Insight

August 22, 2024

Harris vs. Trump: Assessing the Potential Regulatory Policy Paths in the 2024 Election

EXECUTIVE SUMMARY

- As convention season concludes and the 2024 general election season formally begins, attention should focus on the diverging policy visions of former President Donald Trump and Vice President Kamala Harris; this insight considers how each is likely to direct federal agencies to implement their respective agendas.

- A President Harris would likely continue the historically expansive regulatory legacy of the Biden Administration, with perhaps the most notable divergence coming in an even greater willingness to leverage the power of the federal government to artificially determine market prices.

- Voters can expect that a once-again President Trump would implement a regulatory policy vision largely mirroring the record established during his previous term – a vigorous series of up-front initiatives and actions seeking to roll back regulatory burdens on various economic issues – albeit with potentially more aggressive measures on immigration, trade, and various social issues that could impose regulatory costs.

INTRODUCTION

As the 2024 general election campaign begins in earnest, Americans’ attention should turn toward the substantive policy differences between the campaigns of Vice President Kamala Harris and former President Donald Trump. Given that so much of the nation’s actual policymaking in recent years – across the past several administrations – has emanated from federal agency rulemakings, it is important to get a sense of where the candidates stand in terms of their respective visions for how to deploy the regulatory state.

Both the Harris and Trump campaigns provide a historically unique opportunity in this regard, with both candidates claiming a kind of quasi-incumbent quality, either in being the immediate predecessor to the Biden Administration, or its clear heir apparent. An examination of the candidates’ records and relevant campaign materials reveals the largely intuitive conclusion that voters can expect a President Harris to continue the Biden legacy of unprecedented regulatory activity, while a once-again President Trump will likely produce a much more restrained result with decidedly deregulatory efforts – but with some clear exceptions on policy priorities such as immigration, trade, and social issues that are inherently regulatory in nature.

COMPARING PAST RECORDS

Part of the reason one can foresee why these two potential administrations could have such wildly divergent regulatory policy trajectories is because there is a recent record of policy results to draw from. The Trump Administration, in implementing a “regulatory budget” for the first time under Executive Order (EO) 13,771, was able to attain historically constrained levels of regulatory costs. Meanwhile, though not the incumbent president, Vice President Harris as the Democratic nominee has given no indication that she intends to distance herself from the historically high level of regulatory activity put forward under the Biden-Harris Administration.

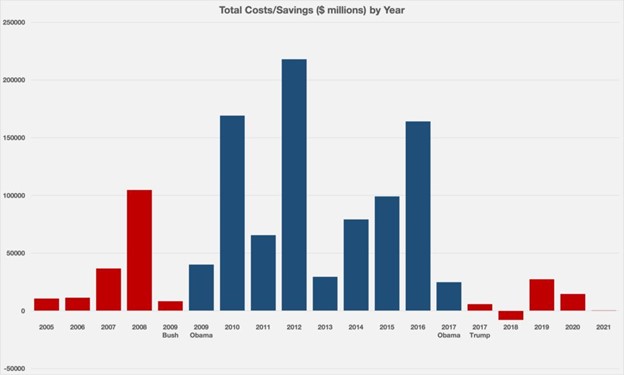

As the American Action Forum (AAF) noted at the end of former President Trump’s term in January 2021, his administration left office with a net total of $40.4 billion in regulatory costs. AAF also had a deeper analysis of the regulatory budget’s legacy found here. Despite the various deregulatory efforts under his presidency, the only calendar year during which agencies produced net cost savings was 2018. This was primarily due to the simple fact that – outside of a series of rules repealed with the help of the Congressional Review Act – shepherding through deregulatory rulemakings takes time and effort. Additionally, once agencies cleared out the low-hanging fruit during the first part of that administration, there were diminishing opportunities for rulemakings that would have had a measurably deregulatory effect. Nevertheless, one need only look at the chart from AAF’s Trump retrospective to get a sense for how, if nothing else, the regulatory budget framework constrained the growth of regulatory activity: Contrast that level of constraint with what we have seen from the Biden-Harris Administration thus far. As of August 16th (the week before the Democratic National Convention), the total cost tallies for the Trump and Biden Administrations were the following:

