Insight

September 12, 2024

Biden’s Paperwork Burden Report Shows Need for Structural Reform

EXECUTIVE SUMMARY

- The Biden Administration recently released this year’s edition of its “Burden Reduction Report” presenting the series of initiatives it has conducted over the past year aimed at streamlining the administrative burdens involved in the provision of certain public benefit programs.

- The report details 56 actions agencies have undertaken, with 21 of these items containing quantifiable estimates that amount to 34.5 million hours in claimed burden reductions.

- Since the release of the original 2023 report, however, the government-wide paperwork burden has grown to the highest total on record at 12.1 billion hours, demonstrating that the administration’s burden-reduction efforts represent little more than a rounding error and that more structural reforms are necessary to bring the nation’s red tape load under control.

INTRODUCTION

The Biden Administration has released its latest report on “Tackling the Time Tax: Making Important Government Benefits and Programs Easier to Access” (or Burden Reduction Report). The report includes a series of examples where agencies tried to cut red tape in public benefit programs over the course of fiscal year (FY) 2023, with quantified savings adding up to roughly 34.5-million-hours-worth of paperwork reductions. While this may seem like a notable development at first glance, the government-wide paperwork burden total has jumped by 1.6 billion hours to more than 12.1 billion hours – the highest such total on record – since the Biden Administration produced its original Burden Reduction Report. Such a disparity demonstrates the failure of piecemeal, ad-hoc efforts to meaningfully address the issue of administrative burdens and suggests the need for deeper, more structural reforms.

LATEST EFFORTS

The Biden Administration’s latest Burden Reduction Report comes in two parts: a main summary report and an appendix that the Office of Information and Regulatory Affairs (OIRA) designates as its “Information Collection Budget” (ICB) for FY 2023 under the Paperwork Reduction Act (PRA). For reasons that are unclear, the main report focuses only on a handful of initiatives and includes only scant quantifiable estimates of burden reductions. The appendix, however, goes into more detail regarding agency actions and includes substantially higher estimates. Across both documents, agencies claim a total of 34.5 million hours in burden reductions with the Departments of Health and Human Services (HHS) and Homeland Security (DHS) being the primary contributors.

The main report focuses on the following agency initiatives:

- Medicaid Process Improvements

- Simplifying Taxpayer Notices

- Simplifying Reporting Requirements for Supplemental Security Income Recipients

- MySBA

- Reducing Burdens in [HHS] Grantmaking

- Federal-State Cooperation: Reducing Burden in Nutrition Assistance Programs

- Reducing Burden in Presidential Pardons Requests

- Streamlining Employment Eligibility Verification

OIRA includes only quantified paperwork savings for the general public in two of these items. “Medicaid Process Improvements” will purportedly yield 4.5 million hours in savings between both individual applicants and state governments, and “Simplifying Reporting Requirements for Supplemental Security Income Recipients” will produce roughly 200,000 hours worth of reductions. In the section providing updates on initiatives from the 2023 report, OIRA finds 51,300 hours in reductions from DHS’ “Improving the Disaster Assistance Experience” initiative. In a somewhat curious inclusion, the report also highlights 3.8 million hours of reductions in internal administrative burdens for the U.S. Agency for International Development. While such a program change may have some salutary effects in terms of government efficiency for this agency, it does not represent a real burden reduction for the public at large.

The 2024 Burden Reduction Report’s appendix includes another “48 burden reduction initiatives from 18 agencies.” Of these, 16 entries (one-third of the overall number of initiatives) included the following quantified burden reduction estimates:

| Agency | Title | Hours Reduced |

| Commerce | Market Development Cooperation Program Preliminary Eligibility Assessment Tool | 242 |

| Commerce | PTAB | 200 |

| Education | Direct Loan, Federal Family Education Loan (FFEL), Perkins and Teacher Education Assistance for College and Higher Education (TEACH) Grant Total and Permanent Disability Discharge Application | 80,000 |

| DHS | DHS Burden Reduction Initiative – Reducing Public Burden by 10M Hours: Enable online submission of form(s) | 2,178,000 |

