The Daily Dish

July 25, 2024

AAF’s Plan to Address the Nation’s Fiscal Woes

On July 23, the American Action Forum participated in the Peterson Foundation’s Solutions Initiative 2024: Charting a Brighter Future and unveiled “Unbalanced,” its plan to address major budgetary and economic needs. One way to think about such a plan is to look at its constituent parts: reforms to Social Security and the nation’s major health care programs (Medicare, Medicaid, the Children’s Health Insurance Program, and the Affordable Care Act exchanges), comprehensive pro-growth tax reform, immigration reform, funding for national defense, and reforms to other areas of the federal budget. These parts combine to put debt on a downward trajectory over the next three decades. Details of AAF’s plan are available here and those of the six other participating think tanks here.

Unbalanced emphasizes three core recommendations: entitlement reform, addressing global threats, and tax reform. On entitlement reform, AAF’s plan recognizes that the primary drivers of the nation’s future debt accumulation are its retirement and health care programs, and any meaningful fiscal consolidation must substantially and materially reform these programs. For perspective, spending on these programs constitutes 45 percent of the federal budget and is projected to rise to 51 percent of the budget by 2034 and to 79 percent by 2054 under current law.

The AAF plan includes a suite of policy changes – including raising the retirement age and subjecting 90 percent of earnings to the payroll tax – to bring Social Security revenue in line with spending and restore solvency to a program on which more than 60 million Americans rely. On the health care front, AAF’s plan focuses on cost containment for the federal government and slowing the growth of per-person health care spending through the establishment of per-capita caps on federal Medicaid spending and movement to a premium support model for Medicare.

AAF’s second recommendation to address global threats acknowledges that the United States faces an increasingly complex set of national security challenges. For this reason, the plan provides additional defense funding to meet global challenges.

AAF’s third recommendation of comprehensive pro-growth tax reform acknowledges that while the Tax Cuts and Jobs Act of 2017 (TCJA) made sweeping changes to the federal tax code, there is more to be done. The looming expiration of many of the TCJA’s provisions at the end of next year is an opportunity for durable tax reform that would build on the best elements of the TCJA and reform those that could be improved. Under AAF’s plan, the business tax outlook would substantially improve, notably by maintaining the 21 percent corporate tax rate, expanding and making permanent expensing of equipment, and reforming international tax rules to remove complexity and barriers to U.S. competitiveness that plague the international tax system.

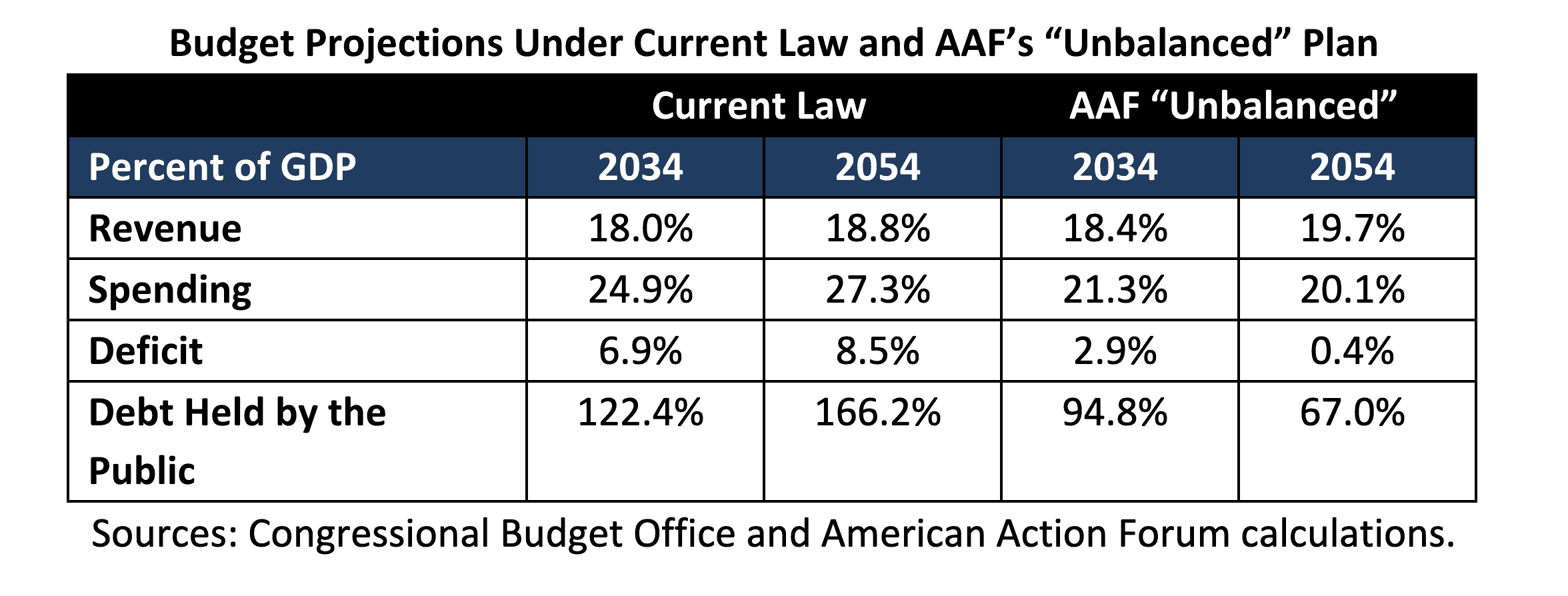

All told, the reforms in AAF’s Unbalanced plan would reduce debt to about 95 percent of gross domestic product (GDP) by 2034 and to 67 percent of GDP in 30 years, while running modest annual budget deficits. The plan would protect the fundamentals of growth, security, and freedom.

Fact of the Day

In 2019, antimicrobial resistance pathogens killed roughly 48,000 nationally and 1.3 million people globally, and were associated with 5 million deaths globally.