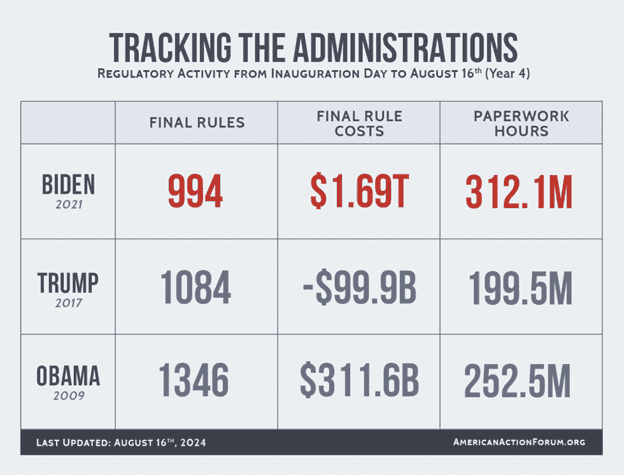

Contrast that level of constraint with what we have seen from the Biden-Harris Administration thus far. As of August 16th (the week before the Democratic National Convention), the total cost tallies for the Trump and Biden Administrations were the following: The major differences in both scale and direction are readily apparent, with the Biden record pushing near $1.7 trillion in net costs while the Trump total hovers around $100 billion in net savings[1]. As the findings below reveal, there’s little reason to think that a potential Harris Administration or a second Trump Administration would wildly diverge from such trends.

The major differences in both scale and direction are readily apparent, with the Biden record pushing near $1.7 trillion in net costs while the Trump total hovers around $100 billion in net savings[1]. As the findings below reveal, there’s little reason to think that a potential Harris Administration or a second Trump Administration would wildly diverge from such trends.

WHAT TO EXPECT FROM A HARRIS ADMINISTRATION

Planned Actions from the Most Recent Biden-Harris Regulatory Agenda

As the Democratic presidential nominee, Vice President Harris has relayed only limited policy plans for what a future Harris Administration may do. Therefore, with the caveat that this situation may change within the next two months, one possible avenue for understanding what a President Harris may do on the regulatory side is the latest Unified Agenda of Regulatory and Deregulatory Actions (UA) for the Biden-Harris Administration. To this end, the best set of actions to examine are likely those that the current administration has tagged as “Long Term Actions” – or those that it intends to promulgate from the spring of 2025 onward.

This list from the Office of Information and Regulatory Affairs (OIRA)[2] focuses on the 151 rulemakings in the hopper that agencies have either affirmatively deemed to be “major” or those for which “the major determination has not been made.” The most active agency here is, unsurprisingly, the Environmental Protection Agency (EPA) with 18 entries. Somewhat surprising, however, is that none of these have greenhouse gas emissions as their primary focus, but rather center more upon addressing various other forms of pollution. Other active agencies include: the Department of Treasury at 12 entries; the Departments of Labor and of Health and Human Services (HHS) with 11 apiece; and the Department of Homeland Security (DHS) and Federal Communications Commission (FCC) with 10 apiece. In terms of other notable subject-matter trends among cabinet-level agencies, a sizeable portion of HHS-planned rulemakings focus on new standards for tobacco products while a majority of the cohort from DHS focus on immigration issues.

Additional Potential Plans

While there have only been limited details thus far about the overall agenda under a Harris Administration, there have been some items from which to draw inferences, such as the Democratic Party’s official platform for the 2024 elections. Granted, party platforms are, historically speaking, somewhat flawed documents to take at face value since they generally focus on laying out aspirational policy aims that may or may not come to fruition. Nevertheless, they can be a useful resource in determining directional flow of policy choices should the party’s candidate be elected.

