important, to date in 2022 (see below), shelter price inflation has shown no sign of peaking. The Fed will be making real progress on inflation when shelter price inflation starts moving downward in a significant and sustained manner, and not before.

Fact of the Day

Across all rulemakings this past week, agencies published $39 billion in total net costs but cut 5.4 million annual paperwork burden hours.