| DHS | DHS Burden Reduction Initiative – Reducing Public Burden by 10M Hours: Simplification, automatic renewals, and “short form” options. | 66,100 |

| DHS | DHS Burden Reduction Initiative – Reducing Public Burden by 10M Hours: Acceptance of electronic or digital signatures | 24 |

| DHS | DHS Burden Reduction Initiative – Reducing Public Burden by 10M Hours: Simplification, automatic renewals, and “short form” options. Other Centralize location of fee information. | 1,230,920 |

| Labor | Voluntary Self-Identification of Disability Form | 776,767 |

| Treasury | Tax Simplification (Beer Industry Members) | 45,150 |

| FCC | Bridging the Digital Divide for Low-Income Consumers, Lifeline and Link Up Reform and Modernization, Telecommunications Carriers Eligible for Universal Service Support | 1,997,480 |

| SSA | Intermediate Improvement to the Disability Adjudication Process, Including How we Consider Past Work Final Rule | 938,735 |

| SSA | Omitting Food From In-Kind Support and Maintenance Calculations | 95,668 |

| SSA | Use of Electronic Payroll Data to Improve Program Administration | 75,154 |

| USDA | Community Eligibility Provision (CEP) Expansion: Increasing Options for Schools | 18,908 |

| USDA | WIC Online Ordering and Transactions and Food Delivery Revisions to Meet the Needs of a Modern, Data-Driven Program and Preparation of Final Rule | 1,203,031 |

| HHS | Streamlining Medicaid; Medicare Savings Program Eligibility Determination and Enrollment | 21,000,000 |

| TOTAL | 29,706,379 |

THE SCALE OF THE PAPERWORK PROBLEM

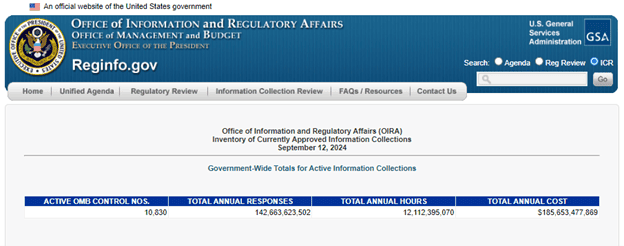

Despite the efforts included above, the federal paperwork load has continued to grow at an incredible rate. On July 10, 2023, – the release date of the 2023 Burden Reduction Report – the government-wide paperwork burden stood at 10.5 billion hours. As of September 12, 2024, that total was more than 12.1 billion hours – the highest level the American Action Forum (AAF) has recorded in more than 12 years of tracking this figure.[1] Thus, over the past 14 months, federal paperwork has grown by roughly 1.6 billion hours, essentially averaging 114-million-hours-worth of new paperwork requirements each month.

Thus, over the past 14 months, federal paperwork has grown by roughly 1.6 billion hours, essentially averaging 114-million-hours-worth of new paperwork requirements each month.

To give a sense of the scale of this estimated total, 12.1 billion hours amounts to:

- 4 million years in terms of time;

- Requiring the equivalent of 5.9 million full-time employees[2] to complete; and

- Representing an opportunity cost of $426.5-billion-worth of labor[3] that could be directed toward other ends.

For further perspective, these numbers respectively represent:

- The span of time that current evidence suggests humans have populated Europe;

- The combined workforces of Walmart, Amazon, the U.S. Postal Service, Home Depot, UnitedHealth Group, FedEx, and Target[4]; and

- Approximately the currently estimated gross domestic product of the state of Wisconsin.

A recent addition to this massive paperwork inventory highlights a potentially troubling development as well. Last week, OIRA noted the official clearance of an information collection requirement (ICR) from the National Oceanic and Atmospheric Administration (NOAA) regarding “Generic Clearance for Citizen Science and Crowdsourcing Projects.” The agency estimates that the various paperwork items involved in this requirement add up to more than 202 million hours each year. In the accompanying supporting statement for the ICR, NOAA notes how it “realized that it had a variety of citizen science and crowdsourcing projects, which required but did not have approval from the Office of Management and Budget under the Paperwork Reduction Act .” As such, this was not even a newly developed ICR, but rather a current set of paperwork requirements that were not duly recognized as such – all 202 million hours of it. This raises questions about other paperwork that exists but remains unaccounted for in this government-wide total.