In this instance, the 2024 Democratic Party platform’s core value comes in affirming the idea that a Harris-Walz Administration will be, in the main, a continuation of many of the policies pursued under the current Biden-Harris Administration. For one, the document included multiple references to “President Biden’s second term.” In fairness, this may be something of a stylistic mishap due to the rapid change in the party’s nominee. The fact that there was not some effort to correct it before its pre-convention release, however, suggests that – at least implicitly – those involved largely agree with the idea of continuing Biden-era policy priorities.

In terms of policies specifically related to regulatory process and structure, there is not much included outside of some allusions to the administration’s work on alleviating certain administrative burdens. Much of the rest of the document – especially the chapters on “Lowering Costs” and “Tackling the Climate Crisis, Lowering Energy Costs, & Securing Energy Independence” – focuses on highlighting past rulemakings and urging further actions in the next term. Some of the main themes across these sections include establishing further labor standards, expanding environmental regulations, and utilizing agency power to adjust the market price of pharmaceutical drugs and other consumer goods.

Outside of the party platform, the other set of stated policy priorities currently available for a potential Harris Administration comes from the “economic plan,” the nascent campaign released in the week preceding the convention. The only section that specifically addresses the nuts and bolts of regulatory procedure comes in its housing policy section, which calls for “streamlining permitting processes and reviews, including for transit-oriented and conversion development, so builders can get homes on the market sooner and bring down costs.” Across the rest of the document though, a regulatory theme becomes increasingly apparent.

In the sections addressing the price of rent, prescription drugs, and groceries, there is an eagerness to more dramatically intervene in the relevant markets with the goal of lowering prices. The ability of a Harris Administration to successfully and lawfully effectuate such aims will generally involve securing more expansive authority via new legislation, and thus will be largely dependent upon the partisan make-up of Congress. Nevertheless, even in the absence of such legislation, the overarching intention is clear. One can expect an incoming Harris Administration to have few qualms about pressing current agency authority to its limits in the pursuit of applying artificial pressure to market prices.

WHAT TO EXPECT FROM A TRUMP ADMINISTRATION

Planned Actions From the Spring 2020 Regulatory Agenda

The circumstances of Trump’s current candidacy – primarily the fact that he was the president four years ago – affords a unique insight into the prospective regulatory policies of a second Trump term. Much as with the above examination of the current administration’s Spring 2024 UA, the last Spring UA of his first term in 2020 provides an especially useful guide to the actual rulemakings the Trump Administration originally had planned for the first year of a potential second term.

The Spring 2020 UA had 186 potentially “major” rulemaking entries, as detailed in the list found here. Notably, only nine of these actions definitively carried the “deregulatory” tag as determined under President Trump’s EO 13,771. Another 26 carry the designation of “other,” and thus could potentially be deregulatory in nature as well. Having only 35 out of 186 such rulemakings (roughly 19 percent) even possibly being deregulatory in nature, however, further supports the conclusion discussed above that, by the end of the Trump Administration’s term, there were diminishing prospects for actively deregulatory measures with agencies already having exhausted their potential targets.

The top five agencies in this Trump-era cohort are the following: FCC (54), the Securities and Exchange Commission (SEC) (28), DHS (16), EPA (11), and Department of Transportation (10). While FCC and SEC lead the pack by a fairly wide margin, since they are independent agencies and thus technically outside the direct purview of the White House, associating their priorities with those of the Trump Administration would be a complicated matter. In terms of agencies that report directly back to the White House, having DHS take first place is hardly shocking. Furthermore, all but three of the agency’s rulemakings pertain to immigration, which seems consistent with the issue being one of then-President and now-candidate Trump’s core policy priorities.

