The Daily Dish

September 3, 2024

New Economic Data Sets Stage for Interest Rate Cut

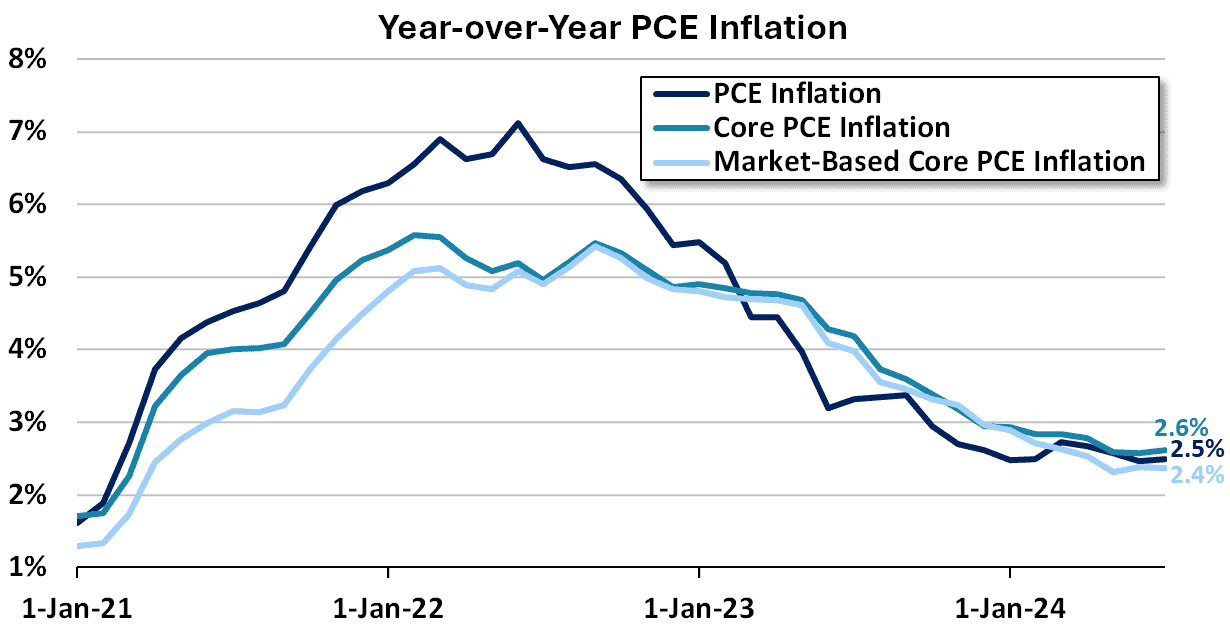

On Friday, the Bureau of Economic Analysis (BEA) released its report on Personal Income and Outlays for July 2024, which contains the Federal Reserve’s preferred measure of inflation: the Personal Consumption Expenditures (PCE) price index. Month-over-month PCE inflation ticked up from 0.1 percent in June to 0.2 percent in July. Core PCE inflation – which excludes food and energy – and market-based core PCE both remained unchanged at 0.2 percent. Year-over-year PCE inflation remained unchanged at 2.5 percent, core PCE inflation held steady at 2.6 percent, and market-based core PCE stayed constant at 2.4 percent.

Overall, the report was mostly in line with forecasts. Month-over-month PCE inflation was expected to total 0.2 percent and 2.6 percent on a year-over-year basis. Core PCE inflation was expected to be up 0.2 percent for the month and 2.7 percent over July 2023. Friday’s data showed month-over-month changes in line with forecasts, while the year-over-year change in core PCE came in a bit softer than expected. The details of the report were promising, as well. Goods price inflation remains contained and services inflation ticked down from 3.8 percent to 3.7 percent over the past year.

Friday’s data also showed a 0.1 percent month-over-month increase in real disposable personal income, which is the cash flow available to support household spending, and a 1.1 percent year-over-year increase. Real consumer spending was also up 0.4 percent for the month and 2.7 percent over July 2023.

In other economic news, the BEA released its second estimate of the growth in real gross domestic product (GDP) during the second quarter of 2024. BEA now estimates that real GDP grew 3.0 percent, up from its initial 2.8 percent estimate. This follows 1.4 percent growth during the first quarter of 2024.

This is all good news for the Federal Reserve as it ponders cutting interest rates for the first time in more than four years at this month’s meeting. Chairman Powell recently said that “the time has come” for the Fed to begin reducing borrowing costs after keeping them at a 20-year high (a range of 5.25 to 5.5 percent) since July of last year. All of this good economic news makes a rate cut appear likely.

Fact of the Day

The median amount saved on the costs of the first 10 drugs “negotiated” under the Inflation Reduction Act was $214 less than under private-sector negotiations.