WHAT REFORM COULD LOOK LIKE

Long-time followers of AAF’s regulatory work are likely familiar with its preferred reform framework to address the federal government’s excessive paperwork burden: the implementation of a true “paperwork budget.” AAF has regularly noted since 2013 the benefits of such a policy. The basic concept is summarized thus:

The core premise of such a program is not dissimilar from the broader “regulatory budget” framework in which agencies and the government writ large set certain policy targets for what the “limit” on new burdens will be and then go about balancing out the burdens involved with new requirements versus savings from eliminating, consolidating, or streamlining old requirements.

Yet perhaps given the issues identified in this recent Burden Reduction Report, it is worth walking through some of the more granular steps that policymakers would need to take to successfully implement such a policy program.

Step 1: A Paperwork Audit

To get a firm handle on the overall size and scope of a “budget,” one must accurately ascertain all of its component aspects. The current OIRA ICR database is already quite extensive, but as the NOAA ICR discussed earlier illustrates, there are some significant paperwork requirements that sometimes fall through the cracks. In past ICBs, OIRA has conducted a review of “PRA Violations,” or instances in which agencies show paperwork requirements that were not properly cleared. Last year’s Burden Reduction Report included this section in an appendix; for reasons that remain unclear, this year’s does not include this section across any of the currently released documents. Whether it be through OIRA, the Government Accountability Office, or even a potential “Congressional Regulatory Office,” some entity must be in charge of maintaining a rigorously accurate record of all federal paperwork requirements.

Step 2: Establish a Proper Baseline

Before one can go about setting goals for the next budgetary period, one must determine each agency’s baseline and the component categories therein. Past ICBs – even those like last year’s that relegated it to an appendix – have produced such an accounting. Again, for reasons that remain unclear, such an analysis is absent from this year’s report. Historically, this PRA accounting has broken down the overall paperwork burden agency by agency and also noted the following categories of burden changes: “discretionary agency actions, statutory changes, lapses in renewal or discontinuation, and adjustments (changes in agency estimations).” These are important points of data because they allow the “budget-setter” to: A) know which agencies have the greatest room for improvement, and B) understand which changes are more easily adjusted (i.e., discretionary agency actions versus statutory actions that would require legislative action). Additionally, it is important that this baseline accounting happen on a timely basis. As one can see from the publication dates of ICBs in recent years – across multiple administrations – this has not been the case:

Step 3: Set Reasonable Goals

Having established all the proper data involved, one can move on to setting budgetary goals. As posited in AAF’s analysis of last year’s Burden Reduction Report, a sensible goal might be to follow the track record of an agency such as DHS and aim for a 10-percent reduction in the overall paperwork total. It is important to recognize, however, that this goal may not be achievable for all agencies.

For instance, the Internal Revenue Service (IRS) currently accounts for roughly 7.9 billion hours of paperwork, or roughly 65 percent of the government-wide total. It is unfortunately quite understandable that tax-related paperwork accounts for such a large – and growing – portion of the nation’s paperwork load. Additionally, given the nature of tax law, there may not be as much flexibility to adjust such a total year over year barring certain statutory changes.

Nevertheless, even if one simply pored over the non-IRS paperwork burdens, it would leave one with 4.2 billion hours to work with. Coming up with a 10-percent “haircut” across the cohort would, of course, provide roughly 420 million hours in savings. For perspective on the magnitude of such a set of reductions, the to-date total of estimated paperwork attached to Biden-era rules sits at 324 million hours.

CONCLUSION

Standing at 12.1 billion hours each year, the nation’s overall red tape burden is at the highest level on record. The Biden Administration’s latest Burden Reduction Report represents a well-intentioned effort that – as with any number of such efforts conducted by prior administrations – fails to meaningfully address the overall problem. The key issue here is scale. These initiatives focus on solutions in the millions when the conundrum numbers are in the billions. Policymakers interested in truly making a dent in the federal government’s current paperwork inventory must take a more wholistic, systemic approach.