Additional Potential Plans

As with the above discussion of a potential Harris Administration’s plans, the most obvious document to start with in examining the broader regulatory policy aims of a second Trump term is the Republican Party platform. After somewhat famously forgoing the creation of such a document for the 2020 presidential campaign, the party released its 2024 platform ahead of the Republican National Convention in July. The relatively compact document – it clocks in at about one-third of the length of the Democratic platform in terms of page count – largely consists of lists of concisely worded policy priorities.

In terms of identifying policy plans related to regulatory policy, some core items are readily apparent. Points titled “Cut Costly and Burdensome Regulations,” “Cut Regulations,” and “Lower Everyday Costs” make clear that reestablishing the deregulatory posture of the Trump Administration’s first term – via such policies as its regulatory budget – will be a priority. The points regarding “Unleash American Energy,” “Reliable and Abundant Low-Cost Energy,” and “Save the American Auto Industry” suggest that repealing or revising Biden-era energy and environmental regulations will be a primary focus in this regard. The points on reducing barriers to innovation in “Emerging Industries” such as cryptocurrency, artificial intelligence, and commercial space travel also stand out as conspicuous inclusions.

Other aspects of this party platform, however, suggest that some of the policy priorities of a second Trump term could prove to be headwinds against these deregulatory positions. A significant portion of the platform focuses on such items as dramatically restricting the flow of immigration, implementing protectionist trade and labor policies, and leveraging federal agency authority over relevant educational and health care institutions to establish certain preferred socio-cultural norms – all policy directives that are, at their core, inherently regulatory in nature. As such, one can expect a potential second Trump term’s regulatory policy record to be broadly similar to his first: some significant, dramatic deregulatory trends up-front followed by a more complicated picture on the back end.

Outside of the relatively brief Republican platform, there are some other resources to draw from in discerning what a prospective second Trump term may look like in greater detail. One such document is the latest iteration of the Heritage Foundation’s “Mandate for Leadership” produced under the auspices of the organization’s Project 2025 initiative. Another potential resource is “The America First Agenda” produced by the American First Policy Institute (AFPI). It is worth noting, of course, that both organizations stand independent of the official Trump campaign apparatus. Indeed, no less than former president Trump himself has sought to publicly distance his campaign from Project 2025.

Nevertheless, given: 1) that many of the contributors to these initiatives are former Trump Administration officials (up to and including cabinet secretaries), and 2) how even a cursory examination of the relevant documents’ general policy themes reveals virtually zero areas of any real substantive daylight, it is fair to take these initiatives as guides to what a second Trump Administration could do. The AFPI agenda pillars are relatively sparse on details in and of themselves, but one can look to the organization’s ongoing work for more context of what the actionable policies would be. Meanwhile, the “Mandate for Leadership” is anything but sparse, laying out an agenda across nearly 900 pages that gets so granular that it includes items on the sub-agency level. While some of the policies detailed within those pages involve securing further congressional authorization, much of the discussion comes down to quite specific administrative policy suggestions that generally align with the broader bullet points included in the Republican platform.

CONCLUSION

While much could change before Election Day, there is likely to be a remarkable amount of relative continuity on the regulatory front, with each side having a uniquely recent baseline to draw from. A review of currently available campaign materials yields some divergences on the margins, but the broad outlines for each prospective administration are fairly well-known. A second Trump term would see sizable deregulatory efforts duking it out with the more restrictive policy items of the former president’s agenda, while a Harris Administration would effectively be a second Biden term and continue the current administration’s historically expansive regulatory legacy.

[1] For those confused by seeing a net negative number here, but a net-positive figure in the chart above for the entirety of calendar year 2020, please note that the Tracking the Administrations totals are running tallies produced week-by-week. From August 17, 2020 through December 31, 2020, new costs from agency rules totaled nearly $140 billion, effectively erasing the net savings figure included here.

[2] The OIRA website does not currently support the capability to link directly to Unified Agenda search query results. This attachment is a .pdf file containing the list of rules from the relevant query. Interested parties can click on the RIN links in the far-right-side column for further details on each specific rulemaking entry.